Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

By Olga Grinina

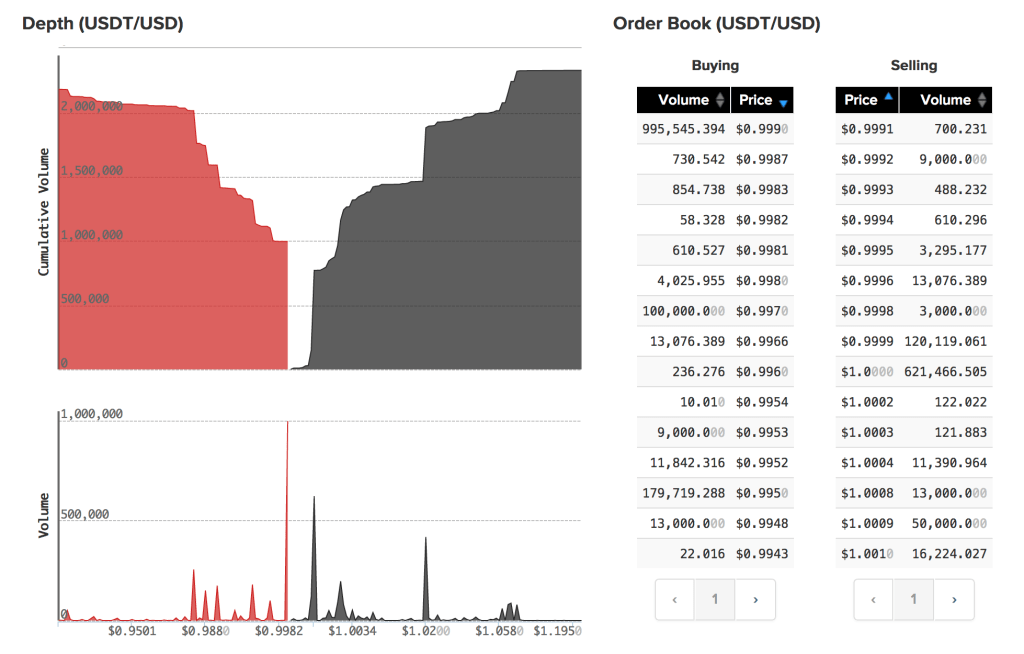

Kraken may be furiously denying allegations on their involvement with the USDT price manipulation, yet that Bloomberg journalist who stirred the waters surely has enough finance background to make a trustworthy conclusion and actually comprehend the basic trading concepts ‘arbitrage’, ‘order book’, and ‘currency peg’. So, what were those ‘weird signals’ spotted by his curious eye? Taking a look at a snapshot of the USDT order book at Kraken, we see that there is well over $1 million dollars of resting buy and sell orders within a suspiciously very close range around a price level of $1 US dollar. As a result, USDT price alterations are very small. What argument Kraken holds for the Bloomberg ‘haters’? Well, it’s basically calling them dummies not able to grasp crypto trading basics and USDT inherent design ‘to be stable against USD’.

Have you ever wondered how tokens are getting listed at crypto exchanges in the first place? All the exchanges, whether it be the tycoons like Binance or smaller players like Exmo, need stable liquidity providers and more users. Trust me, there is a lot going on under the counter — especially when we’re talking emerging exchanges ready to ‘negotiate’ whatever terms to get user base boost.

Crypto exchanges are not the ones caught in manipulation. Wash trading has long been known at traditional stock market. On the crypto market, as always, the phenomenon scaled up tremendously. Investors holding a significant amount of crypto — either startup founders or simply persons of interest — would simultaneously sell and buy the same amount of tokens to create a misleading activity suggesting artificial demand. The modus operandi is pretty easy: a player or a bot places a sell order, only to then place a buy order to simply buy out from himself, or vice versa. And voila, there you have it: the trading volume is surging giving the impression that the token is more in demand than it actually is. It’s hard to access what percentage of newly launched tokens have gone through this grey scheme, no one gives you that statistics!

It’s a logical leap to suggest that faking trade volumes and token price manipulations are not going anywhere any time soon, at least until crypto wash trading is announced illegal by the regulators who finally force the bitcoin Wild Wild West players to comply. Until then, the exchanges will be talking to token launchers negotiating mutually beneficial deals. However, we as a community, might have a way to raise awareness of suspicious activities. Why not start some sort of a blacklist indicating each cases of an unusual market dynamics? Or use the existing scoring platforms that provide general information on key players in the blockchain realm? Revain, for instance, is about to launch their long-awaited Version 1 with a view to add on ratings for crypto exchanges in addition to their existing ICOs rankings.

It’s official: the crypto market remains a highly manipulative space. Shady startups and ICOs, exchanges, media outlets, and whatnot are all guilty. The implications of this are rather alarming for both blockchain and traditional financial industries. Not only the reputation is at stake. By launching the token for the sake of getting it on the exchange and then boosting the price, could those ‘artful entrepreneurs’ be merely demolishing the good faith in the new technologies?

Manipulating exchanges, or crypto Catch 22 was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.