Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Why am I working on police brutality insurance?

When I have never been brutalized by the police How can we go from how things are now to how they should be?

How can we go from how things are now to how they should be?

This week was fantastic. I had one of those “oh my God what have I done with the last five years of my life,” moments. I wouldn’t exactly call it fun. But it was honest and it caused me to take stock of where I am at and how to move forward.

I’ve only got two months to find my pilot group

The MVP for the TandaPay app will be ready in September. I’ve got to find a pilot group of 50+ people by that time for one of these four use cases:

- Latinos who want coverage for the $500 auto insurance deductible(practically speaking my only market is Latino Americans)

- A group who wants police brutality coverage

- A group who wants campus sexual assault insurance

- A group who wants workers’ compensation coverage independent from their employer approving claims

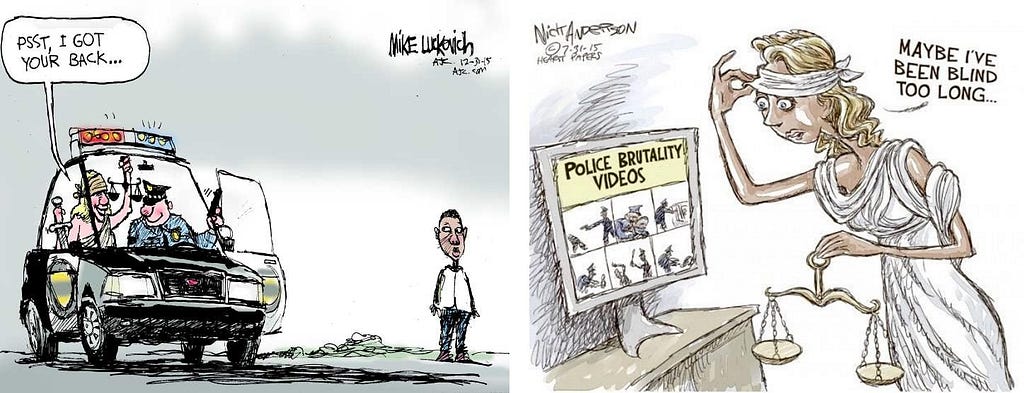

I’m not qualified to help any of these groups of people. All these groups are going to be equally suspicious of me if I contact them directly. I decided to focus on police brutality and then I wrote this article, How P2P insurance can empower social justice in local communities. I chose police brutality insurance because:

- TandaPay can likely provide the greatest benefit to ideological groups.

- Stories from the mainstream media evoke the strongest reaction of anger in me with respect to this issue, partially due to its graphic nature.

- Most people are surprised to find out how much power insurers have over the police. This results in a reassessment of the power of insurance.

- Potentially TandaPay can do the most good by tackling the problem of police brutality first, before attempting other types of coverage.

Jaleel White aka Steve Urkel then and now

Jaleel White aka Steve Urkel then and now

So being a naive dumb white guy I call up Lawrence Grandpre at LBSBaltimore and a few other groups with a hopeful attitude. I’m sure I probably came across as a white version of Steve Urkel, “hey guys, can you try out my cool new app for police brutality insurance.” I didn’t say that, but I’m sure that’s how I sounded like to people.

Everyone was polite, no one was rude but it was clear that this inquiry was not welcome. I got a lot of, “just email me and I’ll take a look at it.” If I tried to call back I would go to voicemail or someone would pick up and then “click” line was dead. “What does this guy want,” or “who does this guy think he is anyway,” I can imagine that’s what they thought after hanging up the phone.

I never intended to work on police brutality as a cause

I’m not into blockchain to get rich, that’s for sure. If I wanted to get rich I would have quit a long time ago. I’m just trying to find a reasonable use case for peer-to-peer insurance that doesn’t suck. I began working on this problem five years ago with my first whitepaper and TandaPay is my final attempt at solving the problem. A great deal of my intellectual life these past five years has been consumed by this problem and nearly all of my money. I’ve run out of both funds and patience, this is my last chance to get it right.

Depending on what happens with TandaPay, these are five years I could come to see as either the best possible thing I could’ve been doing with this time, or it could be that the entire five years might have not even happened; because there was no impact my work had on anyone.

Then that’s just five years that are gone. It’s not the sort of thing where there’s a consolation prize. I definitely won’t feel, “oh well I gave it a good try, it’s all fine anyway. It’s just trying that counts.” No, I don’t believe that. I don’t believe it’s just trying that counts. I believe getting it right is what counts.

You’ve got to consider the legal liabilities, the potential use cases, incentives for the participants to join, the cost of premiums relative to claims, available markets, and more. There might be 10 to 20 different constraining factors that need to be taken into careful consideration. This is not an easy problem to solve. In the end you don’t get to choose what types of products you can or can’t cover. The constraints upon the problem continue to limit your options until very few viable choices are left.

One thing becomes abundantly clear. Decentralized platforms for insurance MUST produce more value than anything centralized companies could ever provide. A cheaper, more transparent version of what we already have isn’t valuable enough for an organization to spend millions of dollars building speculative software. This value likely comes in the form of new insurance products that don’t exist yet.

But why then use blockchain? If blockchain is so inconvenient and so awkward as a technology why then even bother?

These two features have enticed men to their doom

The allure of blockchain with regard to insurance products can be summed up in just two key points. I would consider these two points as “siren sisters” because their allure has drawn people to become “shipwrecked” upon the “jagged reefs” of reality. Blockchain can do a lot of neato things but in terms of insurance you’ve got to capitalize on both of these two points to score a win:

If blockchain does one thing good its record keeping. This is not something human beings are particularly good at. If a company spends money, the accounting for what the money was used for is completely separate from the money itself. So the chance of their being a discrepancy between the record of what the money was used for, and the actual fact of what the money was used for, is a huge problem. With blockchain, an entity’s money and its accounting can become the same thing and that has never happened in the entire history of money.

Even if you could trust people to honestly create the initial record all non-blockchain records have the same problem. Without blockchain there is no guarantee of data integrity. This means that people can always come along later and change, tweak, improve, fix or massage the items in the record. Doing so would leave no trace of what the original values were. In addition the record can also be destroyed, either willfully or accidentally.

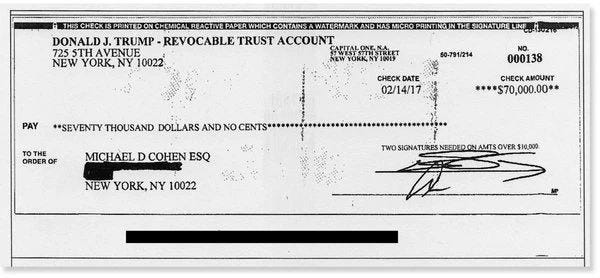

Revocable trusts — During the life of the trust, income earned is distributed to the grantor, and only after death does property transfer to the beneficiaries. *cough*shellgame*cough*

Revocable trusts — During the life of the trust, income earned is distributed to the grantor, and only after death does property transfer to the beneficiaries. *cough*shellgame*cough*

There is also no way to know for certain who created a record when humans do the record keeping. In technical jargon if you can know for certain who created an entry in a record then the database is said to have the property of non-repudiation. This is a very important property. Did one CEO sign the check or did two? Did one scribble on the second line to make it seem like two people signed the check? Who can understand these things? How can they even tell if that signature is even your signature anyways? What’s to prevent anybody from just stealing a check and scribbling on it? What’s to stop them from cashing it?

It’s when people start to actually look closely at how our financial system works that they realize its all a bunch of smoke and mirrors. That’s why we spend so much money on audits and anti-fraud measures and that’s why they are of so little use in actually deterring fraud.

Immunity from unfavorable regulations

Given that human beings are not particularly good at record keeping, it comes as no surprise that keeping people honest requires frequent audits. Audits are the only way to make sure that an insurance company is wisely investing your premiums and paying valid claims. Audits are expensive because they require an army of auditors, accountants and lawyers. These people are to records what security guards are to banks. The only way to make sure that money isn’t being mismanaged is for accountants to constantly patrol an insurer’s records similarly to how security guards patrol a bank’s vaults. Blockchains can do this better than humans can, which allows them to provide financial services which are legally compliant by design. Built-in legal compliance is the magic key that gets decentralized insurance platforms out of regulatory jail.*

This feature is very special because it means that the cost barriers to providing group coverage are eliminated. Previously if a group wanted to form a RRG or a discretionary mutual the initial legal costs involved were tremendous. Sometimes this involved lobbying congress to change the law to create a specific exemption for your industry. Since no small groups can afford these huge up-front costs, this has effectively denied small groups access into insurance markets and removed their right to self-insure. This problem is known as the crushing burden of government regulation.

Solving the problem of costly government regulation provides us with new markets and new opportunities. We are effectively getting insurance coverage for cheaper than we should be paying for it because we don’t have to pay the regulatory expense. This is why regulatory arbitrage is like finding free money. If we can scale this model up in the future, peer-to-peer insurance may someday be able to compete directly with traditional insurers.

Sometimes you choose an idea and sometimes an idea chooses you Did Neo choose or was he chosen… there were two pills but only one cookie.

Did Neo choose or was he chosen… there were two pills but only one cookie.

As I stated earlier I didn’t choose to create police brutality insurance. It resulted as the most promising option after studying various use cases. The initial concept of the $500 auto insurance deductible made logical sense but there was still several problems:

- Mutual insurance requires coordination, coordination requires time. People are effectively sacrificing two hours a month to get cheap deductible coverage.

- Acquiring and using cryptocurrency requires the group leader to take several hours to learn the technology and several hours each month to assist users.

- The technology is new and has its unique shortcomings, and disadvantages. Is deductible coverage valuable enough for groups to persist and not give up?

I felt that the technology just wasn’t there yet to be able to provide sufficient value for this use case. I needed a use case that was more compelling than deductible coverage. I put aside everything I thought I knew about insurance and started thinking about what might be special about this type of insurance. That’s when I made my critical breakthrough.

Putting aside the value of covering a claim, can TandaPay do anything else? It creates an official, historical record of what everyone in a community believes. I thought about this for a while. Is this type of record keeping valuable? Out of all the people and groups in the country, is there anyone who could stand to benefit from being able to create a record when an event triggers an insurance claim? Is there any community who can’t rely merely on government records, social media or blogs to tell their personal story?

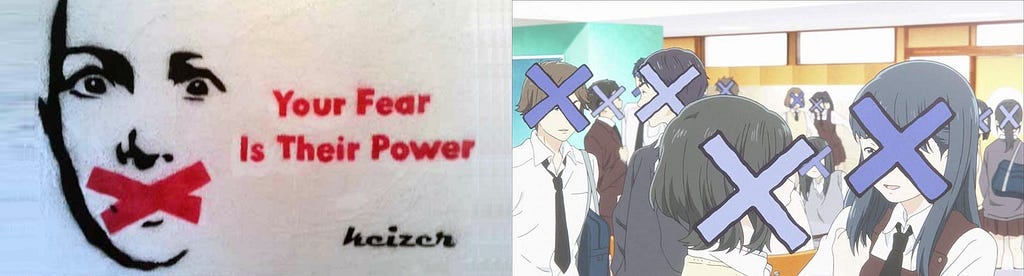

TandaPay’s records are censorship resistant

this is what censorship feels like — all your records are belong to us

this is what censorship feels like — all your records are belong to us

I remember hearing a podcast or reading a news article about how the posting of a police shooting video to youtube or social media was causing controversy. The violent content was in violation of the platforms ToS but if the content was taken down then the victims freedom of speech was being denied. Since the users didn’t have control over the platform this means they couldn’t be guaranteed their posts wouldn’t face censorship.

Bingo, the TandaPay protocol could provide users with a value going beyond the mere payment of an insurance claim. The creation of the record itself was valuable because it was censorship resistant and not subject to rules imposed by governments or other authorities.

Out of all the people and groups on the planet, who could stand to benefit the most from the ability to create an indisputable, censorship resistant record of history from the perspective of their local community? Insurance is a record of history documenting policyholders paying premiums and a policy paying out claims. But, if it exists on the blockchain it becomes a special type of record because it is granted the properties of data integrity and non-repudiation. The only record we have of what the police are doing in local neighborhoods today are:

- Official records kept by the police (not public)

- Unofficial records created by mainstream media outlets

- Blogs or social medial posts created by individuals

- Official records created when victims take the police to court, kept by the government

We seem to be missing a category of “official records kept by the community”

Conclusion

For great justice (and liberty)

For great justice (and liberty)

Blockchains are good at holding people’s money because they are good record keepers. They don’t permit any creative accounting and they can’t misplace people’s money. The best blockchain architectures for insurance are designed to be fully compliant with the law, without users needing to take any legal action to form a coverage group. This lowers the initial cost to start a group to nearly zero, which allows blockchain to provide new insurance products that could never be provided previously. When combined with the feature of censorship resistance, the value of offering police brutality coverage goes beyond merely paying a claim. Now communities have a censorship resistant way of creating an unimpeachable, official record which represents the communities point of view.

* Blockchains do not provide this by default. Just because policyholders give their premiums to a smart contract does not exempt the smart contract from acting as a third-party custodian of funds. Additional architecture is required to take advantage of blockchain’s capacity to eliminate custodial risk. TandaPay accomplishes this through the use of zero-reserve architecture.

Why am I working on police brutality insurance was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.