Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A word of warning: everything in this post is my opinion. It’s also a bit heavy on the technical stuff, but everything should be Google-able.

If you’ve been watching the Bitcoin drama over the past year or so, you’ve probably heard about Bcash (aka “Bitcoin Cash”). I’m not going to go into the details of Bitcoin vs. Bcash, except that I will say this: Bcash is a hostile hardfork, which is an attempt to co-opt the Bitcoin name and brand. In this post, I’ll discuss some of the evidence for this, some of the FUD that Bcash pumpers are using, why they’re shilling their altcoin, and how Coinbase is colluding.

For starters, let’s profile 2 of the prominent figures behind Bcash: Roger Ver, and Jihan Wu.

Roger Ver is a convicted felon, US expatriate, and self-described “first investor in Bitcoin startups” (whether or not this is true I cannot confirm nor deny). He owns bitcoin.com, has more than 400,000 Twitter followers, and frequents Reddit under the name ‘MemoryDealers’, which was also the name of the company from which he first made his riches. He was influential in the early Bitcoin community, and became heavily involved in mining.

Jihan Wu is the cofounder of BITMAIN, a company which produces SHA-256 ASICs, which are used for Bitcoin mining. Today, Bitcoin mining is dominated by ASICs, and the BITMAIN ANTMINER S9 is the preferred choice of miners. Jihan isn’t as active within the community, he prefers to keep a lower profile than Roger, so less is known about this character.

What makes Bcash a hostile hardfork?

There’s a few pieces of evidence to support the claim that Bcash was created with hostile intent. When I say “hostile”, I mean that unlike other Bitcoin forks (of which there are literally thousands), Bcash is attempting to take the Bitcoin name and brand, confuse users, and ultimately destroy Bitcoin as it exists today. Here’s a summary of the things Bcash is doing to destroy Bitcoin:

- Using the name “Bitcoin”: this is confusing to users, especially people who are new to Bitcoin and cryptocurrencies. To make matters worse, Roger Ver owns bitcoin.com, which is a website that uses its reach to further deliver FUD to the masses. Bcash is not Bitcoin.

- Blatantly copying the Bitcoin logo.

- Using the same address format as Bitcoin: most forks change their address format to prevent people from accidentally sending their coins to a wallet on a different chain. For example, a number of people have accidentally sent BTC to BCH wallets (or vice versa) and lost their coins forever.

- Spreading FUD and lies: this one is a little more subjective, but there’s an entire community of people over on /r/btc on Reddit which appear to have jumped on the Bcash bandwagon and lost their minds. It’s a bizarre place.

Why are Bcashers doing this?

It’s quite simple, really. It’s all about money 💸. Bitcoin’s Segwit upgrade had 2 very important implications:

- it fixed a bug in Bitcoin known as “transaction malleability”, which simultaneously disabled an optimization known as ASICBoost

- it enabled the development of off-chain scaling technology like Lightning Network

Let’s look a little closer at these points.

ASICBoost is an optimization which significantly improves the profitability of Bitcoin mining, to the order of “up to 30%”. It does this by exploiting a bug in Bitcoin (the transaction malleability bug) to find new blocks faster than other miners. The creator of ASICBoost will only license the technology to certain parties, one of which includes BITMAIN, the largest mining company in China. In other words: Jihan and his company not only control the production of mining hardware, but they run their own mining operations which are 30% more profitable than everyone else. Can you guess why they might not want to upgrade? (hint: 💰) WhalePanda wrote a detailed post about this.

Now let’s talk a bit about Lightning Network (or LN, as I’ll refer to it here). LN is an off-chain scaling solution which can scale well beyond the ~7 transactions per second that Bitcoin is currently capable of. The Segwit upgrade is required to enable LN. Even with Bcash’s block size upgrade (from 1MiB to 8MiB), Bcash is only capable of about 7 x 8 transactions per second, or about ~60 TPS. To put this into perspective, the Visa network processes somewhere around 24,000 transactions per second, with a peak capacity of 56,000 TPS. Aside from being able to scale well beyond 56,000 TPS, LN would provide extremely cheap transactions: far cheaper than they currently are on the Bitcoin network (and also the Bcash network).

Myth: miners are responsible validating blocks. Fact: everyone running a full Bitcoin node is validating blocks, miners merely generate the blocks to be validated.

Okay, so why is this important? Well, think about it: miners get paid by finding blocks. Every time a miner finds a block, they earn the block reward (which is currently 12.5 BTC) plus the transaction fees. I’ll repeat: plus the transaction fees. This means that miners are incentivized to actually keep fees high. That’s right, everyone who has invested money into mining hardware (Bcashers, Roger Ver, Jihan Wu, Brian Armstrong?) wants to make sure their investment continues to pay dividends. In fact, they’ll make up lies to protect their investments. And since this is crypto, they can do what they want.

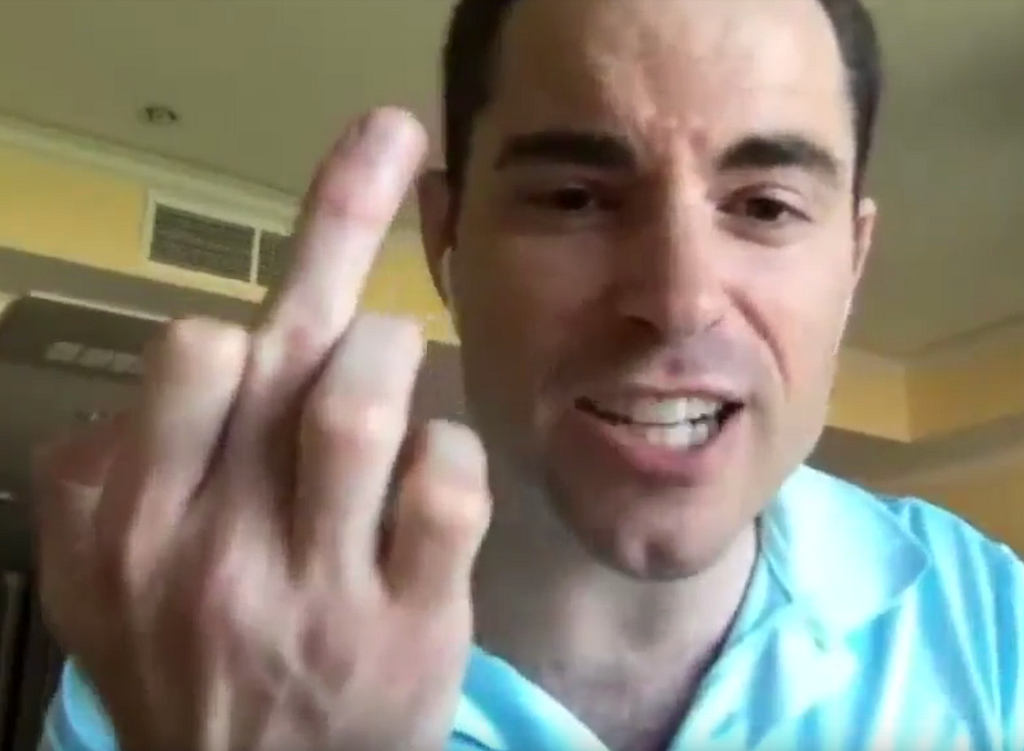

Miners have been spamming the mempool for months (maybe years? I think it started to get crazy about 6 months ago). The more they spam, the higher the fees go. They can afford to create a bunch of extremely low fee transactions knowing they’ll probably never be confirmed. These super low fee transactions eventually disappear from the mempool and never confirm, which means the spammers get to keep their coins. Normal Bitcoin users (non-spammers) now have to increase their transaction fees in order to get their transactions confirmed in the next block. The cycle repeats and reinforces.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

Caught Bitcoin spam attack on camera. #bitcoin (Green = input, Red = output, Yellow = input+output, Blue = transaction) Visualization thanks to @dailyblockchain https://t.co/pQNlYTw6eh

— @sbetamc

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Increasing the block size does not solve the scaling problem and never will. High fees are the result of bad implementations (Coinbase), spammers, and FUD.

Coinbase Collusion

So here’s where things start to get especially interesting. Over the past few weeks, evidence has been mounting that Brian Armstrong and Coinbase have been colluding to pump Bcash and damage Bitcoin. Specifically, Coinbase has:

- not implemented transaction batching

- not implemented Segwit transactions

- not provided a way for users to select custom transaction fees (fees which go directly to miners)

- listed Bcash with very little notice, almost by surprise, resulting in market chaos

- listed Bcash as “Bitcoin Cash”, confusing users, and without adequate testing

- not provided details on their intent to adopt Lightning Network

What’s particularly interesting to me, is that Brian appears to have gone full Bcash retard recently. He’s actually using his company to shill Bcash, and increase market confusion. People who don’t understand Bitcoin will see “Bitcoin Cash”, notice the price is lower, and think “Oh look! Here’s a cheaper Bitcoin! I’ll buy that!”.

Fun fact: both myself and Brian are former Airbnb engineers.

You can see how Brian feels about Bitcoin by looking through his Twitter actions, and specifically, looking at the tweets he’s ‘liked’, such as these gems:

🙄

🙄

So are you saying the fees are too high or too low? 🤔

So are you saying the fees are too high or too low? 🤔

If I were to guess, I’d say Brian has spent a lot of money on BITMAIN’s ANTMINER S9s and wants to make sure they continue producing profits for him.

Who’s responsible for the high fees?

The narrative used by Bcashers is that high fees are caused by small blocks. In a way, they are correct, but it’s more nuanced than that. I would argue that the 2 biggest causes of high fees are:

- crappy wallets (Coinbase)

- spammers

Coinbase’s wallet is crappy for a lot of reasons, but here are the main reasons it’s crappy:

- it doesn’t support Segwit

- it doesn’t support native bech32 (Segwit) addresses

- you can’t manually adjust the Coinbase fees (although you can get around Coinbase fees by using GDAX)

- Coinbase does not batch transactions

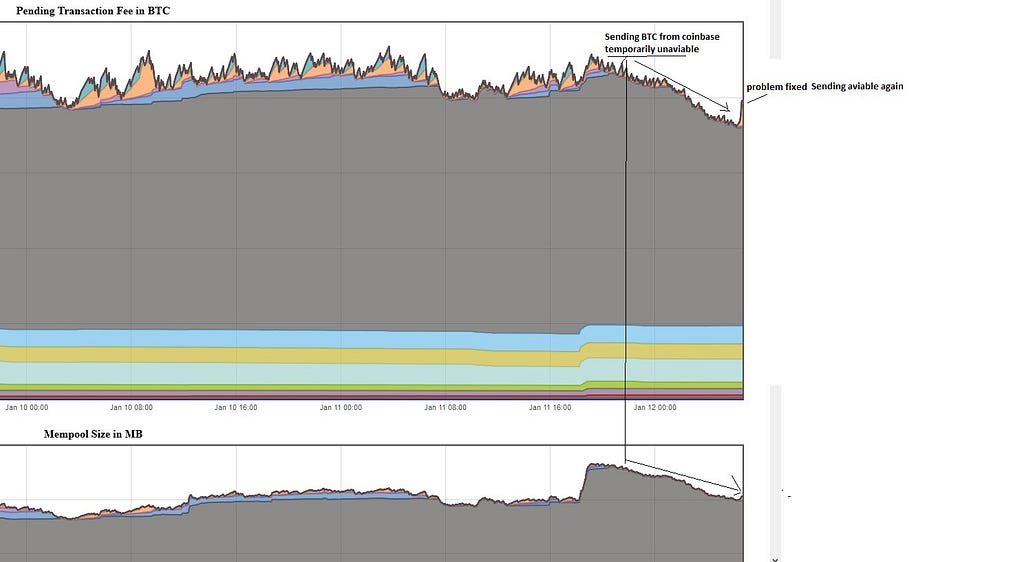

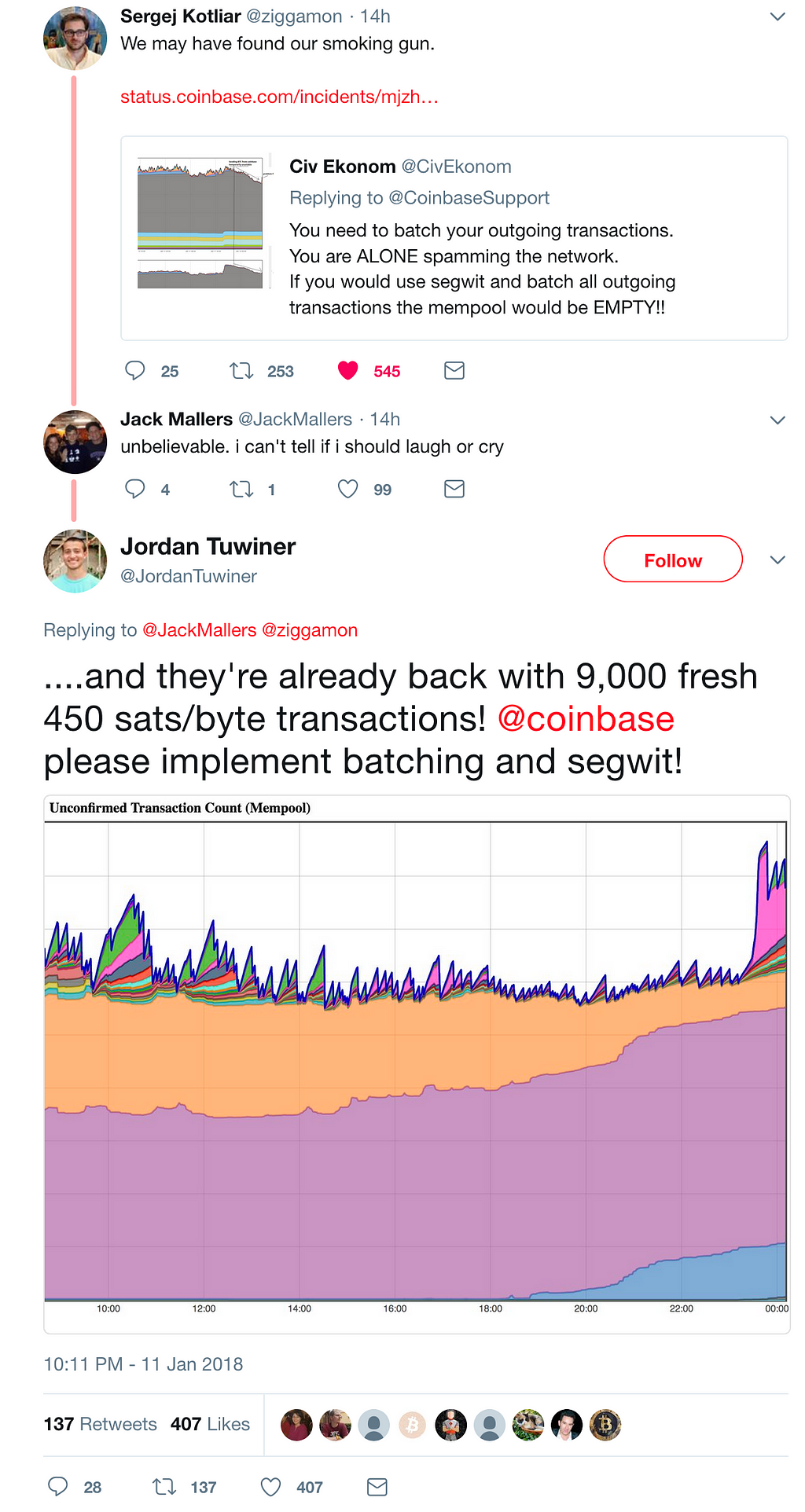

The last point is a big one: Coinbase is certainly one of the largest Bitcoin businesses, but they don’t even correctly implement transaction batching. Batching is a feature in Bitcoin that would significantly reduce the transaction costs if implemented properly. One can illustrate the effect of Coinbase’s incompetence by looking at what happens when Coinbase breaks:

Borrowed from https://twitter.com/CivEkonom/status/951693684692701184

Borrowed from https://twitter.com/CivEkonom/status/951693684692701184

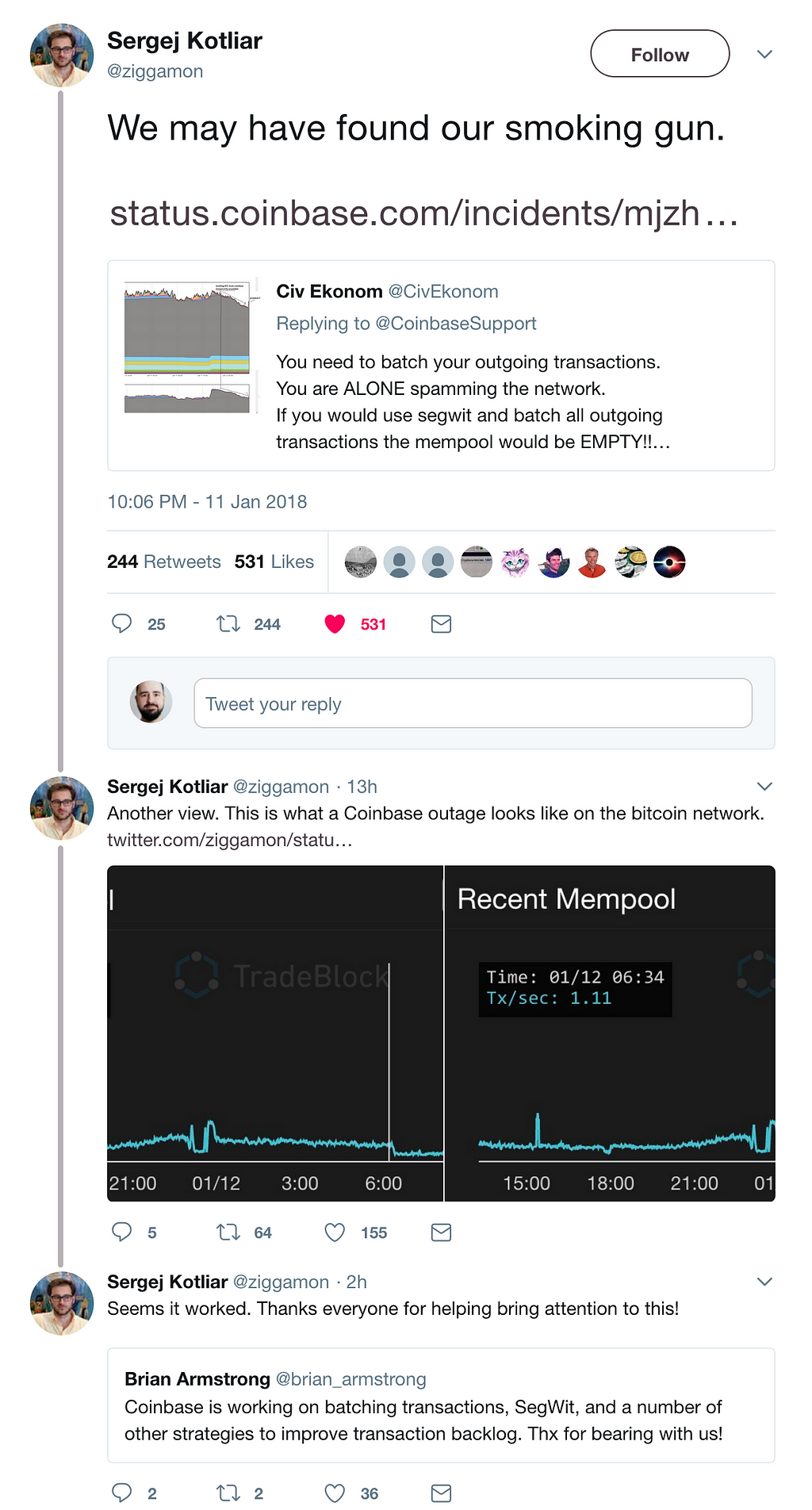

Further analysis shows a strong correlation between mempool size reduction and Coinbase’s failures:

Borrowed from https://twitter.com/ziggamon/status/951696967419113472

Borrowed from https://twitter.com/ziggamon/status/951696967419113472

But wait, there’s more:

From https://twitter.com/JordanTuwiner/status/951698069967589376

From https://twitter.com/JordanTuwiner/status/951698069967589376

And don’t even get me started on the Coinbase UTXO issue. I’m not sure how they intend to get out of that problem without making a deal directly with miners. For all we know, they already have.

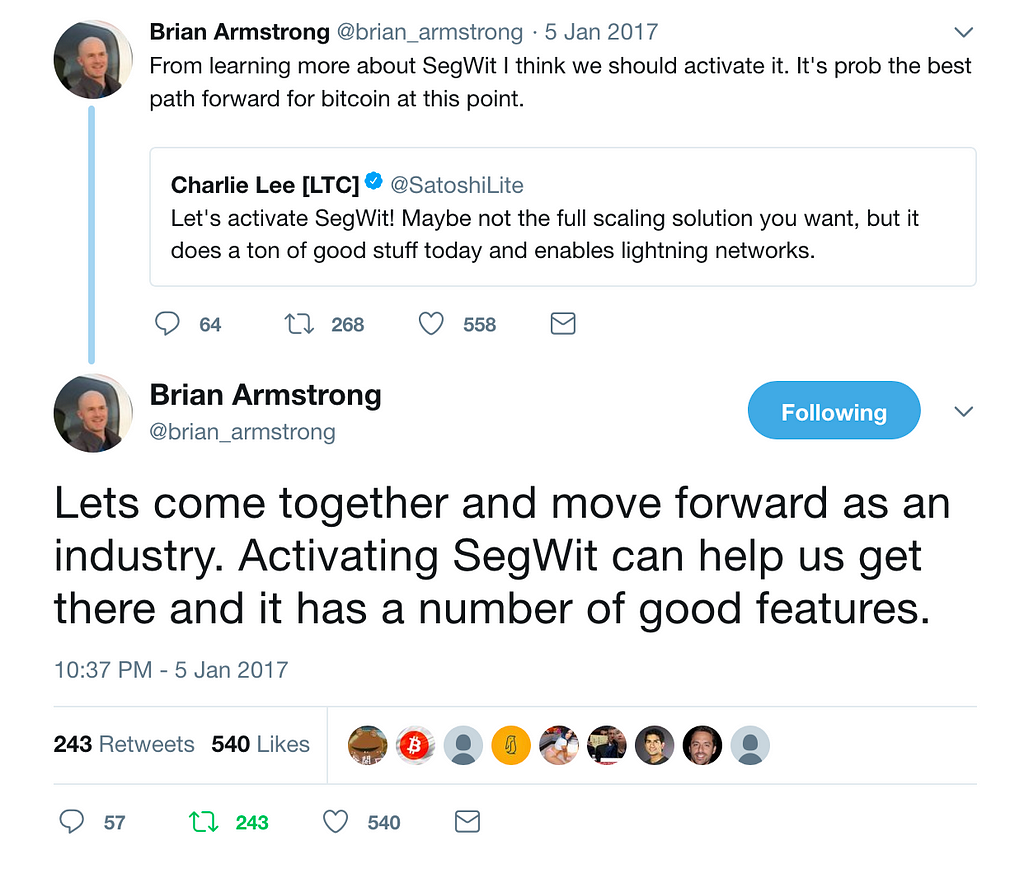

Let’s travel back in time, shall we:

Uhhh 🤔 https://twitter.com/brian_armstrong/status/817258720253988865

Uhhh 🤔 https://twitter.com/brian_armstrong/status/817258720253988865

Brian has responded to the publicity, so that’s good. His words have, historically, not meant a whole lot. Perhaps it’s occurred to him that his userbase is pissed, and he’ll act differently in the future. It’s also hard to imagine whether or not fickle Bitcoin users will remain loyal to Coinbase after all this drama. Judging from the posts on /r/Bitcoin (a subreddit with more than 650,000 subscribers), Coinbase has a lot of work to do. 9 of the top 12 posts (at the time of writing) are related to Coinbase user frustration.

What happened in the past year, Brian? Did you invest significant sums in mining hardware? Or perhaps a year ago you just didn’t understand what Segwit was back when you twatted that tweet?

So, let’s sum it up:

- Coinbase is one of the biggest contributors to mempool spam

- Brian loves Bcash

The real question regarding Coinbase is: are they actively manipulating the market, or simply doing a bad job? My guess is that it’s a bit of both.

Okay, so what now?

Subscribe to /r/Bitcoin to stay informed if you want to follow the drama. If you prefer Twitter, here’s some good people to follow (in no particular order):

- https://twitter.com/brndnmtthws (me)

- https://twitter.com/WhalePanda

- https://twitter.com/SatoshiLite

- https://twitter.com/ToneVays

- https://twitter.com/fluffypony

- https://twitter.com/Excellion

- https://twitter.com/jimmysong

Cheers!

Bcash & Coinbase: collusion, manipulation, and FUD was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.