Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

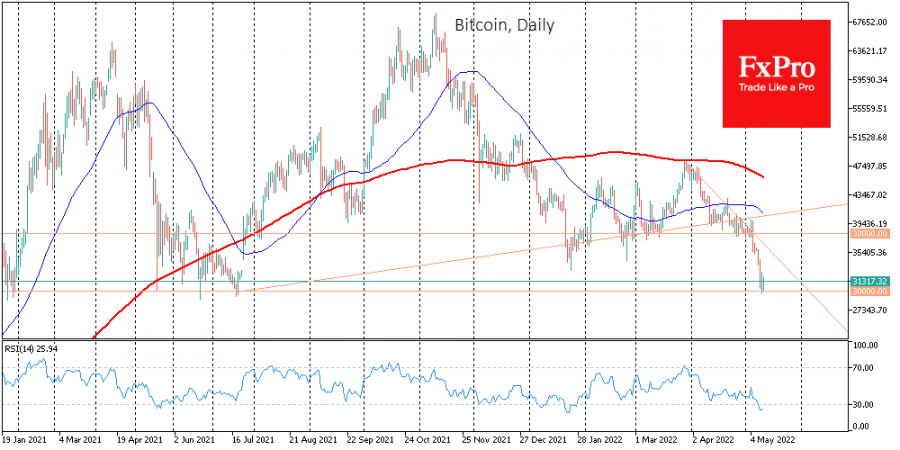

Bitcoin added a symbolic 0.1% on Tuesday, ending the day around $31K and adding another $500 this morning. Ethereum has been adding 0.2% in the past 24 hours. Other leading altcoins from the top 10 showed mixed dynamics, ranging from a 10.8% decline (Avalanche) to a 0.2% gain (Binance Coin). The total capitalisation of the crypto market, according to CoinMarketCap, declined 1.6% overnight to $1.42 trillion. The Bitcoin Dominance Index rose 0.4% to 42.2%. The Cryptocurrency Fear and Greed Index added 2 points to 12 by Wednesday, starting recovery from an area where it rarely lingered.

Although Bitcoin managed to close Tuesday’s trading with a proper strengthening, a powerful offensive did not happen, as bull buying was choked again by stock market pessimism. It remains a situation where the stock or debt markets will determine whether we see another rebound from the critical $30K level or a failure of support and a complete surrender of the buyers. Cardano creator Charles Hoskinson has announced the beginning of new crypto winter. However, he does not see any factors that could trigger the market to rebound soon.

Cryptocurrency investment company Galaxy Digital reported a net loss of $111.7 million for the first quarter of this year. Galaxy Digital founder Mike Novogratz allowed bitcoin to decline further in the coming quarters due to the negativity on Wall Street. Meanwhile, last week saw an influx of institutional investors into crypto funds after four weeks of capital withdrawals.

MicroStrategy chief executive Michael Saylor said it has no plans to sell its cryptocurrency reserves. He said bitcoin would have to fall below $3562 for the firm to have insufficient assets to secure loans. El Salvador has bought another 500 bitcoins at an average of $30,744 amid a fall in the crypto market. Last autumn, the country’s recognition of BTC as legal tender was a landmark event for the global economy.

About the author

Alex Kuptsikevich is a financial market professional with 16-years’ experience and a senior financial analyst at FxPro. He is the author of daily reviews on the impact of economic events with comments featured in top international and Russian media. Alex covers fundamental analysis, global markets, the foreign exchange market, gold, oil, and cryptocurrencies in his analytical pieces. As the senior financial analyst at FxPro, Alex is a guest expert in 1-tier global media such as Forbes, Coindesk, Euromoney and Morning Star.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.