Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Power structures are a hot topic these days. With all the recent criticism of men and particularly white men in positions of power, it’s easy to get the sense that a particular subsection of society that is identifiable at birth poses an undue threat to our well-being. But is this truly the best way to think about the issue? What about Lord Acton’s adage “Power corrupts; Absolute power corrupts absolutely”? I submit that the majority of bad behavior we observe arising from those in power is not due to who is in power, but is due to how our social systems are oriented to protect those in power.

Hierarchies are real and have a biological origin. Like more primitive animals, human serotonin levels are regulated by where we perceive ourselves to be within a social hierarchy. Our perception of the physical size of others has evolved to take their hierarchical position into account, meaning our perception of our physical surroundings is literally warped by our position within a hierarchy. So what does this mean in the real world? It means our brains are literally wired to show greater deference to those above us in a hierarchy. In 2015, about 53% of working Americans worked at companies larger than 500 people compared to just 45% in 1988, meaning more of us are spending more of our days attempting to appease more managers as employees while we work through increasingly complex customer service labyrinths as customers.

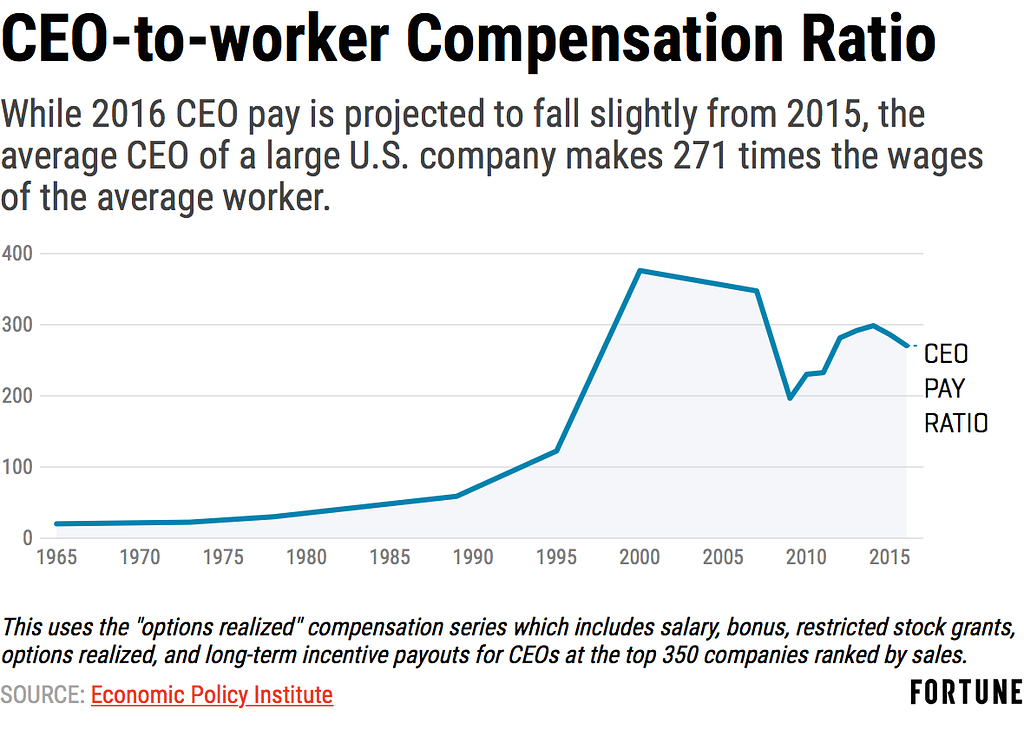

Okay, companies are getting larger, so what? Keep in mind as organizations grow, the difference in hierarchical position between those at the top and those at the bottom also grows, and produces expected outcomes like the increased ratio between CEO pay and that of an average employee:

What this also means is that those in power not only have increasingly more leverage over their subordinates, but if we can extrapolate earlier findings, their subordinates likely perceive their power over them to be greater than it really is. (Ever wonder why CEOs are so tall?) Intelligent despots who understand this dynamic will create atmospheres that maximize this demigod perception of them. In fact, I have heard from friends who’ve worked at major consulting firms and investment banks that many of them will intentionally recruit insecure yet capable junior employees, because they’re the easiest to control and least likely to question this power dynamic. As American corporations became larger, on some level their operating and recruiting models came to resemble those of street gangs that also seek out capable yet insecure soldiers to do their bidding.

Although leaders of large companies are still subject to market feedback, massively reduced enforcement of antitrust legislation has led us increasingly towards winner take all monopoly economics, resulting in fewer leaders whose power is becoming increasingly consolidated and absolute. Remembering Lord Acton’s axiom, how could we possibly expect less corruption, less manipulation, and less selfish behavior, when fewer people have more power?

So is it any surprise when Uber takes advantage of its market position and chastises its drivers for complaining about falling rates? After all, they could (or thought they could) and market forces likely encouraged them to create a manipulative incentive plan to lure drivers in with essentially teaser rates, knowing they would eventually lock them into lower rates after they’ve quit their other jobs, before eventually replacing them once their self-driving technology has made their drivers obsolete. And it shouldn’t be a surprise that Comcast has developed the reputation it has, because as customers purchasing the services provided by a company that likely would have been illegal to construct in the 1950’s, we either lack viable alternatives, or perceive that we lack viable alternatives. So when they say, “Wait,” we say, “How long?”

So how will blockchain technology fix this problem? Because blockchain technology massively expands the number of organizations that can raise startup capital, more organizations will in fact raise capital through the issuance of tokens. And because blockchain incentives are frequently shared through the distribution of these tokens, group participants who contributed to the success of the decentralized organization will get rewarded accordingly, as blockchain technology allows them to receive fractionalized equity in the community they build based on the value of their contribution. Early Uber drivers could have theoretically been rewarded in a similar manner, but the fractional nature by which tokens can be distributed will make this type of incentive plan easier to roll out to part-time service providers in a gig economy.

This decentralized organizational structure will offer community members similar benefits and tradeoffs that democracy offers people escaping fascism. Meaning it’s actually not all better as there will be different challenges around effort coordination, but for some industries this is a small cost compared to the benefit of more consumer choice and fewer people being lured in by teaser rates, only to be stripped of their productive value without benefitting proportionally to their contribution.

This is all very theoretical. What tangible projects are being created to enable this change and why is now the time to be excited? Clear examples of monopolies and cartels seeking unearned rent can be found in many brokerage industries. Prior to the emergence of peer-to-peer technologies, a brokerage company would raise a bunch of capital to lure both buyers and sellers onto their platform, before eventually raising the fees they would extract from participants on one or both ends. Lots of money has been poured into creating these brokerages, because they benefit from network effects and have monopoly-like profit potential.

And because it’s so challenging for smaller brokers to break into these fields, many don’t even try, but this could change soon. In addition to institutional trust trending down over the long term, interesting changes have come about over the last several months that suggest this dynamic could soon shift:

- Massive growth of investor appetite for smaller teams building decentralized exchanges

- The emergence of pre-built marketplace tools to provide smaller teams the functionality they need to avoid reinventing the wheel many times over

The long term trend proves people want an alternative to the reign of existing institutions and the emerging trends show how soon they could come. CanYa & Bee Token are two decentralized marketplaces that have each recently raised over $8M to provide decentralized services and room listings respectively (think TaskRabbit & AirBnB without the fees). And WeTrust, Origin Protocol, and district0x have also raised meaningful capital to provide financial services, developer tools, and organizational governance solutions to their marketplace partners, saving them time and resources enabling them to more effectively tackle their formidable centralized competition.

When will I notice the change? The exact timing of the emergence of formidable decentralized players is very hard to predict, but based on the actions of their powerful yet bloated centralized competition, we should definitely be asking when and not if. Given their nature as platform providers, it’s very possible that the WeTrust’s, Origin Protocol’s, and district0x’s of the world may partner with dozens of early stage consumer facing decentralized marketplaces before a wildly successful one emerges. But ultimately consumers will make the choice and in a matter of months, consumers and vendors will begin to see a proliferation of services provided without the curse (or blessing) of a middleman.

Blockchain will fix many problems you never knew you had was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.