Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ripple’s monthly candlestick appears to be closing in the red tonight, despite the fact that the long lower wick implies the presence of buyers around $0.3. However, the cryptocurrency’s performance in the past month has actually been stronger than Bitcoin’s.

Technical Analysis

By Grizzly

The Weekly Chart

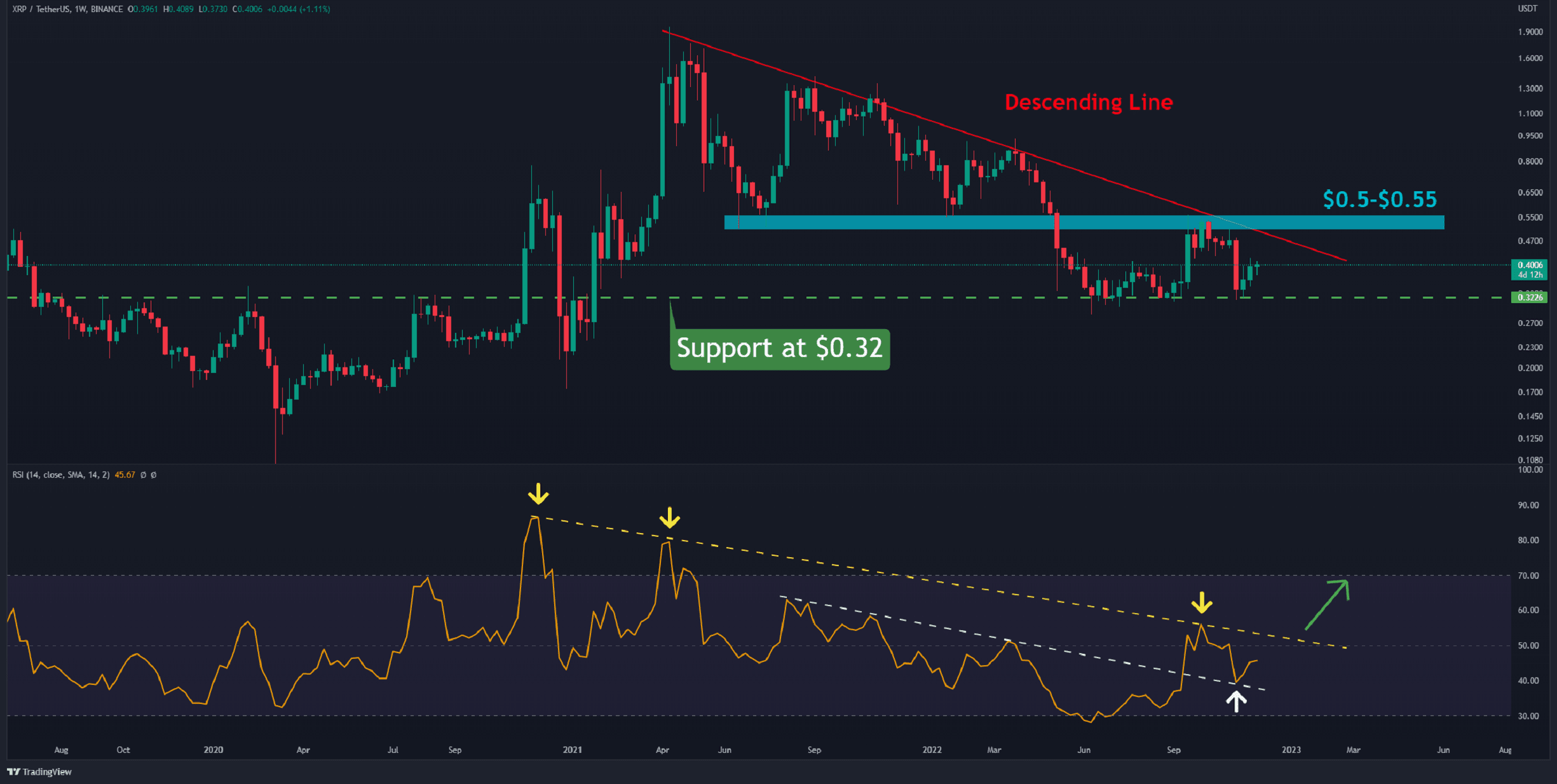

The weekly chart reveals that the downward trend initiated in April 2021 is continuing. The pair has made multiple attempts to break through the descending resistance line (in red) but has been stalled each time.

The 14-week RSI, on the other hand, has moved away from the oversold zone and is approaching the middle line. The primary impediment to gaining momentum in the bullish zone with this indicator is the diagonal resistance (in yellow).

If XRP can break through the resistance zone between $0.5 and $0.55 (in light blue), an upward surge with a goal of $0.8 will be a bit more likely to take place. This rally corresponds with the RSI moving above the baseline, which is a positive sign.

If the asset closes below $0.3, sell setups would be triggered in what will likely be a bearish scenario. In this case, the likelihood of touching $0.24 increases.

Moving Averages:

MA20: $0.40

MA50: $0.53

MA100: $0.70

MA200: $0.49

Source: TradingView

The XRP/BTC Chart

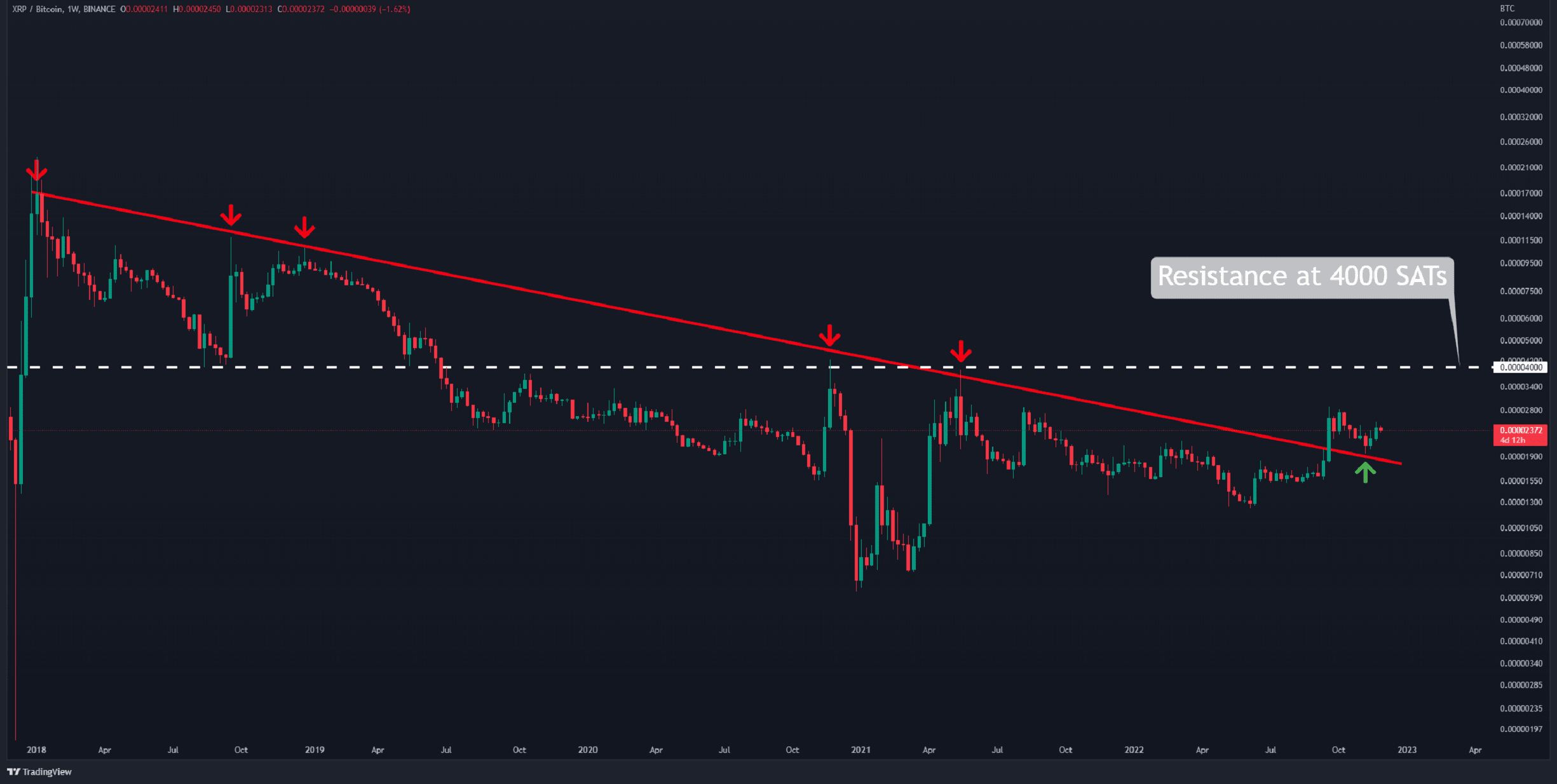

After a lengthy period, XRP has managed to emerge from below the descending line (in red) against Bitcoin. Ripple is now prepared to retest the overhead barrier at 2900 SATs, which it failed to break on the first attempt.

If it cracks, the next hurdle will be 4000 SATs (in white), the level that Ripple has been trading below for more than three years.

When the pair drops below 2000 SATs, the bullish scenario will be breached.

Key Support Levels: 2000 SATS, 1800 SATs

Key Resistance Levels: 2900 SATs, 4000 SATs

Source: TradingView

The post XRP Outperforms BTC in November, Here Are the Levels to Watch (Ripple Price Analysis) appeared first on CryptoPotato.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.