Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Believe it or not, once upon a time investors made decisions past faux white papers and moon/lambo memes.

I’m a large proponent of adopting cryptocurrency and blockchain projects for their actual usage – rarely for speculation or hodling. In general, rampant speculation drowns out meaningful education. However, with the diverse amount of projects released, it was only a matter of time before projects sprung up that reached back to the “fin” part of their fintech roots.

All three major types of cryptocurrencies – transactional, platform and utility – are seeing a crop of projects that are meant specifically for holding as a form of passive and investment income.

Since a plethora of content already exists around mining and since it requires a high barrier to entry relative to traditional income/passive investments, let’s focus on some more attainable alternatives.

Traditional investment (and our friends at the IRS) differentiate capital investments and passive investments based on where the investor derives his/her literal returns. A return realized on the sale of an investment asset (say, selling an ICO token after it rose in value), is considered a capital investment. A return, or income, realized independently of an asset bought or sold is considered an income or passive investment. The clearest cut example here from traditional finance is dividends from stocks held.

Passive income is the most highly sought-after form of investment since it’s the literal actualization of “your money working for you.” Yet passive income is notoriously hard to attain. From Airbnb, to blogging with affiliate links, to collecting stock dividends, to franchising, to leasing real estate, passive income is really hard to capitalize on and often becomes less passive than intended. Additionally, passive income often requires large upfront capital and more importantly, time, yet often returns less than ideal rewards.

Thankfully, a few pioneers from crypto-world are turning the tide by offering a few different methods that resemble income and passive investments.

*Editor’s note: You already know what this is going to say. The second you saw “editor’s note”, you got ready for that “this isn’t investment advice” statement. We can’t stress it enough that this isn’t investment advice, and is purely informational. Cryptocurrencies are very volatile – gain/lose money on your own research and advice from licensed and experience professional providers.

Different Ways Of Earning Dividends In Crypto

There is no exact comparison for dividends within crypto-world, however, there are multiple different other ways of holding cryptocurrencies for a passive return. No two projects are exactly alike in the process either, so be wary that additional research is required for any method suggested below.

The following is a list of the general ways a cryptocurrency can offer passive income:

-

- Staking – holding a Proof-of-Stake coin in a special wallet

- Master Node – controlling a Masternode

- Utility Tokens – holding tokens designed for periodic income

Staking

Blockchains and cryptocurrencies use special algorithms, known as consensus algorithms, that mathematically determine which next block is the “right” one. Bitcoin introduced the most popular type of consensus algorithm known as Proof-of-Work. By far and large PoW is the most popular form of consensus within crypto world.

However, an increasingly-popular second form of consensus, Proof-of-Stake, is slowly but surely starting to take off. This leads us to door number one for creating passive crypto income: staking.

In Proof-of-Stake, instead of mining for cryptocurrencies through hardware, new blocks are created by holding cryptocurrencies in a staking wallet. A staker puts up a stake (coins), or locks up a number of their coins, to verify a block of transactions. Ideally, the more coins one stakes, the bigger the chances are that one will be awarded a block reward.

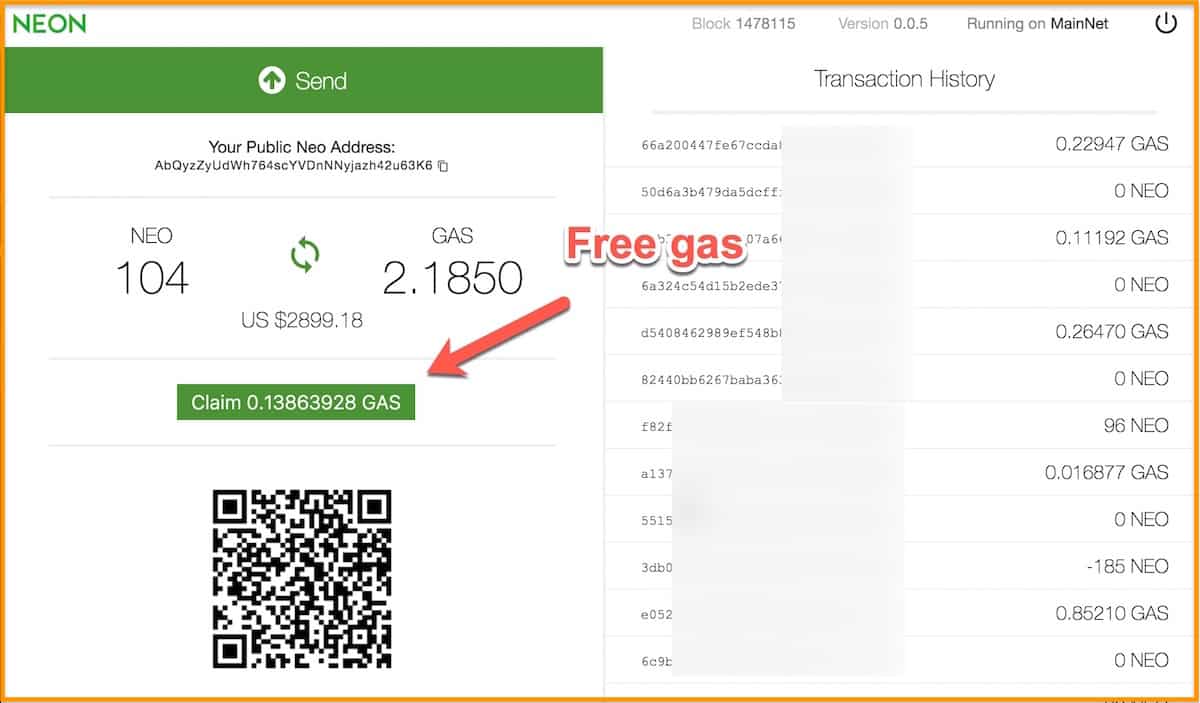

Some coins require a 24/7 connection and power-source, while others require very literally just holding coins in a special wallet. From my research, NEO takes the cake in terms of lowest barrier to entry both fiscally and computer-literacy-wise. All it took was downloading the official City-of-Zion NEON wallet and transferring purchased NEO from exchange to said wallet.

That’s it! As long as I keep my NEO in the official wallet it’s already staked — no additional steps necessary and I can claim my staked rewards (in GAS) up to every 5 minutes. As far as the “passive” part of passive investment goes, PoS certainly fits the bills.

Among other cryptocurrencies now offering rewards through PoS staking are NEO/GAS, Lisk, Stratis, and ARK.

Masternode

Method number two for leveraging an income stream from crypto-holdings more resembles traditional passive income as it typically requires a substantial amount of startup capital. A growing number of crypto-projects have two or more layers of governance — with the upper, higher-power layer, or node, commonly referred to as the masternode.

These master nodes usually provide some additional governing effort to its underlying crypto-community. Some examples are actively/passively voting on software updates, verifying private/instant transactions, and participating in community events.

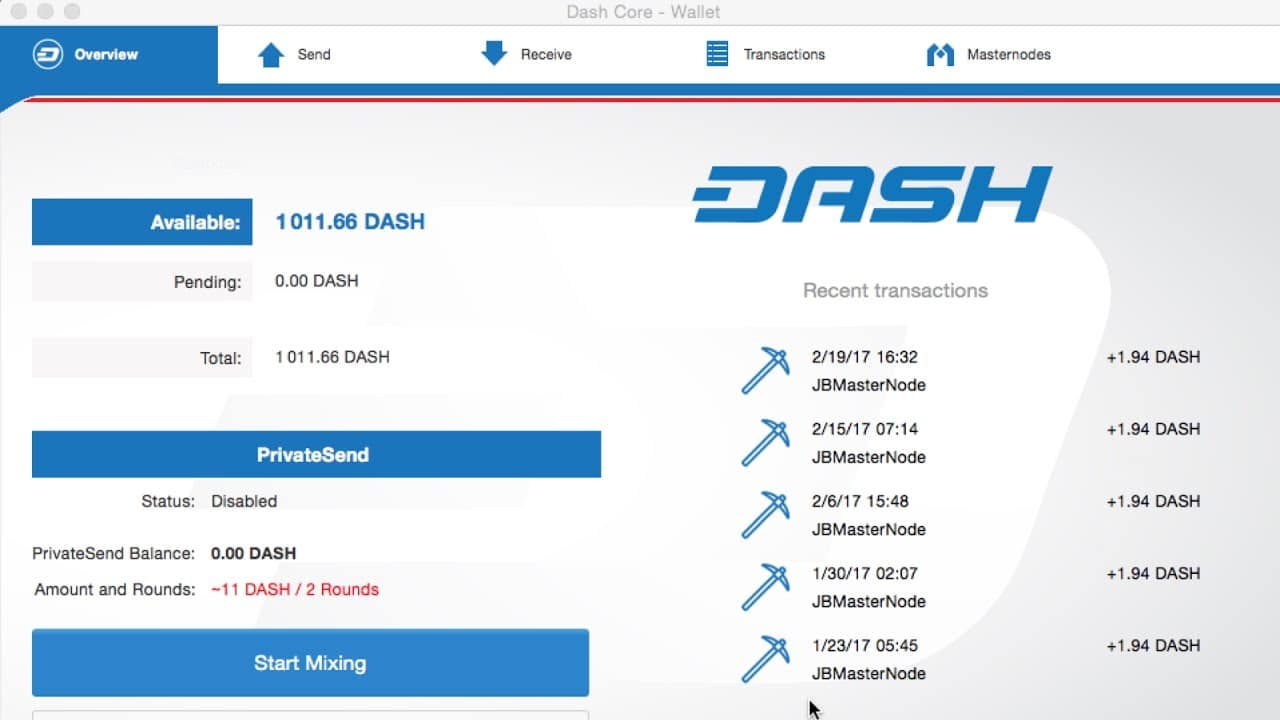

Holders of master nodes are usually rewarded handsomely. For example, in Dash, masternodes receive a whopping 45% of the block reward on every single new block. The official Dash website claims that “typically, around 2 Dash (~$325) is paid to each masternode every 7 days.”

What’s the cost to own a master node you say? Well, that depends on which coin we’re discussing – to continue with Dash, a masternode costs 1000 Dash locked up for a fixed period of time. Unfortunately, not many crypto-enthusiasts have ~$325K liquid lying around that they’re willing to tie to a single coin.

Utility Tokens

This final category represents the widest range of projects as each passive income derives its value from the success (or failure) of a tokens main utility; the core difference between the PoS model previously defined and this utility token model stems from exactly which part of the cryptocurrency project correlates with the decrease or increase in the dividends.

PoS rewards are derived from a cryptocurrency protocol in an almost-standard way, while utility tokens rewards are derived from a cryptocurrencies transactional purpose.

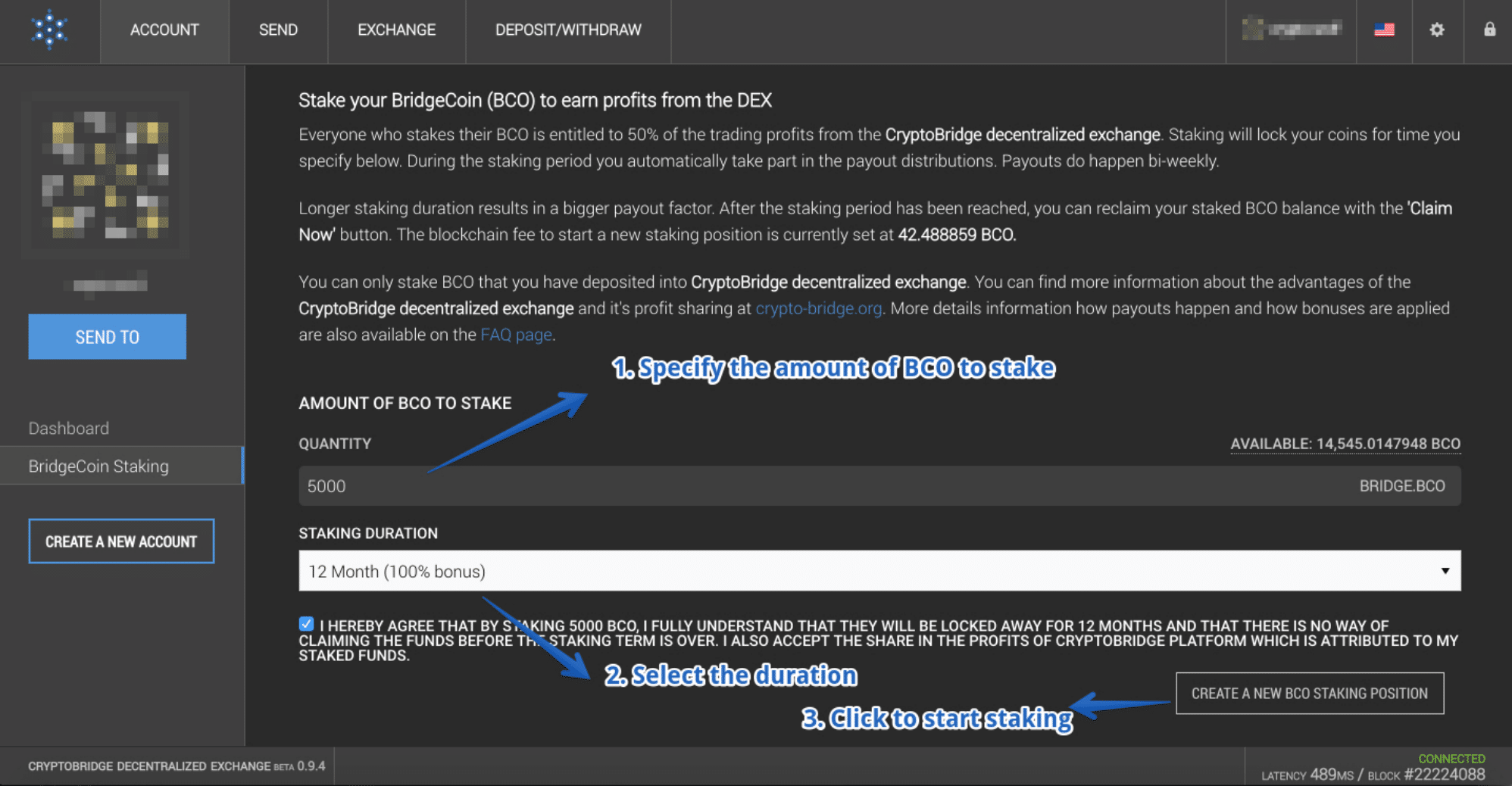

An example is the decentralized blockchain asset exchange CryptoBridge DEX. DEX is an exchange, which means that in order to succeed as a project, DEX seeks long-term growth in terms of exchange volume: the more traders and capital are using DEX, the more transaction fees will be collected. Additionally, the team distributed an accompanying token named BridgeCoin (BCO) on the Bitshare blockchain. through a public mine over the course of six months,

By purchasing and staking BCOs on the DEX exchange, holders are rewarded to a whopping 50% of transaction fees (after-profit*). Even more interestingly, the rewards received from BridgeCoin are not paid out in BridgeCoin, but in the transaction pair that resulted in the transaction fee. If only strictly Bitcoin, Litecoin, Monero and Ethereum are traded on DEX, then the bi-weekly staking rewards would be strictly in Bitcoin, Litecoin, Monero, and Ethereum, not in BridgeCoin – a pretty nifty way to passively grow a diverse portfolio.

Dex/BCO are only one of many utility tokens such as COSS, Kucoin, who’s main business function correlates with an increase/decrease in dividends. As more blockchain teams rush to disrupt archaic business models, it’s likely a growing amount will award dividend-like financial rewards tied to their business model.

Final Thoughts: Passive, but Risky

Ultimately, the cryptocurrency space still resembles the Wild West – volatility and clickbait headlines will continue to dominate the scene for the foreseeable future. However, slowly but surely, stability will provide a pathway for passive income vehicles with growth potential, unlike the previous era of standard dividends.

For now, Proof-of-Stake, Masternodes, and a growing number of utility tokens lead the way for the first generation of passive income cryptocurrencies. Undoubtedly a few of these projects will fail, however, those that don’t will surely pay out a cushy income stream over the next decades.

The post How to Earn Passive Income with Cryptocurrencies appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.