Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

By Vipin Kumar

The cryptocurrency industry has grown rapidly in recent years, with crypto exchanges playing a central role in this expansion.

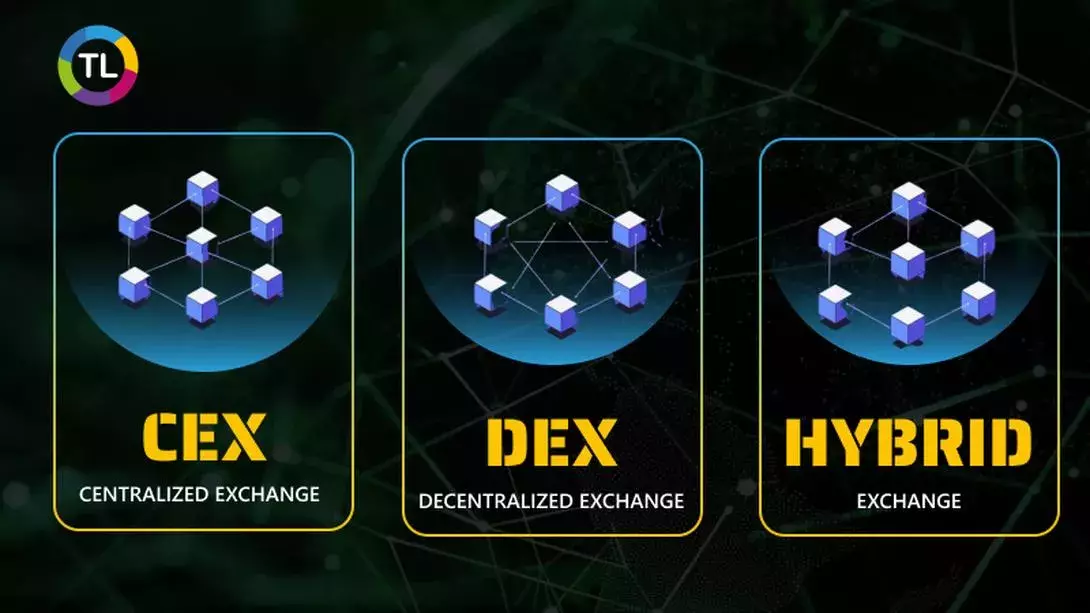

As digital assets continue to gain popularity, crypto exchanges have become essential tools for trading and investing. With multiple types of exchanges available—Centralized, Decentralized, and Hybrid—it’s crucial for investors and traders to understand their differences.

This understanding can help users make better decisions and choose the most suitable platform for their needs.

What Are Crypto Exchanges?

Crypto exchanges are online platforms where users can buy, sell, and trade cryptocurrencies. Acting as a marketplace, exchanges enable transactions of digital assets, providing liquidity to the crypto market and facilitating price discovery.

Choosing the right type of exchange not only affects your experience but also impacts the security, control, and accessibility of your assets. In crypto exchange development, understanding these types is vital to design features that cater to different user needs.

Centralized Exchanges (CEX)

What They Are: Centralized exchanges (CEX) are the most commonly used crypto exchanges. They operate similarly to traditional financial exchanges, where a central authority oversees transactions. Users create accounts on these platforms, deposit funds, and trade within the exchange’s ecosystem.

Key Features and How They Work:

● CEXs provide users with an easy-to-use interface, making them ideal for beginners.

● These platforms offer advanced trading features, such as order types, leverage options, and often extensive customer support.

● Transactions on CEXs are typically fast due to their centralized structure, and they often boast high liquidity.

Pros of Centralized Exchanges:

1. User-Friendly Interface: CEXs are known for their intuitive design, making it easier for newcomers to start trading.

2. High Liquidity: The high trading volume and established user base lead to greater liquidity, which enables smoother and faster transactions.

3. Customer Support: Most centralized exchanges provide customer service, which can be crucial for resolving issues or answering questions.

Cons of Centralized Exchanges:

1. Security Risks: Since these exchanges store funds and user information centrally, they are more vulnerable to hacking.

2. Trust Factor: Users must trust the exchange to manage their funds and personal information securely.

Decentralized Exchanges (DEX)

What They Are: Decentralized exchanges (DEX) operate without a central authority. Instead, they rely on blockchain technology and smart contracts to facilitate peer-to-peer trading directly between users. This structure provides users with more control over their assets and reduces the need for trust in a central entity.

Key Features and How They Work:

● DEXs leverage smart contracts to execute trades automatically and transparently on the blockchain.

● Users retain full ownership of their private keys and funds, enhancing security and privacy.

● Transactions on DEXs may not be as fast as CEXs, but they prioritize security and autonomy.

Pros of Decentralized Exchanges:

1. Enhanced Security and Privacy: DEXs don’t hold users’ funds or personal information, reducing the risk of centralized hacking.

2. User Control of Assets: Users retain ownership of their private keys, providing a higher degree of control and autonomy over their assets.

Cons of Decentralized Exchanges:

1. Lower Liquidity: Compared to CEXs, DEXs generally have lower trading volumes, which can lead to slower transaction times.

2. Learning Curve: For beginners, DEXs can be more challenging to use, as they require knowledge of crypto wallets and blockchain interactions.

Hybrid Exchanges

What They Are: Hybrid exchanges combine the best features of both centralized and decentralized exchanges, offering users a balanced experience. These platforms aim to provide the security and control of DEXs along with the liquidity and ease of use found in CEXs.

Key Features and How They Work:

● Hybrid exchanges provide a middle ground where users can benefit from decentralization while still enjoying the efficiency and user-friendly nature of centralized platforms.

● They often offer advanced security protocols and a flexible infrastructure that supports both on-chain and off-chain transactions.

Pros of Hybrid Exchanges:

1. Improved Security with Centralized Features: Hybrid exchanges use enhanced security measures while still providing some centralized features like customer support.

2. User Control over Assets: These exchanges often allow users to retain control of their assets, striking a balance between autonomy and convenience.

Cons of Hybrid Exchanges:

1. Newer Technology: Hybrid exchanges are relatively new, which means they might have fewer support options and limited adoption.

2. Potential for Slower Transactions: Due to their mixed infrastructure, transactions on hybrid exchanges may be slower than those on traditional CEXs.

Comparison Table of CEX, DEX, and Hybrid Exchanges

|

Features |

Centralized (CEX) |

Decentralized (DEX) |

Hybrid |

|

Security |

Lower (risk of central hacks) |

High (user control of assets) |

Improved (combination of both) |

|

Control |

Limited (controlled by platform) |

High (user owns assets) |

Moderate (mix of both) |

|

Liquidity |

High |

Low to Moderate |

Moderate |

|

Transaction Speed |

Fast |

Moderate to Slow |

Variable |

|

User-Friendliness |

High |

Low to Moderate |

Moderate |

Which Exchange Type Is Right for You?

Choosing the right type of exchange depends on your priorities:

● If Security and Privacy Are a Priority: DEXs or hybrid exchanges may be a better fit, as they allow users to control their assets and maintain privacy.

● If You’re New to Crypto: Centralized exchanges offer the most user-friendly experience, with added customer support and a familiar interface.

● If You’re Seeking a Balance: Hybrid exchanges might be ideal, combining the best of both worlds for a more flexible and secure trading experience.

When developing or choosing a crypto exchange, it’s essential to consider these factors. Understanding the different exchange types can empower you to make the best decision for your trading goals and risk tolerance.

Conclusion

In the world of cryptocurrency, the type of exchange you choose can significantly impact your trading experience, security, and asset control. Centralized exchanges (CEX) offer convenience and liquidity, while decentralized exchanges (DEX) provide enhanced security and user control. Hybrid exchanges bring both aspects together for a balanced solution.

If you're exploring crypto exchange development or looking for a reliable provider to bring your exchange vision to life, consider Technoloader. With experience in both centralized and decentralized solutions, they can guide you in developing an exchange that meets today’s crypto demands.

Author Bio

Co-Founder and CEO at Technoloader Pvt. Ltd, a fast-growing team of blockchain and cryptocurrency experts based in Jaipur, Rajasthan (India). Well experienced and possess strong business development professional skills providing a wide range of blockchain solutions all round the globe.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.