Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In The Economist’s “World in 2018” introduction to the year multiple articles refer to a coming “techlash,” or the scenario when social media’s powerful network effects are targeted by governments for antitrust violations (or tax avoidance) & when its mob-ruled platforms begin to turn on itself.

In the two years prior to 2018, tumultuous political headlines had been met with a strangely bullish economy. With the tech titans at the forefront, the rising tide of stocks had certainly served to cool down many festering societal wounds.

However, as the bull market inevitably turns bear (question of when, not if), I wonder if this last bastion of social placidity will crumble to catastrophic effect. Just as the tech giants led the world’s economic bull by the horns, they are now slashing down with the bear. Hopefully widespread internet connection led by the growth of the tech sector will in the long-term be an invariably good/democratic phenomenon. Yet in the short-term, unprecented growth of the digital economy/social media has started to reveal many dangerous side effects.

For starters, the ‘democratic” nature of social media has dramatically shifted the nature of journalism. As anybody with a smartphone can now be a journalist, integrity and standards have simultaneously declined. Social media algorithms have become masters at attention hacking and at preying on lowest common psychological denominators: such as outrage, sex, and narcissism. Billions of avid users are finding themselves feeling increasingly depressed and anxious, as continuous research suggests. Historically, the downfall of democracy is its danger of being overtaken by the mob. So as the negative side effects of social media’s democratic platform become more clear, there is an increased chance that its users will revolt.

Probably the most concerning idea however, is that Facebook, Twitter, Google, and Apple, essentially have the power of blackmail over literally billions of people: in every realm from political, religious, sexual, personal, health, etc.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Mark Zuckerberg Prepares For Congressional Testimony By Poring Over Lawmakers' Personal Data https://t.co/oMsNkKRIlF

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

This gives a few people (the executives/engineers at these companies or hackers of unsecured data) unprecedented potential power over all spheres of human society. While I certainly hope that this power is not abused, the fact that it could be abused at all (by either accidental or intentional means) reasonably makes these titans a target for widespread concern.

At the first sign of trouble, such as with the Cambridge Analytica breach this past week, the tip of the iceberg has begun to reveal itself. With senior engineers at one of the social media giants bragging about having access to more sensitive forms of data than consumers can imagine, another grievous breach may be primed to trigger an avalanche of antitrust regulation/negative user spiral. In the end, either consumers will become desensitized by the sheer frequency of data breaches, or they will eventually revolt against the system itself. Regardless of consumer sentiment, these companies will be increasingly interrogated by governments all over the world, in the name of antitrust or tax avoidance, especially as shareholders become more disillusioned by a larger macroeconomic contraction.

Every 8–10 years across the world economy, a confluence of bearish factors historically compound to incite a massive correction. Tech took the blame for crashing the world economy in 1999, Wall St. crashed the economy in 2008, and 2018 will most likely be a combination of tech, Wall St., and the American government itself. The current techlash is only proving to be the firing shot that will awaken larger socioeconomic monsters.

As multi-trillion debt weighs down on American households, its government, and many other countries abroad, an inevitable stock market contraction will start to make the entire world feel very poor, very fast. Or even worse, the reserve currency of the entire world, the US Dollar, may rapidly devalue as the response to impending credit crisis will logically be rampant money-printing (a trap that many other countries have fallen into in the past).

I hope I am wrong — Because there is the slightest chance that proliferation of the Internet & technology across the world has ushered a kind of golden age that defies historical trend as we know it. Perhaps we will never have a recession again. And if the market does go bear, maybe it could be a healthy and manageable correction.

I however, do not think “this time is different.”

For the average investor, I believe it may be time to start hedging your bets. The question is, how best to hedge the kind of scenario where techlash incites a massive worldwide correction?

Past all of the hacks and scams, one possible hedge exists in cryptocurrency, with its developer culture devoted to building a more trustless & secure digital economy by cryptography. Whether the cryptoeconomy will succeed in its vision, I have no idea, but there are many interesting projects underway that will make its ultimate success a viable possibility. That means a small portion of cryptocurrency can potentially go a long way to de-correlate a portfolio and aim for high risk:reward. Because there is a chance that where technology companies fail, its decentralized cryptoeconomic counterpart can fill the vacuum.

And for those who continue to go long in low-cost index funds, or those who are not arrogant enough to try to time the market/buy cryptocurrency, an interesting kind of “portfolio insurance” exists in the form of options trading.

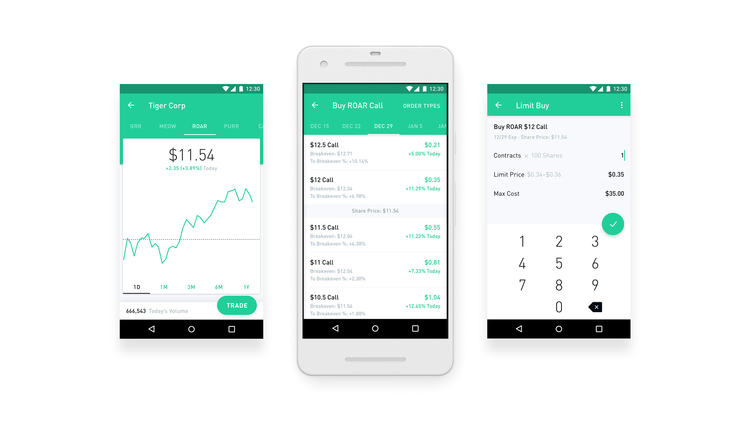

Interestingly, Robinhood has recently added both the ability to buy cryptocurrency and go short on stocks via options trading in the last couple months. Just in time for the impending bear market, I suppose? The millenial generation, as opposed to their analog parents, are natives to the digital economy. So free tradeing along with these new features, has made Robinhood (use this ref-link to get a free stock on the app) a clear favorite for the younger generation. I appreciate Robinhood’s user-friendly interface, and I truly believe that commission free trades is very empowering for the average investor (because otherwise paying 10$ every trade quickly cuts into the bottom line).

So by exercising relatively small amounts of money through options trading, you can potentially protect your portfolio against massive market drawdowns. Take the following example of buying puts explained by CNBC:

“You own 100 shares of AAPL at 190 and want to protect your position, so you buy a 175 put for $1. Should the stock drop to 120, you are protected dollar for dollar from 174 down, and your loss is only $16, not $70.”

(I personally think AAPL will weather the techlash better than FB, AMZN, TWTR, or GOOG, but that’s beside the point)

Buying longer-term, lower-risk puts across your portfolio can be a way to insure against catastrophic drawdown. Because while I certainly could be wrong about my bearish diagnosis, this pessimistic scenario is definitely a looming possibility.

So if you want to come out on top of an impending bear market, consider paying a premium for some portfolio insurance, starting by looking at trading options or cryptocurrency, commission-free on Robinhood. As always, do your due diligence, and consider your personal appetite for risk. Both the bulls and the bears will be correct on a vague enough timeline. Craft your own investment thesis, just be aware of the tools you can use to outperform.

Should I Sell My Stocks Now? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.