Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

We dive into the anticipation of what looks like an imminent approval of a U.S. listed Bitcoin ETF. We analyze the market's positioning as important dates approach and interesting patterns emerging.

This Week's Key Metrics for Bitcoin & Ethereum

Price: $59,200 (+10.0%)

Weekly Fees: $7.28M (+52.5%)

Exchanges Netflows: -$219M (+117%)

Price: $3,830 (+7.90%)

Weekly Fees: $242.5M (+26.2%)

Exchanges Netflows: -$266M (-326%)

Weekly Fees

Sum of total fees spent to use a particular blockchain in a week. This tracks the willingness to spend and demand to use Bitcoin or Ether.

- Both Bitcoin and Ether registered double-digit increases in fees, showing growing demand to transact in their blockchains as prices rise

Exchanges Netflows

The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges over the past seven days. Crypto going into exchanges may signal selling pressure, while withdrawals potentially point to accumulation.

- $219M worth of Bitcoin left centralized exchanges, pointing to investors looking to hold ahead of next week

- $266M worth of Ether was withdrawn from exchanges compared to $300M being deposited the previous one, suggesting a shift in positioning

Bitcoin ETF Week

Bitcoin continues to outperform, with only Polkadot increasing more in price out of the top 10 crypto-assets over the past week. Bitcoin dominance is closing in on 50% and is currently near a three month high. Much of this is likely due to anticipation for a Bitcoin exchange-traded fund (ETF) that may get approved as early as next week.

Here is the timeline - key dates leading up to the potential first US-listed BTC ETF:

- July 26 - SEC's official twitter states "Thinking off investing in a fund that holds Bitcoin futures contracts?..."

- July 27 - First U.S. Bitcoin mutual fund (BTCFX) approved; launches next day

- Aug 3 - Gensler hints about SEC being open to futures-backed Bitcoin ETF

- Aug 5 - ProShares and Invesco submit proposals for futures-backed ETFs

- Aug 9-20 - 5 more applications for futures-backed ETFs are submitted

- Oct 14 - SEC tweets "Before investing in a fund that holds Bitcoin futures contracts..."

- Oct 14 - Ark files for futures-backed Bitcoin ETF (ARKA)

- Oct 14 - Bloomberg states "Bitcoin futures ETF said not to face SEC opposition"

- Oct 18-19 - ProShares and Invesco Bitcoin futures-backed decisions due

Next week the SEC can choose whether to accept, reject or postpone the decision for the upcoming ETFs. However, Bloomberg's senior ETF analyst is giving it over 90% odds of at least one futures-backed ETF being approved next week.

What is a futures-backed ETF? These ETFs are settled with underlying derivatives contracts on the CME, rather than actual Bitcoin. There are a few key differences versus "physically" backed ETFs:

- Investors would not be able to withdraw BTC from the fund for arbitrage purposes or otherwise

- Since Bitcoin futures are typically in contango, or priced at a premium relative to spot markets, it could incur high costs and create downward pressure on price. This would be the case as the ETF would be selling positions ahead of expiration and buying, or rolling over, those positions into the next contract at a higher price

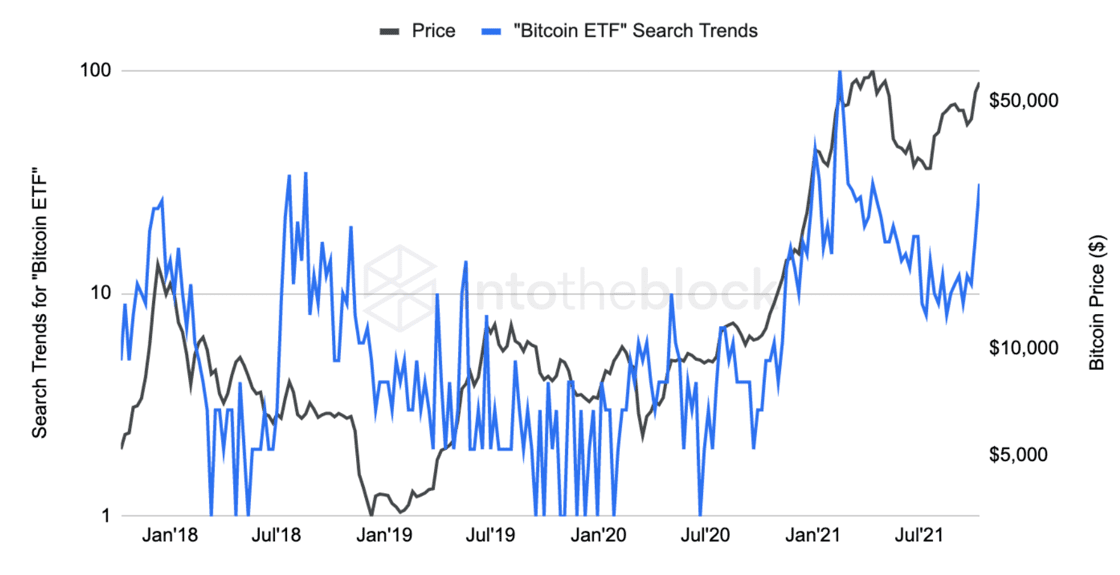

Regardless of these intricacies, the market appears to be laser focused on the ETF. Bitcoin's price and search trends for "Bitcoin ETF" have been soaring in tandem.

As of October 12 through IntoTheBlock's Bitcoin social indicators

As of October 12 through IntoTheBlock's Bitcoin social indicators

The correlation between Google search trends for "Bitcoin search trends" and BTC's price has climbed to 0.91, indicating a very strong statistical relationship between the two. While many will point out that this does not necessarily point to causation, it does highlight the market's emphasis on the upcoming ETF decisions.

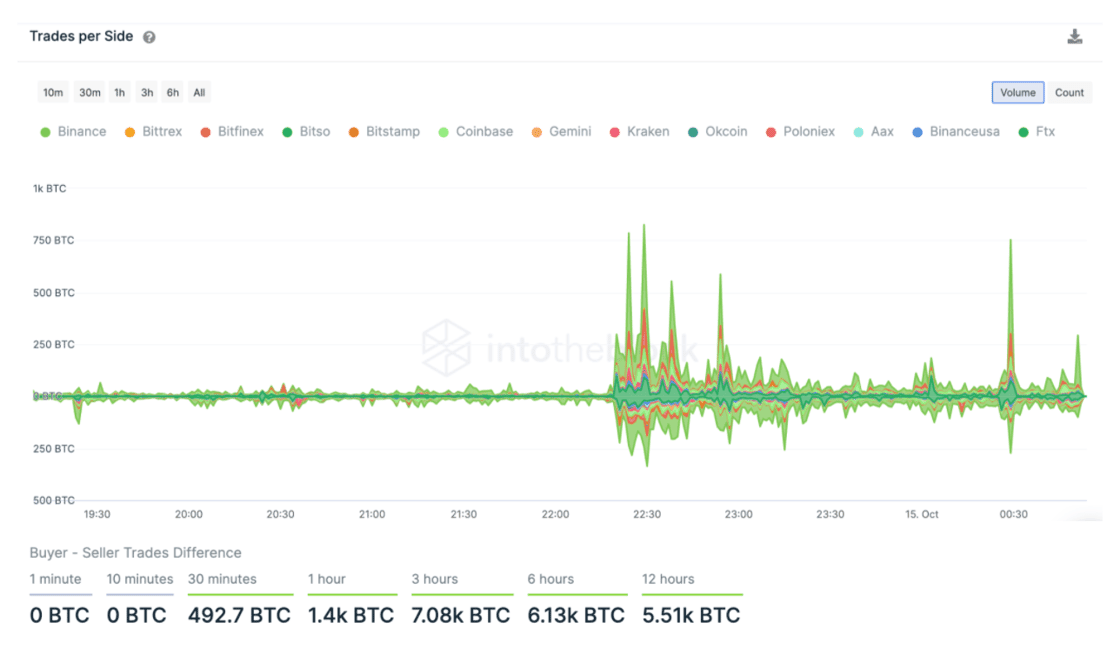

This also became evident following Bloomberg's news of the SEC not posing opposition against the ETFs, which came around 10:15PM EST. Centralized exchanges registered tremendous buying activity throughout the following minutes.

As of October 15 through IntoTheBlock's Bitcoin order books indicators

As of October 15 through IntoTheBlock's Bitcoin order books indicators

Trades per Side

Order books have market makers, who provide liquidity, and takers who remove liquidity through market orders. The Trades per Side indicator aggregates the volume of takers based on whether they are buying or selling. Here we observe a couple of interesting patterns:

- Takers bought over 750 BTC in a minute in three separate occasions between 10PM and 1AM (EST)

- Average volume grew by over 20x within minutes, indicating the overwhelming relevance of the Bitcoin ETF in trading activity

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.