Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The cryptocurrency market is a complex and sometimes puzzling space, and to operate in it with any degree of confidence, one has to continually learn new things. To trade crypto, you need to go to a cryptocurrency exchange, and each exchange runs on a slightly different set of rules and principles that it is essential to understand. We'll try to provide some basic information to help you navigate the marketplace and make informed crypto trading choices.

Things to take into account when choosing your crypto coin

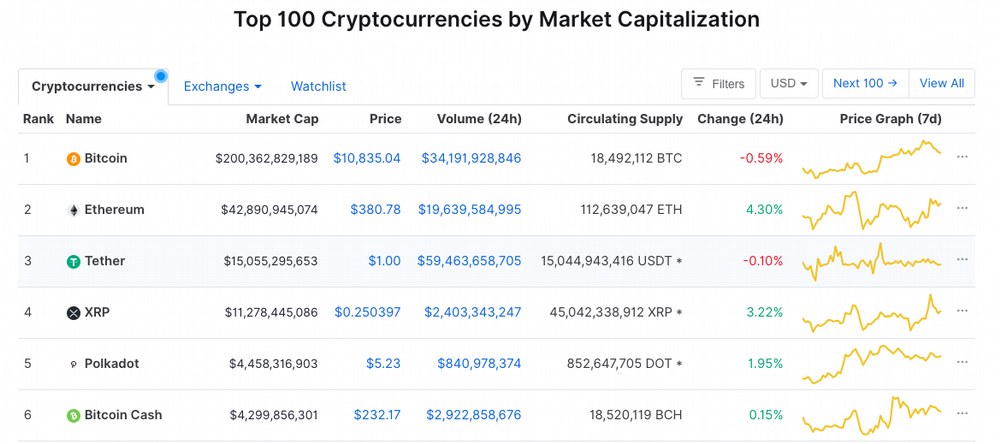

Few things are as important in making your decisions about a crypto coin as its ranking ₋ a set of vital data points about the coin and its fluctuations, based on which you can then pick the one that seems the most attractive to you. CoinMarketCap publishes the rankings for various coins based on numerous factors. Here's what a rankings table usually looks like:

Ultimately, the critical data points for you are the price and the market capitalization, and they should be considered both together and separately. A coin's low value in and of itself should not automatically be a disqualifying factor in making your decision. The low value/demand may have resulted from many different scenarios, such as, for instance, relatively low community trust, untargeted messaging, or insufficient management skills on the part of the coin's developers. Once these factors come into play, they create downward pressure on the coin, further lowering its value. This, however, is not universally true for all coins in the marketplace, so you will be wise to do your own research to gain a better understanding of the coin's standing.

The next factor to contemplate is how a particular coin stands against the others. For instance, what's known in the market as "stablecoins," backed by real-world assets, whether they are fiat money or precious metals. This makes them more immune from the wild ups and downs of the crypto market. Stablecoins are usually divided into three categories: fiat-collateralized, crypto-collateralized, and metal-backed. Each of these categories is also ranked, so you can study the rankings and find the coin to your liking.

Understanding your coins

To better comprehend the real market value and utility of a coin, you may want to dive further into research into its background. The following questions may be useful in guiding you in your investigations:

- Does the coin have an actual real-world utility or application?

- Does it enjoy the trust of an active and well-informed community?

- What is its liquidity? How easily can it be converted into fiat currency or other crypto coins?

- What are the legal regulations concerning cryptocurrencies in different countries?

Using charts to keep abreast of the market situation is also informative and expedient. Candle charts provide a birds-eye view of the entire market for a specific trading pair as it moves up and down in the historical perspective. This visual presentation enables market participants to draw conclusions about the current and past trends and attempt to foresee the future direction of the price vector.

Deciding on a trading pair

In the crypto market, trading pairs can be of different types: crypto-to-crypto or a crypto-to-fiat.

Although different cryptocurrencies have their own pros and cons, the following five appear to be the most popular, usually staying at the top of the charts: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), EOS (EOS), and Tether (USDT). You may want to look into their properties and market dynamics and decide on which one works best for you.

Comparing different exchanges

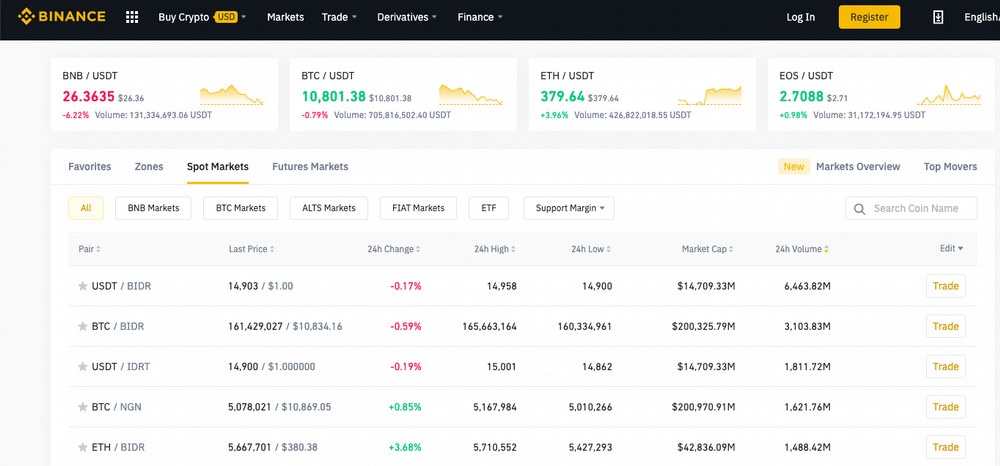

When zeroing in on your desired trading pair, it’s vital to weigh all of the above-mentioned aspects that may affect your prospective trades. One other factor that has not yet been mentioned is to see if your crypto exchange actually lists the trading pair you're considering. If it does, you will also need to check your pair's trading volume on the exchange.And this is where Market Overview section on each exchange helps greatly.

Here’s what a Market Overview page at Binance, the world's largest exchange by trading volume, looks like. It provides information about the prices and trends for the top pairs traded at the exchange, about various markets and market instruments, and much, much more.

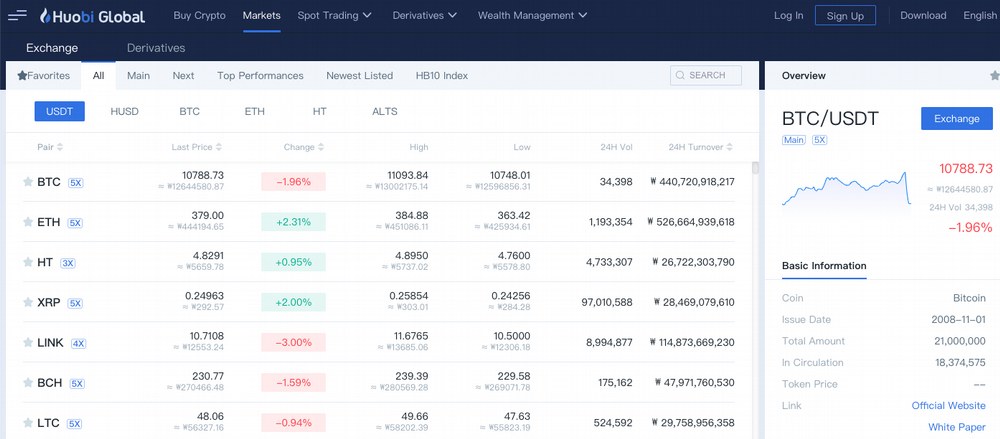

Here's what the Market Overview page looks like at Huobi, another popular crypto exchange. It is a little different from the one above, but essentially presents the same types of information. The top pairs are also different, which reflects their listing options and their customers' preferences.

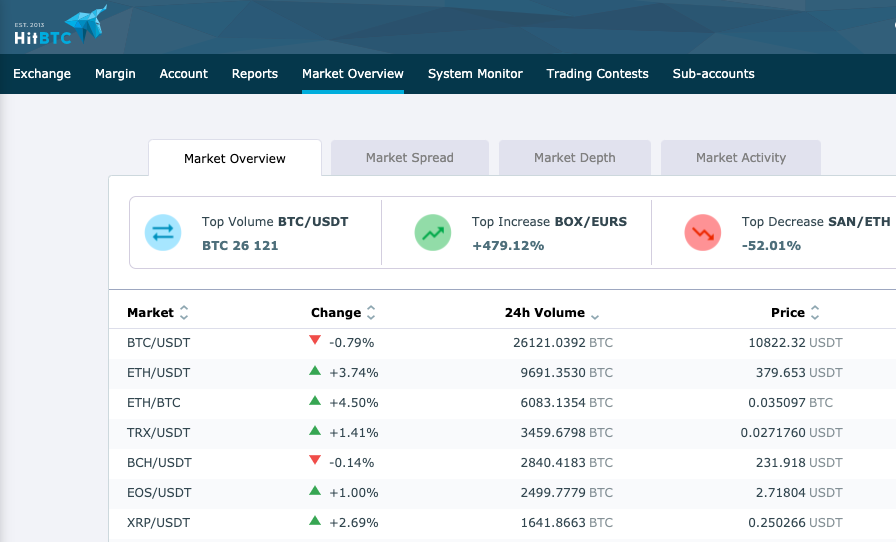

If you go to the “Market Overview” section at HitBTC, you will see that the top positions by trading volume are occupied by trading pairs involving USDT, a ticker (or abbreviated name) for Tether ₋ one of the world's most popular stablecoins tied to the value of the US dollar. When operating in the crypto space, choosing wisely both an attractive coin and a reputable exchange is vitally important. HitBTC is one of such exchanges: it has been in business since 2013 and can boast of no hacks or breaches in this entire time, which means that your digital assets will be safe under their watch. They also offer the most competitive fees on the market.

The crypto world is extremely dynamic and volatile - it never sleeps or takes vacations or holidays. Whether you're a beginner or an experienced trader, you will have to continually maintain your knowledge of its trends to be able to survive and prosper. Good luck navigating it!

Are you interested in trying your trading skills on top of crypto exchanges? Sign up with TradeSanta, the platform for automated cryptocurrency trading that provides an easy on-ramp for novice and sophisticated traders.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.