Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Cryptocurrencies have been massively rewarding for both early investors and savvy traders. Take bitcoin for example. All those who invested before 2017 have seen returns greater than 550%. Traders on the other hand greatly benefit from bitcoin’s significant volatility: one day of bitcoin volatility is nearly equivalent to volatility of an interval of roughly 23 trading days for the S&P 500. For traders, volatility brings opportunity.

In this article I will focus on the reasons behind a grim outlook for crypto investors, at least in the short-term.

Sections:

- Valuations

- Usage

- Demise of the ICO

- Plunge Protection Team

- Retail Demand

- Institutional Demand

- A Bitcoin ETF

- Natural Sellers

- What’s Left?

Valuations

Most cryptocurrencies can’t be valued by traditional means (discounted cash flows) as they lack associated cash flows. Models for valuing cryptocurrencies require a great number of made up inputs.

Take for example this fantastic hypothetical model by Burniske. Here the author attempts to value a token by borrowing the Equation of Exchange from monetary economics . The valuation requires coming up with an imaginary value for a token’s Velocity (i.e. the number of times a token changes hands in a year) as well as with an Adoption Curve. In that model, changing the time one assumes adoption goes from 10% to 90% from 15 years to 30 years reduces the value of the token from $0.12 to $0. Readers can find more details on that valuation approach on this article.

In short, from the perspective of a fundamental investor, the whole asset class could go to zero. Therefore valuations provide no floor.

Usage

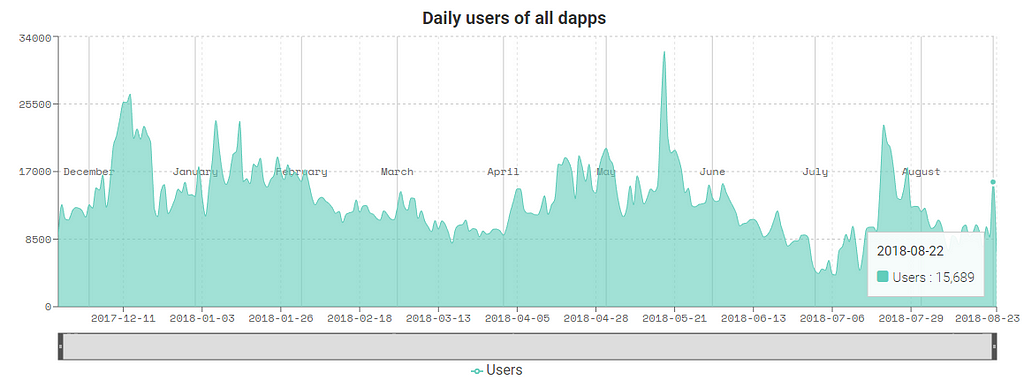

Cryptocurrencies are barely used for anything aside from speculation. Take ETH for example. Ethereum’s main uses are DApps and ICOs. However DApps have barely any users: on Aug/22/2018 there were a total of 15,689 users (more data available on this website). At the moment of writing, the well-known prediction market Augur has had a whopping 52 users in the prior 24 hours. The market capitalization of Augur’s token, $REP, currently stands at $200 million — with only 52 users.

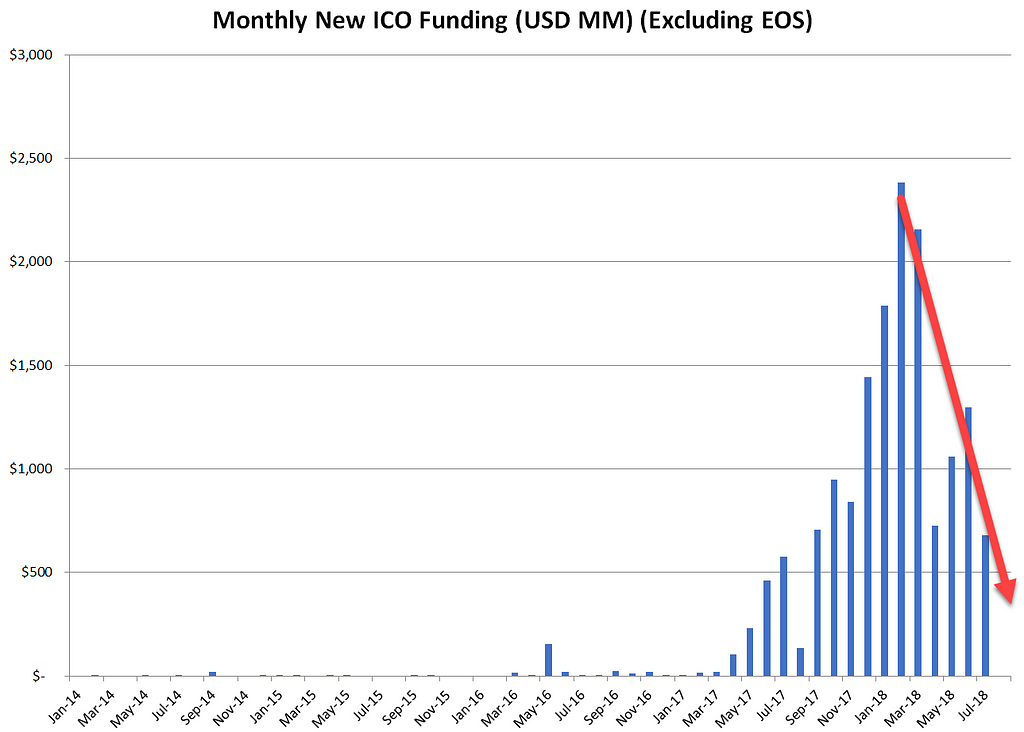

Meanwhile the amount of money raised by ICOs has nosedived. Furthermore, in 2018 ICO investing largely stopped generating fiat inflows as investors started recycling pre-existent crypto holdings into new ICOs. What does that leave? Speculation! Usage provides no floor.

(Readers can look into ICO numbers using Coindesk’s ICO Tracker — although their numbers incorrectly list the mammoth EOS ICO as conducted in June 2018 — or Icodata.io)

Demise of the ICO

In this article from 2017, I covered in detail how flawed most tokens are and how ICOs were driving crypto prices higher.

Picture Pether Block (pun intended), a sharp entrepreneur seeking to raise funds. Imagine Pether raises funds not by issuing equity (stocks) or legal promises to pay funds back (loans, bonds), but instead by giving out pretty bits of paper with no legal backing saying he plans to pay back. Now imagine Pether actually gets funding by giving out pretty bits of paper that do not even promise to pay back. Furthermore, imagine a case where Pether is actually anonymous, he did not even have to disclose his identity to raise funds. This is happening in some ICOs. Ponzi schemes abound. OneCoin is the most famous uncovered Ponzi scheme. Bitconnect, a cryptocurrency that offers guaranteed 149% annualized returns (assuming daily reinvestment) plus variable returns generated by a “volatility trading bot”, is in my humble opinion the most striking Ponzi scheme of present times.

Eventually economics caught up with hype and most ICO prices collapsed over 80%-90% from their January highs. The SEC helped along the way by driving the message that ICO tokens were in most cases unregistered securities.

Over half of ICOs dies within four months of token sale. Readers can find details on the great number of dead ICOs on Deadcoins.com.

“I accept figures I have seen that 80 percent of ICOs were frauds, and 10 percent lacked substance and failed shortly after raising money. Most of the remaining 10 percent will probably fail as well.”

The average ICO investor was stubborn and uninformed. Most did not even read the whitepapers or offering documents, nor were aware their tokens provided them with absolutely no rights, even though they believed they were acquiring participation in the success of a project.

Here’s a great example of an ICO scam promoted by an intricate web of fake LinkedIn profiles:

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

During the ICO bubble setting up a few fake profiles and posting here and there was enough to raise money. RxSmartCoffee for example raised 50K. I got an invitation from one of the associated profiles, to join their "investors' pool". #JokeProfile.

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Or even better: drug lord Pablo Escobar’s brother launching his own cryptocurrency called Diet Bitcoin as an alternative to bitcoin. This scam is happening right now. Just wait for it to hit some exchange and see it go to zero. Not convinced yet? What about Viola.ai, “Your Lifelong AI Love Advisor” … because of course we all want to leave our dating history permanently stored in a blockchain.

This one is hilarious, from China, happening at this very moment:

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

From a friend working in Blockchain in China: "The ICO scam is alive and well in China. People are actually investing in this company on the back of this 'genuine certificate' that's been posted on Wechat. Enjoy finding the flaws.

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Plunge Protection Team

Crypto has no “plunge protection team”, which is often interpreted as a party or set of parties that buys to stabilize or prop a market, a white knight and savior. US assets including the US Dollar can count on the Federal Reserve and the US Treasury if things get extremely dicey. Commodities can count on corporate/industrial demand (consumers of physical commodities) if commodities get too cheap. Equities can count on companies’ treasury departments buying shares back when shares get too cheap — they are the ultimate legal insider trader, as they buy with full knowledge of cash flows and pipelines, and can thus better assess when their stock has become too cheap and they would rather exchange it for cash. Who can crypto count on? Miners? Exchanges? Cryptosphere whales are structurally inclined to sell cryptocurrencies rather than buy.

Retail Demand

Retail demand has been crashing together with prices. Widespread losses are the cause. The average retail investor invests in assets that are fashionable, following recommendations and word of mouth. FOMO.

The base audience is the hardcore libertarians and so-called “Austrians”. This pocket of demand is in my opinion almost fully tapped. That leaves the Average Joe, who is no longer interested in crypto.

“I guess I thought we were ‘sticking it to the man’ when I got on board,” Mr. Herman said. “But I think ‘the man’ had already caught on, and had an exit strategy.”

The word of mouth in crypto is “I lost over 60% of my investment in just a few months, it s*cks”.

The following polls are from July 2018 — crypto market cap has since dropped another 25%.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Run this same poll on a popular FB #crypto group. Results even more bearish, with 61% of people down over 50% since January 2017. https://t.co/avqFeyougZ

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Have you overall made money trading or investing in crypto in 2018?

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Irrational exuberance slow progress and adoption down. There is a reason for independent central banks such as the Federal Reserve. These, through the implementation of monetary policy, smooth out the fluctuations of the business cycle and reduce the probability of bubbles appearing.

It should take time for retail investors to forget their pain. They’ll be back!

Institutional Demand

Smart money generally invests in assets that are either cheap, or trending up (with upwards momentum). Cryptocurrencies have been falling like a knife. Why, then, would an institutional investor buy crypto? Well, if crypto were cheap. Yet as already covered, institutional investors can’t actually value cryptocurrencies, and therefore they can’t determine when cryptocurrencies are cheap. Furthermore, these assets produce no cash flows.

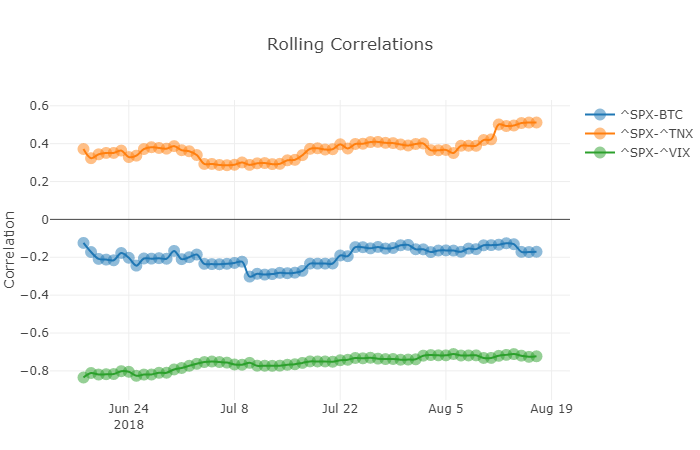

Why would then institutional investors buy crypto? There’s one last possibility: to diversify portfolios. Cryptocurrencies have been consistently uncorrelated with risk assets. That could add some demand. However there’s one thing that is MUCH better for diversification than no correlation: negative correlation. Sovereign bonds offer better diversification than crypto — and provide with regular cash flows!

A Bitcoin ETF

A bitcoin ETF is seen by many as the ultimate savior for cryptocurrency prices, the one thing that will bring about an enormous influx of institutional investors. I covered the subject in detail in this article.

The SEC recently rejected the proposals of 9 bitcoin ETFs. One ETF is still on the table: the VanEck SolidX Bitcoin Trust proposed by the CBOE. The marketplace is awaiting the SEC’s decision to approve or reject this ETF proposal. Per the SEC, when markets are not demonstrably resistant to manipulation, the ETF’s listing exchange must have surveillance-sharing agreements with regulated markets of “significant size” (in order to deter manipulation).

Given that the SEC believes bitcoin markets are not demonstrably resistant to manipulation, the key variable for the ETF’s approval becomes the size of the bitcoin markets with which the Trust has surveillance-sharing agreements. Are they of “significant size” or not?

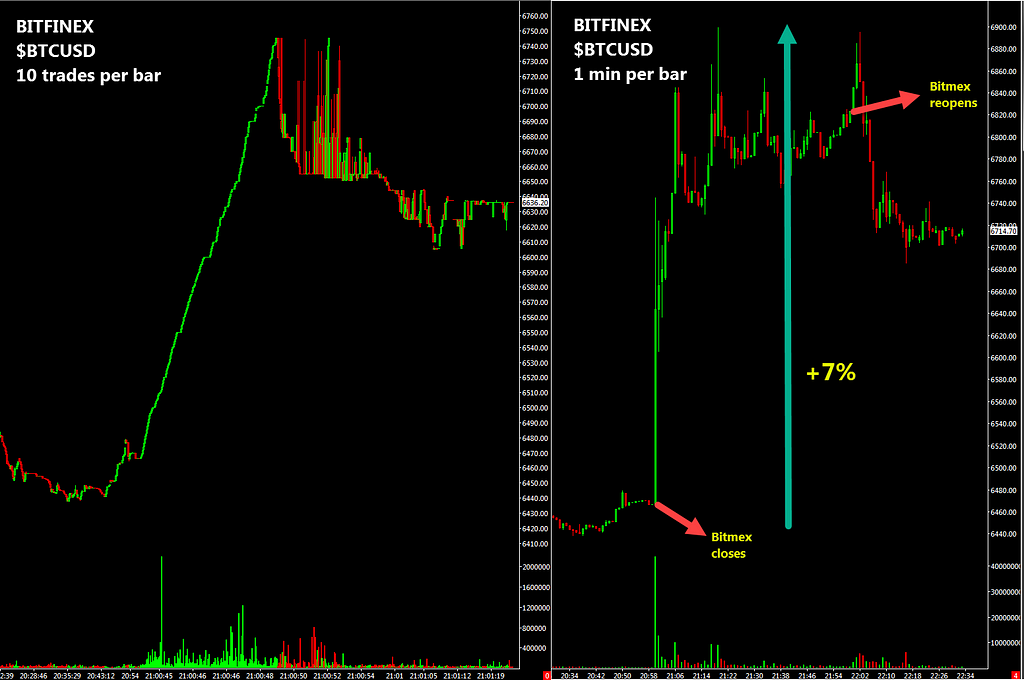

In the aforementioned article I cover how Bitmex, a fully unregulated Hong Kong based bitcoin derivatives platform registered in the Seychelles, has a 40% market share of bitcoin/USD volume. I furthermore show how the Trust’s chosen counterparties have a market share ranging between 3% and 15%, depending on the calculation method employed.

To emphasize the importance of Bitmex, on Aug/21 it went off-grid for an hour for scheduled maintenance. On the precise minute Bitmex shut-down, bitcoin’s price was pumped by at least one large market participant, resulting in a +7% lightning breakout. Adding insult to injury, on the Bitmex re-open Bitmex’s XBTUSD moved an additional +4%, for a total of +11%. A few hours later the #BitmexMaintenance move had reversed in full.

Regardless of the optimism those involved with the CBOE filing from the CBOE/VanEck side may express, the probability of an ETF getting approved in the near term should be close to zero. Although I will never be surprised by the power of lobby.

An ETF will eventually be approved — it should just take much longer than expected.

Natural sellers

Miners, exchanges and ICOs need to sell their coins to fund their operations. These market participants represent natural sellers.

Miners & Exchanges

At current prices, the top 5 Proof of Work coins (BTC, ETH, ZEC, BCH, LTC) are creating about USD 22 million in coins every day, USD 8 billion a year. Bitcoin represents 56% of that total, while ether represents 30%. Given current depressed prices, it is safe to assume almost all are being sold.

The break-even of a professional bitcoin Chinese miner depreciating capex in one year can be currently estimated at $7190 all-in, while its operational break-even would be $5980 (source). Note that break-evens will change (up and down) with mining difficulty, equipment and personnel costs, and are more flexible than for physical commodities (for which mining difficulty does not adjust down with overcapacity). There’s anecdotal evidence of Chinese breakevens being much lower: “roughly $5000”.

On the exchanges’ side, Bitmex is making about 650 BTC a day in fees, or USD 4 million at current prices. Assuming an average trading fee of 0.30% (maker+taker), exchanges listed on Coinmarketcap (excluding Bitmex, US Futures, and Transaction Mining exchanges) are receiving USD 46 million in coins as fees every day (calculations here). So exchanges receive a total of USD 50 million in coins per day. What percentage are they selling every day? Let’s assume 50%: that’s USD 25 million every day.

That would make the combined daily selling pressure from miners and exchanges USD 47 million, or USD 17 billion per year. And that excludes ICOs. Is there over USD 17 billion of fresh fiat coming into crypto, to counter the natural sellers? Consider as well these outflows represent a staggering 8% of the current market cap. The imbalance is notable.

ICOs

ICOs are akin to startups that received all required funding for developing their product (and oftentimes much more) upfront — with the added twist of not having provided investors any equity. Most of that funding was received in the form of BTC & ETH — mostly the latter.

ICOs generally hoarded token sale proceeds in crypto form. ICOs are in the business of developing a product, not in the business of speculating with the value of cryptocurrencies in their treasury holdings. Given that most of their liabilities are denominated in fiat currencies, they should have sold a considerable percentage of those cryptoassets, to match their liabilities, soon after raising the funds. This is called Asset Liability Management. It represents Corporate Finance 102. ICOs should have hired a Treasurer or Asset Manager to hedge their crypto exposure and maintain the USD value of their assets. Most didn’t.

Some ICOs started selling their treasury holdings once the market crash was well underway. I expect most ICOs to eventually unload most of their token sale proceeds.

ETH in particular could be at considerable risk. Now at $275, it could easily continue falling on the back of miner sales as a potential rat race to the bottom develops among ICOs. They are all positioned in a delicate Prisoner’s Dilemma: given the 80% crash from January highs, everyone would be better off by cooperating and hoarding their remainder ETH. Yet collectively agreeing to hold is practically impossible — even more so given operational needs. Recall as well that the ICO market of 2017 was already in bubble mode with ETH at $200.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

🎯 Bullseye $ETH https://t.co/RhZXH1xuRu

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

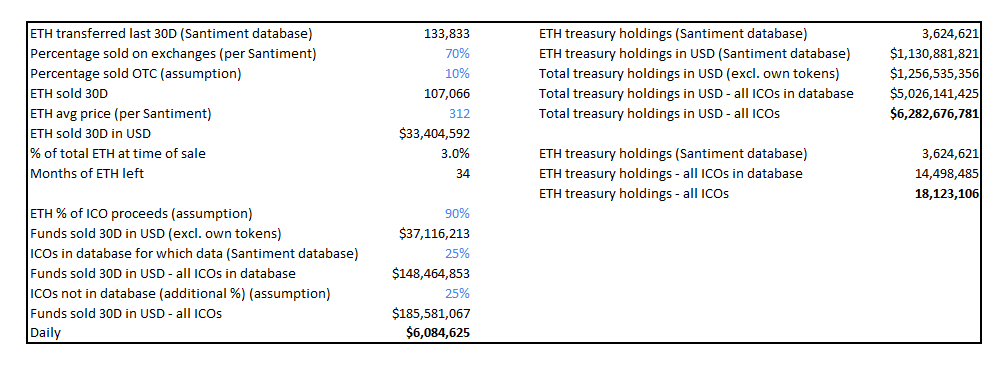

According to Santiment’s database, ICOs for which Ethereum wallets are known (25% of their database) have a visible balance of ETH 3.3 million, or USD 900 million at current prices. ETH 135K were transferred out in the last 30 days. Funds transferred out does not necessarily mean spent — could have been transferred to addresses also controlled by the ICOs. Assuming 70% of those funds are sold in exchanges (source) and an additional 10% were sold OTC, this would result in these ICOs selling ETH 107K per month. That’s about 3% of their total balance. Furthermore assuming those funds suffice to cover monthly capital requirements, and assuming steady prices, that would provide ICOs with about three years to develop a self-sustainable product. That is plenty of time.

How about the selling pressure coming from ICOs? Assuming a) 90% of token sales proceeds were in the form of ETH, b) average selling price for the last 30 days of $312, c) ICOs in the database for which there is no data sell similar amounts (there’s data for only 25% of ICOs in the database, so the baseline number needs to be multiplied by 4), and d) ICO universe is 25% larger (Santiment’s database does not include all ICOs), that results in USD 6 million in daily selling pressure coming from ICOs — a fraction of estimated coin sales coming from Miners & Exchanges.

Interestingly, in a recent article Santiment stated that the average monthly selling of ETH in 2018 by ICOs for which Ethereum wallets are known has been ETH 312K i.e. selling has slowed down considerably recently. Re-doing the prior calculations using ETH 312K rather than ETH 135K results in a) ICOs having only 15 months left to develop a self-sustainable product, and b) USD 14 million in daily selling pressure coming from ICOs.

Using the aforementioned assumptions puts the current ETH ICO treasury holdings at ETH 18 million (18% of circulating supply) and total current ICO treasury holdings at USD 6 billion (at current prices). That leaves ICOs plenty of room for increasing the pace of their sales.

What will ICOs do with their remainder BTC & ETH treasury holdings? Some are holding steady for the time being. Some heavily invested parties such as Vitalik Buterin and Consensys are expressing concern and trying to defend prices, each in its own particular way. Meanwhile talk of ICOs cashing out has been increasing as of late over news articles, tweets, and private channels.

(The Natural Sellers selling pressure analysis is heavily dependent on its assumptions. Many of these are highly contentious. Readers can download this spreadsheet and modify it with their own assumptions.)

What’s left?

What is left is an asset class for which selling pressure is significant and constant, buying pressure is temporarily subdued, and longs should not be expected to spike for a while (yes, that’s bearish). An asset class for which valuations and usage provide no floor. Bitcoin in particular is a wildly volatile asset that can go from $1,000 to $10,000 and back to $1,000. Traders’ paradise. Gamblers’ promised land. Investors’ hell.

Before you go…

If you enjoyed reading this, please consider showing your support by clicking on the Clapping Hands button — the more the merrier, it increases visibility. Can share the article via the following links: Facebook | Twitter | Reddit | LinkedIn | Whatsapp | Email. You can also follow me on Twitter to stay connected. Thank you.

Crypto: Traders’ Paradise, Investors’ Hell was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.