Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Risk Measures Towards DeFi

Lending Economic Attacks

Risk management tools to help users asses possible threats in lending protocols

Risk monitoring and management is paramount for any financial service. The recent events in the DeFi market have proven that risk management is essential to catalyze the growth of the space. From both users and protocols perspective risk management has become a key factor for success within the DeFi ecosystem.

The purpose of this article is to show developing tools that could help prevent losses and contribute to DeFi’s broader security by tracking economic risk conditions. This piece further explores economic risks that could be managed in light of a recent series of events like the Mango Markets attack. Indicators shown on this article are for educational purposes, and currently are only portrayed as mockups; no live data is shown since it’s just for reference.

Identifying Weak Spots

Assets with lowest liquidity and market cap, tend to be the weakest link on lending protocols. Low liquidity assets are the most vulnerable to flash loan or price oracle manipulation attacks. This is true for unified liquidity protocols, while isolated markets have been seen less affected since borrowing is only available for the same asset.

Via IntoTheBlock Risk Indicators

By tracking liquidity available for an asset in decentralized exchanges, we can gauge how prone it can be to being manipulated. A healthy level of available liquidity for supported collateral assets is an important safety factor. In the case of low liquidity tokens listed as collateral, problems of stability in the protocol could arise. Moreover, this could facilitate an easier path for price manipulation, in which attackers take advantage of the protocol. The main goal of an attacker orchestrating this will be to increase the amount of money he can borrow. This could be done by pumping the low liquidity asset, in order to be able to borrow large quantities of other supported more stable assets, as happened with the Mango attack

In addition, low liquidity of collateral tokens could also affect the liquidators’ efficiency. Liquidators are currently a vital part of any borrowing and lending protocol, since they maintain the market balances in check. A reduction in available liquidity could bring the profitability of an arbitrageur to be minimized due to slippage and could affect the stability of the protocol by reducing liquidations.

Furthermore, weak links on supported collateral factors are often also found on low market capitalization tokens. Markets with low capitalization are less costly to manipulate, therefore are an easier target for attackers. This would follow the same process explained above, in which attackers try to increase the amount of other more stable tokens that they can borrow.

Identifying Possible Attackers

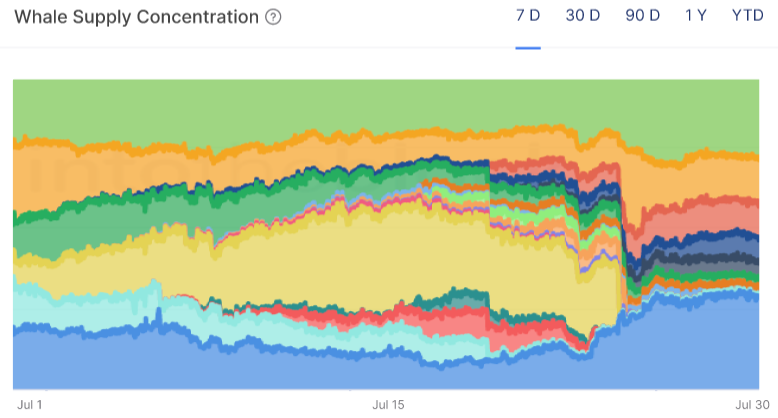

In relation with the first indicator shown, this section is focused on trying to identify possible attackers to the protocol and users. Usually economic exploits are fastly executed, the indicators shown below serve as educational purposes in trying to assess potential threats from the supply concentration of whales.

Via IntoTheBlock Risk Indicators

Borrowing and lending protocols depositors have the risk of having their liquidity trapped on the protocol if all deposits are being lent out at that time. This information helps users in analyzing the liquidity risk of not being able to withdraw if a whale withdraws their liquidity first. It’s also important to clarify that most protocols have mechanisms in place to correct these trends with time. In the case utilization rates are driven too high, rates increase act as an incentive for either for more assets being deposited or repaid.

In addition to the whale supply concentration being helpful for the risks mentioned above, it’s also helpful to spot potential threats to the protocol. For example if one of the largest depositors has a concentrated liquidity on the least liquid asset that the protocol supports as collateral asset. This indicator could be valuable to use together with the DEX Pools Liquidity indicator shown above, and is particularly worth monitoring if the concentration whale tokens is one of the weakest tokens supported by the protocol. This could help bring light to possible damaging trends.

Furthermore, whales usually have high interactions with protocols in which they deposit. This makes new addresses that are among the big whales and do not have a reputable background suspicious.

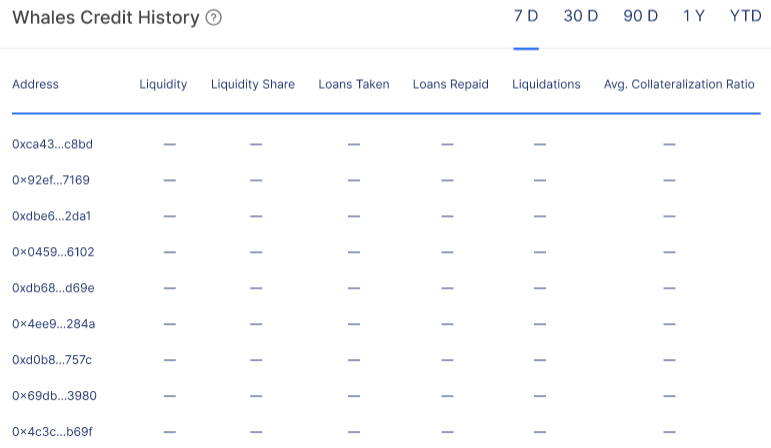

Via IntoTheBlock Risk Indicators

The table above, shows a credit history of the biggest whales from the protocol. This tracks large depositors’ loans, repayments and liquidations. The information presented can be beneficial in several ways, like knowing how native and reliable can specific whales be.

Moreover, by analyzing the Whale Supply Indicator above and noticing if a top whale of the protocol has a significant deposit on the weakest token of the protocol could represent a significant risk. The Whale Credit History table could be useful to further explore this specific address. Attackers will usually create new addresses for their own safety precautions. The Whales Credit History indicator will allow us to gauge to a certain extent the relation this specific address has previously had with the protocol.

Conclusions

Appropriate tools like the above shown aim to move the DeFi ecosystem one step closer towards the right direction. These are just some of the initial indicators thought of after the recent series of incidents. The object is that users as well as protocols gain advantage from available on-chain information.

All of the above images are part of a mockup done for a proposal in the Euler forum. We believe tools like the shown above will help make DeFi safer over the mid- to long-term. Check out the initial list here, in order to find some other beneficial indicators to protect users and protocols from economic attacks like the recent one.

Risk Measures Towards DeFi

Lending Economic Attacks was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.