Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

After consolidating around $47,000 for several days in a row, bitcoin dumped by double-digit percentages in the past 24 hours to a three-month low beneath $43,000. The altcoin space is also deep in the red as the entire market cap lost $200 billion in a day.

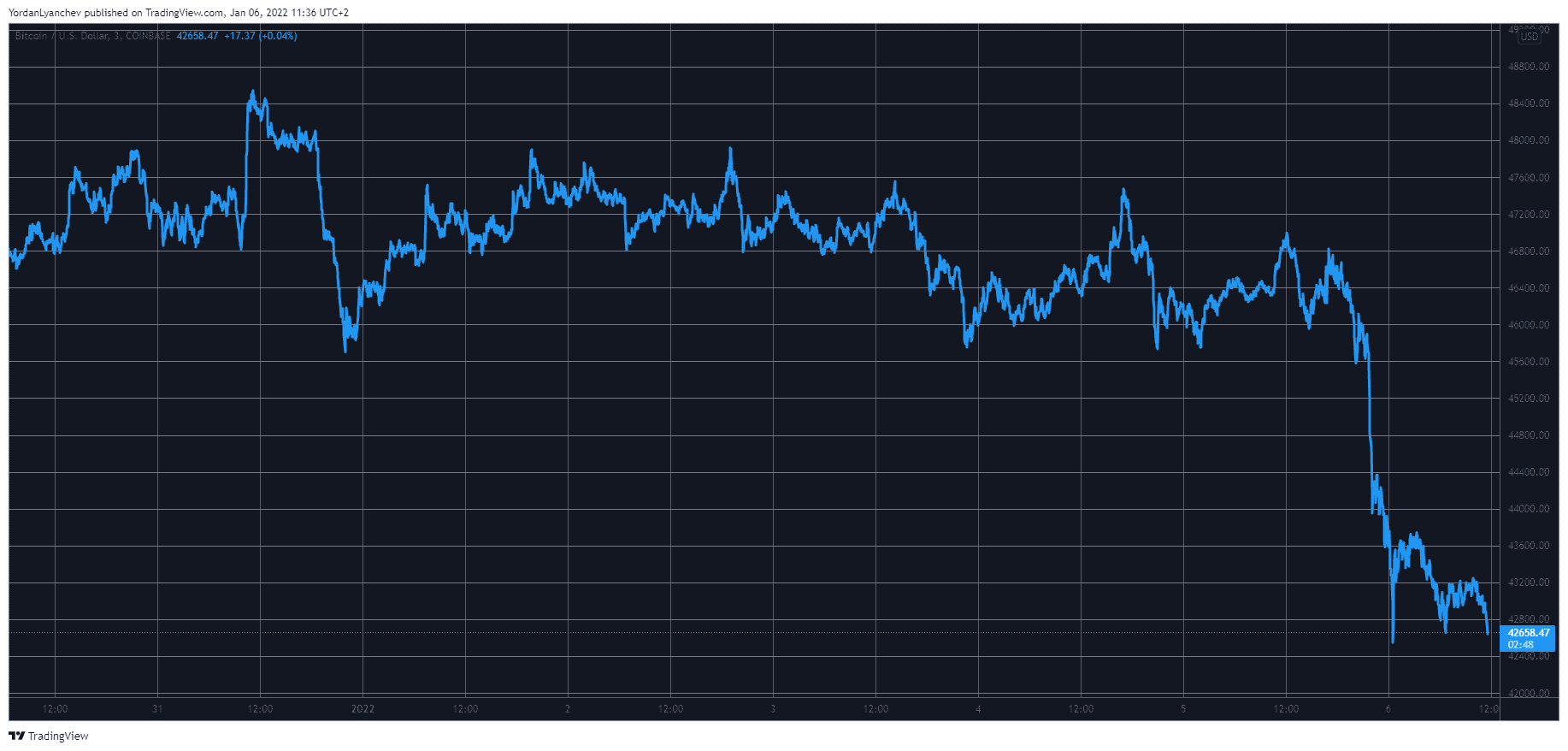

Bitcoin Plummets Hard

The past several days seemed quite untypical for bitcoin as the asset remained relatively still around the $47,000 mark. A few exceptions came and disappeared quickly when the bears halted each attempt to go higher rather quickly.

However, it all changed in the past 24 hours. As BTC stood around $47,000 again, it started to lose value rapidly. In a matter of hours, it dumped by more than $5,000 and dropped to an intraday bottom of $42,500.

This 11% daily decline meant that BTC reached its lowest price line since September 30th, beneath $43,000. As of now, it has added a few hundred dollars, but it’s still below that particular line.

Moreover, its market capitalization has decreased to just over $800 billion. This correction coincided with similar price developments in the stock markets following a Fed announcement in regards to its balance sheet.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

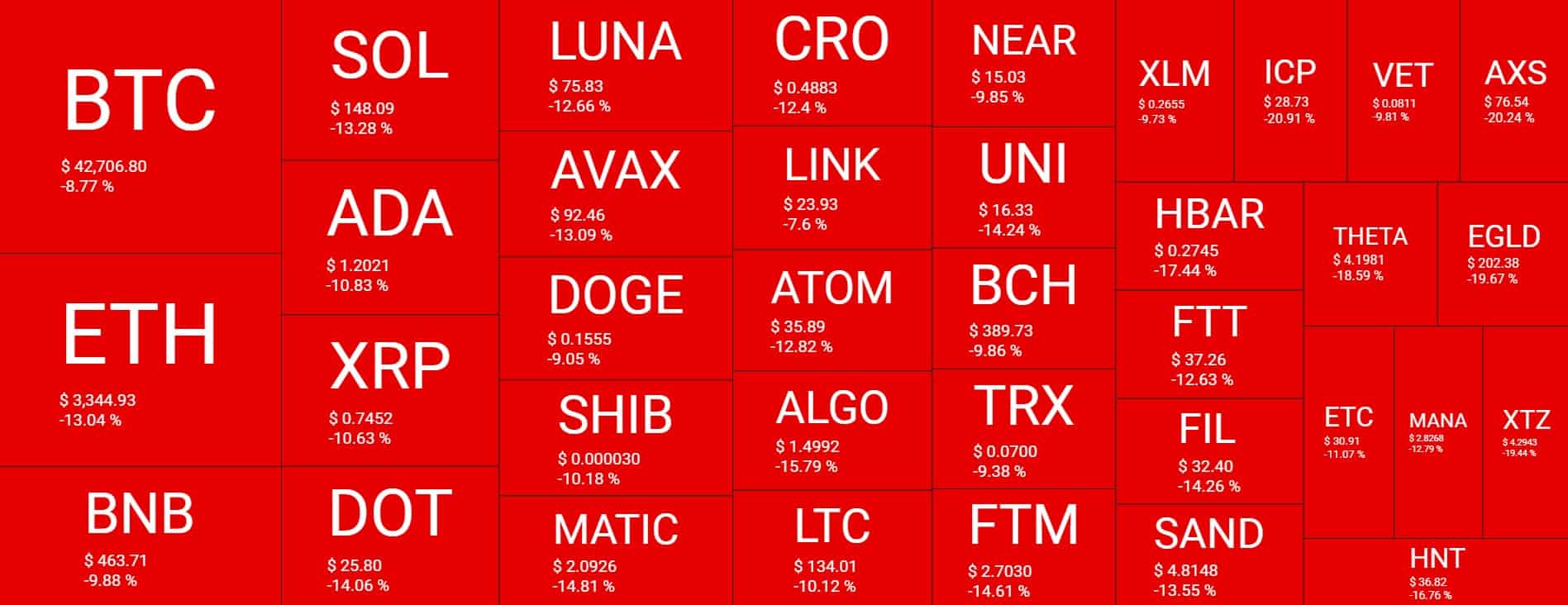

Altcoins See Nothing But Red

As it generally happens when BTC heads south vigorously, so do the altcoins. Ethereum dabbled with $3,800 for a few days before the market-wide correction pushed the second-largest crypto down to its current price line below $3,400, meaning a 12% daily decline.

The rest of the larger-cap alts have lost similar percentages in a day. These include Binance Coin, Solana, Cardano, Ripple, Polkadot, Terra, Avalanche, Dogecoin, Shiba Inu, and MATIC.

The situation with the lower- and mid-cap alts is quite identical. Curve DAO Token (-19%) leads the way, followed by Loopring (-18%), ICP (-18%), Axie Infinity (-17%), Compound (-17%), Tezos (-16%), SushiSwap (-16%), and many more.

Ultimately, the cumulative market cap of all digital assets lost roughly $200 billion in a day, and the metric is down to just over $2 trillion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.