Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Why first-generation cryptocurrencies, like Bitcoin or Ether, can not be widespread among people, but, stablecoins can.

Cryptocurrencies, unlike government money, are currently mere assets with a constant risk of gaining or losing their value; as a result, they can not be a sound, trustworthy way to store value or to be exchanged for other goods and services. For instance, one might sell a number of goods and receive some coins in return only to find out that prices have fallen in just a couple of minutes, and feel fooled. On the other hand, a buyer might spend some Bitcoin, Ether, or other cryptocurrencies to purchase something and then, figure out prices have skyrocketed in just a few days, and feel a great deal of remorse.

The majority of the population would set aside no more than a small chunk of their assets to put at risk in hopes of gaining profit, but, are more interested in keeping and holding the bigger part of their assets in hopes of having the same amount with the same value whenever they want without facing any risk. Since, despite claiming to do so, Bitcoin, Ether and the kind can not store their value and have shown great volatility at many points in time, people prefer to secure their assets against volatility in a different way. There must be a way to produce a kind of risk-free cryptocurrency with a stable value in order to use it in business on a daily basis, or, to hold it as a trustworthy asset.

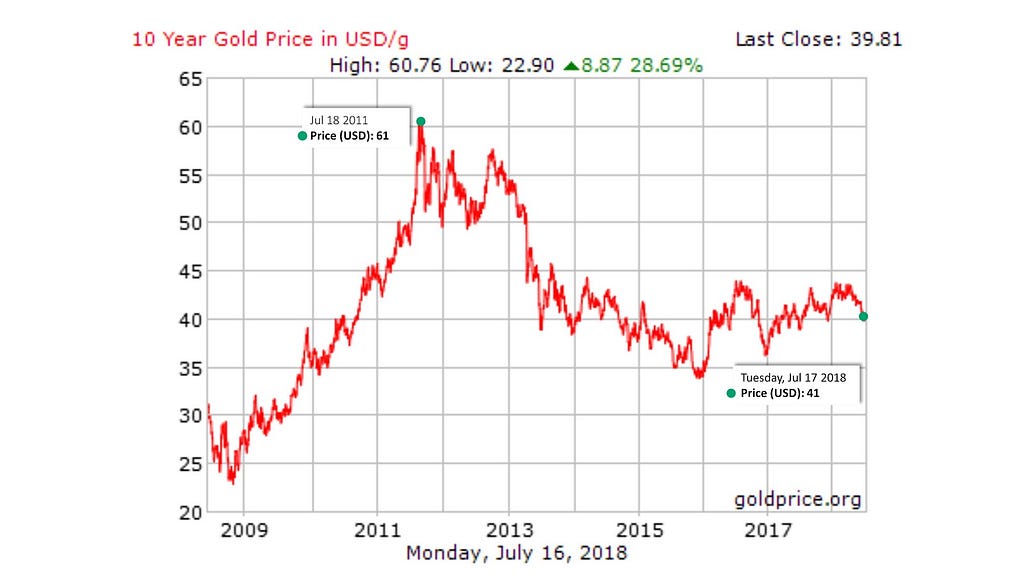

Proof That Gold And Similar Cryptocurrencies Can Not Store Value

First-generation cryptocurrencies’ biggest claim is that as a result of being decentralized and avoiding the interference of influencers and governments, they can store value and replace government money. However, about a decade after these assets were invented, they have proved that _in best case scenario_ they can have features like gold and face great volatility because of the changes in demand and also speculations.

For instance, the following graph evidently shows that if someone had changed the bigger part of his assets to gold in July 2011 he/she would have lost 32% of his assets so far. This volatility exists even in shorter periods of time, like 2013 to 2014, 2016 to 2017, etc.

This is true not only for gold, but also for Bitcoin, Ether and other first-generation currencies that implement a limited monetary policy like gold as well. As the graphs reveal, people who bought Bitcoins, or Ethers in late 2017 with the intention of keeping their value have lost about 60% by now.

The mentioned evidence clearly demonstrates the extent gold, Bitcoin and Ether are volatile, and shows how none of them can resemble a sound money that does not depreciate in value. The main reason for the volatility of Bitcoin and Ether or other first-generation cryptocurrencies is the fact they are produced through time via an algorithm in which there is no accordance to demand or the lack of it. So, Bitcoin and Ether, just like gold, can get cheaper or more expensive relative to the increases or decreases in demand or even attacks by speculators who want to inflate their own profits.

If people do not want to change their assets to gold, Bitcoin, or Ether; government money, i.e. Dollar, is their only remaining option. Let’s take a look at Dollar as one of the most widespread currencies in the world.

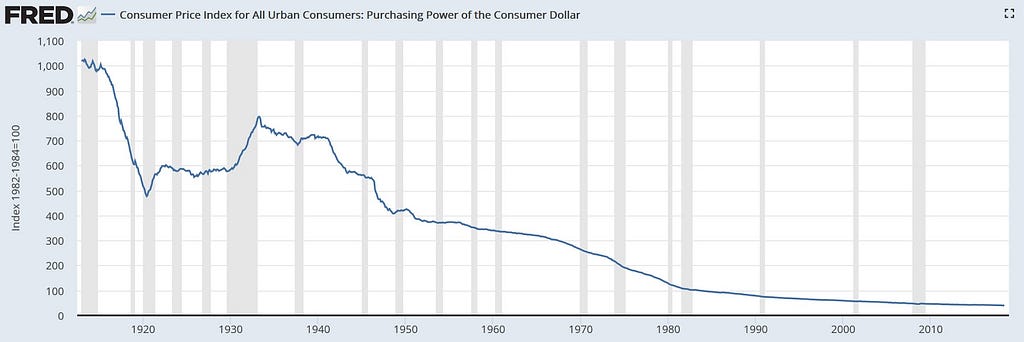

Why Government Money Can Not Store Value

One of the most important purposes of creating governments’ money is storing value, but, through the past centuries experience has revealed that governments have for so many reasons failed to achieve this purpose. For instance, Dollar, which is the strongest and most used currencies in the world and is even kept in the central banks of the world as one of their most important reserves, is slowly but surely depreciating through time and losing its purchasing power. The following graph clearly shows that the purchasing power of Dollar has been constantly depreciating.

Accordingly, experience teaches us that if someone turns to Dollar in order to keep the value of his assets without putting them at risk, he will lose some of his asset value by about two percent.

Stablecoins Vs. Government Money

People yearn for owning something — asset, money, or whatever — that does not put them at the risk of loss, unlike what gold or Bitcoin and Ether do; and, at the same time, can maintain its purchasing power unlike Dollar. Stablecoins are designed to satisfy this very need.

They have a stable value, because, compared to other cryptocurrencies such as Bitcoin and Ether, they are created via a kind of algorithm that creates them according to the increase in demand and eliminates them in case the demand falls so that their price remains stable.

Stablecoins can peg their price to any suitable index. Dollar, for instance, is the index some stablecoins currently peg themselves to. An ideal index, however, does not suffer the shortcomings of Dollar like the loss of value through time. If a stablecoin is armed with a powerful index like ‘a basket of goods and services’ which is called ‘consumer price index’, or ‘CPI’, in economy, it is ensured that the power to purchase a number of goods or services does not change through time. Long story short, If one can buy a house with his tokens, he should at least be able to buy the same house with exactly the same number of tokens after ten years or so.

In order to peg a stablecoin, one has to measure the prices of the index, and lead the system to create more or less coins or eliminate some, according to rises and falls in prices. Thus, we can confidently state that if they are designed and implemented properly with practical mechanisms for creating and eliminating, stablecoins have a stable price or a maintained value, or, in other words, the same purchasing power, through time.

Furthermore, stablecoins are more trustworthy than government money due to their decentralized means of creation and existence. As a result of their initial smart contracts, they can never act against their promise, which is an action governments have proved not to be scared of doing. Thus, they have a great capacity to compete with government money, like Dollars, because they are dependant on individual decisions, so they can avoid all the disadvantages of government money.

Governments, by nature, claim that their money is of the ideal quality, and, boast about how their currencies maintain their purchasing power throughout long periods of time. However, as we observed the graph regarding the purchasing power of Dollar, which is currently the strongest, most accepted and trusted currency in the world, governments either do not intend or simply can not maintain the value of their currencies. Stablecoins, however, by their decentralized programmed nature, are going to do what governments promise to do but fail to deliver.

They are the neon light at the end of the tunnel giving us hope towards a future where people do not lose what they have for no reason other than passing of the time, and, are able to save what they have without worrying about losing it.

It is crucial to notice that the shortcomings we mentioned about Ether, or other cryptocurrencies, do not mean that stablecoins are going to compete with or replace them. In fact, the creation of stablecoins is not a threat to them at all. They are rather good news for other cryptocurrencies. I elaborated on this in ‘The Next Explosion in Ether Price’

This is another hackernoon story from the “Freedomland: Ethereum from monetary viewpoint” series. I try to discuss monetary aspects of Ethereum in these posts. Here is the list of “Freedomland” posts:

- Blockchain After the Gold Rush

- Ethereum as a New America

- The Next Explosion in Ether Price

- Stablecoins, The Only Real Threat To Government Money

Do not hesitate to share your thoughts on this article in the comments below.

Follow me on Twitter and Medium to get notified on the next posts, and help me reach Ethereum Freedomland inhabitants by clapping 👏 and sharing this post in your networks.

Stablecoins, The Only Real Threat To Government Money was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.