Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The ultimate success of cryptoeconomics is far from certain; Most projects will likely fail and a select few might change the world. At this early stage of cryptoasset development, identifying the diamonds in the rough is difficult.

Some of the only factors we can try to measure are: experience of the team, ambition of the project divided by evidence of realistic execution, liquidity/accessibility, and the importance of its patrons.

With over 13 million users and processing greater than $50 billion total transaction volume, Coinbase is a veritable juggernaut in the cryptocurrency space. Like Paypal once pioneered ecommerce, Coinbase is doing the same for cryptocurrency today. Just as the Paypal Mafia (Thiel, Musk, Hoffman, et al) proceeded to capitalize all frontiers of technology, the Coinbase alumni network is primed to do the same for cryptocurrency.

And recently Coinbase has made two interesting announcements: supporting ERC-20 tokens, and the creation of Coinbase Ventures.

After having built a robust exchange business, the ultimate vision of Coinbase’s “Secret Master Plan” is to grow the dApp ecosystem for an open digital economy. Many notable Coinbase employees have graduated to startups or funds dedicated to building an open financial system on the Ethereum platform.

ERC-20 allows trading Ethereum tokens on Coinbase platforms, and will allow the masses to enter the rapidly growing world of Ethereum dApps.

Coinbase Ventures will entail an initial $15 million investment into early stage companies fitting into the overall master plan, and you can expect that Coinbase will “enthusiastically invest in ideas from across their own alumni network.”

So what can we speculate this to mean exactly?

First, we need to look at the notable Coinbase alumni, beginning with Coinbase’s first employee, Olaf Carlson-Wee:

Carlson-Wee’s main endeavor is a fund called Polychain Capital, which has raised hundreds of millions in capital. Some of the companies running cryptographic protocols in the Polychain portfolio are:

- Coinlist: A service for vetting, supporting, and running compliant ICOs. Assets include Filecoin (distributed file storage), Blockstack (distributed apps), and PROPs (distributed social media/video).

- DFINITY: A protocol for massive distributed compute.

- dYdX: Decentralized financial derivatives. Will provide mechanism for shorting & margin trading blockchain assets.

- Maker: Building & governing a stablecoin called Dai.

- Basecoin: Another stablecoin protocol.

- Kin: Tokenizing the Kik messaging app.

- Orchid: A tokenized version of Tor protocol, which theoretically would incentivize greater scaling than its volunteer-based predecessor.

All of the aforementioned protocols could fit the definition of “ideas from the Coinbase alumni network.” The question is, do all of these necessarily fit into the goal of an open financial system? Protocols for messaging, file storage, social media, and compute, might not fit perfectly with this financial focus. Stablecoins, however, do answer a critical question about cryptocurrency’s financial volatility. And dYdX will allow financial shorting mechanisms for ballooning cryptocurrency market caps.

dYdX is particularly interesting because Coinbase’s most recent competitor, Robinhood, just unveiled options trading alongside cryptocurrency trading. A decentralized protocol for betting against assets of all kinds will fit nicely into Coinbase’s larger vision, and help hedge against competition.

Moving on, one of the other interesting projects that Carlson-Wee is working on is called the 0x protocol, which is a framework for decentralized Ethereum ERC-20 token exchange. Direct peer-to-peer trading will solve many of the issues involved with entrusting your private keys to middlemen at hackable, centralized exchanges.

An interesting note in the post announcing Coinbase Ventures also states, “You may see us invest in companies that ostensibly look competitive with Coinbase.” Theoretically, a decentralized exchange like 0x may one day eliminate the need for the exchanges that Coinbase currently operates, or it may help competitors like Bitfinex build innovative tools. However, a decentralized exchange for trading ERC-20 tokens accessed via Coinbase could significantly set them ahead of the pack.

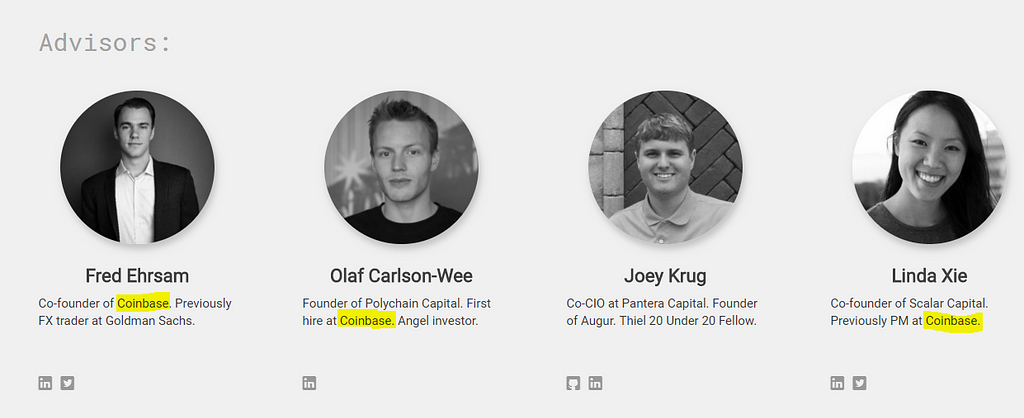

The 0x advisor team is also heavily stacked with notable alumni, and even the Coinbase co-founder, Fred Ehrsam:

Connecting the 0x dots to Coinbase is no public secret. Speculation has been running rampant for months, with 0x’s token valuation briefly exceeding $1 billion, in anticipation of Coinbase integration. Since when Litecoin was added to Coinbase last year as per Charlie Lee’s (the creator of Litecoin & former CTO at Coinbase) assistance, its skyrocketing price set the trend.

So when looking past Polychain’s high-profile investments, and 0x’s obvious ties to the Coinbase vision, what other suspects might fit the investigation?

Two other members of the Coinbase alumni network have gone on to build innovative protocols: Joey Urgo of District0x, and Maria Gomez of the Aragon protocol.

District0x is a protocol for creating decentralized marketplaces of all kinds, and Aragon is a protocol for decentralized governance of these organizations.

District0x is especially fascinating because it integrates both 0x and Aragon. Two district0x marketplaces are already live on its network, simultaneously providing functional products for consumers and for documenting tools for users to build their own marketplaces: Ethlance, a decentralized job marketplace and Namebazaar, a decentralized domain name marketplace. District0x’s integration of Aragon will allow token holders to make critical decisions about governing each of the marketplaces, or districts. Furthermore, 0x integration will allow consumers to pay for such services with any ERC-20 token of their choosing.

In theory, the entire world of e-commerce can be broken down, remodeled, and improved onto the open district0x system.

The visions of District0x, Aragon, and 0x, all clearly sound like grand ideas within Coinbase’s vision of a more open & decentralized financial system. Each of these companies have grand ideas and evidence of real implementation, & accessibility/liquidity on exchanges like Binance. Most notably, however, each of these companies operating cryptographic protocols have support from key members members of the Coinbase Mafia.

So by taking all of this information with a speculative grain of salt, we have no idea what Coinbase will or won’t do in the end. What we know now however, is that Coinbase is a powerful leader in the cryptocurrency space, and that they will invest heavily across their growing network of entrepreneurial alumni.

Therefore, when dYdX finally goes live, I will most likely be very reluctant to bet against any of these three protocols.

Tracking Down the Coinbase Mafia was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.