Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

During our last markets update cryptocurrency markets were wild with energy, as bitcoin’s (BTC) price dropped below the $6K range last weekend. Since then the decentralized currency’s market value has rebounded and is averaging around $7,125-7,200 on Wednesday, November 15. Last week when the price per BTC plunged the digital asset bitcoin cash (BCH) spiked in value reaching an all-time high of $2,400 per token. BCH markets has dropped since then as the price per BCH is hovering around $1,230 this week.

Also read: Bitcoin.com Wallet Celebrates 500,000 Downloads in Three Months

Bitcoin Prices Rebound Back Above $7K

Bitcoin prices have bounced back from last week’s 30 percent dip as the currency has pushed above the $7K range on November 15. Last week both bitcoin (BTC) and bitcoin cash (BCH) markets had an exciting market correlation, but that relationship has since changed. Right now there are not that many reasons out there, at least within the community, that explains why bitcoin’s price bounced back. Some speculate that it was CME’s announcement explaining that the firm’s futures markets will be coming this December. Further, during the extraordinary value percentage dip the former Fortress macro-investor, Mike Novogratz, admitted to purchasing $15-20M worth of bitcoin this past weekend. Some believe the statements from Novogratz and his claimed purchase may have helped push the price back up.

BTC Technical Indicators

Charts show the decentralized currency is consolidating at the moment before it makes its next move. Order books across popular exchanges indicate there’s some heavy resistance above the $7350 range, and even more so above the $7600 territory. Presently, the short-term 100 Simple Moving Average (SMA) is above the long-term 200 SMA indicating the path to the upside may not prove too difficult. The Relative Strength Index (RSI) is meandering above oversold conditions while the Stochastic oscillator is revealing similar findings. According to the Fibonacci extension tool at 50 percent, the price could top $8,200 while the connected lines at 61.8 are well above the $8,600 territory. If bears manage to squeeze the market again, there are strong foundations between the 6800-6900 range. However, a panic sale could easily drop prices to the $6,500 region where there is more support.

The Altcoin Wild West

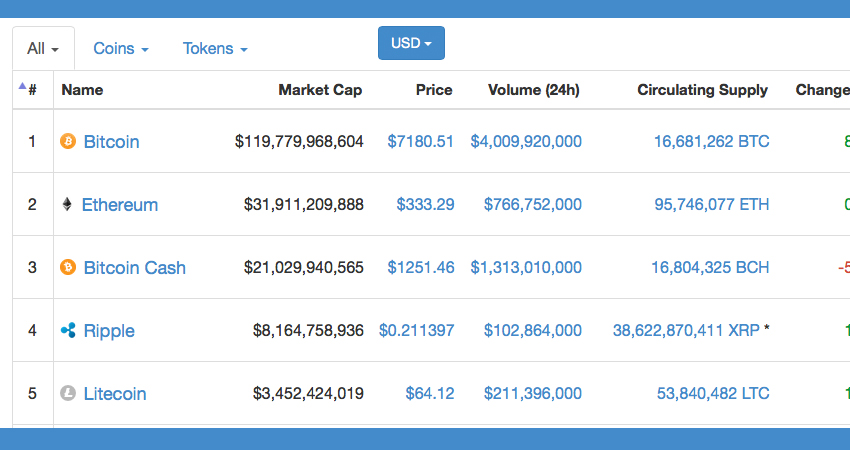

Most altcoins positioned within the top ten market capitalizations are seeing an increase in value; minus tokens like dash, neo, and monero. Ethereum is up 1 percent with an average price around the $330 range. Ripple XRP is up 2 percent as each XRP is valued at $0.21 per token. The fifth top cryptocurrency litecoin has seen a 1.5 percent increase and one LTC is trading at $63 per coin. Out of 6591 markets and 1281 cryptocurrencies, bitcoin’s $120B market is dominating by 55 percent. One notable coin increase within the top ten caps is IOTA’s 18 percent gain on November 15.

Bitcoin Cash Markets Dip After All-Time High

The third highest valued cryptocurrency market cap held by bitcoin cash (BCH) is down 6 percent as one BCH is $1240 per token. Since last week’s BCH price spike, the currency’s volume has dropped significantly from over $5B to $1.2B over the course of the past 48-hours. Bitcoin cash fans are pleased with the network’s successful hard fork that implemented a new Difficulty Adjustment Algorithm (DAA). Since then block time intervals have leveled off and have been more consistent than before the consensus change. One significant announcement for the BCH community comes from the firm, Blockchain, who has decided to fully support the currency by the year-end.

BCH Technical Indicators

Technical indicators looking at BCH charts show some strong resistance between the $1,300-1,400 range. BCH bulls have to muster up some strength to break these key zones in order to progress further. The short-term 100 SMA is below the 200 SMA trendline, an indication the bearish market sentiment is still not over. Both the RSI and Stochastic, however, has shown the overbought conditions during last week’s analysis is seemingly over. Applying some Fibonacci retracement to BCH charts show at 50 percent prices could breach $1,400 again. At 61.8 the extension shows an even larger spike could bring the value to $1,700. If the bearish sentiment continues, then prices could drop below the sub-$1K region. Watch for the Displaced Moving Average (DMA) to break below $1,100 for this to come to fruition.

The Verdict

The cryptocurrency community sentiment is calmer this week as people have settled down after last weeks market madness. The ‘bitcoin rivalry’ is still happening but has simmered down quite a bit. Speculators believe either one or the other chain will be the ‘triumphant bitcoin’ in the future, while others believe both bitcoin-siblings can coexist. Expect both markets to have price swings that affect each others ecosystem as the two markets correlated effects will likely continue.

Where do you see the prices of these two cryptocurrencies going from here on out? Let us know what you think in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Poloniex, and Coinmarketcap.com.

Need to calculate your bitcoin holdings? Check our tools section.

The post Markets Update: Last Week’s Price Trends Move in the Opposite Direction appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.