Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

How BTC holders are getting 9% yields onchain

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

This week, we cover the prospects of the Bitcoin staking space. We introduce the core players and architecture being used to provide yields to Bitcoin holders. We lay out some of the limitations of the current state of Bitcoin staking, while exploring some of the long-term potential and high yields it can offer.

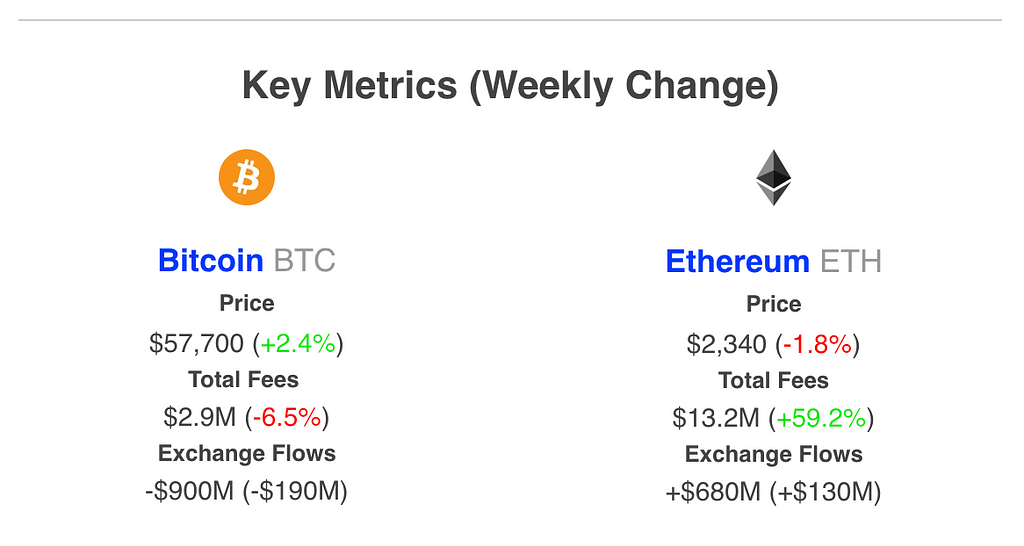

Network Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether

- Bitcoin’s weekly fees dropped by 6% to their lowest in over a year and a half as Runes and ordinals activity now appears a distant memory

- Ethereum network fees, on the other hand, climbed by 59% as activity on Mainnet grew as people return from summer vacations

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges

- $900M worth of BTC left exchanges this week, $190M more than the previous week

- $680M ETH was net deposited into CEXs, an increase of $130M over last week’s inflows

Bitcoin Staking is Here

For the first time, native yields are available on Bitcoin. Though it is not “staking” as usually described in proof of stake networks, multiple projects have recently launched offering returns on BTC.

The restaking concept pioneered by EigenLayer is getting extended to the Bitcoin blockchain and BTC-pegged tokens. Here Babylon has emerged as the main platform, building an architecture that allows applications to launch and leverage Bitcoin’s crypto-economic security. On the Ethereum side, Symbiotic is another restaking protocol, accepting tokens such as WBTC essentially as collateral that will eventually also back applications looking to use these assets for security.

Let’s dive into the main players leading the way with Bitcoin staking.

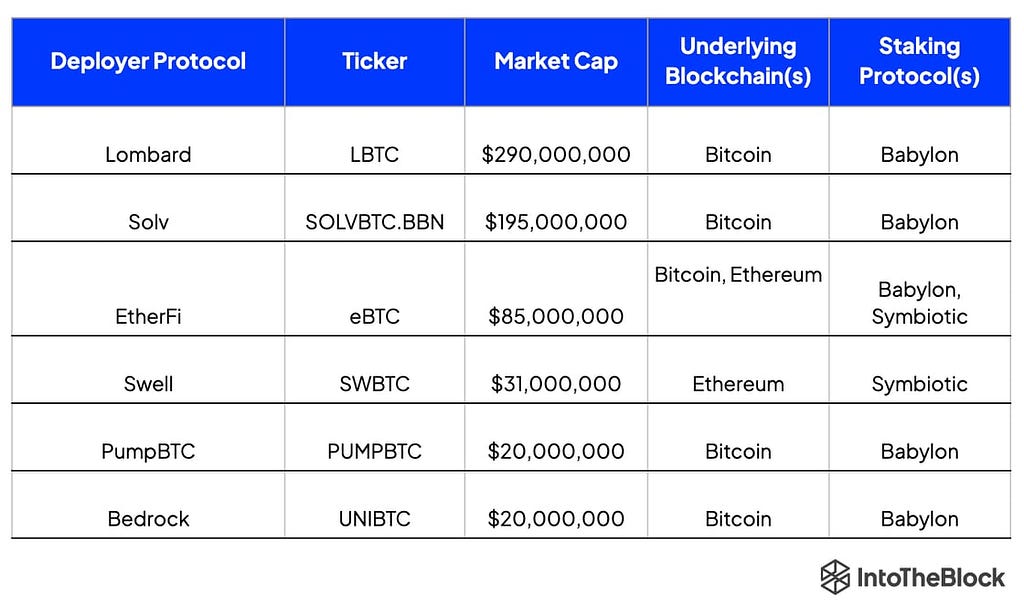

Source: IntoTheBlock’s Upcoming Bitcoin Staking Dashboard

$500M Staked — Over half a billion of assets have been deployed to Bitcoin staking protocols within just weeks of launching

- Lombard leads the way in Bitcoin staking with nearly $300M staked into their LBTC product for Babylon

- Babylon recently raised $70M, led by Paradigm, fueling the credibility that this technology will eventually build something similar to EigenLayer, but for applications looking to leverage Bitcoin security instead of Ethereum’s

- Symbiotic, on the other hand, focuses on using assets already available on Ethereum such as WBTC and tBTC, eventually putting these assets as a form of collateral delegated to operators that risk losing a portion of them if they act maliciously

- EigenLayer also announced it will be expanding to offer support more assets, suggesting BTC-tokens will also be available for their restaking services soon

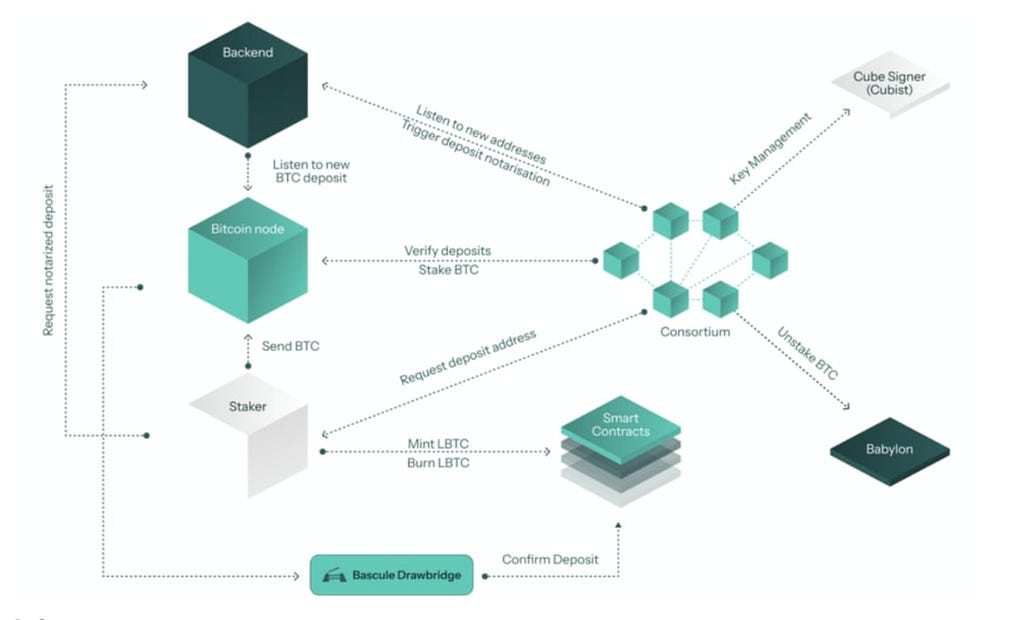

Source: Lombard Docs

How Does Bitcoin Staking Work Under the Hood? It combines Bitcoin’s security layer with Ethereum’s DeFi ecosystem

- LBTC is minted by sending BTC into a consortium of addresses that deposit into the Babylon protocol, and then mint LBTC on Ethereum

- At the moment funds are simply held in the Babylon contracts and are not validating any applications and don’t have withdrawals enabled

- Instead, depositors are simply rewarded in points both, both from Babylon and Lombard, for helping them bootstrap their supply-side

- Eventually the BTC held by these contracts will enable an ecosystem of applications to leverage these assets to secure their own applications or chains on top of Bitcoin

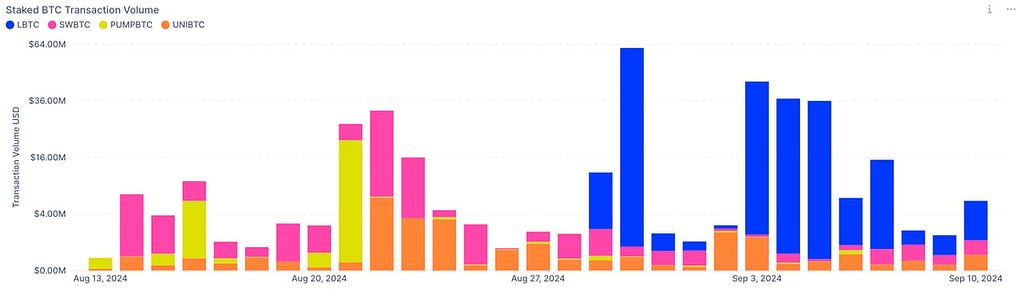

Source: IntoTheBlock’s Upcoming Bitcoin Staking Dashboard

Are Points Back? Volumes for Bitcoin staking tokens have been climbing as Pendle markets pop up

- The Pendle protocol allows traders to buy or sell the future yield of tokens such as LBTC and eBTC

- Currently Pendle markets are pricing in a projected yield of 7%-9% for these Bitcoin staking tokens

- Within less than two weeks, the markets for eBTC and LBTC on Pendle have been able to attract over $40M in liquidity

- These tokens are likely to continue growing as yields like these are rarely available for Bitcoin holders

Source: IntoTheBlock’s Upcoming Bitcoin Staking Dashboard

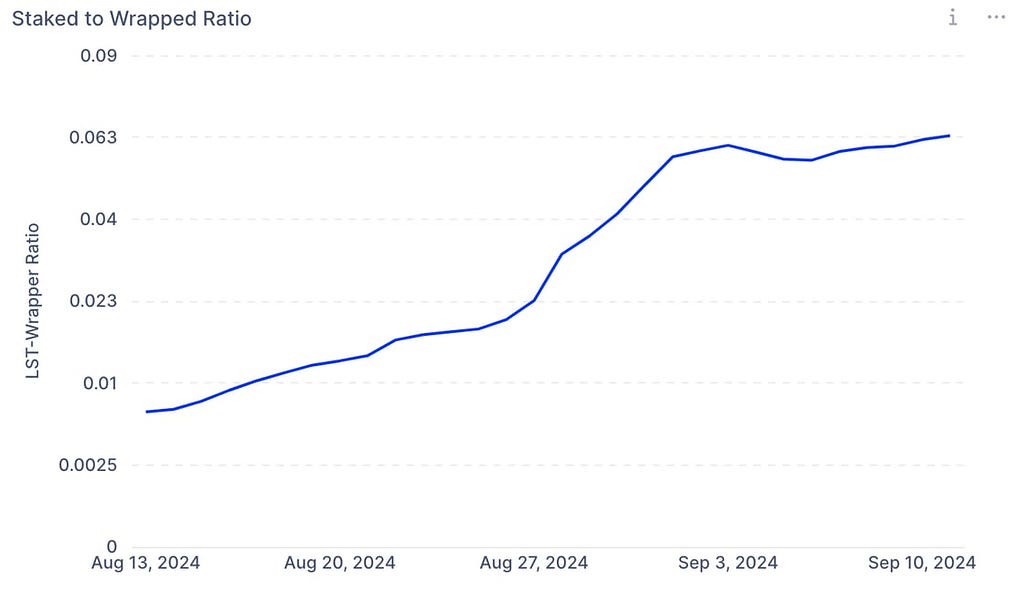

Staked Bitcoin is Just Getting Started — The aggregate market cap of different versions of staked BTC is still less than 1% of the value allocated to wrapped tokens

- The market cap of WBTC has declined by nearly 2,000 BTC (~$120M) since news surfaced of Tron being linked to a potential acquirer of the token

- In parallel, Coinbase recently launched their wrapper token cbBTC, which is a strong contender to compete with WBTC’s dominance

- Within 24 hours cbBTC has surpassed a $100M market cap despite not earning any yield

- In the next few weeks we are likely to see people borrow wrapper tokens like WBTC and cbBTC against Bitcoin staking tokens to earn leveraged exposure to Babylon and Symbiotic

This playbook, previously used by Ethereum LRT protocols, should accelerate the growth of this ecosystem dramatically over the foreseeable future. While all of this infrastructure is still very nascent and risky, excitement around Bitcoin staking is brewing and likely to continue.

Bitcoin Staking is Here was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.