Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Real World Applications of Cryptocurrencies — Art & Collectibles

Given this series has amassed quite a following, I thought I’ll write one more, before I take a small 2-week break from writing. Following on from my previous post on Online Ticketing Systems & the GET Protocol, which you can find here, I will be discussing how the Arts & Collectibles (A&C) industry will be disrupted by the emergence of the blockchain and cryptocurrencies.

Unique Asset Registry — Codex Protocol

Overview

A&C is comprised of objects such as art, fine wine, collectible cars, music instruments, jewellery and much more. Over the past few years A&C has become so big, that Deloitte is considering it as an asset class — “a group of securities that exhibits similar characteristics, behaves similarly in the marketplace and is subject to the same laws and regulations”.

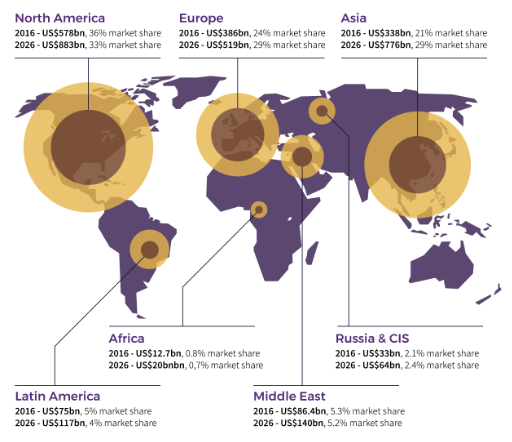

It’s an asset class in which high-net-worth individuals (HNWI) currently allocate an average of 6% of their portfolios to. Additionally, according to Deloitte’s 2017 Art & Finance Report, this asset class is estimated to be worth $2 trillion projecting a growth of $0.7 trillion by 2026 with an estimated $620 billion of annual transactions.

Despite the size and growth of the market there is one massive issue; the lack of a title registry. This comes down to lacking two things:

- Provenance — This is the history of ownership and associated documentation of a particular object. It’s what drives the monetary value of an object as it indicates whether it’s authentic or not. Proving an object’s authenticity, is a long, often manual and hard process which requires analyzing a lot of paperwork and is often inconclusive. Without proper provenance, fraud, fakes and forgeries become very prevalent. It is estimated over $6 billion are lost annually due to this. There are numerous recently examples of fraud, including, John Re scamming art buyers out of $2.5 million over nine years for fake Jackson Pollock (and more) artwork.

- Metadata —Is information related to an object such as photographs, past appraisals, receipts, restoration records, etc. The A&C space, is plagued with a lack of comprehensive, secure, easily accessible metadata. Metadata are vital to ‘unlock the value’ of collectibles as the provision of services (more on this later) relies heavily on this. For example, a buyer may want to know what kind of damage a collectible car had in the past or whether there have been any modifications.

Provenance and metadata, is very hard to achieve, transparently and securely, using current technology. Of course, there are some centralized registries that provide provenance, however, neither collectors nor intermediaries will ever fully trust a centralized registry.

These issues inhibit buying and selling with an ease of mind. Additionally, securing and insuring collectibles becomes more complicated, whilst, making forgeries and fraudulent behavior easier.

The Proposal

Enter the Codex Protocol.

The Codex Protocol is designed as an asset registry tailored for A&C objects. A Codex Record is designed to preserve all information about a piece, including the evidence of ownership and other metadata.

The Codex team is building a protocol that will revolutionize A&C by creating a decentralized title registry for them, coupled with a decentralized consortium of experts to validate authenticity. The Codex Protocol will track an object’s “history of ownership through a neutral and decentralized verification”. The protocol will also have the ability to securely store metadata about objects whilst also making them easily accessible (if required). In one simple sentence, Codex is bringing provenance onto the blockchain — a match made in heaven.

To top it all off, the Codex Protocol is backed by a consortium of 5,000 auction houses and trusted industry stakeholders thus putting it in pole position for adoption and becoming a standard. Since they are building a protocol, it will provide others to build decentralized applications on top of it. Codex itself is has already launched Biddable.

How It Works

The centerpiece to the Codex Protocol is the Codex Record. A Codex Record contains provenance details and other metadata for a particular object and is created when an object is loaded onto Codex.

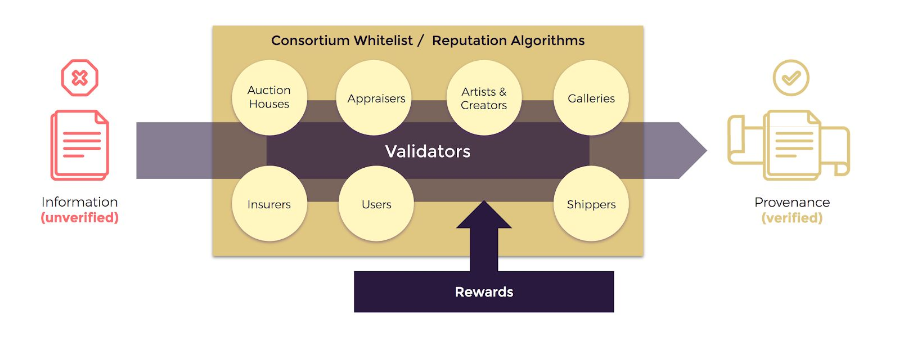

Before loading an object onto Codex, all associated information needs to be verified by validators (these include appraisers, auction houses specialists, dealers, gallerists, etc.). If an object is loaded by end-users, validators need to confirm that the information provided by them is correct. If an object is loaded directly by validators, they need to research and load this information themselves. In order to ensure the integrity of the system, validators will be rewarded in a very similar fashion to how they are today.

At first, the validators (and their rewards) will be selected on a discretionary basis but the Codex teams expects that in the future rewards will be “algorithmically distributed along with a reputation system that scores end-users who have expertise”.

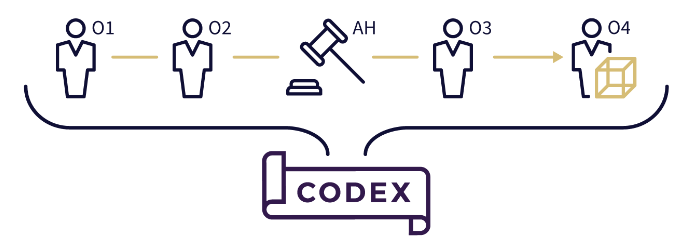

To illustrate how the Codex Protocol works, I will walk through a simple example below:

- Alice loads her artwork, Lona Misa, onto Codex. Since Lona Misa is getting loaded onto Codex for the first time, any associated information needs to be verified by validators.

- Validators confirm the authenticity of Lona Misa and successfully gets loaded onto Codex.

- Alice then wishes to anonymously sell Lona Misa to Bob. Since all information on Lona Misa is recorded in a Codex Record, Alice has the ability to delegate view permissions to the Bob to view the information attached to the Record.

- Despite the fact that Alice chose to remain anonymous, Bob can be certain that the Lona Misa is genuine due to the proper provenance provided by the protocol.

- Once the sale is complete, Bob will now be registered as the new Lona Misa owner.

The Solution

Codex has placed itself in prime position to solve the issues discussed above (and improve upon them) by becoming a decentralized asset registry tailored for A&C objects. It will do so by providing Proper Provenance & Secure & Accessible Metadata. By leveraging the advantages of the blockchain and smart contracts, the identity of the object, its path of ownership, authenticity and related data will always be secure, immutable, guaranteed, verifiable, accessible and transparent.

Having proper provenance in place with the addition of secure and accessible metadata will bring a host of benefits, including:

- Anonymity — Ownership of A&Cs can now be proven, without compromising privacy

- Better Services — Applications and Services (asset-backed lending, bidding, escrow, insurance, etc.) will have greater confidence serving their customers.

- Greater Accessibility — This is particularly geared towards newly created wealthy holders of cryptocurrencies. They will now have the opportunity to diversify into an asset class that provides an uncorrelated, appreciating and private store of value.

- Greater Market Size — By having a widely adopted registry which brings a host of benefits, will help grow the A&C space “by hundreds of billions of dollars” and “could increase the value of the asset class by over $1 Trillion”.

- No Middlemen — The Codex Protocol will eliminate the costly middlemen and the risk and suspicion that sometimes comes when centralized single entities hold information. This will inherently reduce transaction costs as well.

- Reduced Fraud — This is pretty obvious but the number of frauds, forgeries and fakes will be dramatically reduced as provenance will now be secure, accessible and transparent.

How Are CodexCoin (CODX) Tokens Used?The CodexCoin is a token used to access the protocol. Users, or applications on their behalf, will pay fees in the form of CodexCoin to create, update, and transfer Codex Records. These fees will be used to provide rewards.

The CodexCoin (CODX) is used to access the Codex Protocol. It has a multitude of uses, including:

- Paying fees for creating, updating and transferring Codex Records. These fees will be discounted depending on how many CODX an application (built on top of the Codex Protocol) stakes and for how long.

- Rewarding validators for their verification work and penalizing them if proper behavior is not followed.

- Providing a mechanism for an on-chain voting scheme, meaning that token holders will be able to govern the decentralized system.

The Codex Protocol has not launched their token yet. You can only purchase CodexCoins (CODX) during their Initial Coin Offering (ICO) which is dated for the end of July. You can find more information about their token sale and sign-up for their ICO, here.

How many claps does this post deserve? How about a follow?

If you enjoyed this post, please feel free to 👏 clap 👏 many times (you know you want to!), give my blog a 👣 follow 👣 and 🤲 share 🤲 with your friends. There’s a limit of 👏 50 claps👏 you can give to each post, so I urge you not to try and exceed that limit… you might break Medium!

Speaking of which…

If I still have your attention, please leave a comment and let me know what else you would like to see me writing about. You can find links to my social media and sign up to my newsletter below.

You can also show your support by donating to the following address:ETH: 0x4c7195E074cf0Ab6F77Bdb7C97Fd2567066Bb712

Disclaimer: All information and data on this blog post is for informational purposes only. My opinions are my own. I do not provide personal investment advice and I am not a qualified licensed investment advisor. I make no representations as to the accuracy, completeness, suitability, or validity, of any information. I will not be liable for any errors, omissions, or any losses, or damages arising from its display or use. All information is provided as is with no warranties and confers no rights.

Real World Applications of Cryptocurrencies - Art & Collectibles was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.