Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ethereum’s fee collapse and $ETH’s underperformance

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

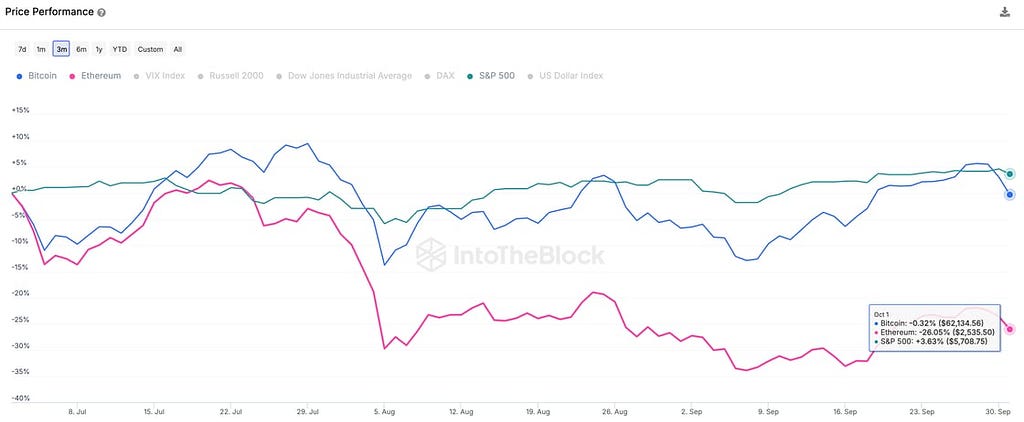

This week, we discuss one of the prevailing trends of the last quarter: ETH’s underperformance. Not just over Q3, but in reality since April, Ether’s price has lagged significantly behind Bitcoin and other crypto-assets. We explore the key indicators that are driving this and analyze what that means as to how ETH is being valued by the market.

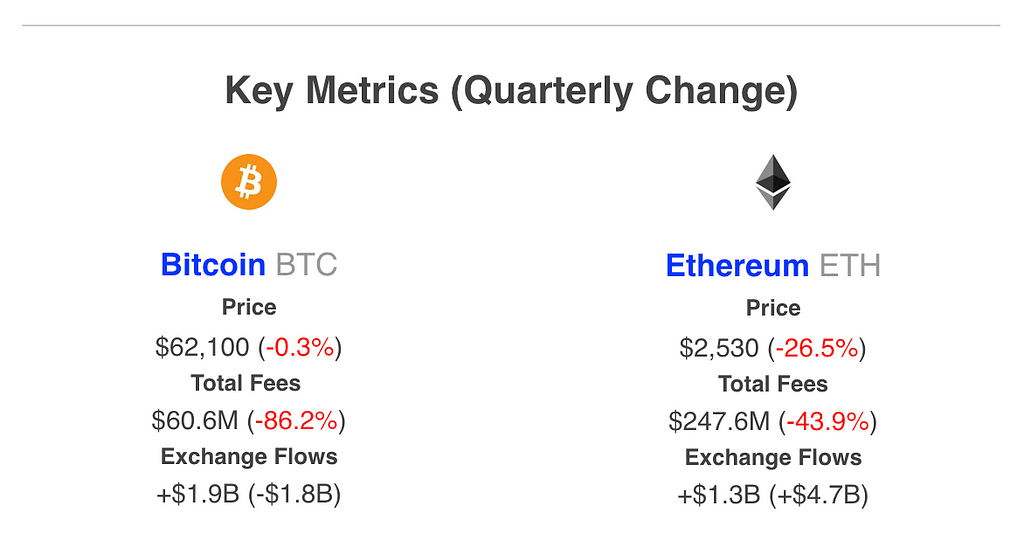

Network Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether

- Bitcoin fees dropped a whopping 86% on a quarterly basis, yet the market doesn’t seem worried about this as we’ll later discuss

- ETH, on the other hand, is getting more pressure as fees dropped 44% quarter over quarter while onchain activity on Mainnet dwindled

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges

- Bitcoin recorded $1.9B in net inflows to exchanges after a neutral quarter

- Ether saw $1.3B in net inflows, following a quarter of $5B+ in outflows post ETF launch

Ethereum’s Identity Crisis

Q3 was a rough quarter for most of crypto. People stepped out of screens for holiday vacations while traditional markets chopped sideways. This summer-related seasonality led to onchain fees dropping to multi-year lows. While fees have bounced back slightly in September, Ethereum’s trend towards substantially lower fees is a key contributor to ETH’s underperformance as the market effectively rejects the thesis of ETH as money.

Source: IntoTheBlock’s Capital Markets Insights

Rising Bitcoin Dominance — BTC’s market share reached it’s highest since April 2021 this quarter

- Bitcoin’s price traded mostly sideways throughout the quarter, while ETH and smaller tokens set new yearly lows in terms of price

- Ordinals and Runes seem like a distant memory as fees on Bitcoin dropped 86% quarterly, yet the market seems to be unfazed

- The divergence between BTC and ETH’s price, while both of their fees plummeted, suggests one of them is being valued as money and the other one more closely tied to its cash flows

ETH’s underpeformance since the Dencun upgrade reflects this trend.

Source: IntoTheBlock’s Ethereum Indicators

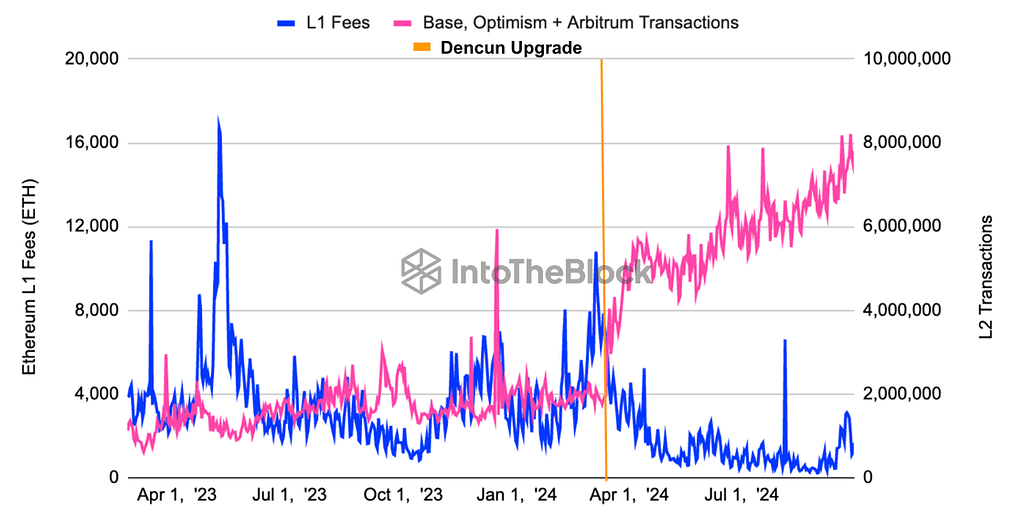

Tale of Two Cities — ETH’s Mainnet fees crashed while L2 transactions boomed post Dencun upgrade

- The Dencun upgrade introduced EIP 4844, which reduced the cost of L2 transactions by more than 10x

- This benefitted onchain activity across the main L2s, which have been hitting new highs in transactions month after month with Base leading the way

However, this has taken a hit on ETH’s direct value accrual:

- Average transaction fees on Mainnet hit an all-time low this quarter

- Due to the low fees, less ETH is burnt, leading it to become inflationary again after the Ethereum community consistently focused on its deflationary path before that (see ultrasound.money)

- Both of these are the equivalent of a company facing declining revenues and suspending their stock buyback program

Through that lens, it may not be surprising to see ETH’s price struggle. Moreover, indirect value accrual has also come into question as the amount of benefit that ETH can capture from L2s’ MEV long-term remains unclear.

Source: IntoTheBlock’s Optimism Financial Indicators

OP/ETH Increases by 28% in Q3 — Optimism’s governance token has benefited significantly from onchain activity moving to L2s

- L2 sequencers have been printing money as the costs to settle transactions in Mainnet declined by over 10x

- Optimism has outperformed other L2s, likely due to the rise of Coinbase’s Base L2 on top of the Optimism Superchain

- Base currently has 66% market share of active addresses and 57% of transaction volume between the main optimistic rollups (Base, Arbitrum and Optimism Mainnet)

- Through a revenue-share agreement, a portion of the revenues earned by Base goes to the Optimism DAO, thus likely contributing to OP’s price

- Going back to MEV, priority fees paid to front-run a swap for example, are now going to the entities operating L2s sequencers; not benefiting ETH holders

The ETH/BTC ratio is down nearly 30% since the implementation of Dencun upgrade. While there are long-term benefits to having lower fees on L2s, Ethereum has faced an identity crisis over the past quarter: the focus on ultrasound money now seems to have been misplaced as revenues decline, ETH becomes inflationary again and, more importantly, ETH’s price significantly underperforms.

This is not to say it’s the end for ETH. There is now an increasing amount of momentum to help improve the L1 recover its economic activity, but we’ll get into that another day. For now, ETH’s struggle show the market may not believe ETH is money after all.

Ethereum’s Identity Crisis was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.