Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Market Watch Weekly is a review of crypto markets and developments each week.

Bitcoin’s weekend rally of more than $1,000 allowed it to recover most of its midweek losses. The leading digital currency narrowed the weekly loss to 1.34% after closing at $19,162 as per the OKEx BTC Index price. This surge came as a relief for bulls after BTC had tested $17,600 twice through the week.

The strong rally over the weekend is also reflected in the premium on futures. The OKEx BTC futures annualized rolling three-month basis has now reached over 14%, with similar levels seen on Nov. 24 when BTC moved up to $19,400 levels. This shows that the market’s confidence in the price trend for the next three months remains very strong. In addition, this high quarterly premium provides opportunities for arbitrageurs.

Major altcoins fail to outperform while OKB gains 10%

Bitcoin’s mid-week pullback left almost all of the major altcoins failing to outperform it for the week. Ether ( ETH) and Litecoin ( LTC) dropped by 2.23% and 2.52%, respectively. However,

XRP suffered a sell-off and lost 17% of its value in the last week after the end of SPARK’s airdrop for XRP holders. One highlight among major altcoins was OKB, which gained more than 10% in the past seven days. Overall, major altcoins failed to develop an independent trend, and Bitcoin’s dominance has not changed much.

SushiSwap becomes the biggest winner of yearn.finance’s merger

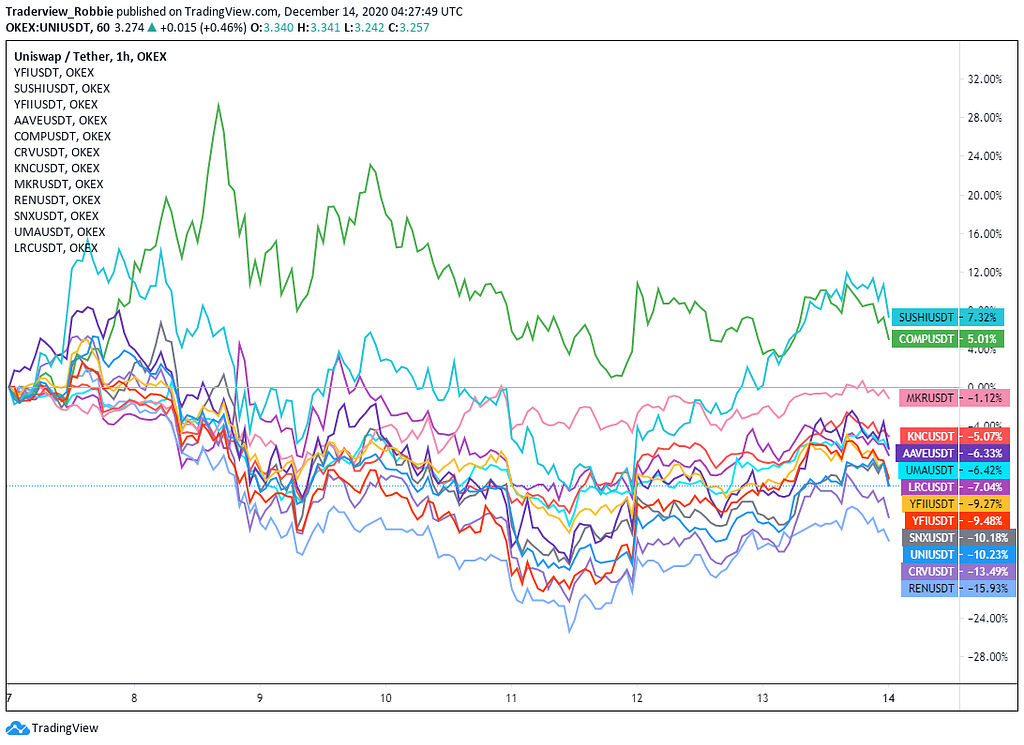

In the DeFi sector, the total value locked reached $15 billion for the first time last Tuesday, but that number dropped in Bitcoin’s pullback. And at the same time, the price of many major DeFi tokens went down over the past week.

Uniswap ( UNI) dropped by 10.23%, though its seven-day volume still took 60% of DEX trading, as per Dune’s data. The market remains bullish on SushiSwap ( SUSHI), which rose 7.32% last week, expecting more upside from its merger with yearn.finance. Compound ( COMP) also rose another 5% over the week while most DeFi tokens were down 5% to 15%.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

Retail BTC buying pushed quarterly premium higher, but institutions reduced long positions was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.