Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The environmental impact of Bitcoin mining has been a hot topic in the past year, especially in the U.S. Following the coveted mining ban in China, a huge number of large mining operations set up shop in the U.S., taking advantage of loose regulation and low energy prices.

The influx of mining companies to the U.S. raised concerns about their impact on energy consumption, as many regulators feared that they would raise demand for fossil-fuel-based energy.

However, the latest research from Daniel Batten, the founder of CH4Capital, shows that the net emissions from Bitcoin mining have significantly decreased.

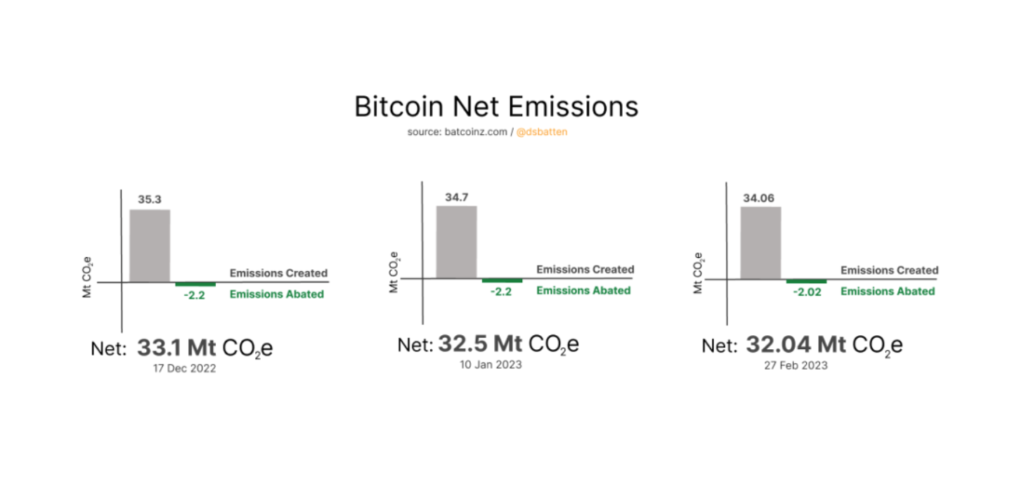

The research looked at Bitcoin’s electricity consumption as estimated by the Cambridge Bitcoin Electricity Consumption Index (CBECI) and adjusted it to account for various energy sources miners use. It found that the net emissions from Bitcoin mining in the U.S. have dropped from 35.3 megatons of CO2 in December 2022 to 32.04 megatons of CO2 in February 2023.

Chart showing Bitcoin’s net emission from December 2022 to February 2023 (Source: Batcoinz.com)

And while Batten acknowledged that these calculations rely on Cambridge’s data which tend to overestimate electrical consumption, he noted that the downward trend still remains in place.

A huge part of this decrease can be attributed to Marathon Digital, one of the largest public Bitcoin mining companies in the U.S. In December, Marathon announced that around 100,000 of its newly acquired ASIC miners would be hosted on wind and solar farms, deploying the majority of them in Texas. The company will deploy 133,000 miners in total across the U.S., with all of them powered by renewable energy sources.

The push towards renewable energy in the U.S. will most likely cause other large miners to consider solar and wind power.

The post Bitcoin’s net emissions are down for 3rd month in a row appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.