Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

By Alex Kuptsikevich

Market picture

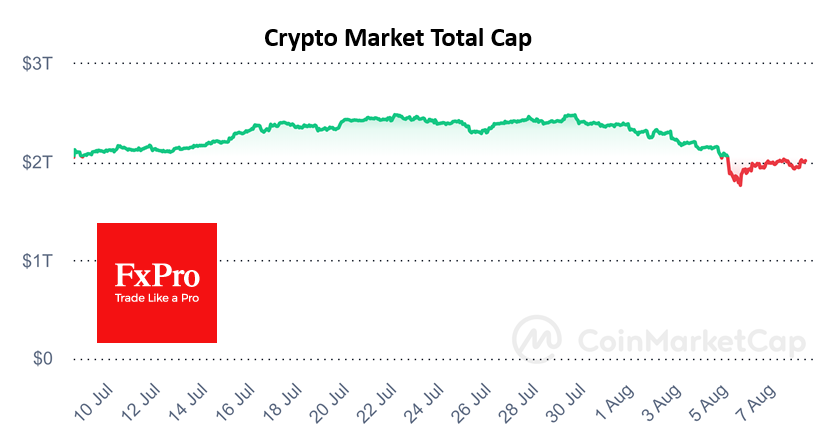

The crypto market has been quietly hovering around the $2 trillion mark for the past two days. However, this could be a base formation followed by an upside momentum as the market recovers from the shock sell-off since early August. This sell-off has been closely linked to the sell-off in BTC and ETH due to their close ties to institutional holders.

At the same time, it's hard to ignore a few positive stories for crypto investors.

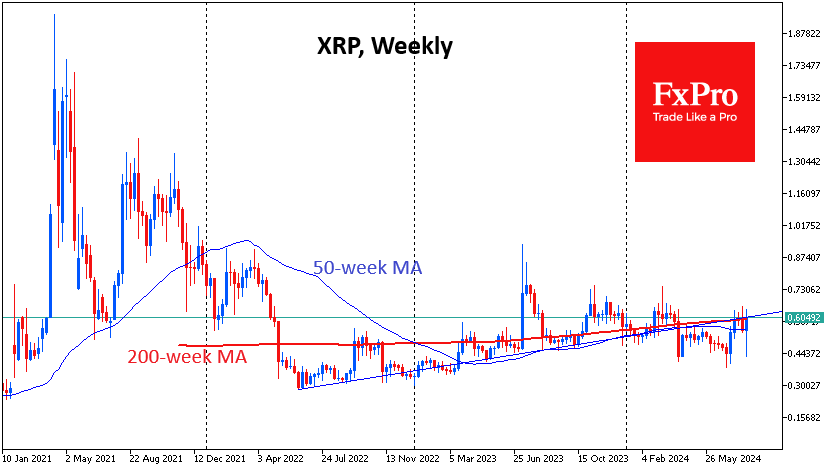

XRP bounced back to its historical support line and traded near $0.60. News of the SEC's decision in the case drove a 28% jump in price over the course of a few hours on Wednesday night. Technically, the price is back above its 50- and 200-week averages and 40% above Monday's low.

Toncoin is up over 10% in 24 hours on news of a listing on Binance. At its current level of $6.38, the coin is back to its August 2nd highs and is recovering faster than other major competitors.

Despite these more high-profile positive stories, it is still worth keeping an eye on Bitcoin and Ethereum's performance. They have the potential to set the mood for the broader cryptocurrency market and act as a sentiment indicator for global risk appetite, heralding a change in sentiment in stocks.

News background

The court issued a final judgment and fined Ripple $125 million, reducing by 94% the initial fine requested by the SEC. "This is a victory for Ripple, the industry and the rule of law. The SEC's opposition to the entire XRP community is gone," said Ripple CEO Brad Garlinghouse.

BitMEX co-founder Arthur Hayes said who will be the next US president won't make much difference to Bitcoin. In his opinion, reserves in the first cryptocurrency are unlikely to be created under any administration due to resistance from the traditional banking industry.

CryptoQuant CEO Ki Yoon Ju has calculated that the wallet balance of long-term investors in the first cryptocurrency has added 404,448 BTC ($23 billion) to the balance over the past 30 days. He is confident that in Q3, some organisations, large companies, and authorities in several countries will announce investments in digital gold.

The CryptoQuant CEO noted that miners' capitulation is almost complete, the hash rate is approaching an all-time high, and it is likely to remain stable. US mining costs are now at $43,000 per BTC.

Jump Trading successfully withdrew 11,500 ETH worth approximately $29 million from Lido Finance's liquid staking platform. Several experts cited the actions of the firm and its associated market maker, Jump Crypto, as a factor in the market correction.

About the author

Alex Kuptsikevich is a financial market professional with 16-years’ experience and a senior financial analyst at FxPro. He is the author of daily reviews on the impact of economic events with comments featured in top international and Russian media. Alex covers fundamental analysis, global markets, the foreign exchange market, gold, oil, and cryptocurrencies in his analytical pieces. As the senior financial analyst at FxPro, Alex is a guest expert in 1-tier global media such as Forbes, Coindesk, Euromoney and Morning Star.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.