Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

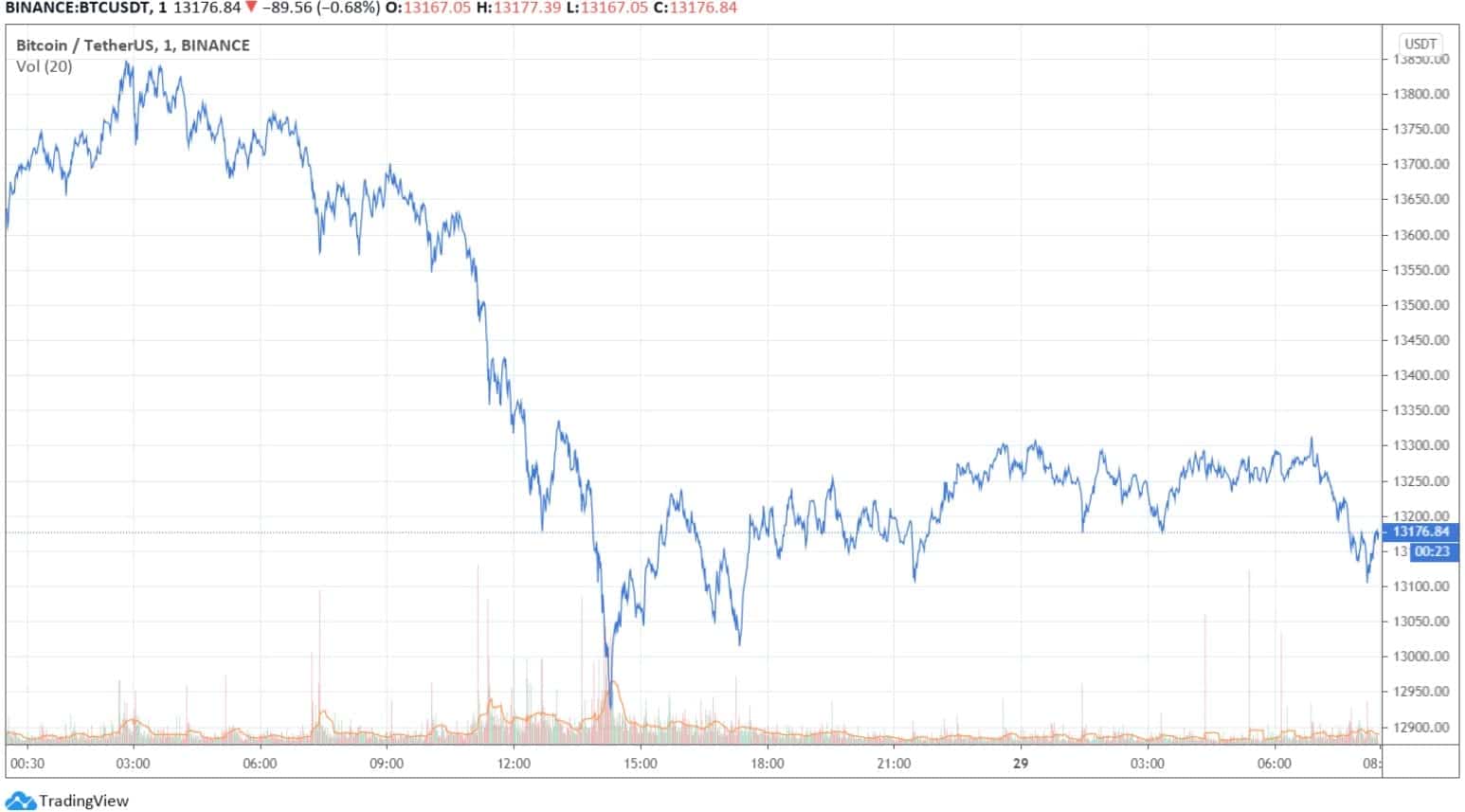

Bitcoin went on a roller-coaster ride in the past 24 hours from a new yearly high of nearly $14,000 to dipping below $13,000. Most altcoins mimicked their leader, and the total market cap has dropped by $15 billion.

Bitcoin’s Wild 24H Ride

As CryptoPotato reported yesterday morning, everything seemed to be going in BTC’s way. The cryptocurrency was surging and peaked at another 2020 high. In fact, with a price of $13,865, it came inches away from breaking last year’s record as well.

However, it was not to be as the situation reversed rather vigorously. In the following hours, Bitcoin plummeted in value. This resulted in a daily low of about $12,920 (on Bitstamp). In other words, the primary cryptocurrency lost nearly $1,000 in just a few hourly candles.

Since then, though, Bitcoin has recovered some of its losses. After reclaiming back the $13,000 price level, BTC has increased to its current position – around $13,150.

On its way down, BTC found support somewhere around the $12,950 line. Should another price dip occur and Bitcoin breaks below it, the next support level is at $12,800. Contrary, BTC has to overcome the resistance at $13,500 to return to its recent bull run.

Red Dominates The Altcoins

As it typically happens, when Bitcoin plummets, so do most of the altcoins. The scenario repeated yesterday, and despite most of them recovering some of the losses, red is still the predominant color.

On a 24-hour scale, Ethereum has dropped by 2.3% and struggles to stay below $390. Ripple (-2.5%) has dipped below $0.25. Binance Coin (-3.3%), Chainlink (-2.4%), Polkadot (-4.6%), Litecoin (-4.25%), and Bitcoin SV (-1.3%) have also painted red.

Cryptocurrency Market Heatmap. Source: Quantify Crypto

Cryptocurrency Market Heatmap. Source: Quantify Crypto

Crypto.com Coin has lost the most value since yesterday – 10%. CRO trades beneath $0.09. The cryptocurrency’s price hasn’t enjoyed October so far as it has dropped by more than 40% since the start of the month.

Aragon (-8.5%), Ocean Protocol (-8%), Maker (-7%), Celo (-7%), and Yearn. Finance (-7%) follow. In total, the cumulative market capitalization of all digital assets has dropped from $410 billion to $391 billion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.