Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s been nearly a decade since blockchain was invented with the promise of providing an alternative to the old monetary system and the ability to make trustless transactions online without a centralized third party. The industry has made a lot of progress especially in the last few years with the recent ICO craze, however ubiquity of merchants who actually accept crypto has been far from reached outside of a few coffee shops and online merchants here and there.

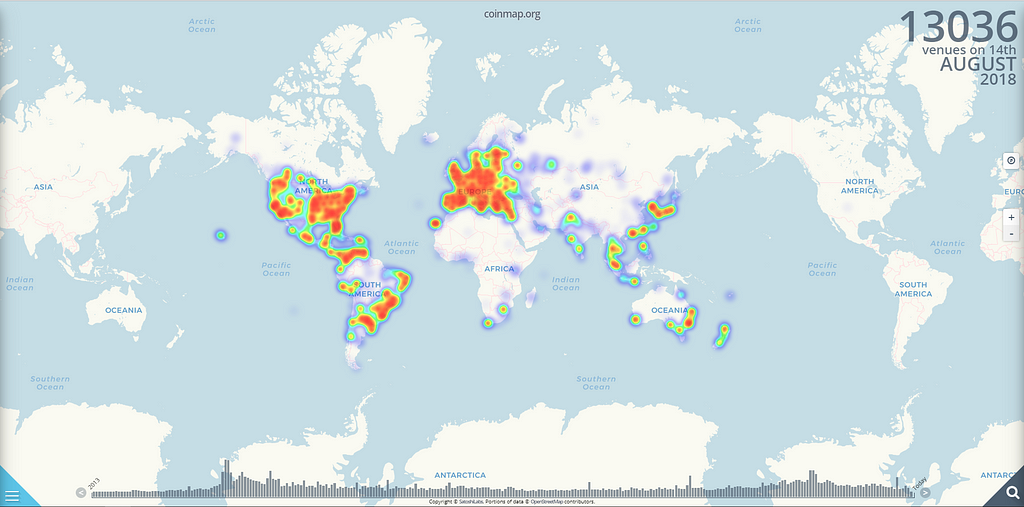

For example, according to coinmap.org there are only around 13K venues dealing with cryptocurrency, including ATMs, globally.

http://coinmap.org/#/world/9.27562218/34.45312500/2

http://coinmap.org/#/world/9.27562218/34.45312500/2

For example, in Calgary, Canada there are dozens of Bitcoin ATMs including one that’s just a few hundred meters of where I am writing this, but the strange thing is that shop doesn’t actually accept crypto as payment. And there are only a handful of places that do accept cryptocurrency in the city. Clearly there is demand for cryptocurrency on the consumer end of things otherwise these shops wouldn’t have ATMs that sell Bitcoin and at a ~15% markup at that.

The lack of merchant adoption is really hindering growth in the space. The more places you can use cryptocurrency the more value it has and the more reason to spend on a day to day or month to month basis. The more participants the more stable the price and the higher the value.

Here are two of the major problems hindering adoption

1. Volatility

This is one of the biggest issues as merchants need to make sure that their assets are relatively stable, a dollar today is a dollar tomorrow as they need to be able to predict expenses, pay employees, taxes, and make orders well in advance. This is especially true for medium to small businesses who have tighter profit margins and don’t have the benefits of economy of scale. A small business owner can’t wait months or years for the next bubble to recoup the losses from volatility.

This is also a problem for regular consumers. Consumers should be able to benefit from this new technology without taking undue risk from an immature market. Most people realistically don’t have the time or energy to be playing in the volatile crypto market. Saving a few dollars on transaction fees isn’t worth losing 70% of your money over just a few months, especially in first world countries where risk of hyperinflation or government forfeiture en masse is very low. The juice isn’t worth the squeeze as they say.

2. Technological Overhead (Complexity)

Not only do merchants have to figure out how to use crypto and make special accommodations for it, they likely have to be constantly selling on an exchange to protect themselves from volatility. This isn’t really worth it in most cases just for the small percentage of people that might pay with crypto.

What’s more is “accepting crypto” can actually be quite overwhelming for merchants as the number of new tokens and coins is proliferating each day. There are well over 1800 crypto assets to choose from and almost each one would take some sort of special technological integration and implementation. Many of which would have to sell on different exchanges or use different platforms and have a lot of friction before getting back to a local or preferred currency.

Each person I know who owns crypytocurrency has a completely different portfolio so even if we imagine crypto reaches 100% saturation for consumers, each person coming into a coffee shop would be paying with a different currency. By the end of the day the coffee shop owner is going to have to potentially deal with hundreds of different currencies, most of which they won’t want.

You can imagine how many stickers you would need on your window if you were to accept dozens or hundreds of currencies and how quickly this would get out of hand trying to accept so many. (Of course stickers on your window is the most trivial issues in implementing multiple cryptocurrencies, but it’s a good visual representation of the larger problem.) Merchants should only need one sticker that reads “CryptoCurrency Accepted Here”. We badly need a scaleable solution for doing commerce in many or nearly unlimited currencies pairs.

Solution: Transaction Agnosticism

Transaction agnosticism is the ability for Alice to pay Bob with whatever asset(s) she wants, and for Bob to instantly receive whatever asset(s) he prefers as payment. And so Bob doesn’t even need to know or care what Alice’s personal preferences or assets are and vice versa.

Some solutions to achieve this could be with pathfinding. Although this will probably be part of the solution in the future its not a complete or efficient solution. The reason being that liquidity between arbitrary currency A and arbitrary currency B, in a lot of cases will be very low and there is still a good chance of slippage even after finding a path as well as some computational overhead.

In order to have transaction agnosticism by swapping arbitrary pairs directly for one another you would need to be sure that there is sufficient liquidity between N^X pairs, where N is the number of supported currencies customers might use and X is the currencies that the merchant wants to accept. However since you likely want to be using a platform that can be used ubiquitously, allowing any individual merchant to easily change and accept different currencies the platform should be able to handle N^(N — 1) currency pairs just to be safe.

If we take the numbers from coinmarketcap.com, there are at least ~1800 cryptocurrencies and lots more on the way or yet to be listed. For this amount there would need to be sufficient liquidity between ~3,238,200 possible pairs.

As more assets hit the market the problem of liquidity will increase exponentially, as most financial instruments will be migrating to the blockchain at some point in the future. Without a solution it will render most assets unspendable in any sort of brick and mortar type situation or even on lots of online shops, devaluing the industry as a whole since you can only actually use the coins or tokens in very limited capacities.

Illiquid pairs could cause the parties to either have to wait a long time or pay a bad price for the transaction nullifying blockchains benefits of cheap and/or fast transactions compared to traditional means.

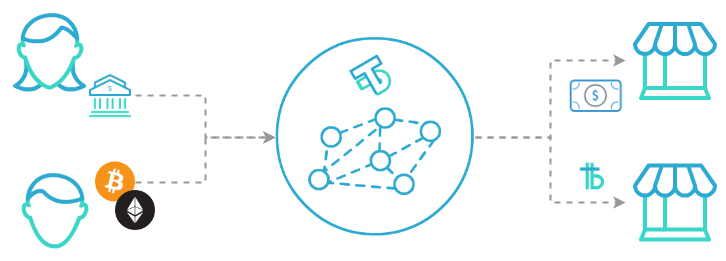

A solution is to use currency X as a settlement or bridge currency. Such a transaction would look like this; swap A for X, swap X for B, send B to merchant (all automatically on the back-end of course). This way we only need to make sure currencies have liquidity with X. Using a bridge currency means you only have to worry about liquidity with N-1 possible pairs, drastically reducing problems with liquidity as it scales linearly as more currencies are supported instead of exponentially.

We at TillBilly are working on making the process even smoother by adding “Just In Time” transactions, meaning we maintain liquidity pools to allow us to simultaneously place a sell order: A for X, while placing a buy order: X for B. So even if the we can’t sell A for a reasonable price instantly, or buy B instantly, the merchant doesn’t actually need to wait for that to happen and they still receive the payment in their preferred currency Just In Time, reducing price slippage of the exchange and increasing speed.

Illustration of proposed TillBilly’s Point of Sale Transaction Model

Illustration of proposed TillBilly’s Point of Sale Transaction Model

Ultimately with “Just In Time” transactions we can wait and take the risk to make a swap at a good price whereas a consumer and merchant shouldn’t be bothered to even think about things like liquidity or even form of payment with modern technology. There are far more important things in peoples lives to ponder.

It is becoming evident that the next big movement within the blockchain space is tokenization and securitization. With transaction agnosticism this opens up some interesting opportunities for people in their choice of currency. For example cryptocurrency users will have the ability to hold asset backed tokens, like a token backed by an apple orchard issued by a company like Smartlands or even something like Amazon stocks. You would then be able to use that to buy groceries from the supermarket or coffee from your favorite coffee shop.

Unlike traditional stocks or commodities you would always be liquid and fungible, no need to sell a large chunk of your investment if you’re short on cash that month. Just spend the amount you need to, when you need to. This way you can keep the upsides of assets, like stability, appreciation., or stock dividends without the downsides of low liquidity and friction caused by fees when cashing out.

This will create great investment opportunities for people all over the world as it allows them to have a wide and diversified portfolio of assets that are not linked directly to their local economy or politics in the way that national currencies so often are at the mercy of. And unlike most traditional forms of investing the bar for entry is almost nonexistent, the minimum amount needed to invest is enough to cover transaction fees. Such optionality for nearly unlimited payment types within a single or few platforms will certainly spur adoption of blockchain particularly because it gives users the option to use relatively stable assets like fiat or commodities ect and easily switch between them.

For crypto to grow it doesn’t need random partnerships or acceptance of random currencies on different sites, but a generalized, currency agnostic, payment solution for both brick and mortar and online shops.

Original Author: Jo, community manager at TillBilly

Transaction Agnosticism: A path to Cryptocurrency Mass Adoption was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.