Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

A comprehensive introduction to Bitcoin and cryptocurrency trading

With 24-hour trading volumes averaging around $50 billion this year, and often crossing $100 billion, cryptocurrency markets have grown significantly since their early years. Today, crypto market participants include a mix of retail and institutional traders, and digital assets — led by Bitcoin (BTC) — are widely considered to be an alternative investment class.

If you’re new to cryptocurrency markets, this guide will introduce you to the basics of crypto trading, allowing you to start trading cryptocurrency with confidence.

Intro to trading: Buy low, sell high

At its core, trading involves buying and selling an asset in an attempt to make a profit. While trading today involves various, relatively complicated instruments (futures, options, swaps, etc.) and strategies (hedging, shorting, arbitraging, etc.), the underlying principle of buying low and selling high remains relevant throughout.

A trader’s primary goal is to buy an instrument at a certain price and sell it thereafter at a higher price (in what’s known as a long trade), pocketing the difference as profit. The order of transactions can change — as is the case in a short trade, in which a trader attempts to sell high first and buy low later — but the goal is the same.

While, in theory, this sounds like a simple concept, in practice, it involves an assessment of the instrument’s market price, and whether it is undervalued or overvalued at any given time. After all, you can only sell an instrument at a higher price if someone else believes it is worth more and is willing to pay for it.

Realized and unrealized profits and losses

Entering a trade — whether you are going long or short — is also known as taking a position, and it can be exciting to see your position turn a profit as the market moves in your favor. However, any gains you see against your position are “unrealized” (also known as “paper gains”) until you actually exit the position. Exiting the position means either selling the instrument you’re holding (against a long trade) or buying it back (against a short trade).

For instance, if you bought 1 BTC at $5,000 during the March 2020 crash in anticipation of future appreciation, you effectively went long. If you are still holding that coin, currently valued at around $18,250, you have an unrealized gain of $13,250 (i.e., $18,250 — $5,000).

However, if the price of Bitcoin drops to $17,000 in the next hour, your potential gain will also be reduced to $12,000. This example demonstrates that your actual gain will only be realized when you sell that coin and exit your long position. Until then, you can only look at potential, or unrealized, gains.

Similarly, unfavorable price movements result in “paper losses” that are also only realized when you exit the position. In either case, as a trader, it is important to mind the distinction between unrealized and realized profits and losses, or P&L. Profits and losses are only real when they are realized.

Trading or investing

Trading and investing are two different activities, even if their goals are somewhat aligned. Both investors and traders are seeking profits, but their mindsets, strategies and commitments are very different.

When you are investing in an asset, such as BTC, you are essentially buying-in to the idea and even the culture behind it. You are possibly committing to hold your position — or “hodl” your BTC — for years, if not decades. In contrast, when you are merely trading BTC, you have no such commitments and are only concerned with the short-term market price and events that drive it.

Even though there are no set durations that differentiate trades from investments, traders are generally more active in target-specific, shorter time frames. Day traders for instance, hold their positions for hours in a day, but scalpers (a subset of day traders) can enter and exit positions in minutes, if not seconds.

The choice between trading and investing depends on your personal financial goals and an assessment of your select instrument’s price, value and prospects, both in the short- and long-term.

Understanding crypto markets

While trading does not strictly require a marketplace, having one has significant benefits. Even though, in theory, you can trade anything by simply buying it directly from a seller and selling it to someone else (let’s say from your neighbor and then to someone you know), this scenario is not scalable.

Marketplaces like cryptocurrency exchanges have many advantages, but perhaps fundamentally is the ability to provide liquidity, which means traders can quickly complete simultaneous transactions in minutes without searching for or waiting on buyers and sellers. Market liquidity is a term for how easily and quickly you can buy or sell an asset against orders available on the market, without your trade drastically affecting the asset’s market price.

Generally, a liquid asset is one that many people are interested in trading — meaning that the trading volume for that asset is high and the price of the asset doesn’t vary drastically from trade to trade. Marketplaces such as exchanges pool demand for a given asset in a centralized place so that buyers and sellers can be more easily and quickly matched.

Given the need for liquidity, reliable price indexes, secure transactions and other features, nearly all cryptocurrency trading today is performed on dedicated exchanges like OKEx, or via specialized brokers.

With OKEx, for example, you can buy or sell BTC and a slew of other supported cryptocurrencies almost instantly, 24 hours a day and seven days a week, for a very small fee per trade.

Spot or derivatives

Crypto markets largely follow the same formats as their traditional counterparts and are divided into spot and derivatives. A spot market is where you can buy or sell a cryptocurrency instantly and receive the actual coins/tokens that you’re trading. A derivatives market deals with contracts — such as futures, options and swaps — that track, or derive,their value from an underlying cryptocurrency. Trades involving derivatives contracts don’t always deliver actual coins/tokens to the trader.

By nature, derivatives are more sophisticated trading products and often involve higher risk as compared to spot trading. While this guide will primarily focus on spot trading basics, most of the broader principles are also applicable to derivatives trading. You can refer to our guide to crypto derivatives to learn more about each type and how it works.

Trading pairs

Cryptocurrency markets, like traditional markets, have various pairs listed for trading (each representing a market), which are denoted by the combination of asset tickers, such as BTC/USDT, ETH/BTC or LTC/BTC. Each market pair fittingly refers to two currencies. These are not always cryptocurrencies, as some exchanges support fiat trading pairs — meaning the trade is between a crypto and a fiat, or government-issued, currency — such as BTC/USD, BTC/EUR or BTC/GBP. These pairs reflect quotes or exchange rates. The first currency in the pair is the “base” currency, and the second is the “quote” currency.

Trading pairs are how cryptocurrency prices are often reflected, especially on exchanges. For example, a BTC/USDT pair trading at 18,250 USDT means 1 BTC equals 18,250 USDT, or roughly $18,250. Similarly, ETH/BTC at 0.03 means 1 ETH equals 0.03 BTC, or about $550 at the time of writing.

Crypto-denominated

As discussed above, trading pairs include base and quote currencies. While base currencies can be any of the listed cryptocurrencies on an exchange, quote currencies are usually more limited.

In the crypto space, BTC is the leading digital currency and is also the predominant quote currency in crypto-denominated trading pairs. The stablecoin Tether (USDT) and the leading altcoin, Ether (ETH), are other common quote currencies. OKEx has its own platform token, OKB, which is also used as a quote cryptocurrency on the exchange.

Fiat-denominated

Fiat-denominated pairs are, in comparison to crypto-denominated pairs, more intuitive for traders who balance their accounts in their respective fiat currencies. For instance, a trader operating in USD may prefer to trade BTC/USD or equivalent pairs in order to see the price of BTC quoted in USD.

However, most crypto exchanges (including OKEx) use stablecoins instead of actual fiat currencies to represent fiat-denominated pairs. USDT is, by far, the most commonly used USD-price-pegged stablecoin on the market, but others include TrueUSD (TUSD), USD Coin (USDC), USDK and others.

Choice of trading pair

Both crypto-denominated and fiat-denominated trading pairs have their pros and cons, and your choice depends on your trading goals and targets.

For example, traders who want to maintain and potentially increase their BTC holdings (regardless of how Bitcoin’s own fiat-denominated price fluctuates) favor BTC-denominated pairs. However, those who are ultimately trading for fiat profits and want their gains to not change with quote currency price movements will opt for fiat-denominated pairs.

Understanding market price and activity

Now that we’ve covered trading pairs and quotes, we will discuss how these quotes — which are, theoretically, market prices — come about.

If the BTC/USDT pair is quoted at 18,000 USDT, it means the market’s going rate for 1 BTC is 18,000 USDT. However, in reality — and especially with volatile crypto markets — this is a very over-simplified description of the price of 1 BTC, since the exact quoted price is subject to change and doesn’t necessarily apply both ways (you can’t always buy and sell at the same price).

This figure (18,000 USDT) is merely the last price at which a trade, no matter how small, was executed on the market. While that does technically make it the market price, it is very unlikely to be the price you will actually get on the market for your buy or sell orders.

Instead, the actual quotes available on the market are represented by “asks” and “bids,” where asks are sell orders (i.e., I want to sell BTC at a given price) and bids are buy orders (i.e., I want to buy BTC at a given price).

Asks and bids, makers and takers

As discussed above, there is a difference between the last traded price and the actual market price. The latter depends on various factors such as the spread between asks and bids and their depth.

Defined simply, asks are sell orders and bids are buy offers that are currently listed on a given marketplace (for example, on OKEx). Each ask and bid comprises a price and an amount. For example, an ask can demand to buy 0.5 BTC at the price of $18,000 per BTC — this means that the total order price would be $18,000 x 0.5 BTC = $9,000. Similarly, a bid can be for 0.25 BTC at $17,500 per BTC, which means the bidder is willing to buy 0.25 BTC for $4,375 (i.e., the total order price would be $17,500 x 0.25 BTC = $4,375).

Both asks and bids are available to be taken or filled by anyone on the exchange (unless the ask or bid is canceled by the trader before being filled). However, in both cases, you don’t need to fill the entire ask or bid amount. You can choose any amount less than and up to the amount quoted. Looking at the ask and bid examples above, that would mean you would have a range of 0.001 BTC (the minimum tradable BTC amount on OKEx) to 0.5 BTC for the ask example and 0.001 BTC to 0.25 BTC for the bid example.

When trading in any market, you have two choices. Either you can fill, or “take,” any of the existing asks and bids (as explained above) or “make” your own. In doing so, you also choose to either become a “maker” or a “taker,” and your orders are subject to different fees in each case. Makers are encouraged with lower fees, as they add liquidity to markets by actively proposing trades, whereas takers pay slightly higher fees because they remove liquidity by filling and consuming existing orders (i.e., those proposed by makers).

For example, if you take a look at the BTC/USDT market on OKEx and see that it has its lowest ask at 18,050 USDT and its highest bid at 17,800 USDT, that means that the lowest price anyone on OKEx is willing to sell 1 BTC at that moment is 18,050 USDT and the highest price anyone is willing to buy 1 BTC for is 17,800 USDT. You can choose to either take one of these orders or make your own.

Let’s say you choose to make your own ask (i.e., sell order): You are prepared to sell your BTC (any amount) at the price of 17,000 USDT per BTC. In that case, your sell order would be shown on the market as the top ask, since it is even lower than the previously prevailing ask, which wanted 17,050 USDT per BTC.

As long as no one else is selling BTC at a rate lower than yours (17,000 USDT per BTC), your ask will be the first in line to be filled on the market.

Given how free markets involve buyers and sellers quoting their desired prices — no matter how high or low — the market balances itself by selecting the lowest asks (i.e., sellers with the lowest price quotes) and the highest bids (i.e., buyers with the highest offers), since they represent the most favorable prices.

Market depth and spread

While critical to market activity, asks and bids don’t reflect the entire picture on their own. As mentioned above, an ask or bid can be for any amount, even as low as 0.001 BTC (roughly $18, at the time of writing).

If someone wants to sell only 0.001 BTC, and assuming this ask was at the top of the market (i.e., because it offers the lowest price for 1 BTC on the market, at that time), then if you were to try to buy more than 0.001 BTC, you would automatically take the top ask; however, your remaining order amount (above 0.001 BTC) would be in the queue to be filled by the next best ask, until your order is completed.

It is pertinent here to mention that there will always be a difference in price between the lowest ask and highest bid — as we saw in the example above, where it was 17,000 USDT for the lowest ask and 17,800 for the highest bid. This difference in price is known as the market, or bid-ask spread. Without there being this spread, there would be no incentive for market makers to provide liquidity by making an ask or a bid, since they too want to buy low and sell high. In highly liquid markets, however, this spread is very tight — meaning there’s a small difference between the buying and selling prices — while markets with low liquidity often have wider spreads.

Having understood the bid-ask spread, now imagine if most asks or bids in a market are for very small amounts, let’s say roughly 0.002 BTC each. Given how the asks and bids are lined up in ascending and descending orders, respectively, your buying or selling price becomes less favorable as you move your way through either column (of asks or bids), as the bid-ask spread widens significantly.

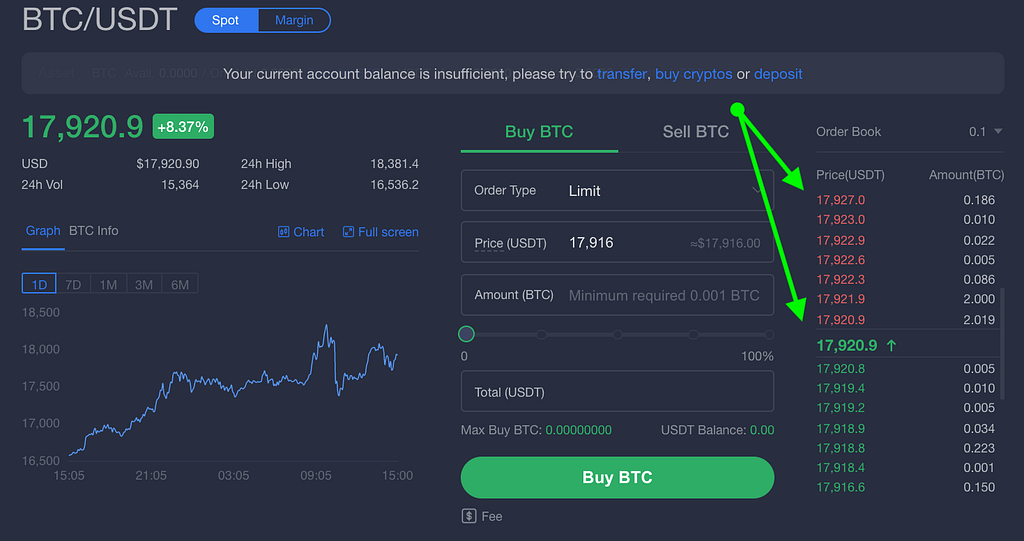

The screenshot above shows the basic spot dashboard for the BTC/USDT market on OKEx. The green arrows point toward the order book section, where the listed asks are red and bids are green. Note how the lowest ask is 17,920.9 USDT per BTC while the highest visible ask (there are more than those displayed here) is 17,927.0 USDT per BTC — a difference of roughly 6 USDT.

Similarly, while the highest bid is 17,920.8 USDT per BTC and the lowest visible bid is 17,916.6 USDT per BTC, the sizes of these bids, collectively, don’t even add up to 0.5 BTC. This means a seller with 0.5 BTC or more will end up filling all these bids and more, but the price that seller gets for their BTC will be lowered as the bids column is consumed.

Going back to our earlier example with small orders (0.002 BTC each), if you wanted to sell 1 BTC in such a market, you would have to go through 500 bids (of 0.002 BTC each) at varying quoted prices before your order would be completely filled. This would inevitably result in your final order price being less favorable than the best price on the market when you made the ask, because the spread (or difference in price) across those 500 bids was wide.

This is, however, a simplified example of what happens in a market that doesn’t have adequate depth. Market depth is a measure of the market’s ability to handle large orders without there being a major shift in the bid-ask spread.

Ultimately, understanding these concepts is crucial to executing your trading strategies and getting your orders filled at desired prices.

OKEx, as one of the world’s largest cryptocurrency exchanges in terms of trading volumes, has industry-leading market liquidity and depth — and, consequently, very tight spreads, resulting in favorable trading prices, even for very large orders.

Visit https://www.okex.com/ for the full report.

Follow OKEx

Twitter: https://twitter.com/OKExFacebook: https://www.facebook.com/okexofficial/LinkedIn: https://www.linkedin.com/company/okex/Telegram: https://t.me/OKExOfficial_EnglishReddit: https://www.reddit.com/r/OKEx/Instagram: https://www.instagram.com/okex_exchange

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

Cryptocurrency trading guide for beginners was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.