Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The six-month waiting is over as bitcoin managed to break the previous all-time high and set a new one at $67,000 yesterday. While the asset has lost some ground since then, numerous altcoins have started to chart impressive gains, including ETH and SOL.

Bitcoin’s ATH at $67,000

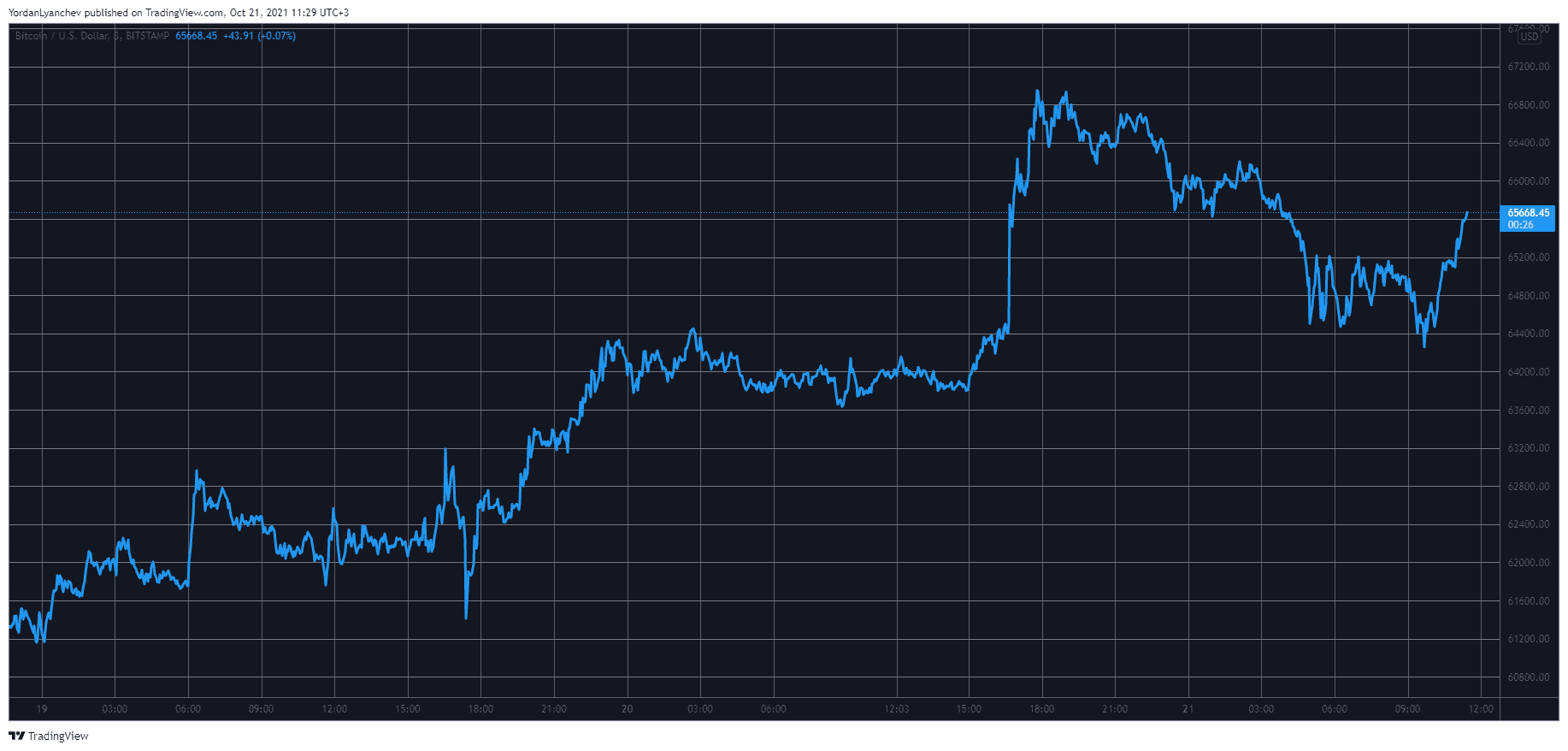

As reports started to intensify claiming that the US Securities and Exchange Commission will finally allow a Bitcoin ETF in the country last week, the question of whether or not the asset will break its April all-time high was just a matter of when not if.

BTC went above $60,000 for the first time in six months after news that ProShares’ ETF will go live on October 19th and stood north of that level for the majority of the weekend.

As the exchange-traded fund indeed started trading on Tuesday, bitcoin once again pumped and came just $500 away from its record. It all changed yesterday, though, when the cryptocurrency skyrocketed well above $65,000.

It actually went as high as $67,000 in the following hours, which became the new record. Although it has retraced by more than $1,000 since then, its market capitalization is still well above $1.2 trillion.

Altcoins: Green Takes Over

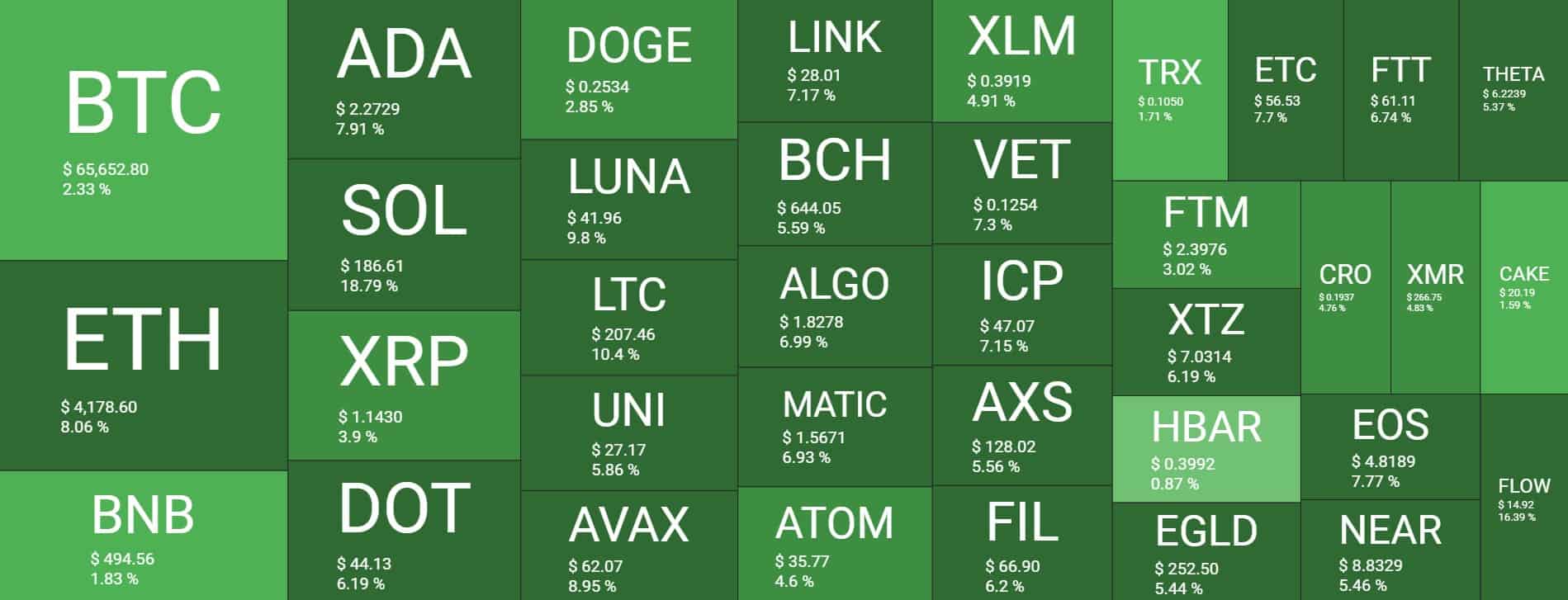

The alternative coins had failed to follow their leader north in the past several days, but the situation is quite different now. Ethereum is among the most substantial gainers following an 8% increase. As a result, the second-largest crypto had finally broken above $4,000 and trades just shy of $4,200.

Binance Coin, Ripple, and Dogecoin have marked more modest gains, while Cardano, Polkadot, Terra, Litecoin, Uniswap, and Avalanche are up by 6% to 10%.

Nevertheless, Solana has surged the most from the top 10 coins. SOL is up by nearly 20% in a day and is close to $190.

Further gains come from Nexo (20%), Flow (15%), THORChain (15%), Enjin Coin (14%), The Graph (13%), Ren (12%), Qtum (12%), and more.

The crypto market cap, which also broke its old all-time high, has increased to $2.650 trillion as of now. The metric is up by $400 billion in a week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.