Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As news.Bitcoin.com reported earlier this weekend, bitcoin cash (BCH) markets have been on a rampage following the canceled 2MB hard fork event. BCH prices have increased three-fold since then, reaching a high of $1810 across global exchanges and has since dropped to around $1400. Alongside this, the network hashrate has also met parity with the BTC chain.

Also Read: Tezos Founders Enter Legal Battle for Control of $400m in Raised ICO Funds

Bitcoin Cash Reaches an All-Time High of $1,800+ and $7B in Daily Trade Volume

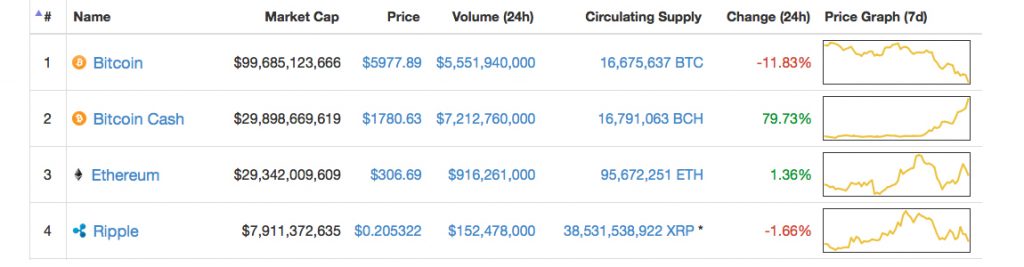

All eyes are on crypto-markets this week, and they’re looking at two markets in particular: bitcoin (BTC) and bitcoin cash (BCH). The two ecosystems have been sharing a strange correlation over the past 72 hours as BCH has reached new all-time highs and BTC has dropped over $1,300 in the last three days. Bitcoin cash markets are up over 70 percent over the course of the day.

Bitcoin market prices have hit an average low of $6,100 per BTC.

Bitcoin market prices have hit an average low of $6,100 per BTC.

Moreover, Bitcoin cash trade volumes have surpassed $7B in BCH swaps over the past 24-hours. The South Korean exchanges Bithumb, and Korbit are dominating BCH markets, as the won captures 47 percent of the market.

On November 11, 2017, at 11 pm EDT Bitcoin Cash took the second highest market cap by temporarily displacing Ethereum.

On November 11, 2017, at 11 pm EDT Bitcoin Cash took the second highest market cap by temporarily displacing Ethereum.

Further, the market capitalization of bitcoin cash reached over $29B, temporarily taking ethereum’s second place position.

Bitcoin cash markets touch an all-time high of over $1800 per BCH across global exchanges.

Bitcoin cash markets touch an all-time high of over $1800 per BCH across global exchanges.

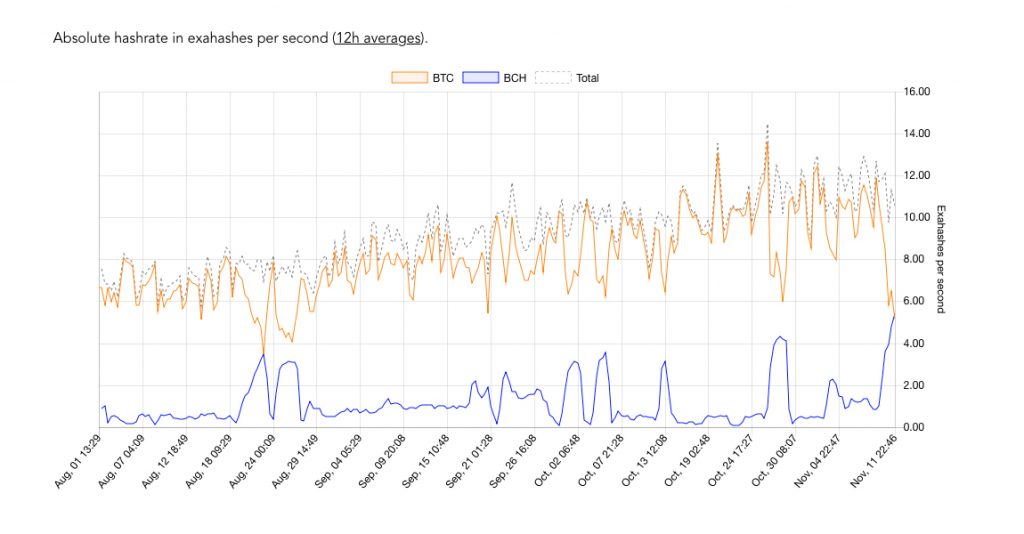

The Hashrate Parity

In addition to the market action, both BTC and BCH markets are seeing a strong correlation in the hashrate arena. At the time of writing, both networks have an equal share of roughly 5.4 exahash per second. BCH is operating at 10 percent of the BTC’s difficulty, and it’s 100.7% more profitable to mine BCH, according to Coin Dance statistics. There’s also a bunch of pools mining bitcoin cash including F2pool, Antpool, Viabtc, BTC.com, Bitcoin.com, BTC.top, Supernova, Bitclub, and some unknown pools.

BTC and BCH hashrate November 11, 2017.

BTC and BCH hashrate November 11, 2017.

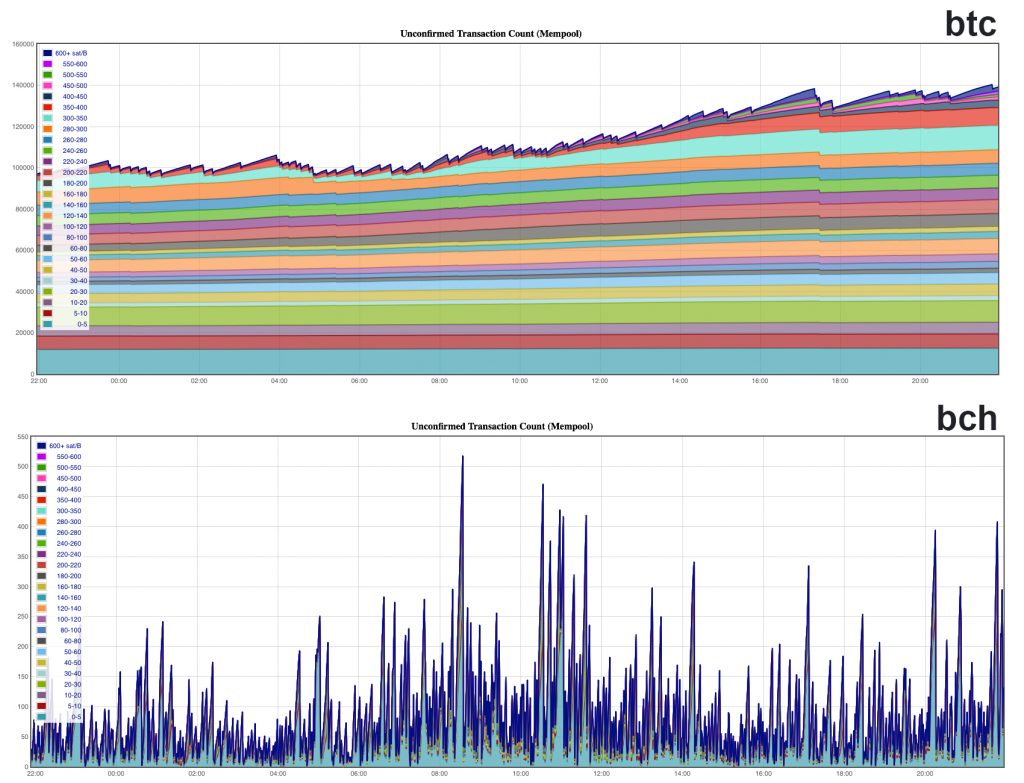

Mempools and Fees

To add to all the market mayhem, the Bitcoin network’s mempool (transaction queue) is backed up by 139,000 transactions waiting to confirm. According to Johoe’s Mempool statistics, the backup has accumulated quite a bit over the past three days since the 2x cancellation. On November 11, using Earn’s fee calculator the average 226-byte transaction costs $9.64 or 155,940 satoshis. Some users are paying upwards of $15-20 per transaction just to get them confirmed quicker. The bitcoin cash mempool is also seeing some action but is clearing smoothly. The average fee for a bitcoin cash transaction is roughly $0.10-0.25.

The bitcoin (BTC) mempool top. The bitcoin cash (BCH) mempool bottom.

The bitcoin (BTC) mempool top. The bitcoin cash (BCH) mempool bottom.

The week going forward should be interesting, to say the least, watching both of these markets and ecosystems. Now, of course, the story could go on forever with the two community’s raging back and forth at each other in typical internet fashion. However, the statistics alone on November 11th are more fascinating, and the story will play itself out as time progresses.

What do you think about the market and mining ecosystem correlation between BTC and BCH over the past 72 hours? Let us know what you think in the comments below.

Images via Shutterstock, Johoes mempool stats, Poloniex, Bitstamp, and Coinmarketcap.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Bitcoin Cash Price Surpasses $1,800 — Eying the Second Largest Market Cap appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.