Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

We’re excited to share that we’ve just added support for Swell’s rswETH to the IntoTheBlock Risk Radar. This addition offers both retail and institutional users deep insights into the economic risk factors associated with Swell’s Liquid Restaking Token (LRT), rswETH.

What is Swell Network?

Swell Network is a decentralized Ethereum staking protocol offering liquid staking and restaking solutions. Users can stake their ETH to earn staking rewards while maintaining liquidity through its liquid staking token (LST), swETH. Building on this, Swell introduced liquid restaking, allowing users to maximize their yield with the restaking token, rswETH.

How Does rswETH Work?

When users stake ETH through Swell, they receive swETH, representing the staked ETH plus accumulated rewards. This token is liquid, meaning it can be traded, used across DeFi protocols, or held to accrue further rewards. Alternatively, ETH can be restaked to receive rswETH, which represents the staked ETH plus staking rewards and restaking rewards.

The rswETH token is part of Swell’s integration with EigenLayer, enabling stakers to earn additional rewards from services validated on the network. This further enhances yield opportunities by allowing users to participate simultaneously in multiple staking and restaking activities. However, unlike swETH, which is freely liquid, rswETH is tied to specific restaking activities and may have different liquidity and withdrawal mechanisms.

Swell Risk Analytics on IntoTheBlock Risk Radar

With Swell’s integration into the DeFi Risk Radar, you now have access to 12 advanced risk indicators that provide real-time insights into the risks associated with Swell Network’s rswETH. These indicators cover vital metrics such as DEX liquidity, staking flows, pool concentration, and exit fees.

Example: Understanding DEX Liquidity

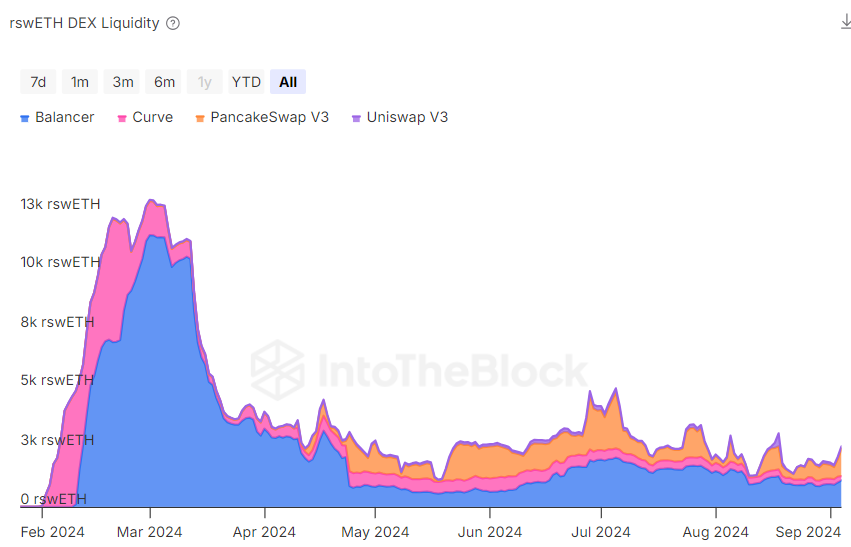

Liquidity plays a critical role in managing the risks associated with liquid restaking tokens like rswETH. The Risk Radar dashboard offers indicators that analyze liquidity across decentralized exchanges. Sudden drops in liquidity or excessive concentration within specific pools can present significant risks to stakers, and these indicators enable proactive risk management.

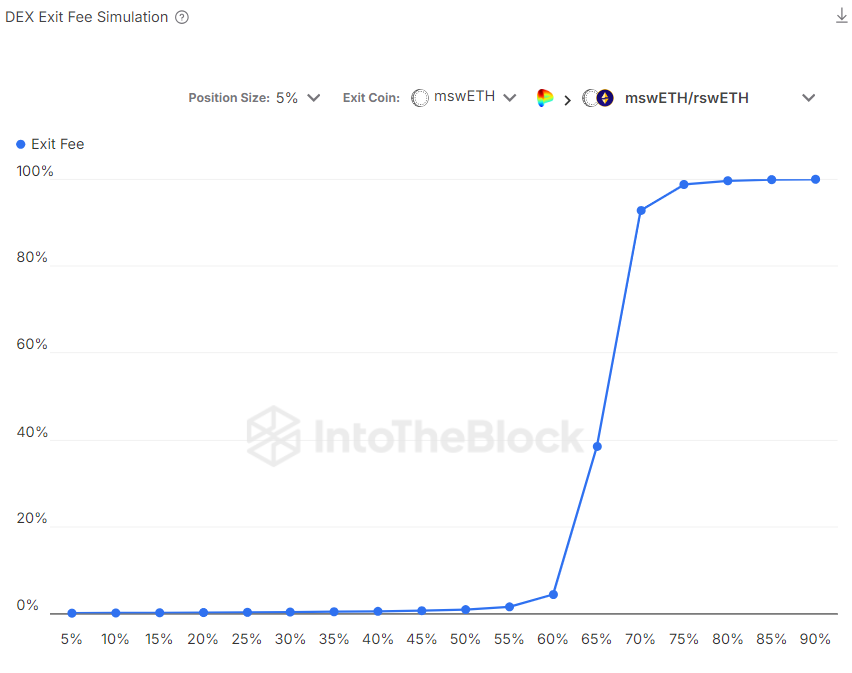

Keeping an eye on liquidity is especially important for large traders and institutional investors. The Exit Fee Simulator allows users to estimate potential slippage when executing large trades, helping investors better manage their operations.

The chart below shows that if your position is 5% of the total pool, your slippage will be 40% if 65% of the pool exits before you.

Explore Swell’s Risk Insights

These examples only scratch the surface of the insights available in the IntoTheBlock Risk Radar for Swell Network’s rswETH. With access to these analytics, users can better assess and mitigate the risks of liquid restaking, ensuring they make informed decisions while maximizing their returns.

IntoTheBlock Risk Radar - Real-time Economic Risk Analysis for DeFi - Stay One Step Ahead

About IntoTheBlock

IntoTheBlock is a leading provider of on-chain analytics and risk indicators, equipping the DeFi community with the tools to make informed decisions. By integrating with Swell Network, we continue to deliver critical insights for users, ensuring they have the data necessary to navigate the DeFi ecosystem safely and effectively.

Risk Insights for Swell Now on IntoTheBlock Risk Radar was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.