Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows the Ethereum whales have recently gone on a significant accumulation spree, a sign that could be bullish for ETH’s price.

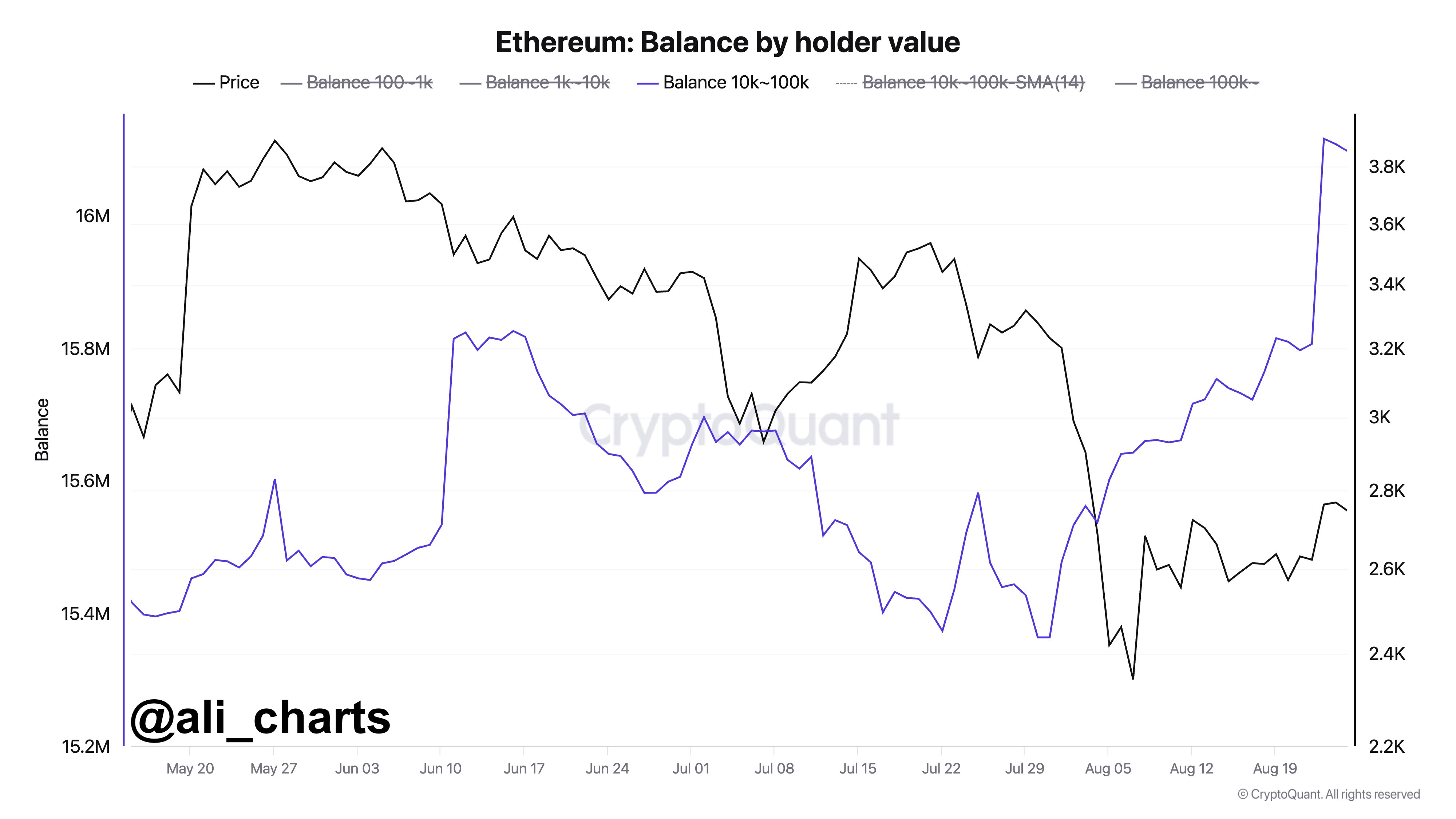

Ethereum Whales Have Added 200,000 ETH To Their Holdings Recently

As explained by analyst Ali Martinez in a new post on X, the ETH whales have gone on a buying spree recently. “Whales” refers to the Ethereum investors holding between 10,000 and 100,000 ETH in their wallets.

At the current cryptocurrency exchange rate, the lower bound of this range converts to $26.4 million, while the upper one is $264 million. The holders of this cohort would be among the largest in the market.

Generally, the influence of any address on the network increases the more coins it holds, so the whales, with their massive holdings, can be considered an important part of the ecosystem.

Because of this, their behavior can be worth keeping an eye on, as even if it may not always directly affect the asset, it can still tell us about the sentiment among these humongous traders.

Now, here is the chart shared by the analyst that shows the trend in the combined balance held by the Ethereum investors large enough to qualify as whales:

As is visible in the above graph, the Ethereum investors carrying between 10,000 and 100,000 ETH have been increasing their total balance since the crash back in early August.

This would suggest that these humongous investors have deemed the recent prices profitable entry points into the cryptocurrency. Interestingly, a particularly sharp buying spree has come within the last few days, as can be seen by the sudden spike in the chart.

The whales have added more than 200,000 ETH (almost $530 million) to their combined holdings with this latest accumulation rush, a notable amount.

Given that this spike in the indicator has come as ETH has managed to recover, perhaps the whales have looked at the surge as a confirmation that there is more bullish action to come, so they have decided to gamble further on the asset.

But of course, it only remains to be seen whether this bet from the Ethereum whales would work out and the ETH price would register a surge from here or not.

Whatever the case, the metric may be monitored shortly, as any changes could point toward where confidence among these investors is heading. A decline would naturally imply the whales are losing hope in the asset.

ETH Price

Ethereum had broken above the $2,800 mark just a few days ago, but the coin appears to have seen a pullback, as it’s now back around $2,640.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.