Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

While bitcoin remains rangebound between $18,000 and the new all-time high, calls for BTC prices making ‘moonshot’ moves in 2021 have already started coming in.

Amongst scores of such predictions, on-chain analysis pioneer Willy Woo opines that a $200,000 bitcoin price is ‘conservative’ and that the top cryptocurrency stands to fly to $300,000 by the end of the next year.

$300K Per BTC ‘Not Out Of The Question’

Even though BTC logged a new high, the top cryptocurrency’s price hasn’t managed to jump past the crucial psychological barrier of $20,000. But that won’t be a problem in 2021. According to noted on-chain bitcoin market analyst Willy Woo’s ‘Top Model,’ BTC is heading for $300,000 by the end of next year.

Views on 2021 (THREAD):

My Top Model suggesting $200k per BTC by end of 2021 looks conservative, $300k not out of the question.

The current market on average paid $7456 for their coins. You all are geniuses. pic.twitter.com/5t1pHXwE0b

— Willy Woo (@woonomic) December 1, 2020

In a tweet thread, Woo opines that investors while buying bitcoin in the current rally paid an average of $7456 per BTC, which is in itself a ‘genius move’ since the cryptocurrency is going to trade at ‘moon prices’ next year.

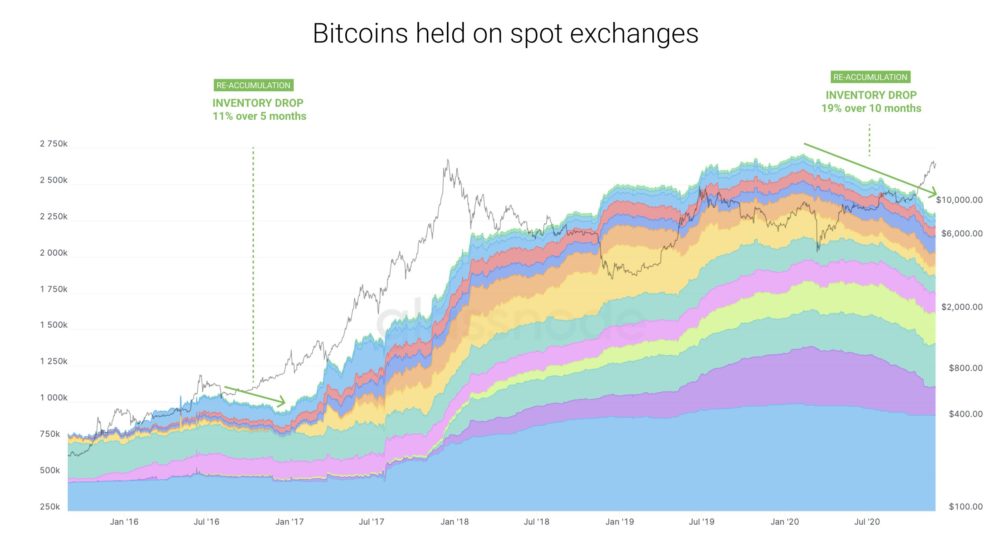

Adding to his commentary and citing data from blockchain market insights firm, Glassnode, Woo said that the drop in bitcoin’s supply on exchanges (due to massive accumulation) is two times ‘longer and deeper’ than what happened during the pre-rally phase of 2017.

Bitcoin Spot Exchange Supply Dropping Twice As Fast as 2017, Source: Glassnode

Bitcoin Spot Exchange Supply Dropping Twice As Fast as 2017, Source: Glassnode

This Woo said is a reason to be supremely on bitcoin’s market outlook going into 2021.

Dollar Gain In Market Cap Per Dollar Invested Significantly Increased

Continuing further in his commentary on bitcoin’s future market outlook, Woo pointed to another indicator that has reinforced his bullish stance manifold. He said that for every USD invested in BTC, the USD gain in the cryptocurrency’s market cap has ‘significantly increased’ compared to previous bull cycles.

Also the $ gain in market cap per $ invested has significantly increased over past cycles, HODLers holding stronger. It was $2.00 in the 2013 bull run, $2.50 in 2017, and $3.50 or more for 2021.

All pointing to reflexivity increasing; an amplified 2021 bullish feedback loop. pic.twitter.com/5nLWOPD49n

— Willy Woo (@woonomic) December 1, 2020

Willy said that this particular market development points to an immensely bullish scenario for bitcoin in 2021.

But Numbers Will Go Down Before It Goes Up

Although Woo’s above on-chain bitcoin market analysis does paint a mega bullish scenario for bitcoin in the coming months, a drop is also ‘not out of the question.’ Popular TradingView based analyst Alan Masters confirms it.

Masters notes that BTC had a very strong monthly close in November, but by taking a rational stance, he maintained that a pullback is on the cards ‘nothing moves up in a straight line, not even in Bitcoin’.

He posits that the first half of December would see BTC price printing multiple red candles, and then from the next half onwards, things will be all green. But this is not at all an issue worth worrying about as

…this might mean that we get to correct in the first few weeks of the month, and then we end up with big green again…

The trader compares this to the situation in 2017 when BTC closed October on a bullish note. In the following months, though, prices dropped 16% and then continued running up north, eventually posting a higher high. Masters continued by saying that this is the exact market scenario that can be expected this month. And how low could BTC go before rallying back up?

Bitcoin can go as low as $13,323 monthly in a matter of a few days or two weeks and bounce from this level and then continue to increase.

If prices dip below EMA10 (the above price point), then the scenario will be completely different, with bulls losing all confidence. But right now, volumes are the highest since April, and the Relative Strength Indicator (RSI) numbers are also pretty good.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.