Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows the Bitcoin sharks and whales added to their holdings right before the latest rally in the asset’s price occurred.

Bitcoin Investors Holding Between 10 to 10,000 BTC Bought Ahead Of Rally

According to data from the on-chain analytics firm Santiment, the large BTC holders scooped up a significant amount of the asset before the news of Grayscale’s win against the US Securities and Exchange Commission (SEC) broke out.

The relevant indicator here is the “BTC Supply Distribution,” which tells us about the total amount of Bitcoin each holder group in the market carries in their combined wallets.

Addresses or investors are divided into these groups based on the number of coins that they are currently holding. For instance, the 1 to 10 coins cohort includes all wallets with a balance of at least 1 BTC and at most 10 BTC.

In the context of the current discussion, all cohorts falling within the 10 to 10,000 BTC range are of interest. Holders with addresses of these sizes are popularly called “sharks” and “whales.”

As these investors hold significant amounts, they can have some influence in the market. The sharks are relatively small, so they don’t have too much power, but the whales are enormous and carry more relevance.

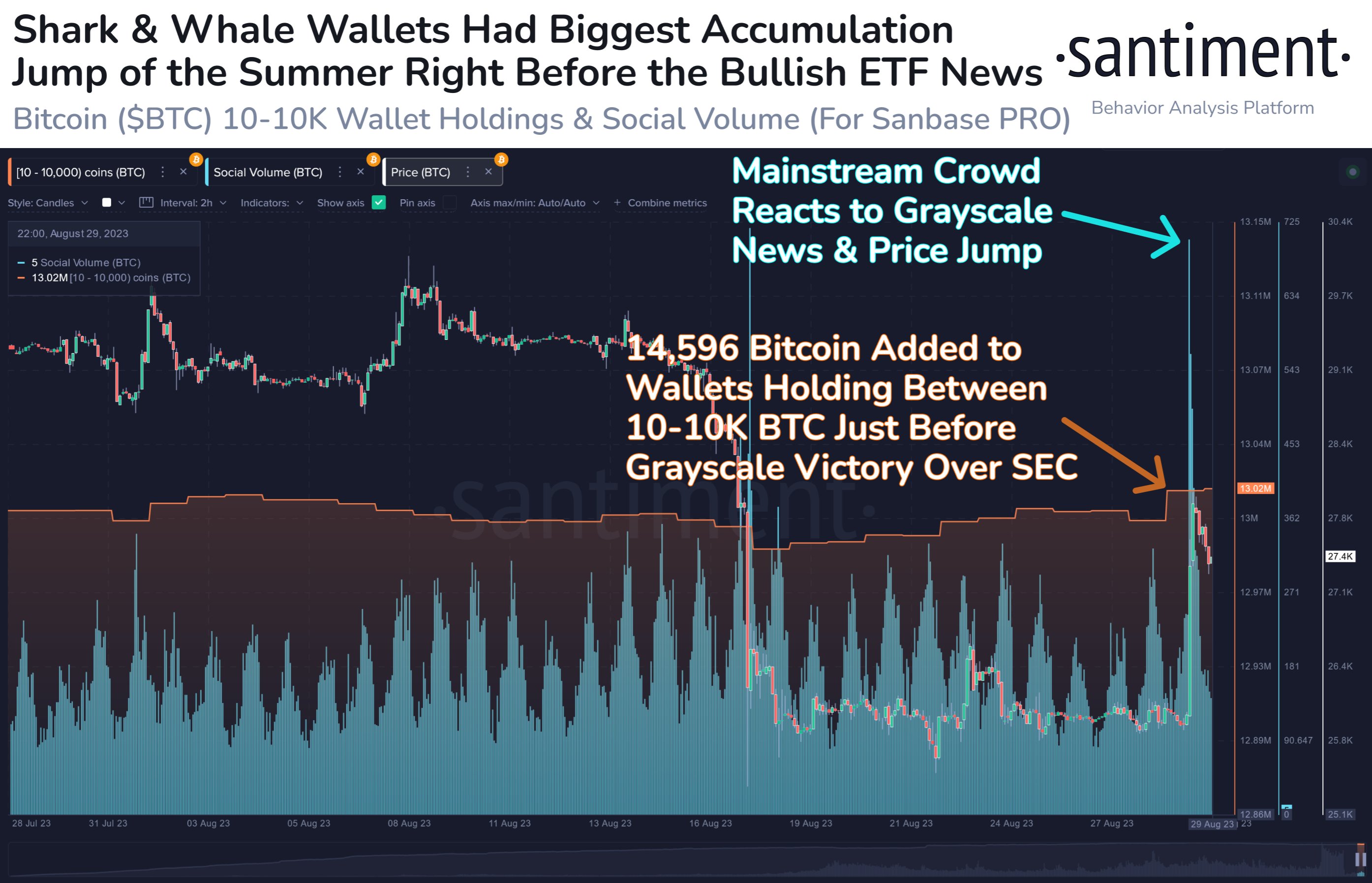

Now, here is a chart that displays the trend in the Supply Distribution of these Bitcoin sharks and whales over the past month:

As shown in the above graph, the Bitcoin supply held by the sharks and whales had registered an increase during the day leading up to the bullish Grayscale news.

These large investors had added around $388.3 million worth of the cryptocurrency to their wallets during this buying spree, which isn’t huge compared to the total size of their holdings but is still a notable amount.

In the chart, Santiment has also attached the data for another metric: the “social volume.” This indicator measures the degree of discussion the asset receives across the major social media platforms.

It can be seen that this indicator had observed a huge spike when the news broke out, and the general public became aware of Grayscale’s victory. During the crash earlier in the month, a spike of similar scale had appeared as FUD had spread around in the market.

This previous spike during the crash, however, had coincided with the selloff from the sharks and whales (that is, the drawdown in the indicator). In the case of the latest rally, that wasn’t the case, as the moves of these large holders had occurred in advance.

The sharks and whales may have already known about the lawsuit’s outcome, so they had accumulated in advance, anticipating the rally. Because of these buys, these investors were able to take full advantage of the price surge.

BTC Price

While Bitcoin had surged towards $28,000 during the rally, the coin has since observed a pullback towards the $27,100 level. Nonetheless, BTC investors are still up 3% since the surge started.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.