Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

If you’re looking up what a DeFi liquidity pool is, chances are you’re deep in a decentralized finance rabbit hole. Maybe you’ve played with DeFi products like Uniswap and Aave, and perhaps even yield farming.

Or, maybe, you’re just getting started and have no idea what that last sentence means.

Wherever you are on the DeFi knowledge spectrum, you’re at the right place. We’re going to do something few have accomplished before: try not to make DeFi sound extremely confusing and complicated.

In this guide, we’re going to go over a crucial DeFi puzzle piece: liquidity pools and liquidity mining.

Why are liquidity pools so important? Well, that answer depends on you.

From a technical POV, liquidity pools help make decentralized trading possible. Anyone can trade swap tokens at any time without any single centralized entity. Rather than peer-to-peer (P2P) trading, where Bob trades with Sally, you have peer-to-contract trading (P2C) where Bob trades with a smart contract. Liquidity pools are at the center of this.

From an investing POV, liquidity providers are earning yields of 100% (and exponentially higher) APR from providing liquidity, which is a relatively passive but pretty risky practice.

Let’s get started with a key concept, decentralized exchanges.

Liquidity Pools 101: How a Decentralized Exchange Works

Picture our ancestors trading chickens for seashells thousands of years ago. Now, imagine Ooga Booga, captain of the prehistoric seashell industry, throwing his seashells into a big magic vortex, which automatically spits out a predetermined fair-market value of chickens.

This is obviously a gross oversimplification, but the vibe is similar to peer-to-contract trading in decentralized exchange.

A decentralized exchange (or, if you want to sound really in the know, a DEX) is essentially software that allows people to trade (or swap) tokens without a centralized intermediary.

A DEX can be open-source software created by independent developers, which should be audited by third parties to assess its efficacy and legitimacy. Many decentralized protocols are owned by a centralized parent company. Uniswap, for example, is a Brooklyn-based startup with a Series A led by famed venture capital firm a16z. In other cases, many DEX upstarts don’t have a centralized company established or an office you can call if things go awry.

Rather than requiring a human third party to custody assets, DEXes use smart contracts to provide nearly instant settlement times.

A DEX like Uniswap makes money by:

- Charging a “protocol fee” of between 0.05% to 1%. This feature can be voluntarily turned on by UNI token holders per their governance features.

- Token price appreciation. 20% of the 4 billion UNI tokens were assigned to Uniswap employees. As the protocol and UNI token grow in popularity, so will the wealth of the company and of the token holders.

DeFi protocols can differ in their liquidity protocols structure; one might charge higher fees, and one might distribute tokens that don’t have governance rights, etc.

Since these exchanges are completely decentralized, they need access to a large number of funds to ensure traders always have access to the token pairs they need.

To go deeper into DEXes, check out our decentralized exchange guide.

This brings us to liquidity.

Why Liquidity in DeFi Is Important

Ok, let’s take a momentary breather before we get into some nitty-gritty, but really freaking cool DeFi stuff.

Liquidity is the extent an asset can be quickly purchased or sold at a price that reflects its true value; it’s at the heart of any functional market.

A lack of liquidity correlates to higher-risk categories and is priced accordingly. Without liquidity, or anyone to purchase an asset, the demand, and subsequently the value, of the asset drops. For example, if I buy $1,000 of some obscure token, and every cryptocurrency exchange removes it from trading, I’d have nowhere to sell it, making it a much less valuable asset.

Low liquidity also means low volume, which leads to a pesky thing called slippage, where your order executes at different tiers of decreasingly preferential prices. For example, when Elon Musk buys a massive $100M order of Bitcoin, his order might even move the market as the order is being executed. Let’s say the first 10M BTC is filled at $50k per BTC, then the next $30M at $52k per BTC, and the last $60M is at $53k per BTC.

Legacy systems offer relatively functional marketplaces for most needs; if Bob wants to sell his $TSLA stock, a stock trading platform can execute the trade almost immediately, often without slippage since most reputable stock exchanges only carry assets with significant volume.

Since DEXes don’t have a centralized order book of people who want to buy or sell crypto, they have a liquidity problem.

In other words, in the face of highly efficient exchanges, an exchange without liquidity sucks– and DEX developers planned for this.

There are certainly infrastructural tradeoffs between the order book model that dominates centralized exchanges and the Automated Market Maker models in DeFi. However, the blockchain can offer significant improvements over traditional methods of exchange.

For one, most central marketplaces are confined to limitations such as market hours, reliance on third parties to custody the assets, and occasionally slow settlement times.

A DeFi liquidity protocol enables:

-

- Fast settlement: peer-to-peer trading settles immediately on-chain

- Simple to use: The liquidity protocol smart contract determines the trading price algorithmically.

- Non-custodial: A decentralized exchange doesn’t take custody of your private keys, meaning traders always have full control of their funds.

- Interoperability: Many of DeFi programs are interoperable and can be stacked on other compatible apps, like Lego blocks. Think of a company like Uniswap as a “Liquidity-as-a-Service” platform, where other third-party dApps, wallets, and payment processors can grant their users access to liquid markets as an ingrained feature.

- 24/7/365 Global Liquidity: Traders get liquidity anytime and anywhere in the world.

Order books make sense in a world where reasonably few assets are traded, not so much the madhouse world of crypto where anyone can launch their own token.

A centralized exchange like Coinbase or Gemini takes possession of your assets to streamline the trading process, and they charge a fee for the convenience, usually around 1% to 3.5%.

DeFi aims to accomplish the same goal of enabling a fast “always-on” marketplace, but without holding anyone’s private keys or assets. And here’s the conundrum: how do DeFi protocols get access to funds to fill trades without turbulence?

That’s where liquidity pools come into play.

DeFi Liquidity Pools in a Decentralized World 101:

A centralized exchange like Coinbase or Gemini uses the “order book” model, as do traditional marketplaces like the New York Stock Exchange. In the “order book” model, buyers and sellers bid in an open market: buyers want the asset for the lowest price possible, sellers want to sell for the highest price possible. For the trade to happen, buyers and sellers must agree on the price.

That’s where the Big Hoss of the whole ordeal comes in– the Market Maker. A centralized exchange acts as the market maker by establishing a fair price where buyers and sellers are willing to meet.

The Market Maker is always willing to buy or sell assets at a specific price, usually using its own pool of assets to make sure there is always something available. This means users can always trade on the exchange– cryptocurrency is unique in that exchanges operate 24/7/365, whereas something like the NYSE opens at 9:30 AM and closes at 4 PM EST.

Centralized exchanges invest resources to create a convenient and fair marketplace for users to exchange cryptocurrency, and make a hefty chunk of revenue from what they charge for facilitating the transaction.

Deeper dive: To see how a centralized exchange functions as a business, Coinbase is a public company– check out its S1 Statement or regular earnings reports.

The “order book” model is impossible without a market maker.

Instead of buyers and sellers being matched by a central market maker like Coinbase, traders using liquidity protocols trade directly against a smart contract. Peer-to-contract!

Where do the smart contracts get access to deep pools of funds to make trading possible? You guessed it– liquidity pools!

A liquidity protocol (think Uniswap, Bancor, or Balancer) acts as an Automated Market Maker (AMM) allowing users to access a liquid market at any given moment.

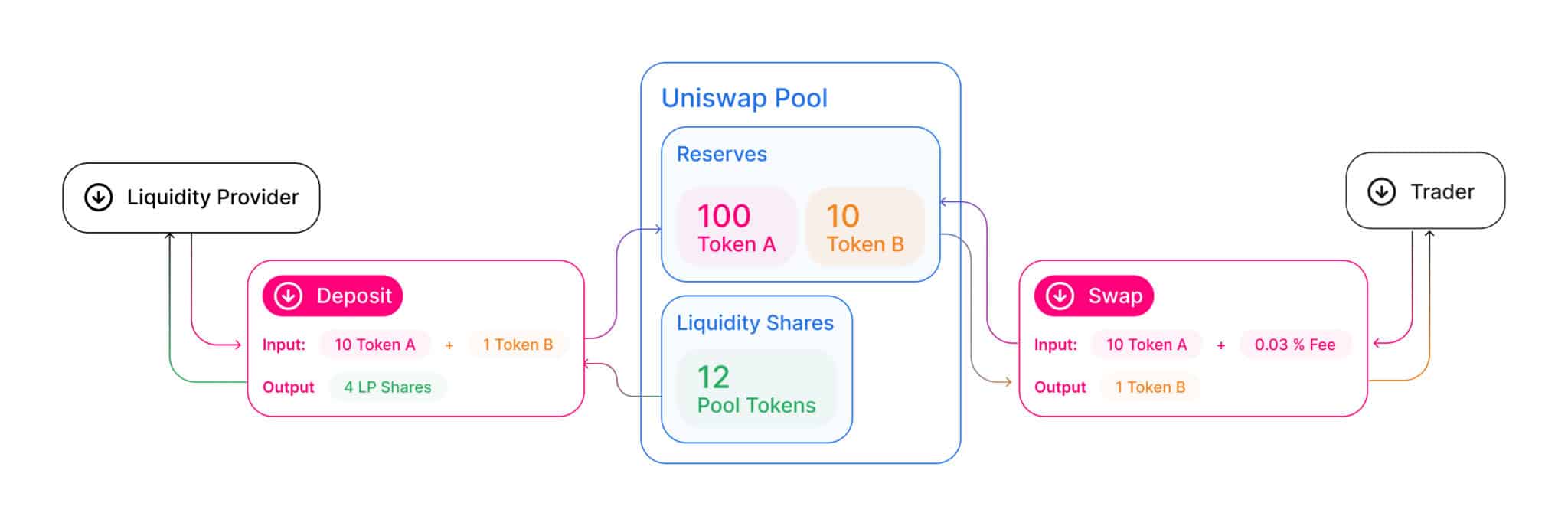

A liquidity pool is a combination (“pool”) of at least two tokens, locked in a smart contract.

Now, why would anyone do such a thing?

Well, it’s pretty lucrative (and risky) and many yield seekers jump into liquidity pools in search of monetary gain. Others with a more technological bent view their participation in liquidity pools as a means to uphold a decentralized project.

These sorts of things are better experienced than understood, so let’s run through some real-world examples.

What is a DeFi Liquidity Pool in Action?

We just mentioned people trading on DEXes trade against smart contracts designed to provide liquidity at a fair price. Those smart contracts access liquidity pools for those actively traded tokens.

We also talked about a liquidity pool being a combination of at least two tokens locked in a smart contract.

Let’s dive into a liquidity pool– put on your snorkels.

Liquidity pools were popularized by Uniswap, a decentralized exchange used by many in the DeFi world. The Uniswap protocol charges about 0.3% in network trading fees when people swap tokens on it.

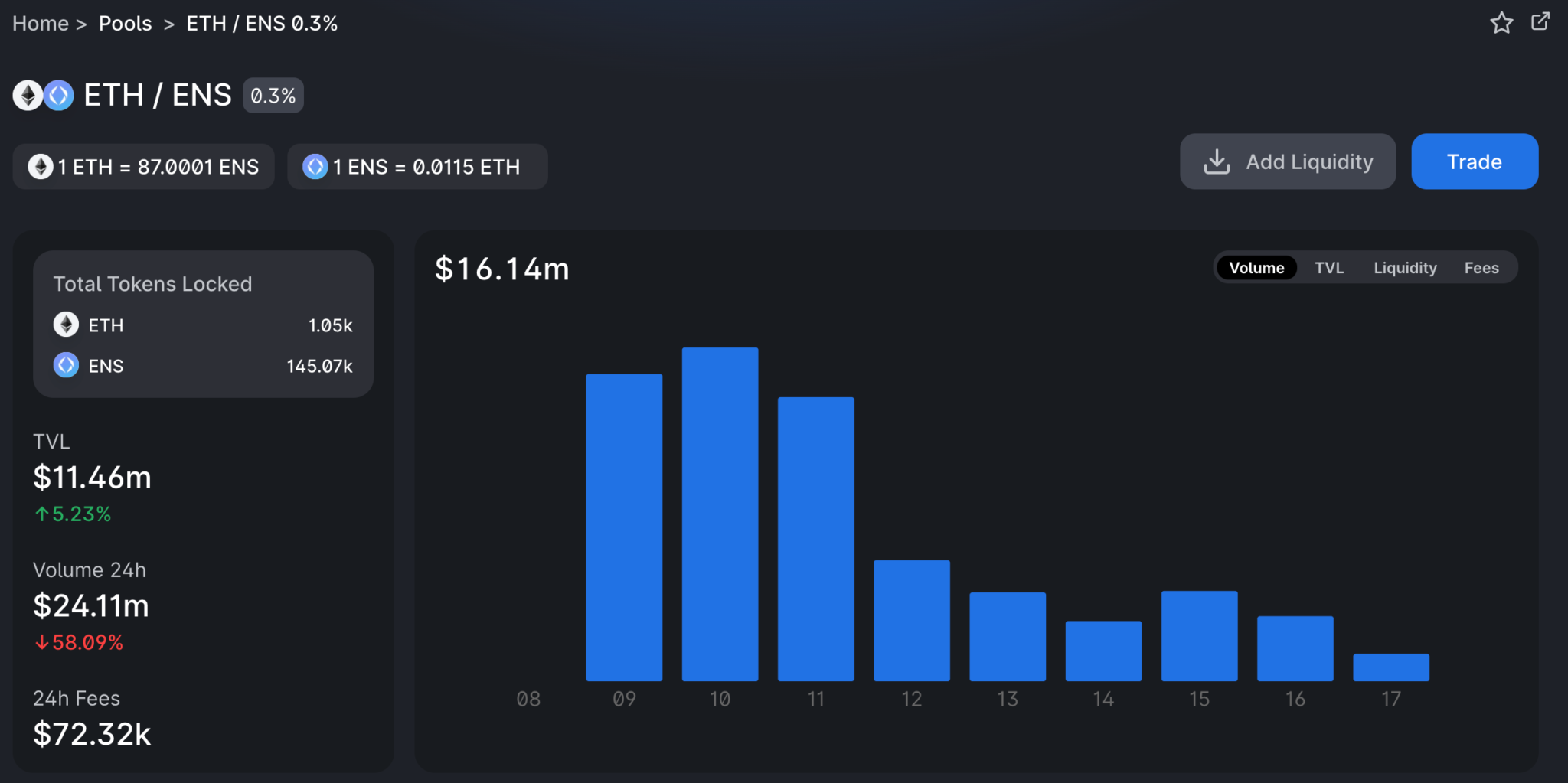

The anatomy of a Uniswap pool. If you don’t get this image, don’t worry– you don’t need to understand it to keep going

Suppose I am an aspiring liquidity provider. As such, I’m incentivized by liquidity pools to provide an equal value of two tokens in the liquidity pool.

Liquidity providers are rewarded. The whole 0.3% trading fee (more or less, depending on the pool) paid by traders is distributed proportionately to all the liquidity pool providers.

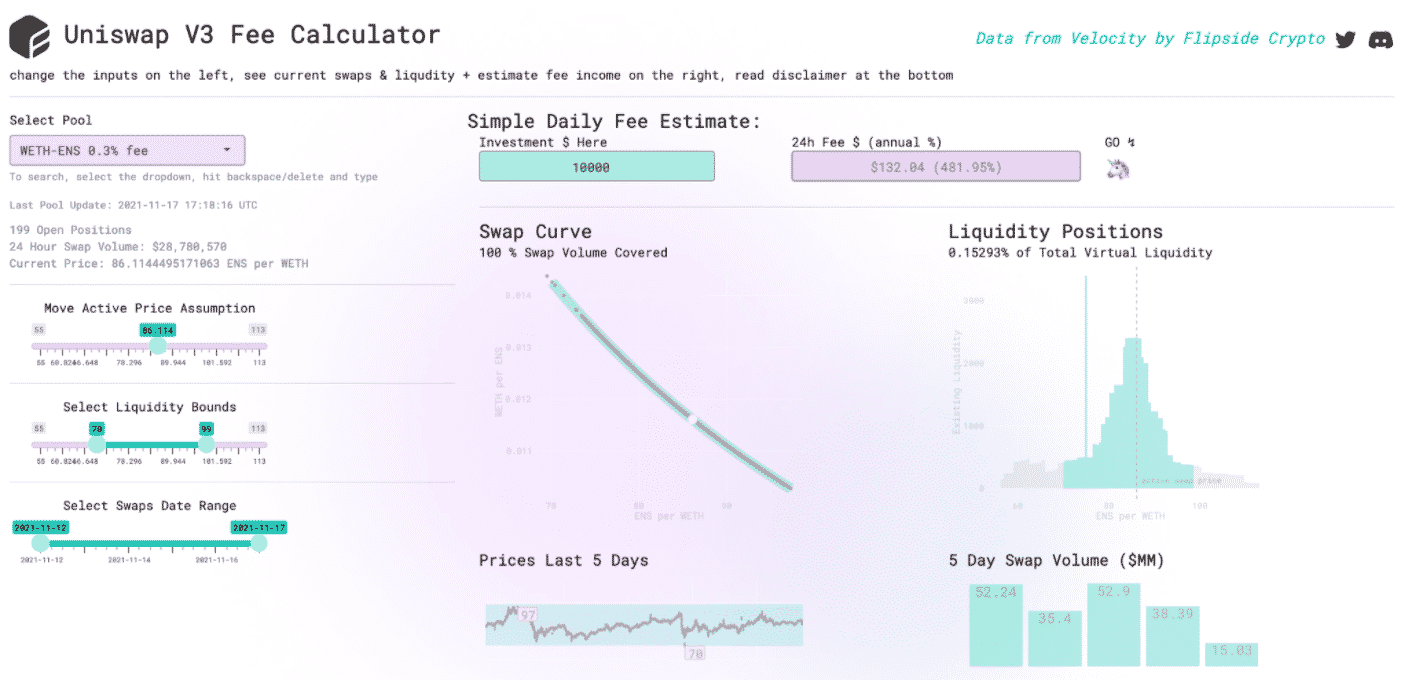

There are plenty of community-led calculators that provide a clearer estimate of rates and returns.

DeFi Liquidity Pool Example #1: Liquidity Pools on Uniswap

For example, putting $10,000 in a WETH-ENS Pool at a 0.3% fee on Uniswap v3 is estimated to generate $132.04 per day in fees, at an estimated annual percentage of 481%.

Uniswap LP return calculations on the Flipside Uniswap V3 calculator. (source: https://uniswapv3.flipsidecrypto.com/)

Going to the actual Uniswap site, we see that the ETH-ENS pool generated $72,320 in the past 24 hours, which were all distributed proportionately to the liquidity providers.

The estimated LP returns on any DEX will always be in the state of flux, and a myriad of DeFi yield farming applications such as aggregators exist to get liquidity providers the best rates.

Keep in mind that these liquidity pool fees earned are just for the pool itself, paid by Uniswap and generated by traders of the platform.

As liquidity becomes a sought-after commodity, some protocols have taken it a step further to compete for liquidity providers by offering liquidity pool token staking, which we’ll get into below.

DeFi Liquidity Pool Example #2: Liquidity Pools on ShapeShift Review

ShapeShift is a centralized cryptocurrency company that was founded in 2014, but elected to decentralize entirely in July 2021. It airdropped FOX tokens to its employees, stakeholders, and users, becoming a Decentralized Autonomous Organization (DAO.)

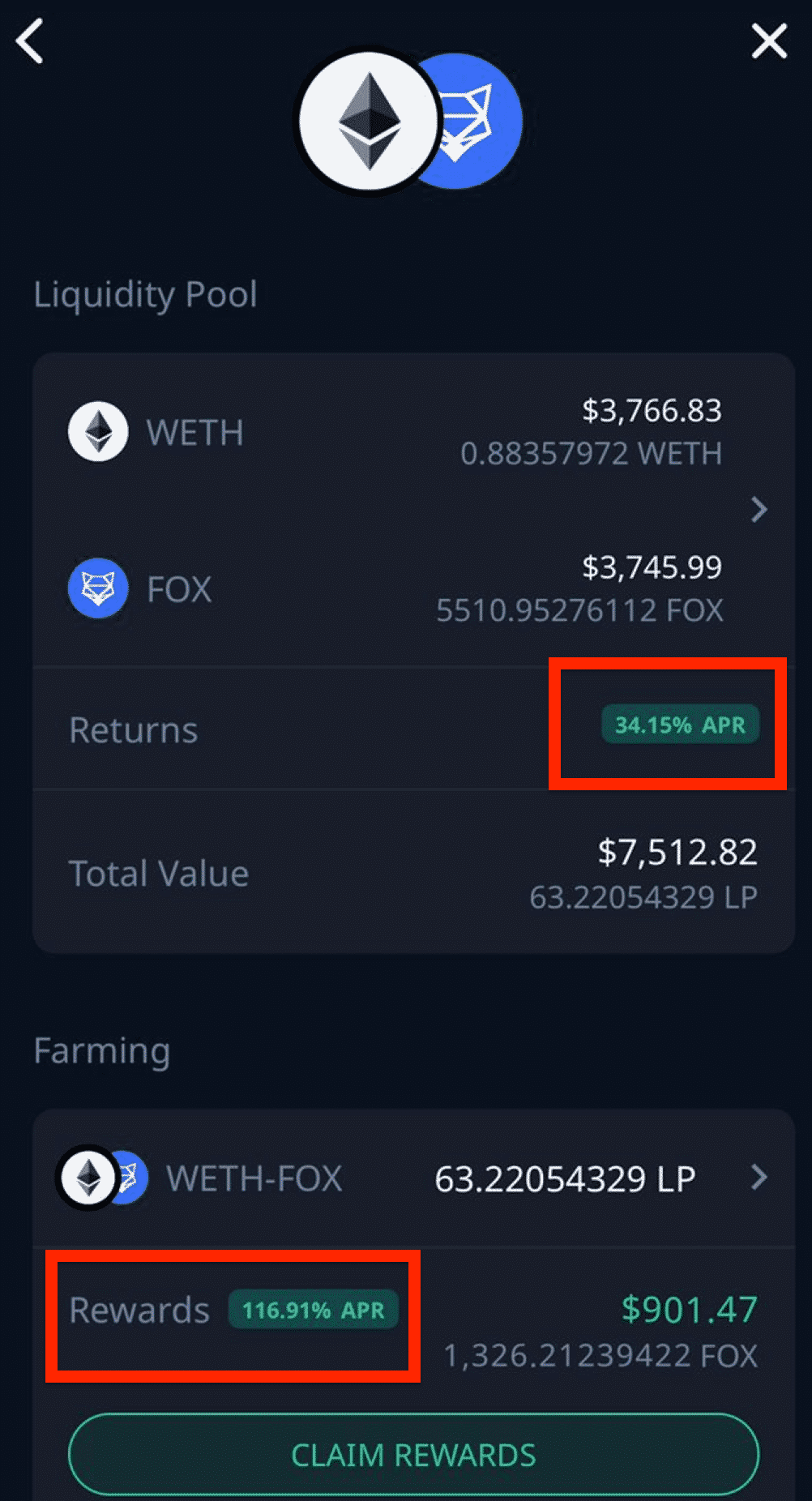

ShapeShift offers just one liquidity pool, WETH-FOX.

I can provide an equal amount of WETH (it’s basically just normal ETH, but “wrapped,” the difference is insignificant for this discussion) and FOX (the token that powers the ShapeShift ecosystem.)

I put in $3,750 of WETH and $3,750 of FOX for a total of $7,500. In return, I receive WETH-FOX Liquidity Pool tokens.

I can then “Stake” these LP tokens for an estimated yearly reward of 116.91% APR.

liquidity pool on shapeshift

Yes, you read that correctly– an APR of 116.91%. So, for the $7,500 WETH and FOX I put in, I should get around $8,758 as profit in one full year, but this isn’t always the case.

Protocols often denominate the APR in the quantity of tokens (often the native token of the platform, like FOX) rather than a U.S. Dollar amount. Your actual dollar APR can be more or less depending on the value of the token.

An APR like 110% APR, or even some as high as 90,000% or higher, isn’t an anomaly among other liquidity pools.

So, who’s paying these bonkers DeFi yields? There’s no way they’re sustainable, right?

What’s the Difference Between Liquidity Pools and Liquidity Mining?

The difference between liquidity pools and liquidity mining has to do with who pays the yield and how.

Remember that the smart contracts written by protocol developers (such as Uniswap) determine how LP staking yields are paid, as a percentage of fees accrued from the token swapping on the platform.

Some projects also give liquidity providers liquidity tokens, which can be staked separately for yields paid in that native token. This is a bit confusing, but the difference is more than just semantics.

- The liquidity pool rewards are based on the protocol fees, like 0.3% on Uniswap.

- The liquidity pool tokens, which are staked on a different protocol, can earn 100%+ APR, paid in whatever token that protocol is incentivizing you with (i.e., FOX.)

Again,

Liquidity providers received a percentage of trading fees in a particular pool. Liquidity pool rewards tend to decrease as more liquidity providers join, as per simple supply and demand.

AND,

Liquidity providers who stake their liquidity pool tokens may get paid in other tokens as a further incentive to provide liquidity there as opposed to another platform. Are yields of 90,000% APR sustainable? Well, the protocol determines how much of its token it wants to print to sustain the yield.

This is the primary difference between liquidity pools and liquidity providing, a contrast with blurred lines.

The practice of seeking out the highest yield in various DeFi protocols is called yield farming; it can get pretty complicated, but it’s within reach for anyone wanting to learn.

Final Thoughts: Are DeFi Liquidity Pools Legit and Worth Your Time?

If you’ve made it this far, congratulations– you’ve just learned about one of the most important components of decentralized finance.

It’s easy to get tripped up in all the funky protocol and token names. It’s important to keep in mind that DeFi is only a few years old, so if you’re reading this, you’re early.

And no, this isn’t going to end as some wild-eyed sales pitch where you, too, can automatically earn 90,000% yields with just a small investment. Our content isn’t investment advice– it’s all meant to be educational, and hopefully, entertaining.

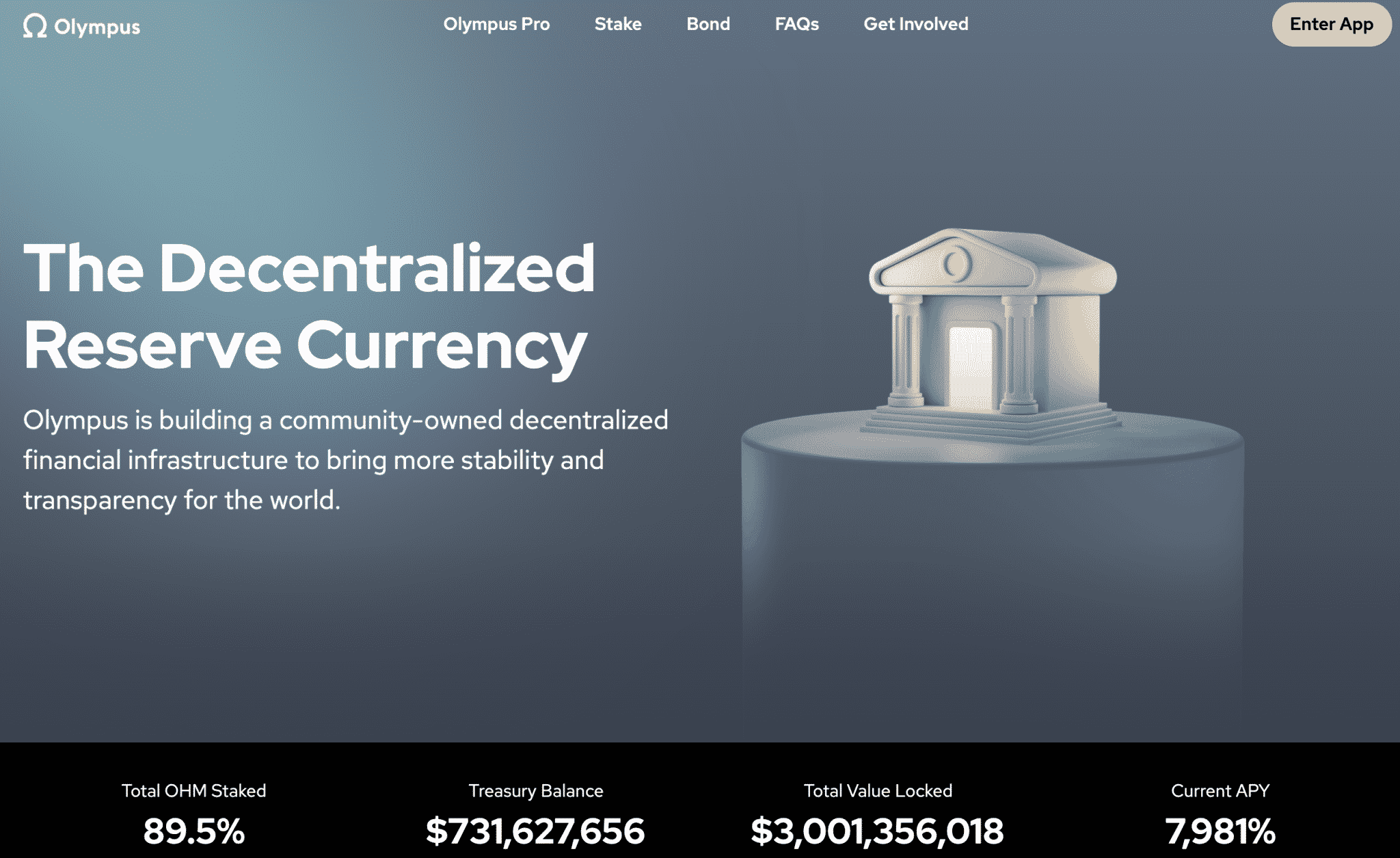

OlympusDAO, an “DeFi 2.0” innovation, markets an APY of 7,981%.

It’s no surprise liquidity pools attract both speculation and skepticism of equal intensity. As a nascent technology, liquidity pools have plenty of growth opportunities and risk factors that should be considered. Providing liquidity is very risky for reasons like a thing called impermanent loss, or even a total loss of funds through smart contract failures or malicious rug pulls.

Liquidity is a critical issue in a decentralized digital asset landscape, and developers have come up with some fairly ingenious and creative solutions. Educating yourself on DeFi liquidity pools and liquidity mining is like having a flashlight in your toolkit of exploring the next era of finance.

The post What is a DeFi Liquidity Pool: A Non-Technical Breakdown (w/ Examples!) appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.