Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Why Stablecoins Matters to Ether HODLers!

ICOs raised $5.6 billion in 2017 and this was enough for Ether’s price to explode and experience a 100x growth in this year. ICOs were the first killer application of Ethereum. The huge demand for Ether, by investors who wanted to participate in ICOs, drove up Ether’s price exponentially. But where will the next huge demand for Ether come from? What will be the next killer application of Ethereum? In my opinion, stablecoins will be the next killer application pushing for an explosion in Ether price. Let’s see why.

Three Types: One Viable Option

There are three types of stablecoins today: Fiat-collateralized, crypto-collateralized, and non-collateralized. The only ones proven to be reliable and fully decentralized are crypto-collateralized stablecoins. Fiat-collateralized stablecoins aren’t decentralized at all, allowing governments to easily destroy them by blocking their bank accounts. Non-collateralized stablecoins, on the other hand, aren’t reliable because of their design. Their creation creates a non-negligible economic problem beyond the scope of this text. As a result, crypto-collateralized stablecoins make the only viable decentralized approach to creating stability in the blockchain world. In the discussion to follow, whenever I use stablecoins, I mean crypto-collaterized stablecoins.

New Demand for Ether as Collateral of Loans

In contrast to the first-generation of cryptocurrencies which are only created, stablecoins are created as demand increases and destroyed as it decreases. But how can they destroy the previously created coins? Stablecoins are created as debt by paying new loans whenever their price increases. Being created as debt, they are enabled to destroy the previously created coins by settling the previous loans whenever their price falls. That is why they can always match their supply with their demand and be stable.

What turns out from the term “crypto-collateralized” is that loans paid here by smart contracts are collateralized by cryptocurrencies. For example, when you want to take a Dai loan from MakerDAO, you freeze some Ether in MakerDAO as a guarantee that you will repay your loan. As the US mortgage market collapse of the 2000s has shown, Collateral is an unstable asset whose price may decrease significantly. Stablecoin smart contracts are designed to take, for example, two or three times more collateral than the original value of the loan as a strong measure against this instability. This ensures the value of collateral is always higher than the debt it’s borrowed against so a borrower is able to pay back their loan.

Let’s put it another way, two or three times more collateral on crypto-based stablecoins would generate demand for two or three times more Ethereum purchased and locked away. For example for each 1 Dai which is worth $1, there is an equivalent of $2 or $3 value of Ether freezed in MakerDAO to back that Dai. In other words, any $1 billion growth in stablecoins’ market brings a $2 billion new demand to the market of a cryptocurrency which is used to back it.

The following questions arises here: How big can the stablecoin market become? Can the stablecoins market size become so large their demand for Ether as collateral puts pressure on Ether market?

A Huge Market for “Minimizing the Risks” Instead of “Maximizing the Profits”

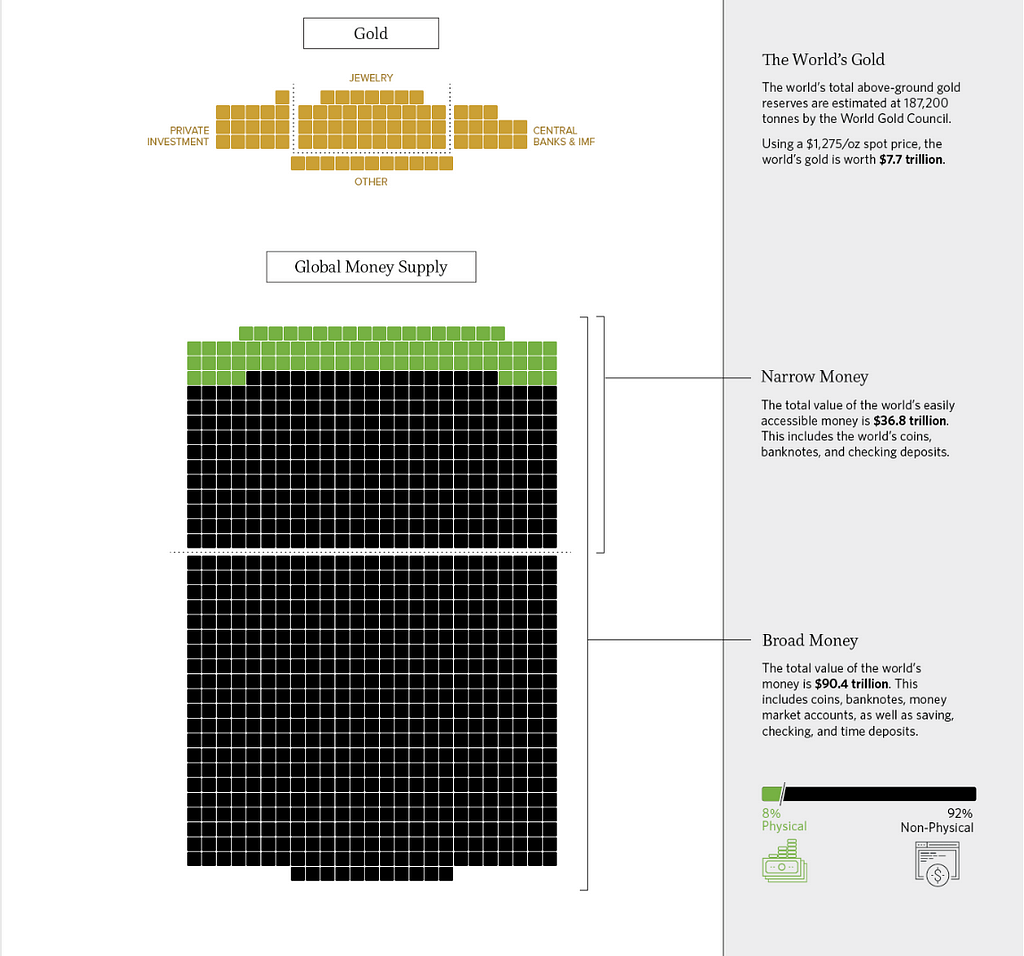

If we consider today cryptocurrencies, like Bitcoin and Ethereum, the gold of blockchain world, stablecoins are the money of this new territory. It may be interesting to know that money market size in today economy is more than 10 times larger than the $7.7 trillion gold market and amounts to $90 trillion!

There is a common misbelief among crypto community that gold is a better “store of value” than fiat money. But if gold is better, why is the money market 10 times larger? There is an important difference between “storing value” in gold and in money which is generally ignored by crypto community.

Although both gold and money market customers are looking for “storing value”, gold market customers are seeking to “maximize the profits” in storing value, while customers of money market want to “minimize the risks”. In other words, customers of gold market are those who are seeking to invest and grow their asset value, thereby accepting the risk of lowering this value as a result of gold price decrease. But money market customers are the ones who are not willing to accept any risk and are just seeking the maintenance of their asset value, not its growth.

Today cryptocurrencies, like Bitcoin and Ethereum, were interesting options for gold market customers, not for money market ones. But stablecoins can pave the way of entering a huge number of money market customers, who don’t like risks, into the decentralized and free blockchain world. If we take a look at today growing conflicts between big economic powers, which are strongly threatening the global free trade, we can easily find out why stablecoins can be very attractive to worldwide merchants to allow them to bypass the increasing limits on their international trades.

Today cryptocurrencies were able to attract 5% of gold market customers to reach today’s $400 billion market size. If stablecoins happen to reach 1% of today’s money market size someday, they would have a $800 billion market. The most interesting part of such an event for Ether HODLers would be that, in such a day, Ether market should be at least two times bigger and worth $1.6 trillion in order to back such amount of stablecoins!

Why Ethereum?

You may want to know why I emphasize on Ethereum and think that Ether, and not any other cryptocurrencies’, HODLers will win most of the benefits of stablecoins’ emergence in blockchain world. There are two reasons. The first one can be easily found out by taking a look at tens of stablecoins’ solutions currently rising in blockchain world. Almost all of them are implementing their system on top of Ethereum network. Why? Because it’s the most simple approach. That’s exactly the reason Ethereum built for, i.e being a platform for the big community of developers to implement anything they like on top of it as simply as possible, without facing many complexities in underlying and low level parts of blockchain.

But there is still a more important economic reason why I think Ethereum is the best platform to host stablecoins. One of the most important risks threatening the stability of a stablecoin is that its backing cryptocurrency drops in value in a way that its collateral value becomes less than the loan value itself. It’s just like what happened to many banks in 2008 economic crisis where the price of houses used as collateral for too many loans in US went below the loan value itself.

The price of cryptocurrencies with low market size can be easily manipulated by speculators through pumping and dumping strategies. The bigger the market of an asset used as collateral is, the less the risk of a sharp drop in its price is. Although Bitcoin has the biggest market in blockchain world, it’s not a proper platform to develop stablecoins on, since it can’t host complicated stablecoins’ smart contracts; however, Ethereum, with the second biggest market, is the best platform to develop stablecoins on with the least risk of being attacked by speculators.

Stablecoins Are like Emails, Social Networks Need Time to Be Born!

Blockchain community doesn’t like stablecoins and thinks that the future of money will be completely different from today’s stable fiat model. They’re right! But we always traverse the path to the future gradually and step by step. When the Internet emerged to change the way we communicate, we were not able to imagine today’s social networks, like instagram, facebook, twitter, etc. We just replaced mails, i.e the old means of communication, with emails, i.e the electronic version of that!

As the Internet was a platform for free communication, Blockchain is a platform for free “economic” communication. Stablecoins, for blockchain world, are just like emails for the Internet. They just add freedom from governments to fiats, and for sure it’s not a small upgrade.

Stablecoins can be the first step to bring the mass used to the old traditional economic communication, i.e. using fiat as money, to Ethereum as our new discovered freedomland. Stablecoins can be the first step of blockchain to pass from competing gold bugs and start competing governments in the money market which is 10x bigger than the gold one.

Special thanks to Leslie Ankney for helping me with this episode.

This is the 3rd hackernoon story from the “Freedomland: Ethereum from monetary viewpoint” series. I try to discuss monetary aspects of Ethereum in these posts. Here is the list of “Freedomland” posts:

- Blockchain After the Gold Rush

- Ethereum as a New America

- The Next Explosion in Ether Price

You can follow me on Twitter and Medium to get notified on the next posts, and help me in reaching Ethereum Freedomland inhabitants by clapping 👏 and sharing this post with your network.

The Next Explosion in Ether Price was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.