Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin has had a slow start to the week so far, with volatility and trading volume falling to uncharacteristically low levels given its recent parabolic performance.

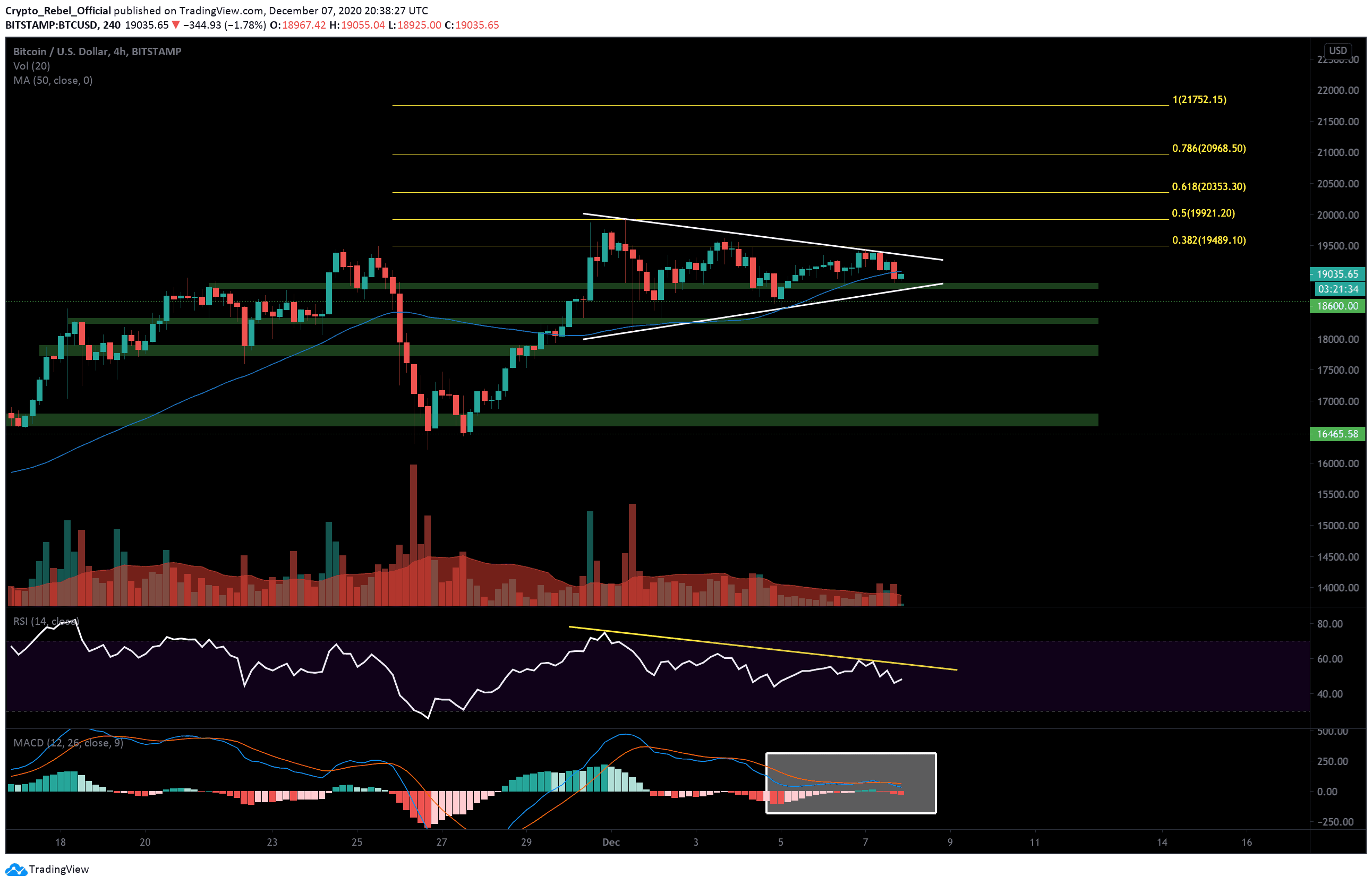

This period of low activity, however, may not be as bad as it sounds. Looking at the 4-hour chart, it’s clear that the leading cryptocurrency is converging inside a pennant pattern. Typically, this formation is a bullish continuation setup and results in a strong breakout once it reaches maximum consolidation between the two trend lines (white lines). Judging by the chart, this event could likely take place sometime in the next 48 hours.

During the consolidation period, it’s common for trading volume and volatility to drop as the asset prepares for a breakout. It’s worth noting, though, that these patterns can also break out strongly to the downside if they get rejected.

Price Levels to Watch in the Short-term

On the 4-hour BTC/USD chart, we can see that the price has recently fallen underneath the 50-EMA (blue line), which usually provides strong support for bitcoin during market downswings, and is now resting along the first major support zone (green bar) between $18,800 – $18,900.

If Bitcoin continues to track within this pattern, we should expect to see prices wick down to the lower end of this support zone before retesting the sloping resistance above – possibly somewhere around $19,265.

When looking at these types of breakouts, it’s important to be aware of fakeouts from whale traders that try to trick weaker hands into FOMO trading. Larger bitcoin traders pump the price at the breakout point to make it appear as though the asset is about to surge so that it encourages smaller traders to begin buying. This rise in buying pressure creates high liquidity so that whales can then execute large sell trades without slippage.

What happens afterward is a brief wick up, followed by a sharp move in the opposite direction. The crypto asset then tends to ‘throwback’ onto the former resistance, establish new support, and then begin a new uptrend.

Trading breakouts is a high-risk/high reward strategy, and even placing tights stop losses is a gamble if whales decide to go stop hunting before initiating a new bitcoin uptrend. Sometimes it’s better to wait until the new trend is more confirmed before entering the market.

Bullish breakout targets.(1) $19,550

(2) $19,920

(3) $20,353

Bearish breakout supports.(1) $18,600

(2) $18,270

(3) $17,810

Total market capital: $572 billion.

Bitcoin market capital: $353 billion.

Bitcoin dominance: 61.7%

Data by Coingecko.

Bitstamp BTC/USD 4-Hour Chart

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.