Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As part of the Afro-Tech Atlanta movement, my team will begin the rollout of first generation micro-market exchange technology leveraging blockchain distributed ledger technology, pending compliance review. Please note our micro-exchanges project been under development for several years and this topic came up several times on how to establish real economic solutions for divested African-American urban communities across the USA. After years of research, we have realized one of the missing components required for economic development in the African-American community was a free market exchange platform.

In this article, our goal is to explain exactly how a market exchange platform works and the role blockchain will play in the architecture and work process. I will be providing some black historical pretext because it is very important to understand the background of our African-American history to fully appreciate why we African-Americans have strong use cases for blockchain technology and why the Afro-Tech are the real leaders and on the forefront of blockchain technology.

The term “Black Wall Street” is a sloppy term used throughout the African-American community to refer to historical black community commercial districts comprised of merchants, insurance, banking and other entrepreneurial efforts.

The problem with identifying these high street areas as “Black Wall Street” is the 100 years of historical confusion among us African-Americans believing merchant-class, retail banking and commercial centers were the equivalent of how the real Wall Street operates in New York City.

The real Wall Street is brokerage houses leveraging free market trading platforms to exchange value. The buying and selling of assets from commodities to future contracts and options and stocks is one of the core components of establishing a free market ecosystem and this is what African-Americans have not established after Civil War Reconstruction and the Great Migration.

What African-Americans historically endured was worked mostly with bigoted white privileged society refusing give black people a fair deal and with dignity and this practice happens up to this day in places like Silicon Valley.

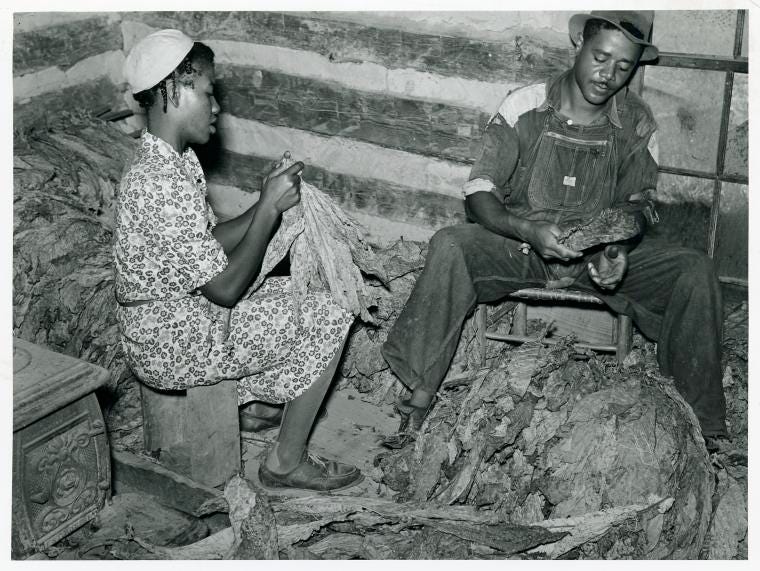

Throughout American history, African-American economic activity is mostly working hard to create value and then being screwed when we try to sell our value in traditional markets. After slavery, freed African-Americans and their children have adopted sharecropping to pick tobacco and cotton but was always low-balled when they bring their crops to the offtaker.

In 2016, the USDA reached a settlement with black farmers who sued for systematic discrimination and disenfranchisement when it came to acquiring farm loans. Today Silicon Valley is operating in the same manner when it comes to discrimination and disenfranchisement of African-American tech talent.

After being screwed over on sharecropping in the South, many African-American descendants of slaves moved to northern cities like Chicago, Baltimore, Pittsburgh and more to open up business, work in the industrial sector only to again just to be shorted on fair market value from wholesalers, distributors and employers.

During the Great Migration, many entrepreneurial African-Americans became long haul truckers driving commodities like watermelon, catfish from the south to northern cities but these trips were also risky and were refused insurance protection by white insurance firms.

Throughout black history, African-Americans never received the dignity and respect for fair market worth when it came to our people wishing to provide value.

From trading in a quality used car at an auto dealer to selling their home to Netflix supposedly low-ball offer to Monique for a proposed series. To this day, when it comes to African-Americans with assets to trade or value to offer, African-Americans routinely are low-balled and rarely see fair value due to systematic discrimination and inequality.

But we African-Americans were never taught exactly how to create economic development in our education curriculum as if no one want us to be economically free. So some of us African-Americans adopted the incorrect line of thought within the black community we can establish economic growth through proxy-based economics and central planning.

One fallacy assumption is the black community will thrive if African-Americans collectively deposit their money into black banks who supposedly in turn lend money to black entrepreneurs to open local black businesses and give black people jobs. This black bank model floated around in the early 1900s during Jim Crow segregation but to apply this logic in 2018 is a clear violation of equal lending laws.

Another far-fetched assertion for economic development is the government give us African-American reparations for slavery and we used that reparation money from the government to build up a “Black Shangri-La” like Wakanda to make up for the 400 years of oppression our ancestors endured because we didn’t land on Plymouth Rock, Plymouth Rock landed on us.

I mean, we African-Americans really have some wild ass thoughts about creating economic growth instead of just sticking to fundamentals — the reason why we didn’t have a true Black Wall Street in our African-American community.

Looking at established economic centers around the world, we discovered what was missing in the African-American community was a true free market system where demand and supply meet and work out trading deals at fair, market competitive value.

If we look at models from Tsukiji Fish Market in Tokyo to the Chicago Mercantile Exchange, we see the true model and platform for establishing economic activity and growth within the African-American community has to adopt to make true genuine process. Assets are extracted and refined and brought to market and speculators bid on the price based on the profit margin they will offer to the consumer, everybody wins in the free market system to meet supply and demand.

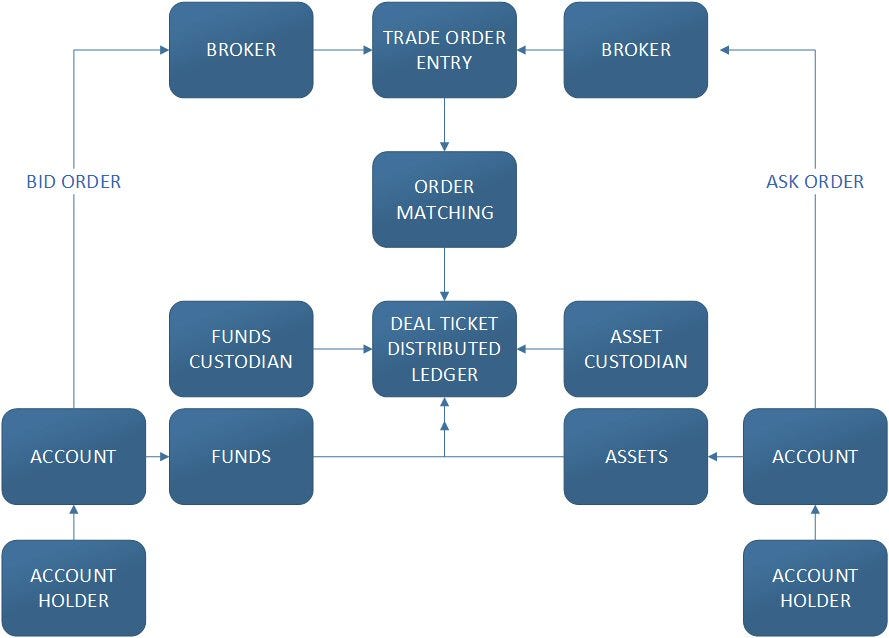

The diagram above is a core version of an exchange platform and let’s talk about each entity/component to understand the inner workings.

Accountholder. This is the retail customer that will conduct trades to buy and sell.

Accounts. The account is a record of the account holder funds, assets and activity.

Assets. These are items available for trade on the exchange platforms. Assets could be physical products like collector sneakers or digital assets like exclusive license rights to a breaking news video roll for the 6pm news broadcast.

Funding. This is the monetary assets and when it comes to African-Americans, we will be working with cash because we got to eat food and pay for rent in our black communities.

Asset Custodian. Assets custodian are the physical holder of the assets. Most pawn shops, consignment ships or buyback shops can serve the role of a custodian. The role of the custodian is to serve as an independent entity to ensure the product is available for trade and fulfillment.

Funds Custodian. This is usually a reserve banking model that holds all of the funds of an account.

Broker. This is the person/entity allowed to enter trade orders on behalf of the accounts they manage. It is important to understand this — only brokers will be able to enter trade orders. When account holders place a trade, that trade is routed to their broker who in turn create a trade order.

Order Entry. The system brokers will enter to generate an order ticket. The order ticket has the bid or ask details and quantity and other rules. In our example, we will be starting off with just end of day or good until cancelled.

Order Matching. The order matching is an algorithm that pull the first in queue order ticket and match an ask order with a bid order or vice versa. This is a complex engine not for the faint-hearted in simple terms (a) for an “ask” order find the highest bid order ticket and match it to a deal (b) for a “bid” order, find the lowest “ask” order and match it to a deal. This is the most critical component of any exchange and there is government regulatory oversight on the order matching process to ensure against market manipulation and fair trades are executed.

Deal Ticket. Once the order matching system match an ask order to a bid order, the trade is final and a deal ticket is generated. The deal ticket becomes a new entry on a blockchain distributed ledger. The proper account holders, brokers and custodians are also notified of the completed deal. All parties will interrogate the blockchain distributed to verify trades and custodians use the ledger to transfer the asset or funding to the new account holder.

For settlement, funds are automatically held and withdrawn during the order ticket and order matching process. The purchaser of an asset can simply go to the custodian and retrieve the asset or request the transfer of the asset to another custodian of choice.

Almost all exchanges will have a set market open and market close time specified and will unlikely be 24/7 operations. Our trading engines will be using in-memory and solid state scalable technology that rivals the large trading exchange platforms around the world in terms of TPS metric performance and scalability.

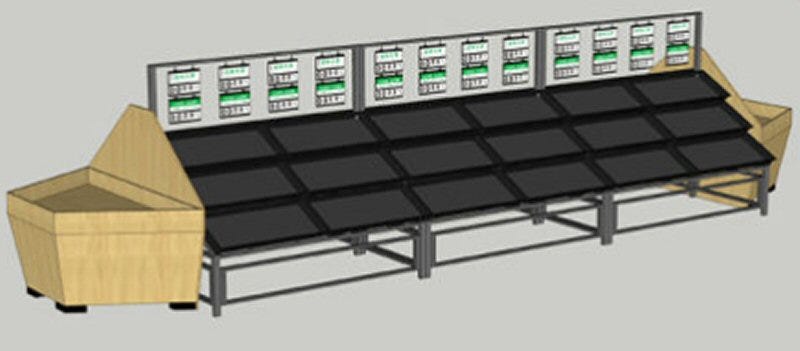

To engage the local community with free market exchanges, we are looking at building exchange board spaces throughout the black community to allow the people view the free market system at play within their community. These spaces will have large boards and news reporting and design to accommodate the inner city public school kids to visit on a field trip and learn about free market systems and trading of assets.

What we observed in China is inspirational to engage the community with free market capitalism by building trading halls. Trading halls is where mostly the elder population can sit down and watch the free market system at play and can go to a trade terminal to enter a trade as well. These social spots can also serve as a secure place for product exchange and we can probably do those pickup lockers as well in these trade halls in more advance modeling.

Another beautiful use case we seen in Tokyo where many brokerages like the one in Akasaka display their exchange board as a window display for passing pedestrians. When there are news on market activity, many news reporters show up to talk to people passing by about the up/down markets and their personal holdings, making newsworthy stories.

The awesome thing is the paradigms of use cases for free market micro-exchanges to drive value exchange within the black community as well as many urban communities around the world. Here are a few examples of value transfer that the Afro-Tech Atlanta family going to see implemented in 2018 as these projects been in the works for years and ready for release pending regulatory review.

Resale Market. Inspired by the “off” shops throughout Tokyo and Japan, we are looking at a supply chain based on resale items already acquired within the African-American community. We leverage existing or new buyback shops, consignment shops or pawn shops serve as custodians and sellers to work with brokers to place ask orders. Buyers can work with their broker to place bid orders to acquire a resale item and settled trades on the blockchain automatically give successful buyers a confirmation code to go and collect their purchased items. This model will work for the urban sneakerhead culture to run to TJMaxx and Marshalls to sell shoes on the exchange. Also the resale model is the fastest and most realistic way to quickly jumpstart African-American communities into economic activity by leveraging the assets we already own and make them available for resale.

Corner Store Slotting. To address the “food desert” issue in black communities where major grocery stores abandoned us, we are developing a new corner store grocery model where each shelve or bin is a slotted asset. The exchange will offer future contracts for food suppliers to bid on a slot (shelf space) in these corners stores for the right to fill and sell. For example, someone can bid on the right to slot the freezer section with packaged frozen meat they paid wholesale to distribute. The corner store can validate the contract every time a slotter arrive and verify on the deal ticket blockchain the slotter is permitted to access the slot in the grocery store. This allow smaller distributors gain market access to delivering foods for profit where the large grocery chains and distributors abandoned. Note: this is a superior grocery model that provides end-to-end supply chain tracking.

Black-owned Alcohol Distribution. One of the biggest challenges and opportunities we realize is the number of black-owned wineries, spirits and craft beer available the but difficulty finding a liquor distributor. There are plenty of bars and establishments in the black community but difficulty getting placement in these establishments. By creating an exchange market, we can allow liquor serving establishments bid on futures contracts to fulfill orders of liquor and spirits created by a black-owned liquor or beer artisans. By using “futures”, small black-owned distilleries and wineries can focus on realistic inventory deliveries instead of feeling pressured to produce more at lower quality or pull out a loan to finance which is the long-term cause of failure — futures reduce those pitfalls and create market equilibrium.

Urban Club Residency. This is a futures contract exchange to allow agency talent like DJs and Instagram celebrity bottle girls receive residency at a club or social establishment to draw in more patrons. In this model using future contracts, the future contracts from both the talent agency or social establishment are reviewed before market trading and bid on like a sports draft events. So we are looking at scenarios where an Instagram hood celebrity can receive a 2 year residency for $300,000 if they have a demonstrated ability to increase the liquor pour rate.

As we presented these use cases, you may have realize how the Afro-Tech is applying blockchain technology — no grandeur stories disrupting the financial sectors but instead addressing challenges and exploring new opportunities within our African-American community.

We knew for the longest time blockchain technology major use case was supply chain management, not financial sector and we are already way ahead of the blockchain game as a result of our research and applied use cases.

Overall, the economic history of African-Americans was a policy of structured inequality to move our people and communities into a role of “docile consumers” purchasing goods produced by others while denying us the ability to create value for ourselves and others. This “docile consumerism” policy is still practiced by Silicon Valley discriminating against and denying opportunities for African-Americans tech entrepreneurs but want us black people to patronage their Internet-based companies like Facebook and Twitter as docile consumers only.

By creating micro-exchanges and leveraging blockchain distributed ledger technology for robustness and low cost of operation, our African-American community can now focus on value creation and establishing a true free-market system.

As we look forward towards the Fourth Industrial Revolution future advent of city-state emergence in America similar to Singapore and applied local fiscalism modeling where value exchange is cycled through a local community, these blockchain micro-exchanges could be the start of something awesome and powerful to drive urban communities and improve the quality of life for urban people worldwide as a pattern and practice.

Before Blockchain, African-Americans Never Had a Black Wall Street was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.