Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

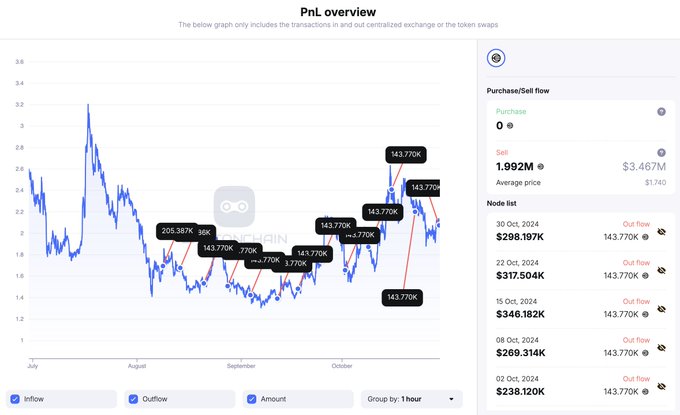

According to blockchain analysis firm Spot On Chain, the bankrupt Alameda Research sent 143.77k Worldcoin (WLD), worth approximately $297.6k, to crypto exchange Binance early today.

Spot On Chain

@spotonchain

·Follow

Alameda Research deposited 143.77K WLD ($297.6K) $WLD to CEX 5 hours ago.

Since Aug 9, they have deposited 2M WLD ($3.46M) to #Binance in multiple small batches, likely to repay creditors.

They still have 23.01M WLD ($47.6M) left and may require over 3 years to fully liquidate…

5:25 AM · Oct 30, 2024

31

Reply

Copy link Read more on Twitter

The transaction has raised eyebrows among enthusiasts, as the event signals increased selling momentum for WLD in the coming sessions.

Meanwhile, Alameda has sold a notable chunk on Worldcoin over the past few months.

Spot On Chain revealed that the firm sent 2 million WLD (worth about $3.46 million) “in multiple small batches” to exchange Binance since 9 August.

Alameda, FTX’s sister firm, debacle as Sam Bankman-Fried empire fell in November 2022 and has been liquidating assets to reimburse its creditors.

The company still holds 23.01 million WLD (valued at $47.6 million). The analytical platform stated that it might take Alameda more than three years to liquidate the remaining coins “with the current speed.”

Sam Bankman-Fried and Tara MacAulay founded Alameda Research in 2017. The firm filed for bankruptcy in 2022 after its sister exchange, FTX, went insolvent.

Recently, a federal judge sentenced Alameda’s former CEO, Caroline Ellison, for aiding SBF’s illicit dealings.

WLD’s current performance

Worldcoin displayed struggles on its price charts, down 0.60% and 8.13% in the past day and week, respectively.

Source – Coinmarketcap

Trading at $2.07, WLD reflects significant underperformance, considering Bitcoin’s 8.45% increase within the past seven days.

Moreover, WLD’s trading volume plunged 16% in the past day to $207.56 million, suggesting weakness and continued price dips.

Worldcoin has struggled to remain profitable due to regulatory challenges, down over 80% from its ATHs of $11.82.

Worldcoin has failed to satisfy global regulators, with many jurisdictions blocking the project due to its iris-scanning validations.

Nevertheless, Sam Altman’s crypto rebranded as “World” and promised enhanced user verification.

The rebrand underscored Worldcoin’s evolving missions, transforming from its original verification methods to a more scalable and decentralized approach.

The updated Orb version, which improves user verification without compromising privacy, is at the core of the project’s objective of global expansion.

Moreover, the rebrand introduced layer2 World Chain, which attracted integrations from leading platforms such as Uniswap within a day of its debut.

Uniswap Labs 🦄

@Uniswap

·Follow

𝘝𝘦𝘳𝘪𝘧𝘺 𝘵𝘩𝘢𝘵 𝘺𝘰𝘶 𝘢𝘳𝘦 𝘩𝘶𝘮𝘢𝘯 𝘣𝘦𝘧𝘰𝘳𝘦 𝘱𝘳𝘰𝘤𝘦𝘦𝘥𝘪𝘯𝘨 ☑️

World Chain is now live on Uniswap

8:44 PM · Oct 17, 2024

926

Reply

Copy link Read 44 replies

WLD should flip the resistance at $2.11 into support to open the path for more upswings. That would trigger stable uptrends to $2.46 and potentially $3 – a 45% uptick from current prices.

Meanwhile, continued selling of the remaining Alameda’s WLD tokens, projected to persist in the next three years, will likely impact Worldcoin price actions.

However, broad-based rallies in the coming months could help Worlcoin absorb Alameda-linked selling pressure. The impressive institutional interest suggests robust growth for the crypto market.

For instance, multinational investment firm BlackRock added BTC worth $642.87 million to its balance sheet following the latest rebound.

Crypto Rover

@rovercrc

·Follow

💥BREAKING: BlackRock purchased $642.87 MILLION worth of #Bitcoin yesterday!

9:56 AM · Oct 30, 2024

526

Reply

Copy link Read 138 replies

BlackRock’s move signals it confidence in crypto market stability in the coming sessions, supporting analysts’ forecasts of imminent all-time highs.

The post Worldcoin sinks as Alameda Research offloads over 143k WLD tokens appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.