Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data from Glassnode shows that Ethereum locked into the Beacon Chain contract is currently carrying an unrealized loss of $4.7 billion.

Ethereum Locked On Beacon Chain Is Carrying A Large Amount Of Loss

According to data from the on-chain analytics firm Glassnode, the Beacon Chain was carrying a peak unrealized loss of $16 billion back during the LUNA crash. The “Beacon Chain” was the name of the blockchain that launched back in December 2020 with the aim of testing an ETH proof-of-stake (PoS) consensus mechanism.

The Beacon Chain was merged with the mainnet back in September of last year, in an event known as the Merge. This means that the entire ETH network now runs on PoS.

In a PoS system, the investors can choose to deposit a certain minimum amount of the asset (32 ETH in the case of Ethereum) into a contract to become a validator and earn rewards for it. This is called staking.

So far, the ETH staking contract only supports deposits; the withdrawals will open for the first time tomorrow when the much-anticipated Shanghai upgrade takes place.

Because withdrawals are not open, the staking contract is carrying a large amount of dormant supply at this point. To see whether this locked supply is carrying a profit or loss, the “unrealized profit/loss” indicator is used.

This metric measures the net amount of profit or loss that a certain segment of investors is carrying currently. In the present case, the holders who have locked their coins into the Ethereum 2.0 contract are the segment of interest.

When the value of this indicator is positive, it means the holders in question as a whole are carrying some unrealized gains currently. On the other hand, negative values suggest unrealized losses dominate the investors’ holdings at the moment.

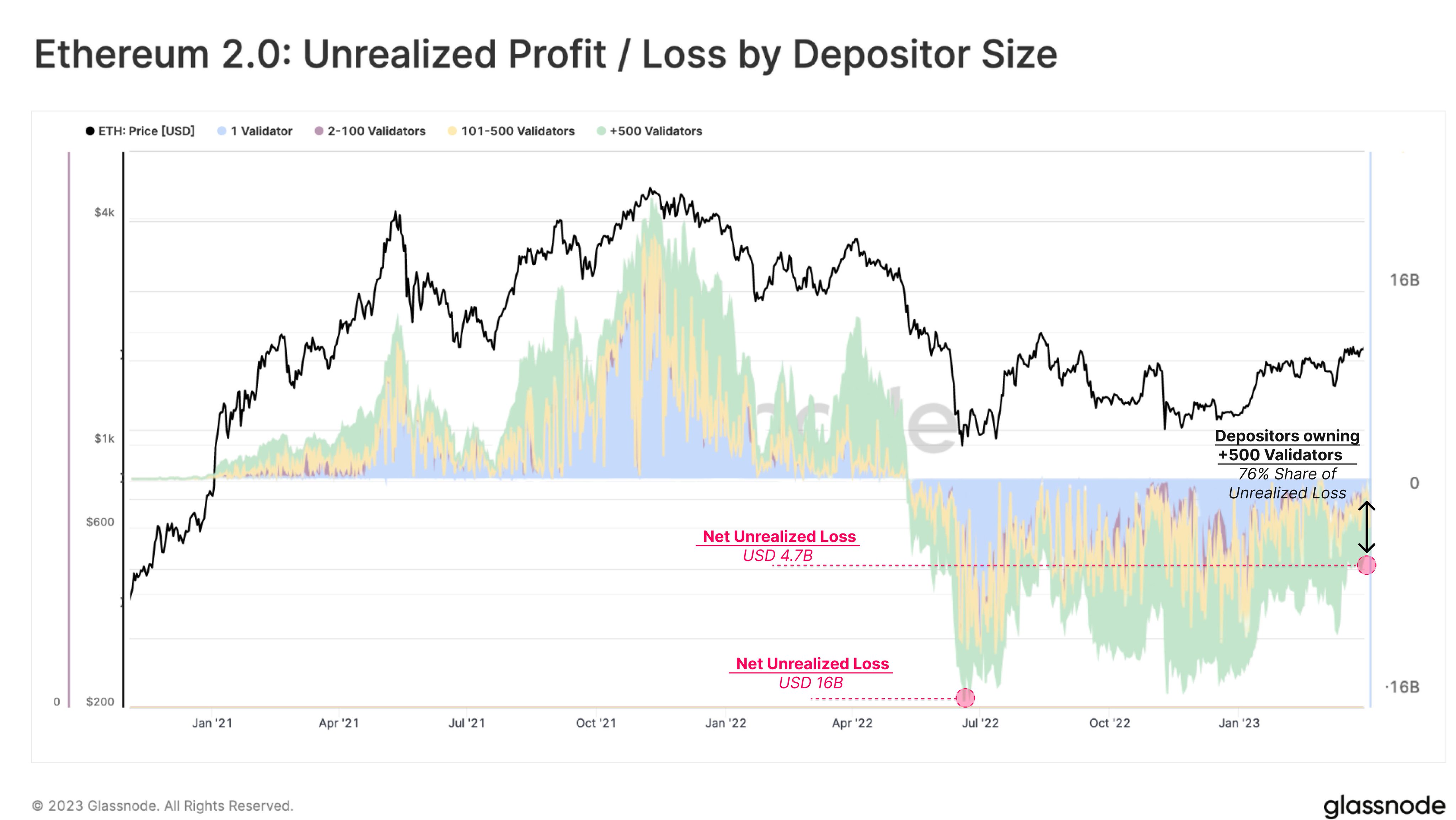

Now, here is a chart that shows the trend in the unrealized profit/loss for the Ethereum locked into the staking contract:

As shown in the above graph, the Ethereum Beacon Chain contract unrealized profit/loss had a positive value during the 2021 bull run and early months of 2022, but with the plunge following the LUNA crash, the indicator’s value collapsed to deep negative values.

At its peak red value around that time, the ETH 2.0 locked tokens were carrying a combined loss of $16 billion. During the rest of the year 2022, the metric’s value continued to be near these highly negative levels.

With the start of the rally this year, however, the losses being carried by these coins have shrunken somewhat, but they are still significantly underwater nonetheless. Currently, this segment of the Ethereum market is holding a net unrealized loss of $4.7 billion.

The chart also breaks down which type of depositors are contributing to how much of these losses. It looks like the largest depositors (with amounts equal to more than 500 validators) are carrying around 76% of these losses.

These coins being so underwater means that when the Shanghai upgrade goes live tomorrow, a high amount of loss-taking may take place in the Ethereum market if investors choose to unlock their coins.

ETH Price

At the time of writing, Ethereum is trading around $1,900, up 3% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.