Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows the largest Ethereum whales have continued to buy recently as their holdings have reached a new all-time high.

Ethereum’s Top 10 Self-Custodial Wallets Have Grown Their Supply Recently

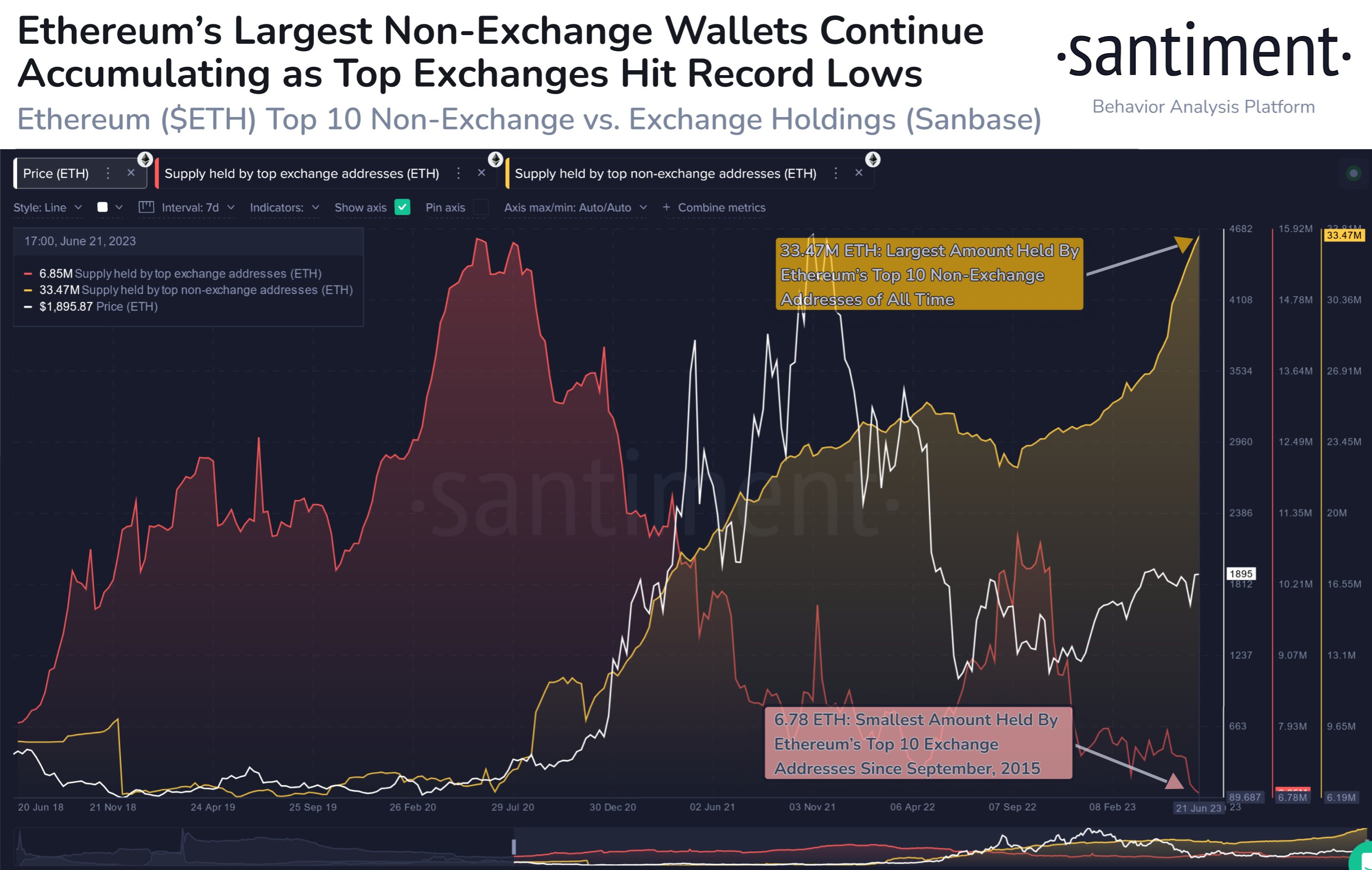

According to data from the on-chain analytics firm Santiment, the top non-exchange ETH addresses have continued to add more coins to their holdings recently. The indicator of interest here is the “supply held by top non-exchange addresses,” which measures the total amount of Ethereum that the 10 largest addresses outside of centralized exchange platforms are carrying in their combined balance currently.

Naturally, the only entities who would be able to own these humongous self-custodial addresses would be the whales. And since the wallets of focus here are specifically the top 10 ones, the holders of these wouldn’t be just any ordinary whales, but the largest even among them.

These investors would be the most influential entities on the network (other than centralized platforms), due to the sheer volume of coins that they can move at once. Thus, their supply can be something to watch for, as any changes in it may be relevant to the market.

Now, here is a chart that shows the trend in the supply of these mega Ethereum whales over the last few years:

As displayed in the above graph, the Ethereum supply held by the top 10 non-exchange addresses has been following an overall uptrend for a few years now. There was a break in this trend during the first bear market relief rally, where this supply went down, implying that some of these whales took the opportunity to exit the market.

The indicator mostly moved sideways during the rest of the bear market, but since the rally has begun this year, these large self-custodial addresses have gone back to accumulation.

In the chart, Santiment has also included the data for another indicator, the supply held by top exchange addresses. From the graph, it’s visible that the holdings of the top 10 wallets on centralized exchanges have registered a decline during the same period as the self-custodial mega whales have thrived.

The supply of the top exchange addresses has now dropped to 6.78 million ETH, which is the smallest value since September 2015, when the cryptocurrency first became available for public trading.

The two lines moving opposite to each other would suggest that the largest whales have been withdrawing their coins from these platforms, as they increasingly prefer to hold them in addresses the keys to which they themselves own.

The withdrawals have been especially intense recently, and so has the accumulation of the self-custodial whales, leading to the supply of the top 10 non-exchange addresses hitting a new all-time high of 33.47 million ETH.

ETH Price

At the time of writing, Ethereum is trading around $1,800, up 8% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.