Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Justin Sun, the founder of Tron, has announced that the SunPump (SUN) community has opted for a 100% on-chain buyback and burn process.

This decision, effective from September 3, 2024, marks a departure from previous plans to burn liquidity pool (LP) tokens.

H.E. Justin Sun🌞孙宇晨(hiring)

@justinsuntron

·Follow

Regarding the issue of revenue buyback and burning for @sunpumpmeme , the community previously suggested burning liquidity LP tokens because this approach is used by mainstream meme tokens like SHIB.

Burning LP tokens has several advantages, including increasing token liquidity…

640

Reply

Copy link Read 346 replies

The shift is aimed at simplifying the process and enhancing transparency.

The shift from LP token burning

Initially, the SunPump community considered burning liquidity pool (LP) tokens as a strategy inspired by successful meme tokens like Shiba Inu (SHIB).

LP token burning was intended to increase token liquidity depth while maintaining regulatory friendliness.

However, Justin Sun highlighted that the complexities and potential misunderstandings surrounding LP token burning could hinder its effectiveness.

Sun in his announcement explained that many community members struggled to grasp the concept of LP token burning, leading to confusion.

To address this issue, the SunPump community has decided to transition to a 100% on-chain buyback and burn process.

This new approach is designed to be more straightforward to verify.

By recording all transactions onchain, verification will become immutable and the need for complex explanations will be eliminated.

This is, however, not unique to SunPump, it mirrors strategies employed by other entities like Binance with its BNB token.

Coincidentally, the decision to implement a 100% on-chain buyback and burn process comes amidst growing competition between SunPump and its Solana-based counterpart, Pump.fun.

Both platforms have emerged as prominent players in the meme coin launchpad space, each with its distinct advantages and challenges.

SunPump overtakes Pump.fun

Pump.fun, operating on the Solana blockchain, has established itself as a leader in meme token deployment and revenue generation.

With a fully diluted valuation (FDV) of $81.4 billion and a total value locked (TVL) of $5 billion, Pump.fun has successfully launched 193,000 tokens and generated $105 million in revenue.

It uses Raydium Protocol, an on-chain order book automated market maker (AMM), to facilitate decentralized finance (DeFi) on Solana.

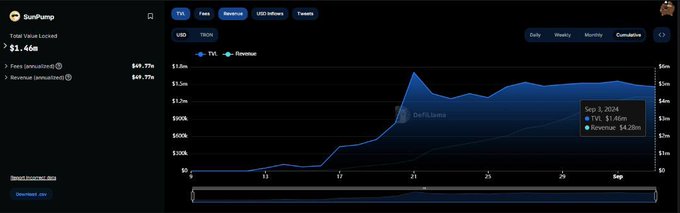

In contrast, SunPump, which launched on the Tron blockchain in August 2024, is rapidly gaining traction. Despite being newer, SunPump boasts a higher daily active user (DAU) count and a total value locked (TVL) of $8.21 billion.

It uses SunSwap Finance, part of the Binance Smart Chain (BSC) network, focusing on yield farming and investment returns.

So far, less than 4 weeks since its launch, SunPump has already hit a total revenue of 7 million Tron.

P R U D E N T 📊 🔺( ♟,♟)

@PrudentSammy

·Follow

SunPump hit a total revenue of 7 million Tron in less than 4 weeks since its launch.

So far, @sunpumpmeme’s biggest revenue day was Aug. 20, when it earned almost 2.78 million TRX worth roughly $400,000, with over 6,000 memecoins created

‣ 𝐈 𝐛𝐞𝐭 𝐲𝐨𝐮 𝐧𝐞𝐯𝐞𝐫 𝐤𝐧𝐞𝐰…

1:20 PM · Sep 3, 2024

128

Reply

Copy link Read 31 replies

However, both platforms face challenges with low decentralized exchange (DEX) conversion rates, with SunPump at 2.1% and Pump.fun at 1.4%.

As the competition between SunPump and Pump.fun heats, SunPump’s aggressive strategies and rapid growth position it as a formidable competitor to Pump.fun.

The new on-chain buyback and burn process for SunPump could further impact this competitive landscape, potentially driving increased adoption and market share.

The post SunPump (SUN) community agrees to 100% on-chain buyback and burn process appeared first on Invezz

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.