Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Cryptocurrency trading is growing in popularity, giving birth to many exchanges – both spot and derivatives – in the past couple of years.

FYBIT is a cryptocurrency exchange founded by professionals in finance, trading, and web development. After conducting thorough research and analysis, the team created a leveraged trading service intended to compete with the heavyweights.

The platform brings forward a simple and easy-to-use trading interface, focusing on infrastructure, safety, speed, fairness, and transparency.

The team pays special attention to security and protection, storing funds in geographically distributed cold storage with multi-signature technology.

In the following guide, we take a closer look at the platform, its fees, security, customer support, and overall trading experience.

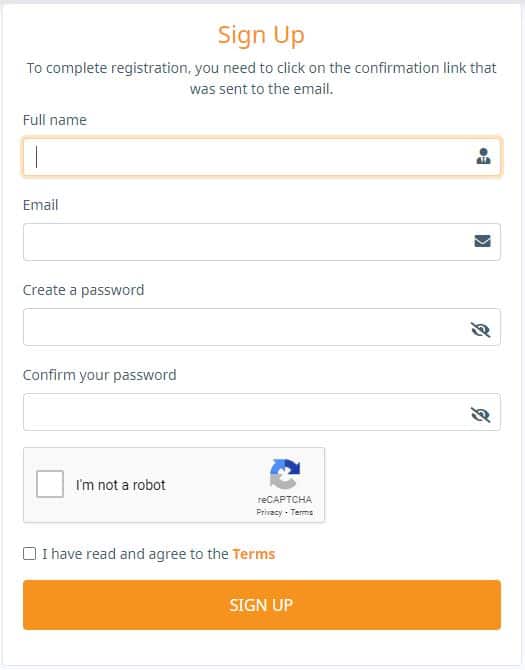

How to Register an Account on FYBIT?

Registering an account on FYBIT is particularly straightforward and quick. All you need to do is input your email address – there is no requirement for a Know-Your-Customer (KYC) verification process.

Apart from your name, you won’t need to input any other personal information. Make sure, however, to put a working email address because you will need to confirm your registration to open up an account. Also, the email will be used to log into your account and to confirm the withdrawal of funds.

Once you have set up your account, it is highly advisable that you enable your Two-Factor Authenticator (2FA). To do so, you will need to download the Google Authenticator app. After that, head to your Account tab and select Account Security. Once there, you will be able to enable and disable the 2FA at will.

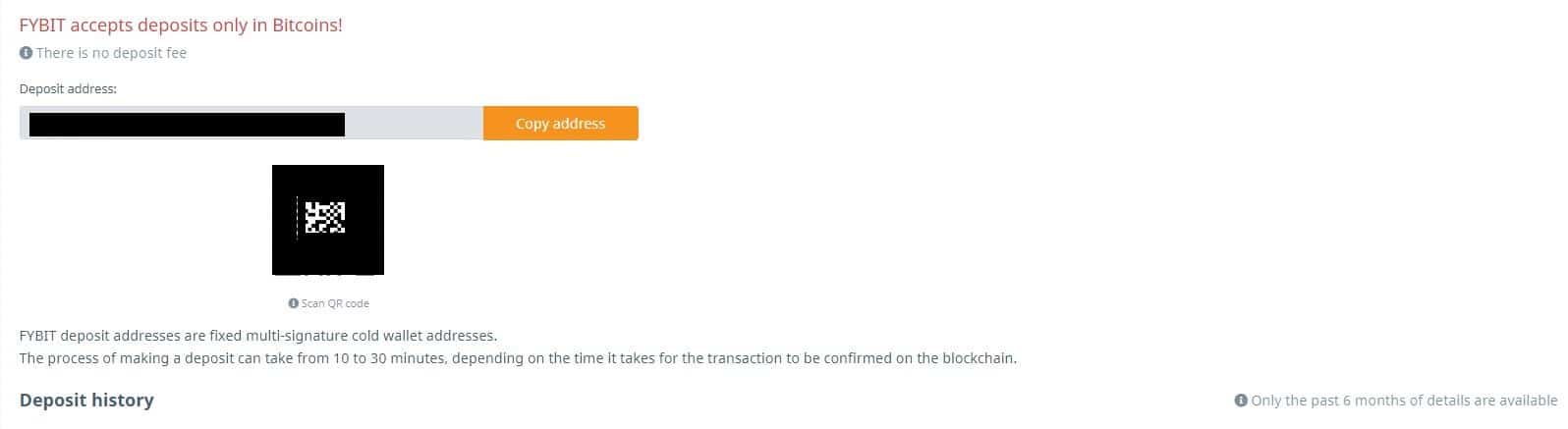

How to Deposit or Withdraw Funds to FYBIT?

Now that you have an account registered, you would need to deposit some funds. One thing you need to know: FYBIT only accepts deposits in BTC.

To deposit BTC, all you have to do is go to the “Deposit/Withdrawal” section and send funds to the address provided to you. Funds are credited to your balance immediately after one confirmation on the network and usually takes less than 10 minutes.

As mentioned on the website, deposit addresses are fixed multi-sig cold wallet addresses for added security.

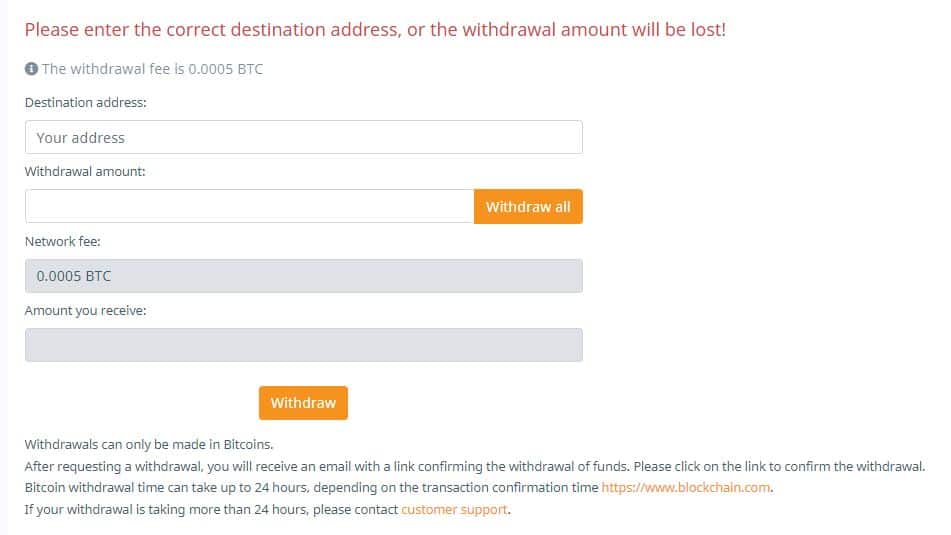

The withdrawal procedure is almost the same, but in reverse: all you have to do is send BTC to your address. After requesting a withdrawal, you will need to confirm the withdrawal by email. Funds arrive in your wallet in less than 10 minutes. Withdrawals, as well as deposits, are available only in bitcoins.

How to Trade Cryptocurrencies on FYBIT?

FYBIT allows its users to trade cryptocurrencies with leverage. This is an important consideration – it allows you to bet on the price going both up and down, and you can also open bigger positions relative to your current account balance, thanks to the leverage.

For example, if you use a 10x leverage and have $100 in your account, you can essentially open a position worth $100 x 10 = $1000. This could allow you to increase your profits if the trade goes your way, but it’s also incredibly risky because you could lose your entire margin.

In the above example, if the price moves in the wrong direction by a margin of 10%, you will lose your account balance and get liquidated. This is why trading with high leverage is incredibly risky and should only be carried out by experienced traders.

At the time of this writing, FYBIT supports the following cryptocurrencies:

- Bitcoin (BTC) – with up to 100x leverage

- Ethereum (ETH) – with up to 50x leverage

- Cardano (ADA) – with up to 30x leverage

- Bitcoin Cash (BCH) – with up to 40x leverage

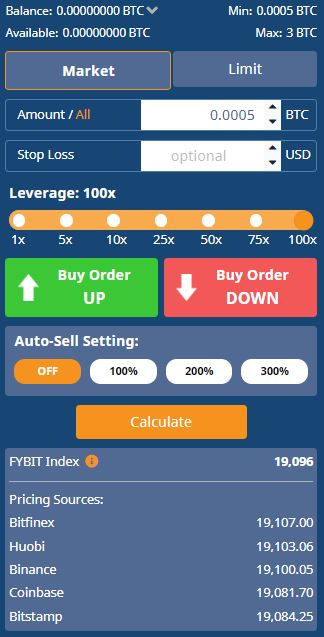

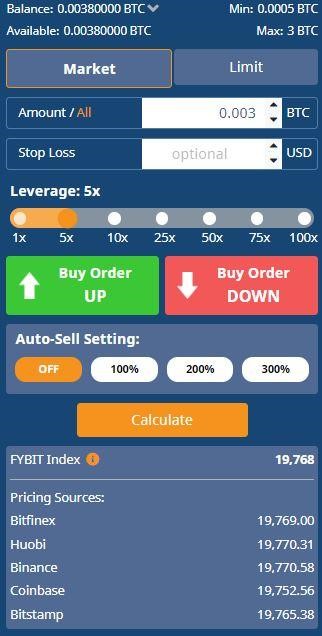

This is what the overall trading interface looks like:

As you can see, the interface is pretty straightforward. On the top, you can navigate between the different available cryptocurrencies, and there’s a chart in the middle. On the right side, there are the different available orders.

Limit Order

Limit orders are set when you want to purchase (or sell) at a price that’s different than the current market price.

In the first tab, you need to put in the amount of BTC you want to open a position for, and in the second – the price. If you want, you can also use a stop-loss price where your position will be automatically closed.

Below that, you can adjust your leverage, as well as the auto-sell setting.

Market Order

Market orders are the simplest type – they are used to open a position immediately and are filled at the best available market rate.

All you need to do here is input the amount of BTC you wish to open the position with and (optionally) input a stop loss. Then, you have to once again select your leverage and decide whether you want to go long (price goes up) or short (price goes down).

How to Open and Close a Position on FYBIT?

For the sake of this guide, we are going to open a long position on BTC using 5x leverage with a simple market order.

As you can see here, because of the high leverage, our maximum position size with the balance that we have is 3 BTC, despite the fact that we only have 0.0038 BTC. As mentioned, we want to open a position with 5x leverage, so that’s what we’ve selected, and our size is set at 0.003 BTC. From here, all we have to do is hit “Buy Order UP”.

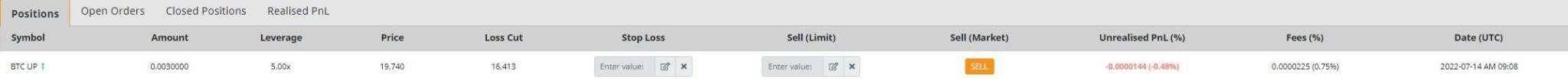

You can monitor your position from the relevant tab right below the main chart.

This is also where you can track its performance and monitor specifics like your unrealized PnL, the fees, the date, and so forth.

To close your position, you can either enter a stop-loss value, a sell limit order, or just hit the SELL market button and close it off. You can also enable the automatic sale of profits, for example, select a value of 100%, and as soon as your unrealized PnL reaches 100%, your position will be automatically closed.

That’s pretty much everything there is to know about trading on FYBIT.

Security and Customer Support: Is FYBIT Safe?

There are multiple considerations to take into account when measuring the security of an exchange. Right off the bat, there’s no information available online that indicates that the exchange has gone through some sort of a security breach.

According to its main website:

Most of your funds are stored in offline (cold) wallets. Only a small part of it is accessible from the platform; hence, all your funds are completely safe. As additional protection, cold wallets are not available from the platform or the platform’s servers. Offline storage facilities require manual intervention from several members of our management team.

The team also promises that their system goes through automatic backups every hour, and these backups are also stored on different servers. The website itself is supposedly protected from DDoS attacks “by a robust system and continuously checks users.”

The fact that users can enable a Two-Factor Authenticator (2FA) also gives some reassurance, although it has long become standard practice.

In terms of customer support, we submitted a manual ticket for review to check the speed at which the team would get back to us. It took them less than 10 minutes to respond to our ticket, which is generally a good feedback time.

What Are the Fees on FYBIT?

Trading fees are particularly important and a major consideration when it comes to picking an exchange to trade on.

According to the official page, there are no fees for depositing funds, and there’s a flat 0.0005 BTC fee for withdrawals. There is a withdrawal limit of 10 BTC per day.

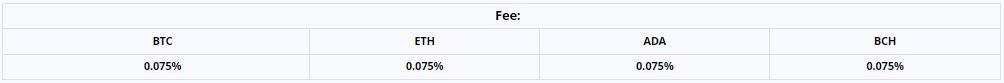

There’s also a 0.1% conversion fee for any crypto.

For trading, FYBIT charges users when they open and when they close a position. The basic fees when using no leverage are:

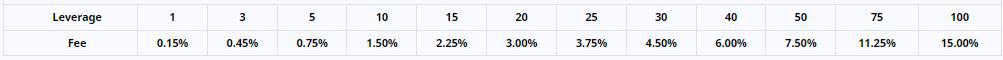

However, when using leverage, the trading fees for opening and closing a position when using different leverage for all currencies on the platform are:

FYBIT Affiliate Program

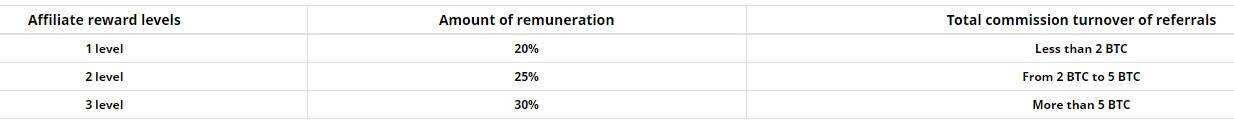

The FYBIT platform has its own affiliate program, which offers a stepwise payout system to its partners. Any registered user has his own affiliate link, which he can send to other traders.

The base percentage of remuneration at the first stage is 20% of the commission turnover of all attracted referrals. If the commission turnover reaches 2 BTC, then the partner automatically moves to the second stage, where his remuneration is already 25%.

The maximum amount of remuneration is 30%, which becomes available at the third stage when the commission fee of all attracted referrals reaches 5 BTC.

The billing period is one month. Within one calendar month, the commission turnover is calculated, and from the 1st day of the next month, the withdrawal of partner remuneration is available.

Conclusion

As with everything, there are specific pros and cons when it comes to using FYBIT. On the plus side, the platform truly is very intuitive and easy to use, catering to traders of all sorts and not necessarily only professionals. It has never been compromised, and the customer support is very responsive – a critical consideration for every cryptocurrency trading platform.

On the offside, trading fees are not the lowest in this segment. Trading with 100x leverage would see the user pay 15% for simply opening and closing the position, which isn’t something you see on a lot of other exchanges.

As an additional risk factor would be the fact that there’s no information about any regulatory licenses. The fact that there are no KYC requirements raises a few eyebrows, especially at a time when many regulators have put crypto under their scope of purview.

Remember, when it comes to storing cryptocurrencies on an exchange – you should never keep an amount outside of what you use to day trade because “not your keys, not your crypto.”

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.