Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Cryptocurrencies have gained a lot of traction during the past few years. A plethora of currencies have come to life and many more are yet to come. Currently, as of 29 May 2018, Coinmarketcap reports more than 1633 different coins, each of which has its own set of goals, roles, and purposes. It has become relatively easy for developers and teams to initiate their own project and deploy their new coin. On the contrary, it has become hard for newcomers to understand the demography of the space and hence, they are becoming more reluctant to invest. Early investors are not capable of keeping up with the pace of growth, missing out on key investments. Moreover, in the midst of this Cambrian explosion, many fraud and scams have begun to grow and thorn their way through.

Part of what we do at zk Capital is educating investors and the general public about the crypto space as part of our vision for a decentralized future. We utilize our teams’ best diverse skillset and apply it in various dimensions, one of which is data analysis. Data analysis defines the process of gathering, cleaning, and modeling data to infer correlations and predict future behavior.

We have decided to create a series dedicated to analyzing the data of cryptocurrencies and visualizing our results to be accessible to the general reader. In this first medium article, we will walk through the cryptoassets demography, in particular, we will illustrate:

1- The Market size distribution per category2- The leading asset per category3- The quantified relationship between asset price and supply.

Visualizing the Demography Distribution

As mentioned before, there are around 1633 coins on coinmarketcap. This makes it hard to differentiate between the various cryptoassets. One way to solve this problem is to divide the space into subsets of different categories enabling us to focus and understand each sector independently of the others. For example, we can understand the market size of each sector thereby, quantifying the amount of capital and investor interest in each of these categories.

One of the problems we found, is that this data is not accessible through the web. So we had to devise our own automated methods that gather data and uses advanced data analysis tools such as clustering and topic-modeling (Latent Drichlet Allocation). The pie chart above illustrates the market distribution of 130 different categories in the crypto asset space. Notice that assets that fall under the digital currencies category (e.g., BTC, Dash, LTC) take over most of the pie chart (around 262 billion USD). In the second place, comes platforms for smart contracts (e.g. Ethereum, EOS, NEO, ETC) taking over 98 billion USD. These observations come as no surprise as most recent interest (public and investors) focus on designing newly scalable blockchains and digital currencies. Another observation is that privacy coins and decentralized exchanges have not attained comparable investment interest as the media suggests. The former has around 2% of entire market cap whereas the latter lies within 0.25%. Go ahead and interact with the chart to find the market size of your favorite coins.

Identifying the Leading asset per Category

Another thing we can do after clustering the data into categories is finding which assets lead its space (by marketcap). This can help investors know which projects have already attained momentum, network effects, and investment allocations. The table below gives a detailed description of this data.

Visualizing the relationship between Cryptoasset Price and Supply

One of the main advertised advantages of cryptocurrencies is the limited supply. Supply and demand is a well known economic model that helps in determining the price of an asset. It is a popular mantra that the more limited the supply is, the more probable demand can get, and thus increase in price. We can see the same behavior in cryptocurrencies. The interactive plot below demonstrates this behavior:

The chart plots price in USD (y-axis) vs available supply (x-axis) for all of the 1633 cryptocurrencies from Coinmarketcap as of 29 May 2018. Both of the x-axis and the y-axis are represented in log-scale. The size of each data point reflects the coin’s rank as per market cap.

From the interactive plot, we can observe several points:

- The majority of coins exist within the ranges of supply between 1 million and 1 billion coins. Also, most of them have a price tag range between 0.01–1 USD.

- As expected, the price tends to decrease as supply increases. However, what is more interesting is to realize the rate of the price drop with respect to supply increase. Can we find a function that articulates this relationship?

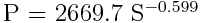

In data analysis, we have a common analysis tool called regression which tries to estimate the correlation between variables — in this case, price and supply — by fitting-in the input data into an output function. We ran several regression tools on the underlying data and found that the power function below fits the most, where P is price and S is Supply.

The function resembles the purple line within the plot. Note that this is NOT a straight line as it is plotted in a log-log chart. The interesting point here is not the constant 2669.7, but the relationship between P and S. First, they are inversely proportional to each other, which makes perfect sense. Secondly, which is the more interesting part, is that the function is not exactly inversely proportional to supply.

The charts show that coin price is approximately inversely proportional to the square root of supply. In other words, as the supply of a coin increases, the decay in its price decreases.

In other words, as the supply of a coin increases, the decay in its price decreases.

This means that the Price (P) line decays fast at the start but then the line plateaus fast with very minimal change, as supply (S) increases. This suggests that increasing supply does not have a strong effect on Price after a certain threshold.

We tried to validate this observation on different clusters of data. Rather than fitting a function on the entire dataset of 1633 coins, we tried to fit it into different coin categories, and the results show a similar trend. Here are two charts that demonstrate this behavior.

Conclusions

Data analysis and visualizations are essential tools for investors. They help in understanding the investment terrain, inferring correlations, and making sound investment decisions. This article serves as an introduction to the demography of cryptoassets. We illustrate the different sectors of cryptoassets; identify the main asset in each category, and quantify the relationship between price and supply.

If you like this post or if you have any further questions or chart-requests, please reach out to me on Twitter or LinkedIn.

Disclaimer: Information in this article is for educational purposes only and cannot be taken as investment advice.

Visualizing the Cryptoassets Demography (Part I) was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.