Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Tether reports record profits, transactions and holder numbers

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

This week, we dive deep into Tether’s impressive metrics. We cover their quarterly report, on-chain metrics and discuss how they are bringing forth adoption into the crypto space.

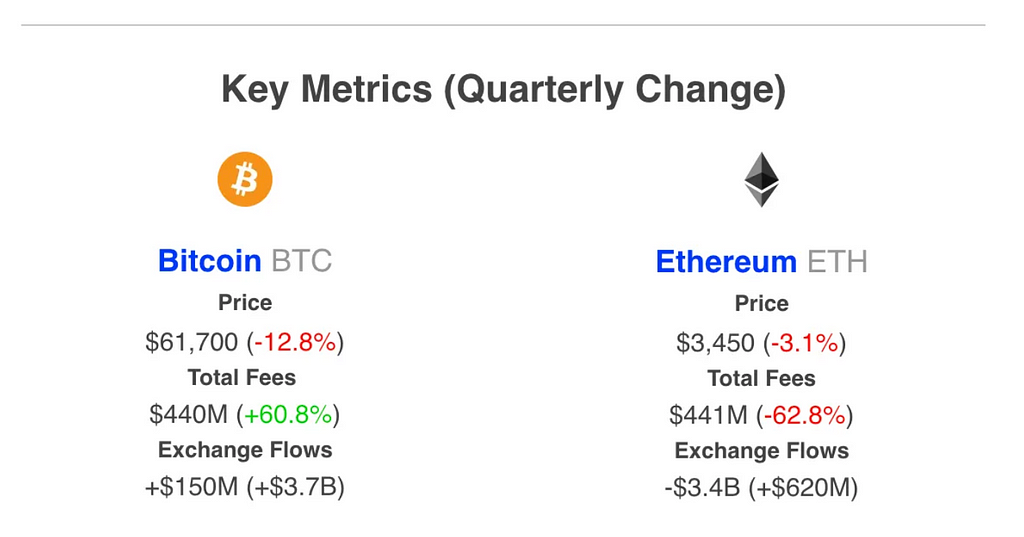

Network Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether

- Bitcoin fees have dropped to their lowest since October as the summer lull continues on-chain

- Similarly, Ethereum fees reached a nine month low, with gas costs dropping as low as 1 gwei (~$1 for a swap transaction)

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges

- BTC recorded $220M of inflows into CEXs, significantly less than the $2.3B from last week as Mt Gox distributions eased

- ETH saw $950M in net inflows while ETFs continue to record outflows

USDT Pushes Stablecoin Market to 2-Year Highs

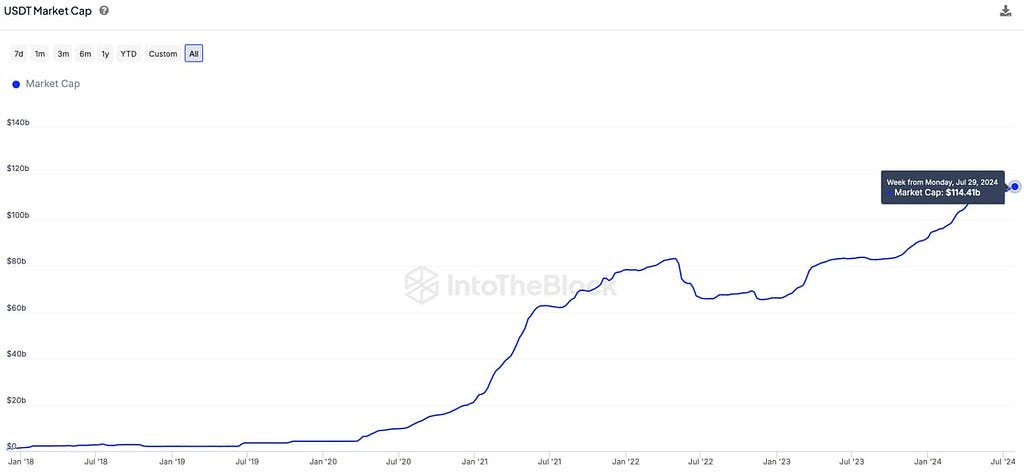

USDT’s parent company Tether reported a record $5.2B profit in the first half of 2024. This comes as USDT continues what is likely the most consistent growth trajectory in the crypto space, still setting new highs in July despite the broader market retracing.

Source: ITB USDT Financial Metrics

Larger, More Stable — USDT is showing improvements in multiple fronts

- Not only is the largest stablecoin approaching a $120B market cap, it also recorded all-time low volatility throughout July

- The largest stablecoin makes up over 70% of the market, constantly holding around that level so far in 2024

Source: ITB’s Free Stablecoin Perspectives

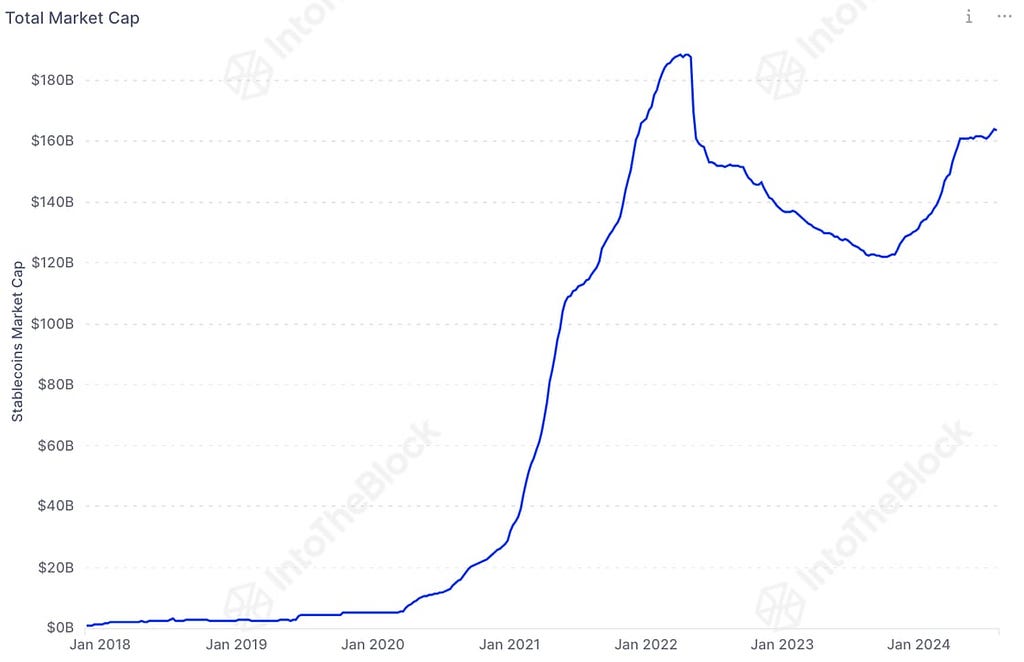

2-Year High for Stablecoins — The stablecoin market has reached its highest market capitalization since the collapse of Terra’s UST

- Beyond USDT, PayPal’s PYUSD also continues setting new highs, reaching a market cap of over $620M within less than a year of launching

- The stablecoin market’s growth reflects liquidity flowing into the crypto-economy, a positive sign of adoption for the space

- This trend is also echoed throughout USDT’s transaction and holder numbers

Source: ITB’s USDT Across Chains Perspectives

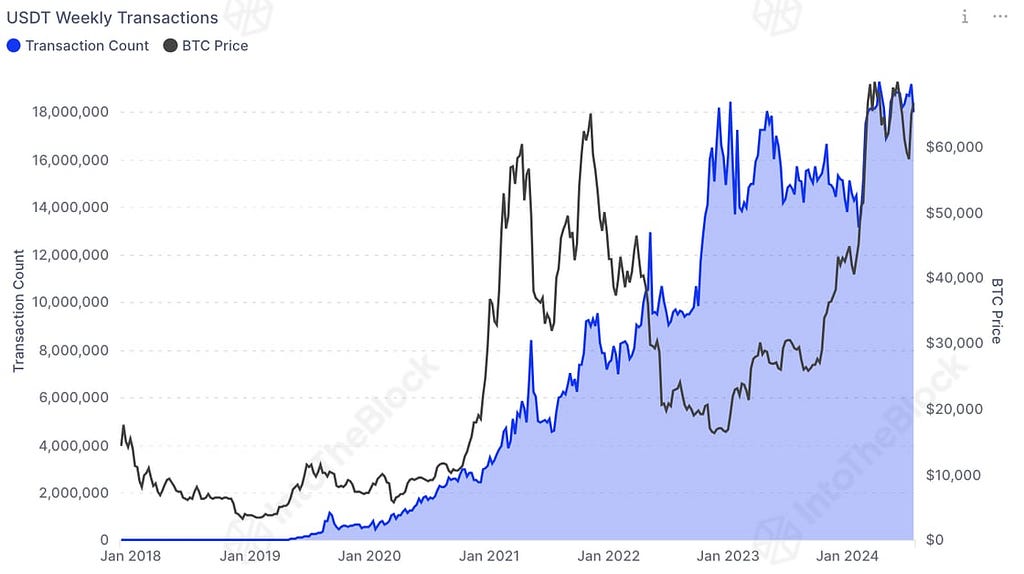

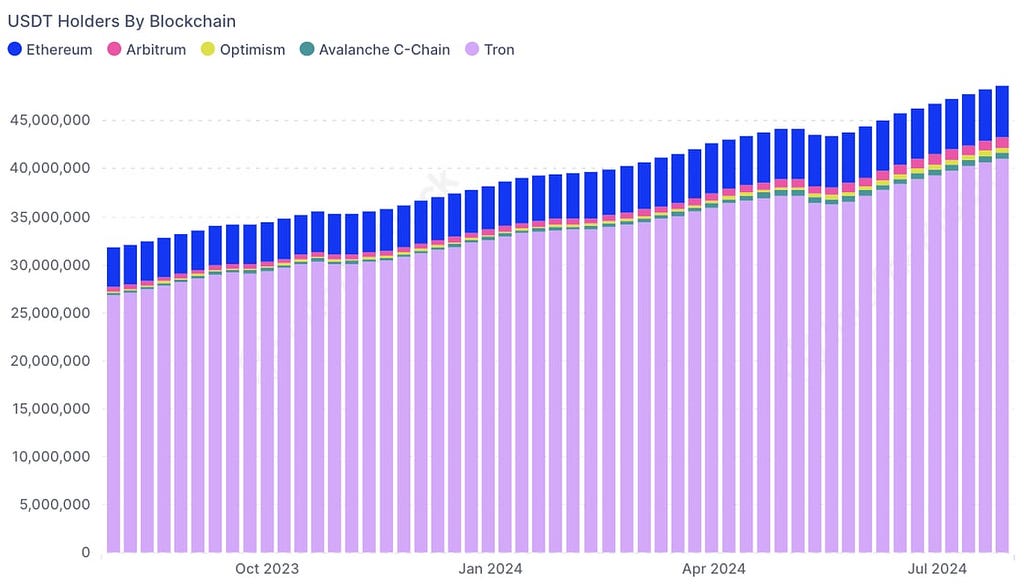

Record Transactions & Holders — USDT on-chain metrics show impressive growth

- USDT has been setting record highs throughout the year in terms of transactions, consistently seeing over 18 million weekly transactions just in EVM chains

- 78% of those transactions happen on the Tron network, which has become the default for most transfers

- With 48 million addresses holding USDT, Tether has expanded access to US dollars, with 84% of those addresses also being on Tron

Overall, Tether has shown its resilience through the multiple episodes of FUD it’s endured. Although it may not be the most exciting use-case, it is hard to argue that USDT is not the crypto project with the most “real-world” adoption so far.

USDT Pushes Stablecoin Market to 2-Year Highs was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.