Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Case for Stablecoins — 2

Two case studies demonstrating how to innovate in fintech Image taken from The Rubin Report’s interview with Peter ThielLet’s start off with a little social experiment

Image taken from The Rubin Report’s interview with Peter ThielLet’s start off with a little social experiment

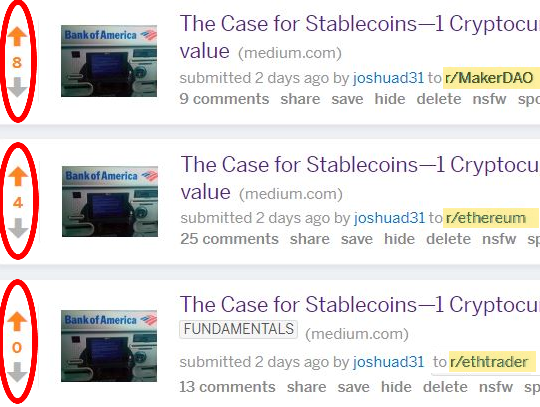

On the left you can see how well received my first post was by three different Ethereum communities. R/MakerDAO, r/Ethereum, and r/ethtrader; I was upvoted 99%, 64%, and 50% respectively. By looking at the screenshot, its even easier to see that for the same post I have three karma ratings of 8, 4, and 0.

This might come as a surprise to some but, the Ethereum community is not entirely behind the concept of a stablecoin token built on top of the protocol. Quite frequently the types of responses I would get highlighted how much people disliked centralization in any form. Others seemed to believe that stablecoins do not have any value beyond their price; thus in their view, owning a stablecoin adds no additional value to transactions beyond simply owning a dollar. The argument that, “cryptocurrency price does not equate to cryptocurrency’s value” seems to have been lost on a few individuals. Certainly I have my work cut out for me before I am able to convince people that value is in utility not in price.

These were some of the nicer comments I received in response to my post

These were some of the nicer comments I received in response to my post

FaceDeer provided a valuable contribution by pointing out that:

Stablecoins are one of many useful applications for blockchains, and since blockchains are permissionless … there’s no way to stop them from existing. If you don’t like them don’t use them.

That said, not all stablecoins are created equal. I’m much more interested in something like DAI, which uses clever game theory to maintain its peg, than something like Tether which is a more traditional “just trust us” sort of thing. Slightly better than old-school fiat in that it’s more easily transactable online, but I certainly wouldn’t hold any significant amount of it for longer than I had to.

He has three points I thought were particularly valid:

- If you don’t like stablecoins don’t use them.

- Money’s value is in a users ability to transact with it (i.e. its utility).

- Because this is a new technology limit your risk by holding only small amounts for short periods of time.

As it turns out FaceDeer’s advice matches perfectly with Peter Thiel’s requirement for what PayPal needed to do to increase its adoption. In the first use case, which we cover later in the blog, Peter describes how tech companies can get people to try new things that are unfamiliar. His advice is:

- It has to be something where there’s an intense need

- An instance where it’s not too dangerous

- Small dollar transactions maybe $40

- Where payment friction is incredibly high

Summing up the argument I made in my first post

I think that even if you are very skeptical of stablecoins you should consider that they will enable new financial services for users who decide they are valuable. If you don’t want to use these new financial services, then don’t. Stablecoins will appeal to a wider audience of users by making it easier for them to transact💱 with smart contracts. As stablecoins make it easier to transact, it will bring with them an influx of new users who want access to these new financial services. As user adoption of Ethereum increases so also likely will its price increase. Speculators rejoice! Applications built with stablecoins will reward your #hodling💰💰. Because the protocol has become more useful to a broader audience of people the adoption of the protocol has increased📈↗️ and so also has its price. Thus you want stablecoins built on Ethereum (Not sure why this was lost on anyone in my previous article).

As previous redditors have demonstrated, some people have no desire to actually read and comprehend my articles. Perhaps I can help you guys out with some easy to understand pictograms. If you are not planning on actually reading what I wrote I’d like to sum it up for you right here:stablecoins = 💱 easy💱 easy = 👍👌🙋♂️💪💱 easy = ETH 📈↗️ETH 📈↗️ = you 💰💰you 💰💰 = you 😃🙌I think some people just need to see the pictures to get it :)

New financial services — peer-to-peer insurance

Let’s assume the next big idea is peer-to-peer insurance. If you want to create a new consumer financial product for insurance you have two major choices:

- Use the Ethereum blockchain

- Use traditional payment networks

If you decide to use the Ethereum blockchain you have two sub-choices:

- Use a stablecoin such as DAI

- Use the native token, ETH

The simplest way I can make a case for stablecoins is by demonstrating that choosing to build applications on the blockchain has far lower costs than using traditional payment networks. Once I’ve done this then we can imagine two versions of the same decentralized application. One version uses a stablecoin and the other uses ETH. By considering the outcomes for users based upon these options, a stablecoin’s value proposition should become obvious.

This blog post will tackle the two major choices and the next blog post will consider the two sub-choices. We will do this by drawing analogies to the adoption strategies of other well known payment technologies. This post will consider the approach of Peter Thiel who built PayPal in 1999 and Patrick Collison who built Stripe in 2010. By learning how they built their respective platforms we can realize that new technologies can provide ways of temporarily circumventing regulatory liability and its associated costs. Both of these are payment technologies, but these two payment technologies were created during different eras. At the time of PayPal’s creation the internet was new and unregulated. As Peter puts it:

I do not know if a company like PayPal could have been started even two or three years later. In the aftermath of 9/11 we got the Patriot Act in the US and that attached much more regulatory scrutiny to financial transactions and payments.

Stripe however was built under the type of regulatory scrutiny which Peter believes would have prevented PayPal’s origination. By listening to these two founders and their perspective on the cost of regulatory compliance we can come to the same conclusion as Peter.

the PayPal hack was a way where we were going to change the world and we were not going to ask for permission (it would just be) technology over politics.

If you have the option to use technology to hack the world why not do it? Trying to create the same financial products using traditional payment networks is onerous, passes on excessive costs to consumers, is unnecessary and erodes your competitive advantage. As Peter puts it, “competition Is for losers.” One way to avoid being a loser is by lowering your total regulatory liability. Insurance using smart contracts and stablecoins permits entry into a regulatory grey zone where no one is operating. Since there is no existing competition, there is no clear regulatory guidance.

With traditional payment networks, you have both competition and regulatory barriers. As we will see in the PayPal case Peter’s strategy was “don’t hire the lawyers and just do it.” Smart contracts built on Ethereum allow you to create escrows which negate third party custodial risk, which is reason enough why someone should “just do it.” I have written about this matter here, and here.

Case 1 — Paypal, using technology to circumvent regulations

The Rubin Report: Peter Thiel on Trump, Gawker, and Leaving Silicon Valley

Thiel (31:54): The big picture with PayPal was to revolutionize money and payments

Rubin (1:55): Where did the idea of PayPal first come from?

Thiel (3:39): We eventually stumbled on this idea of linking money with email because if you could send money to an email address then you’d obviously click on the links and do the work necessary to get the money out and so you didn’t need both counterparts to a transaction to be part of the PayPal Network.

Thiel (4:25): We gave these referral bonuses of $10 just for signing up. You got something to sign up and it just grew exponentially … by the end of December of 1999 it was at twelve thousand, by February of 2000 it was at a hundred thousand, by mid April of 2000 it was up to a million.

Rubin (5:00): what did you do … to (make people) understand that you could work with money differently? … Just the idea that I was somehow linking my bank account to something on the computer (seemed hard to grasp) … How did you train people to realize this is something that’s real?

Thiel (5:43): To get people start doing something (new) like that (the requirement is):1. it has to be something where there’s an intense need and2. an instance where it’s not too dangerous

Thiel (5:51): A natural place to start was on the eBay auction site where (there was): 1. small dollar transactions maybe $40 was the typical amount and 2. if you send check across the country that’s like a 7 to 10 day delay. This delay was because most people couldn’t process credit cards but you could make PayPal payments with a credit card.

Thiel (6:27): There was a hundred fifty million people with emails in the US at the time but there were maybe three million small businesses that were set up to process credit cards so we expanded the ability to process credit cards by 147 million.

Thiel (7:30): Banks didn’t like (PayPal) … (PayPal) was sort of in this in this strange regulatory zone where it was a new form of payments a new form of moving money. The way I often thought of it at the time was that we were in a race between technology and politics.

Thiel (7:52): The politicians didn’t like us but if we got PayPal to be big enough it would sort of overwhelm the regulators and they’d have to accept it as a fait accompli (a thing that has already been decided before those affected hear about it, leaving them with no option but to accept it).

Thiel (8:10): We had an early 2000 conversation where one of the execs at PayPal said, “we needed to hire a whole bunch of lawyers to tell us what we can or can’t do.” I said, “we are not going to hire them (lawyers) because they will just tell us what we can’t do, so don’t hire the lawyers and just do it.”

Thiel (8:30): I do not know if a company like PayPal could have been started even two or three years later. In the aftermath of 9/11 we got the Patriot Act in the US and that attached much more regulatory scrutiny to financial transactions and payments. KYC rules (made processing payments) much trickier and so I do think that … there was an opening to start a business like PayPal in 1999 or 2000 but even three years later I think it might not have been possible.

Thiel (9:18): We had the sense that we were going to change the world and we were going to give people more control over their money. We had all these ideas about getting rid of central banks and creating a new currency. We never quite got to the Bitcoin stage of (development) but certainly these ideas were incredibly motivational in (creating PayPal).

Thiel (9:41): I always have this view on politics where in many ways its incredibly frustrating … and its also so hard to change … the PayPal hack was a way where we were going to change the world and we were not going to ask for permission (it would just be) technology over politics.

Case 2 — Stripe, The cost of being regulatory compliant

How I Built This with Guy Raz — Stripe: Patrick and John Collison

RAZ: So — OK, so here’s what I don’t get. You guys were obviously super smart and very good at coding, but what made you think that you could solve these big, enormous problems like regulation and dealing with banks and developing relationships with credit card companies that, you know, Google and Apple clearly felt that they could not resolve?

P. COLLISON: In large part, a healthy dose of the naivete of youth, but, you know, we didn’t just leap into it. We built the first prototype back in October of 2009. And then, we basically spent kind of eight or 10 months trying to sort of map out what would actually be required to have this work at sort of, you know, any material scale, what sorts of people we’d have to hire, which sorts of entities we’d have to partner with and, you know, what that would look like.

And so we realized, well, we need to hire, you know, very senior and experienced partnerships people to make sure that we can get sort of first-tier relationships in place with banks. And it really was apparent to us that kind of it wouldn’t be easy.

Like, it was not going to be possible for it to be some sort of, well, you know, we code furiously for two months, we launch this thing, and, then, it’s off to the races. Like, from when we started working on it full-time to when we publicly launched was almost two years. That’s how long it took us to kind of orchestrate all those details that sort of you’re describing.

what we came to realize is that because it was financial, that sort of technology companies were very hesitant to go and address it.

P. COLLISON: Because you have to deal with partnerships with financial institutions and regulation and risk controls and making sure that things are sort of done compliantly, and it becomes, then, very complicated to figure out how to offer that service.

And so the fact that you had to kind of span these multiple sectors and deal with all these kind of different constraints with figuring out a better way to do payments, technology startups … tend … to shy away from problems where you have to solve a lot of hard problems in multiple domains.

Building TandaPay

TandaPay will be taking the Peter Thiel approach. In the next instalment we will see how using a stablecoin impacts the user experience for average consumers.

The Case for Stablecoins — 2 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.