Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Futures Friday is a weekly review of quarterly Bitcoin futures on OKEx.

Last Friday marked a reversal for Bitcoin (BTC) after its Thanksgiving correction, as the leading digital currency rose for three consecutive days and hit a new all-time high of $19,912 on Tuesday, as per the OKEx BTC Index price. However, there was a sharp retreat of $1,800 shortly after, following which BTC began consolidating.

While the BTC index currently stands at $19,500, the OKEx Quarterly Futures ( BTCUSD1225) are trading around $19,700 levels and with a premium of $220, or roughly 1.14%, over the index price.

In last week’s Futures Friday article, we noted that retail and institutional investors were all betting on Bitcoin’s bullishness — this was reflected in how the price reached a new high this week. However, $19,900 levels turned out to be challenging and the price was not able to test the critical $20,000 resistance since then.

This week, both the BTC long/short ratio and the margin lending ratio show that retail traders were trapped by the great price fluctuations — shorting before the price rebound and chasing the rally before a big pullback. However, in the second half of the week, several ratios returned to the intermediate levels, indicating that retail traders do not have a clear attitude toward the price trend.

OKEx trading data readings

Visit OKEx trading data page to explore more indicators.

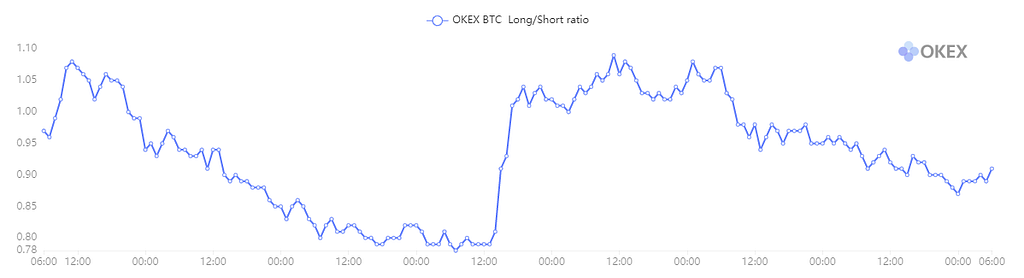

BTC long/short ratio

The long/short ratio actually dropped during the price rally from late last weekend to Monday, falling from around 1.08 to as low as 0.78. This suggests that retail investors were caught unprepared for the rebound and were trapped as short-sellers.

The ratio then spiked when the BTC Index price broke through $19,000, rising from 0.78 to more than 1.0 in just six hours, indicating that retail investors were chasing the price rally at the time. However, the subsequent $1,800 pullback may have also caused these traders to be caught out of position.

As the price of Bitcoin continues to tease the psychological $20,000 mark, the tremendous volatility adds a new challenge for traders. Since Wednesday, the long/short ratio has fallen again and is currently running around 0.9. This figure is in the middle zone of the chart below and shows that market participants are largely unsure about the market’s future direction.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

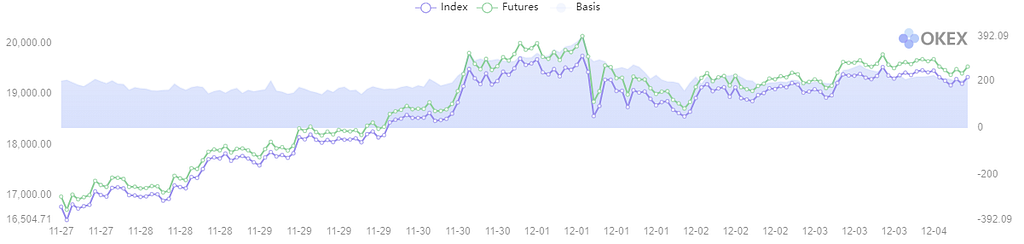

BTC basis

During the price rally at the end of last week, the BTC basis between quarterly futures and index did not follow through. Combined with the fact that negative funding rates on the BTC perpetual swap occurred during the time, it can be concluded that retail investors did not benefit from the rally.

After the index price entered $19,000 levels, there was a sudden spike in BTC basis and funding rates — BTC basis jumped from $200 to $300 levels while funding rates spiked to above 0.2%. This indicates that retail investors were chasing the price increase with high leverage, which explains the subsequent $1,800 crash. Most of the time, the market destroys traders with high leverage.

Right now, BTC basis and funding rates are back to their normal levels of $200 and below 0.3%. The price movements corresponding to the fluctuations of these two indicators last week may be very useful for subsequent trading.

This indicator shows the quarterly futures price, spot index price and also the basis difference. The basis of a particular time equals the quarterly futures price minus the spot index price. The price of futures reflects the traders’ expectations of the price of Bitcoin. When the basis is positive, it indicates that the market is bullish. When the basis is negative, it indicates that the market is bearish. The basis of quarterly futures can better indicate the long-term market trend. When the basis is high (either positive or negative), it means there’s more room for arbitrage.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

Bitcoin futures indicate retail traders unsure about market direction despite new ATH was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.