Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Celestia (TIA has seen bear dominance over the past seven days, plummeting from Tuesday’s $5.3908 to $4.3291 on Sunday.

While the significant plunge saw the altcoin losing all its September gains, TIA signals robust recoveries.

Safeguarding the reliable support at $4.12 would support significant bounce-backs to the $5.23 mark.

Celestia ripe for recovery

Factors such as surged selling momentum and bearish actions in the overall cryptocurrency space contributed to Celestia’s latest plummet.

Also, the recent token release, where the project unlocked assets worth over $1 billion, added to TIA’s downside.

Nevertheless, technical indicators suggest possible relief for Celestia enthusiasts. The Bollinger Bands have begun contracting on the 24-hour chart.

The Bollinger Bands reveals potential price directions by tracking volatility around a digital currency.

The indicator’s expansion signals amplified volatility, suggesting swift movements in either direction, while contraction means upcoming stability before likely shifts.

Also, the Bollinger Bands reveals whether a token exhibits oversold or overbought conditions.

In Celestia’s case, the contracting Bollinger Bands shows that the latest decline could slow down.

Also, TIA’s price sways at the indicator’s lower band, signaling oversold situations and impending upside reversals.

The Relative Strength Index supports this narrative. Reading at 37.80, the RSI approaches the oversold region below 30.

TIA’s current price outlook

Celestia changes hands at $4.50 at press time, exhibiting notable bear influence. The altcoin could extend its downsides, with sellers targeting $4.20.

Source – Coinmarketcap

Meanwhile, the robust support barrier at $4.12 might catalyze bounce-backs for TIA prices.

The $4.12 region offered a solid Launchpad for TIA in September, welcoming a 62% price surge.

While repeating such a performance could be challenging, defending the highlighted support could propel the altcoin to $5.23 in the coming days or weeks.

Meanwhile, failure to keep $4.12 would welcome the $3.72 mark, translating to a 20.97% plunge from the current price of $4.50.

However, broad market performances would be vital in determining TIA’s price direction in the upcoming sessions.

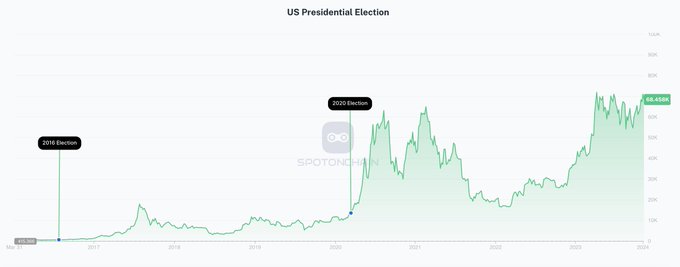

The cryptocurrency sector displays notable volatility amidst the US Presidential elections, though analysts remain optimistic.

Crypto market outlook amid the US elections

Bitcoin plunged to its press time levels of $68,6900 after its recent upswing towards ATHs.

Meanwhile, Spot On Chain warned about surged volatility due to the FOMC meeting and the US elections.

Nevertheless, the analytics platform remains confident about BTC attaining new all-time highs in 2024.

Spot On Chain

@spotonchain

·Follow

The market is entering its most volatile week with the U.S. election and FOMC meeting, but this rally may be here to stay.

Historically, the real bull run begins post-election, and we believe that whether Trump or Harris becomes the next president, $BTC will continue its upward…

7:34 AM · Nov 4, 2024

62

Reply

Copy link Read 2 replies

Spot On Chain highlighted that cryptocurrencies have seen notable gains post-US elections, regardless of which party wins. The platform added,

We believe that whether Trump or Harris becomes the next president, BTC will continue its upward journey, potentially reaching $100K this year.

A Bitcoin ATH would translate to robust price gains in the altcoin market, sending the likes of TIA to unforeseen price peaks.

The post Celestia price recovery expected as TIA becomes oversold after recent dip appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.