Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin’s recent nosedives continued in the past 24 hours, and the asset slipped to a 17-day low of around $42,000. Most altcoins are also deep in the red, with the most losses coming from Terra, Solana, Avalanche, Cardano, and Dogecoin from the larger-cap ones.

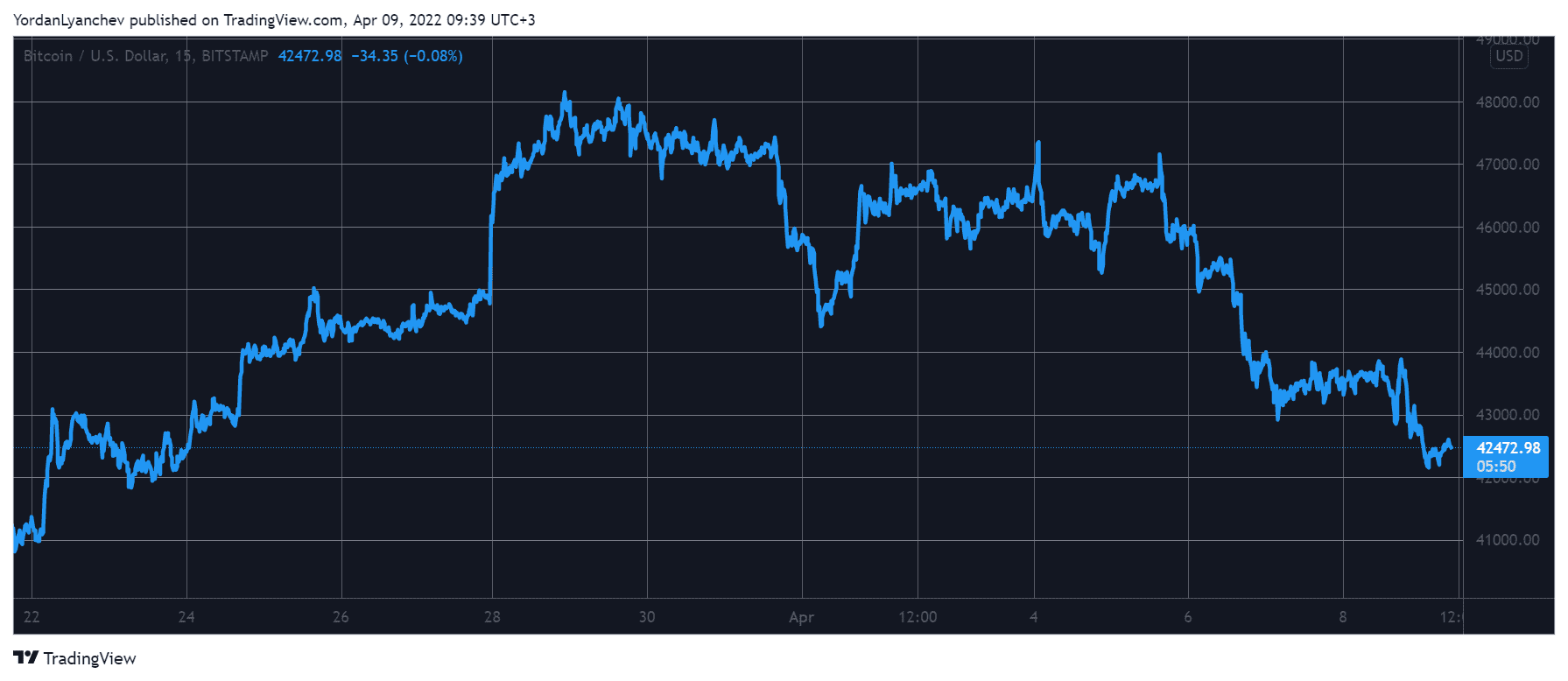

Bitcoin Tested $42K

It was just several days ago when bitcoin was fighting to reclaim $47,000 and spiked above that level twice within a 48-hour period. However, the bears came out from hiding and didn’t allow any further increases.

Both attempts were rejected rather rapidly, but the second one was met with a more violent correction. At first, BTC dumped to $45,000 before it went even further and slipped to $43,000, as reported yesterday.

It bounced off from that line and spiked to $44,000, but that turned out to be a fake breakout, and bitcoin went south once again. This culminated in a drop to just over $42,000 hours ago, which became BTC’s lowest price point since March 23.

As of now, the cryptocurrency stands a few hundred dollars above that particular line, but its market capitalization is down to $800 billion.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Altcoins Turn Red

Similar to bitcoin, the altcoin space has turned red today. Ethereum is among the more modest losers, with a 1.5% decline on a daily scale. As such, the second-largest cryptocurrency has declined to $3,200. It’s worth noting that ETH marked a three-month high above $3,500 just several days ago.

Binance Coin, Ripple, Polkadot, Shiba Inu, and CRO have slipped by less than 5%. In contrast, Cardano, Avalanche, and Dogecoin are down by more than 5% since yesterday.

Solana has dumped by 9% and struggles at $110 after failing at $130 earlier this week. Terra has lost the most – more than 10% in a day – and sits below $95. This comes after a $200 million token swap with Avalanche (AVAX).

The cryptocurrency market capitalization has lost $200 billion in four days. This means that the metric has dumped below the coveted $2 trillion line for the first time since late March.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.