Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

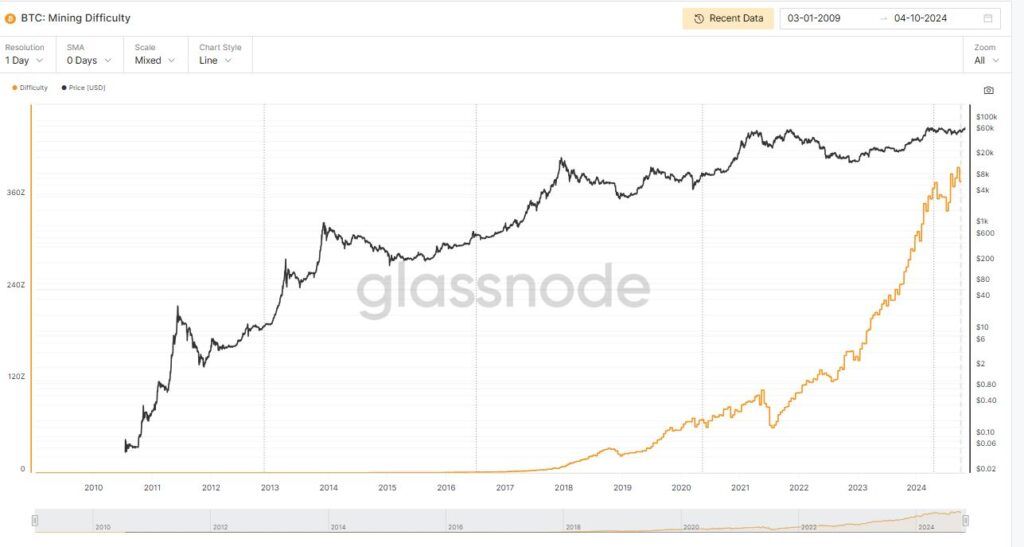

Bitcoin’s mining difficulty has reached a historic 101.65 trillion (T), posing significant challenges for small-scale miners.

The latest increase in difficulty reflects a surge in computational power required to mine new Bitcoin blocks, intensifying competition across the industry.

While larger, publicly traded mining companies often have more capital to maintain their operations, smaller or private players may find it harder to keep pace, potentially needing to sell mined Bitcoin just to cover operating costs.

This record-breaking milestone signals both the resilience and strain within the Bitcoin mining ecosystem as more resources are demanded for profitability.

Bitcoin mining difficulty, which adjusts approximately every two weeks, now presents a new hurdle for industry players.

Source: Glassnode

Calculated every 2,016 blocks, the difficulty has risen nearly 60% over this year’s adjustments, underscoring the increasing complexity of the mining process.

The higher difficulty level means that more computational power is required, raising operational costs and potentially pressuring smaller miners to offload their Bitcoin earnings.

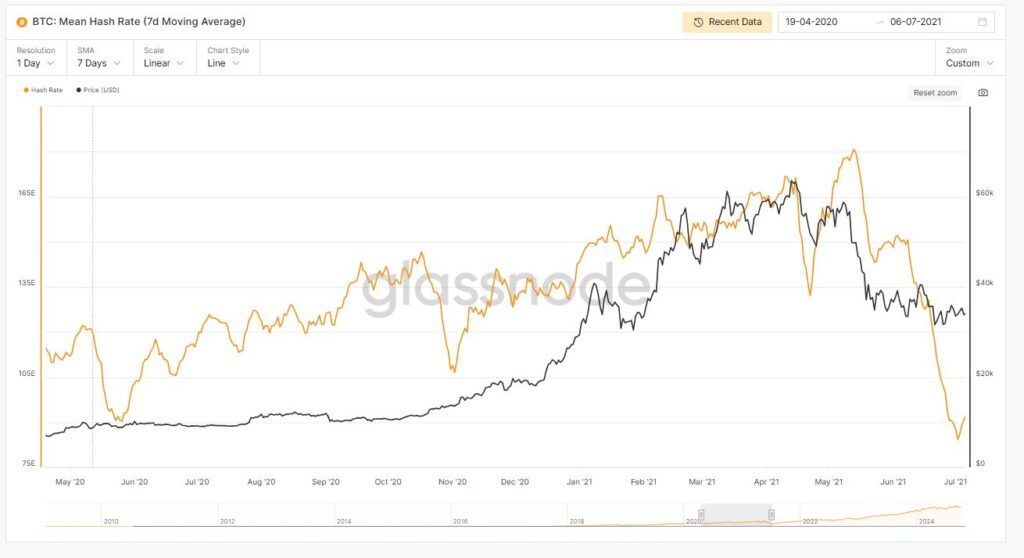

Hashrate hits all-time high

Adding to the pressure, Bitcoin’s hashrate – the computing power used in mining and transaction processing – also hit an all-time high, averaging 755 EH/s over seven days.

At the end of October, a single-day hashrate spike of 12% marked one of the year’s most significant surges.

This spike further underscores the competitive landscape of Bitcoin mining, where miners need powerful, specialized equipment like ASICs (application-specific integrated circuits) to remain viable.

As competition grows, smaller miners could be forced to exit the market if they’re unable to keep up with larger operators’ processing capacity and resources.

Source: Glassnode

In October, Bitcoin miners were, on average, selling nearly all of their mined coins to cover costs, although there was a brief period when some retained their earnings, bolstering their reserves after significant depletion in previous months.

Currently, miners produce around 450 Bitcoin daily, translating to approximately $31.5 million in sell-side pressure if entirely liquidated.

This indicates that while miners remain active, their ability to retain assets is limited, contributing to market volatility.

Why Bitcoin mining difficulty matters

Bitcoin mining difficulty is critical to maintaining a steady block production time of approximately 10 minutes.

Satoshi Nakamoto, Bitcoin’s creator(s), designed the algorithm to adjust difficulty in response to network activity.

When more miners join, the difficulty increases, keeping the block discovery rate stable.

This stability is vital to Bitcoin’s value proposition as a predictable, finite asset, with a maximum supply cap of 21 million BTC.

Bitcoin’s consistent block time prevents an oversupply, a key appeal compared to inflationary fiat currencies.

This controlled supply, coupled with growing demand, is central to Bitcoin’s perceived value as a “digital gold.”

As competition for mining increases, the Bitcoin difficulty will continue to adjust, maintaining this equilibrium.

How Bitcoin mining difficulty is calculated

Mining difficulty is determined based on the time required to mine the previous 2,016 blocks, ideally set at 20,160 minutes (2,016 blocks x 10 minutes).

If block time deviates, the network adjusts the difficulty level proportionally.

This adjustment is vital to ensuring Bitcoin’s inflation rate remains predictable and supply capped.

Despite a minor error in Bitcoin’s original protocol, where the difficulty is set based on 2,015 blocks instead of 2,016, the algorithm effectively keeps Bitcoin’s inflation in check and blocks added at a stable rate.

This recent adjustment in difficulty underscores the resilience and challenges of Bitcoin mining, where small miners face increasing costs while competing against industry giants.

With mining difficulty expected to rise alongside network growth, the future of small-scale Bitcoin mining remains uncertain.

The post Bitcoin mining difficulty surpasses 100T: what does it mean for small miners? appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.