Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What Is Aurora?

Aurora is a smart contract platform that combines two different consensus mechanisms, the delegated Proof-of-Stake (dPoS) and Byzantine Fault Tolerance, in the hopes of creating “lightning-fast contracts to link industries such as gaming, big data, artificial intelligence and IoT.”

The Aurora team has a few goals in mind for the network as they continue to build it out. First, they want its application to expand beyond the creation of digital assets. To do so, they need to “focus on making the perfect smart contract,” improve blockchain technology’s throughput, and solve whatever blockchain difficulties pop up – the second, third, and fourth goals. The final goal of the Aurora chain is interoperability and simple integration with existing applications.

In this guide, we break down:

- How Does Aurora Work?

- Aurora Team & Progress

- Trading

- Where to Buy AOA

- Where to Store AOA

- Final Thoughts

- Additional Resources

How Does Aurora Work?

Fundamentally, Aurora is a smart contract platform. You can program decentralized apps (dApps) and other programs on top of it.

The project is unique in that it implements a combination of two (semi) popular consensus mechanisms: the first, dPoS, and the second, BFT.

Delegated Proof-of-Stake (dPoS)

A myriad of projects utilize dPoS, including EOS, BitShares, Lisk, and ARK. In a dPoS system, every token holder votes on the nodes that create new blocks. This mechanism differs from, say Proof-of-Work, in which miners create new blocks.

On Aurora, all token holder can vote on the proxy nodes that pack transactions (i.e., create blocks). There are 101 proxy nodes on the network at all times.

To become a proxy node candidate, you need to own 5 million AOAs, Aurora’s token. The only way to become a proxy node is by holding more than 5 million AOAs and getting voted in by your peers.

Byzantine Fault Tolerance (BFT)

The other half of Aurora’s consensus puzzle is BFT. The project employs this mechanism to avoid forks and speed up the consensus process.

To accomplish dual consensus, the Aurora blockchain operates a P2P Stereo-net to layer the network and broadcast information among the nodes at different connection lengths.

Other Notable Features

Some of Aurora’s additional features include:

- Pending zone – By placing verified transactions into a pending zone, Aurora can separate different smart contracts and dApps, so that bloated ones won’t bog down the entire network.

- Upgradeable blockchain – Aurora utilizes an LLVM compiler to place blockchain code together with smart contracts to provide seamless upgrades without the need to fork.

- Cluster grouping – Nodes can turn on a self-grouping function to form clusters for transaction verification. Doing so reduces the storage costs for users.

AOA Token

The Aurora network rewards any participant that improves the system with AOA tokens. You earn AOA by finding bugs, promoting the project, and improving the code base, among numerous other activities. Initially, the Aurora team is manually distributing these rewards, but their goal is to write objective rules into the blockchain eventually.

There is a total supply of 10 billion AOA tokens.

Aurora Team & Progress

CEO Aqua Zhao and Global Market Executive Bo Zhang founded Aurora in late 2017. Zhang is also Director of Business Development at Achain, according to his LinkedIn page. The team doesn’t provide too much other information about themselves.

Aurora Executive Team | Source: Aurora website

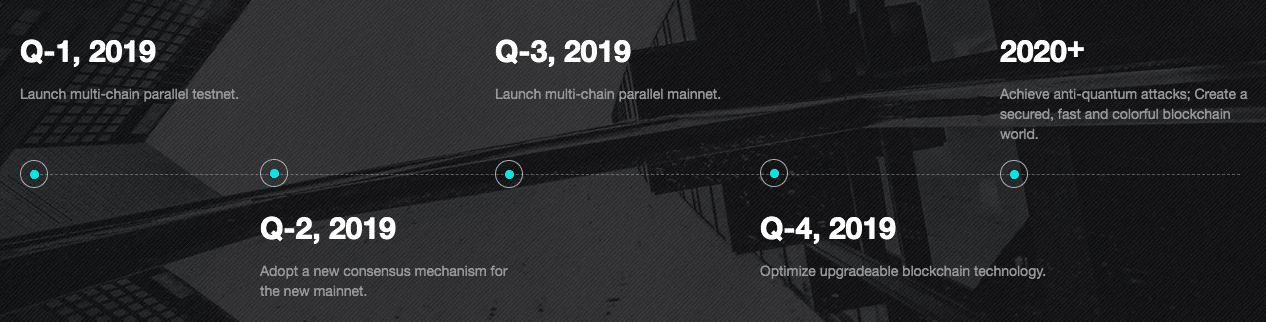

Unfortunately, the Aurora roadmap is rather sparse. On a more positive note, though, the team releases a company update each week. Currently, they’re working on an upgradeable blockchain with upgradeable smart contracts as well as research for multi-chain development.

Competition

Aurora is a smart contract platform focused on industry uses, so it has ample competition. Obviously, Ethereum is the most well-known competitor. NEO utilizes a similar consensus mechanism, delegated Byzantine Fault Tolerance (dBFT). And, VeChain is centered around industry adoption.

The project’s roadmap doesn’t give many details. | Source: Aurora website

Trading

The AOA trading chart is quite a sight to see. After some rocky trading throughout the middle of 2018, the AOA price steadily dropped to an all-time low of about half a cent before gaining momentum again in March this year. At that time, the price doubled in a week. It’s unclear what was behind this impressive leap.

In the past week, the AOA price has bounced between $0.024 and $0.060 with incredibly choppy trading volume. We’re no technical analysts, but charts like Aurora’s current one are usually a red flag for pump-and-dump schemes.

It’s difficult to predict how AOA will perform in the future. With so many other smart contract platforms in the mix, it’s a tough feat to try and carve in a niche now. That being said, hitting development milestones and forming big-name partnerships could boost investor confidence in the short term.

Where to Buy AOA

The majority of AOA trading takes place on BiteBTC and CoinEgg. However, you should probably check out KuCoin instead. On KuCoin, AOA is available in exchange for ETH and BTC.

If you’re not sure where to start, check out our guide on how to buy bitcoin.

Where to Store AOA

Aurora has two different official wallet options. The AOA mainnet wallet is available on Mac and Windows operating systems.

If you’re looking for a mobile option, Aurora provides the AOA lite wallet. It seems as if the wallet resides outside of any app store, so be wary when if you choose to download it from the Aurora website.

Kcash and Math Wallet also support AOA.

Final Thoughts

This project still has much to prove. In the race to become the best smart contract platform, this project is far behind most competitors.

Its delayed start could turn into an advantage, though. The team has the opportunity to learn from the mistakes of more advanced projects and, hopefully, not make them themselves.

Even though it’s still early days for the Aurora network, it’s unique consensus mechanism should be enough reason to at least keep an eye on it. This year alone, its price has already risen over 400 percent.

Additional Resources

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.