Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows that Bitcoin miners have participated in a selloff during the past day as they have offloaded 3,000 BTC from their wallets.

Bitcoin Miners Have Sold $131 Million Worth Of The Asset During Past Day

As pointed out by analyst Ali in a new post on X, the BTC miner reserve has plunged during the last day. The “miner reserve” here refers to the total amount of Bitcoin that the miners as a whole are carrying in their wallets right now.

When the value of this metric declines, it means that the miners are taking out a net number of coins from their wallets. Generally, the main reason why these chain validators would withdraw from their reserve is for selling purposes, so this kind of trend can have bearish implications for the price.

On the other hand, the indicator going up suggests the miners are adding to their wallets currently. Such accumulation from this cohort can naturally positively impact the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past month:

As displayed in the above graph, the Bitcoin miner reserve had been moving in a slight overall downtrend during the past month, but the decline has been magnitudes more rapid during the past day.

The miners have withdrawn a total of 3,000 BTC from their wallets during this sharp drop, worth more than $131 million at the current exchange rate of the cryptocurrency.

It’s unclear whether these outflows from the miner reserve have been made for selling. Still, given that they have occurred after the asset has registered a sharp rally, it would appear possible that some of these chain validators have decided to cash in on the high profits.

Miners have constant running costs in electricity bills, which they pay off by selling some of the coins they have earned in block rewards and transaction fees. As such, it’s not unusual to see this cohort participating in regular selling events.

Such selloffs are usually readily absorbed by the market and cause little to no fluctuations in the price. However, the scale of the selling event this time is still quite extraordinary so that Bitcoin might feel some bearish impact.

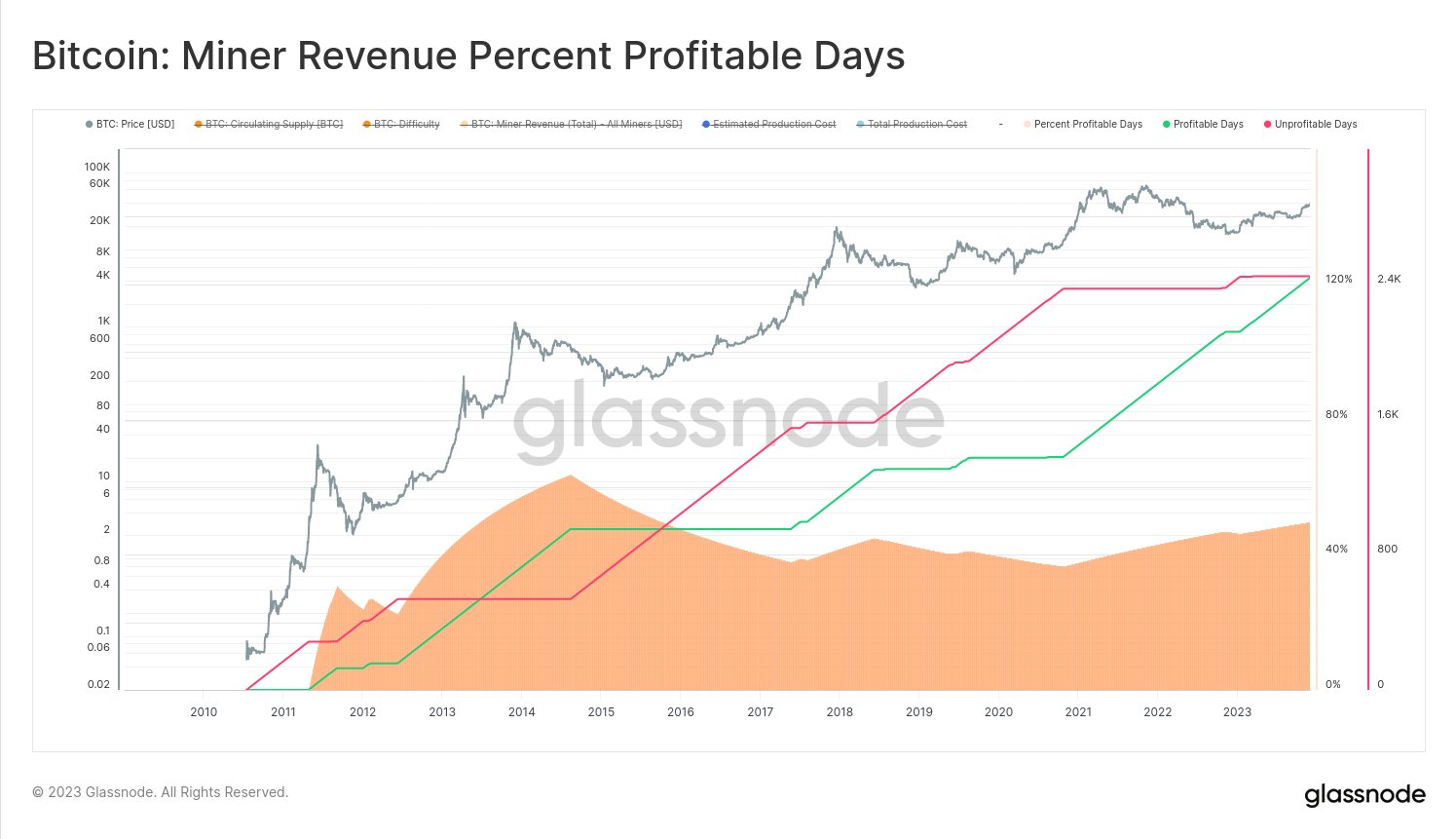

The lead on-chain analyst at Glassnode, Checkmate, has shared an interesting fact about miners in an X post. It would appear that the miners have been in a perfect equilibrium over the history of the cryptocurrency.

“Our framework for estimating Cost of Production found miners are profitable ~50% of the time!” explains the Glassnode lead.

BTC Price

At the time of writing, Bitcoin is trading at around $43,500, up 14% in the past week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.